A massive surge in Biotech stocks

Key points:

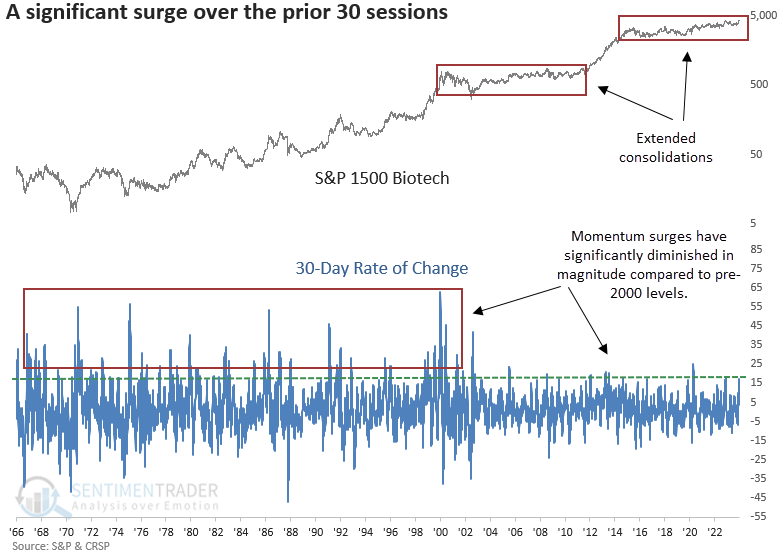

- Over the prior 30 sessions, the S&P 1500 Biotech sub-industry group rallied over 17% and closed at a 252-day high

- Similar momentum bursts accompanied by an annual high preceded a bullish outlook for the Biotech Index

- Adding further credence to the case for Biotech stocks is favorable seasonality in January

Can the recent Biotech momentum persist?

Biotech stocks, a high-risk, high-reward industry, have seen a resurgence over the last 30 trading sessions, with the S&P 1500 Biotech sub-industry group, a cap-weighted index, surging 17% to close at a new 252-day high.

Although most of our research notes stem from trading signals we've tracked for years or even decades, this one belongs in the observation category. i.e., There's nothing special about a 17% rally over 30 sessions to an annual high; it's an observation given that Biotech is in the news with some recent M&A announcements, and the herd is excited about a potential cyclical upswing.

It's important to note that something changed with the Biotech Index starting in 2000. It could be a more mature industry, heightened regulatory hurdles, the index weighting methodology, or a number of other factors. Still, it's evident in the chart, with the index far more likely to consolidate for years at a time and momentum bursts significantly less meaningful in magnitude.

Comparable momentum surges heralded positive returns

Whenever the S&P 1500 Biotech sub-industry group increased by 17% or more over 30 sessions and closed at an annual high, the cap-weighted Biotech Index rallied consistently over the subsequent year.

Despite a significant move over the previous six weeks, one cannot rule out additional upside over the following two weeks, with that time frame showing the best median return relative to history and 18 consecutive gains between 1979 and 2013.

Still, we must be mindful that since 2000, when the character of the Biotech Index changed, momentum bursts, like now, have tended to fail, with the 2011-15 upswing being the exception.

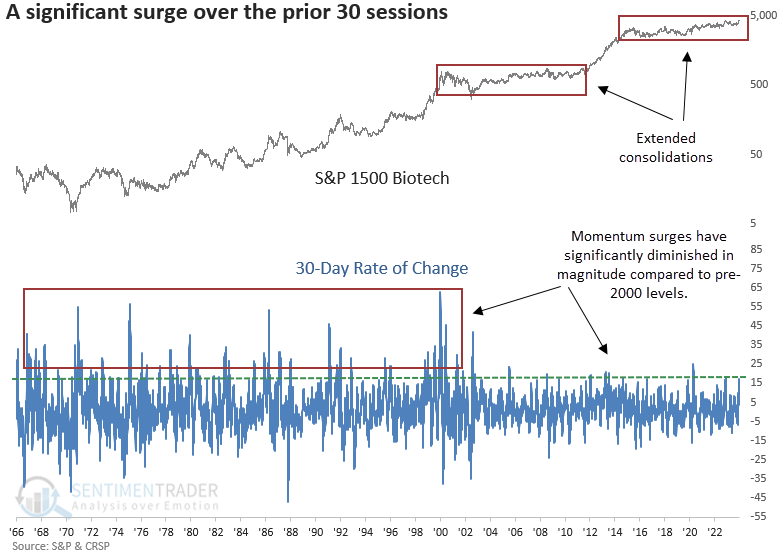

Seasonality

From a seasonality perspective, January maintains the highest win rate and median return.

