A massive gap-up opening in Super Micro Computer

Key points:

- Super Micro Computer (SMCI) surged on the back of positive fundamental data, opening up 11.6% on Friday

- Similar price patterns produced a median return of 11.7% and a 91% win rate over the subsequent month

- Subscribers can use the Backtest engine to evaluate price patterns like this one, ensuring a more informed decision-making process

Assessing the outlook of price-based patterns with the Sentimentrader Backtest engine

Last week, Jason authored an insightful research note detailing the step-by-step process a user can take to assess the outlook for the S&P 500 in the aftermath of the Fear and Greed Model's downward shift from extreme greed, leveraging the enhanced capabilities of the new Backtest engine.

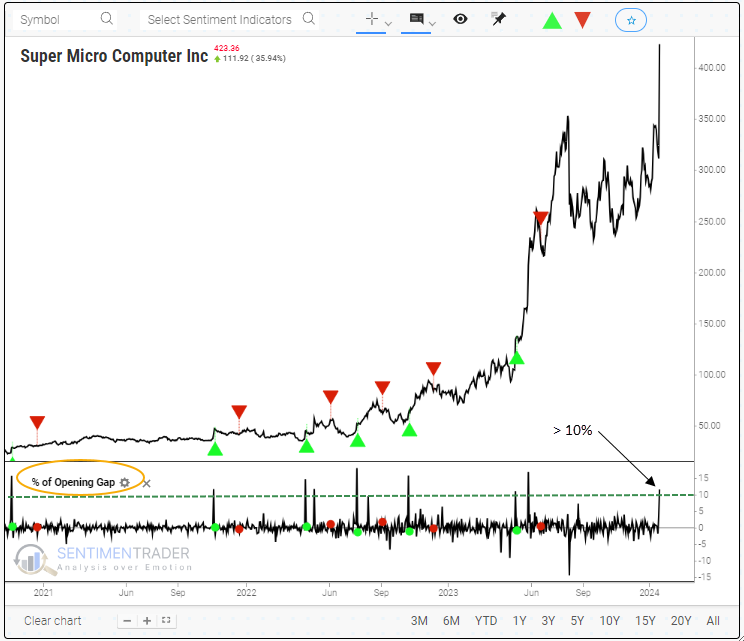

With the upgrade to our event analyzer, you can test traditional technical indicators and price-only patterns, such as the opening gap, which we call "% of Opening Gap."

On Friday, Super Micro Computer (SMCI), a computer hardware company, surged 11.6% at the opening bell following the release of positive fundamental data. Traders often refer to this type of surge as an "Episodic Pivot," signifying a fundamental shift that brings about a dramatic surge in the price of a security.

Let's assess the outlook for Super Micro Computer (SMCI) when the stock increases 10% or more to open the trading session using the new Backtest engine.