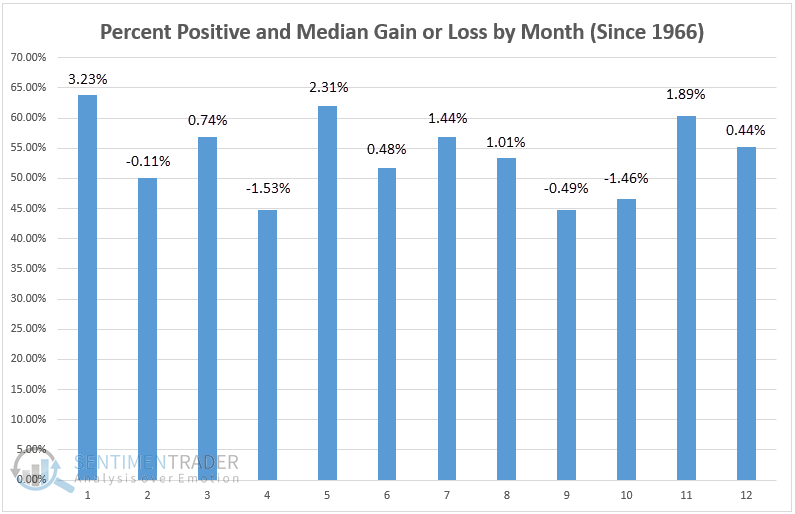

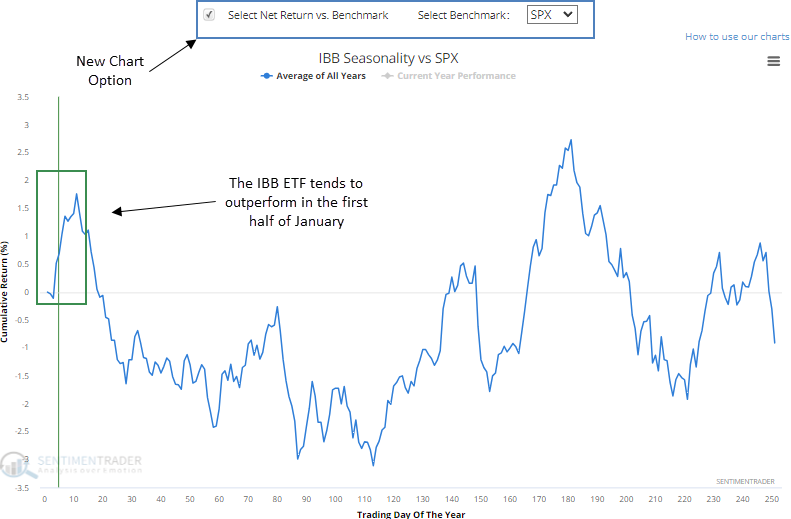

Subscribers with access to the website can now track the net return of a stock, index, or ETF relative to a benchmark. You simply click the "Select Net Return vs. Benchmark" box on a seasonality chart and designate a benchmark from a list of options.

History suggests the iShares Biotech ETF (IBB) could outperform the S&P 500 in the very near term.

How can we invest in a potential upswing?

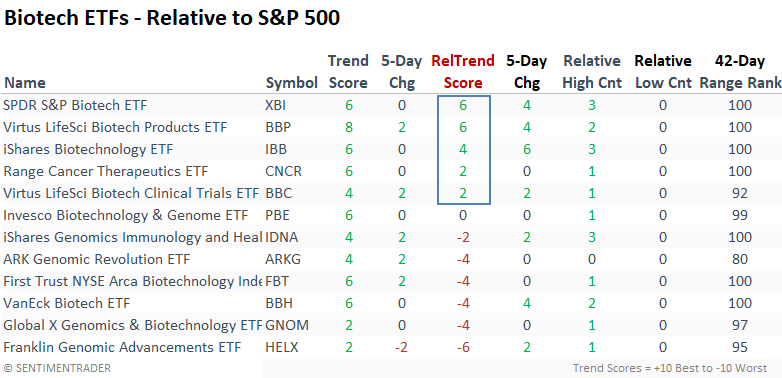

There are plenty of Biotech ETFs to consider, so it's essential to investigate weighting methodologies, liquidity, volume, and other factors. As always, an assessment of absolute and relative trends is imperative.

Although there's improvement in scores, they have yet to reach the elevated levels commonly associated with exceptionally strong uptrends.

What the research tells us...

Over the last 30 sessions, the S&P 1500 Biotech sub-industry group has seen an impressive surge, accompanied by a new high. Previous instances of similar momentum bursts have consistently resulted in a positive upward trend over the subsequent year. Furthermore, favorable seasonality, particularly in January, underscores a compelling case for expecting further gains in the near term. However, we must be mindful that sustainable upswings have been less likely since 2000, and absolute and relative trends, while improving, have not shifted to an outright bullish status. When considering an allocation, it's advisable to exercise prudent risk management.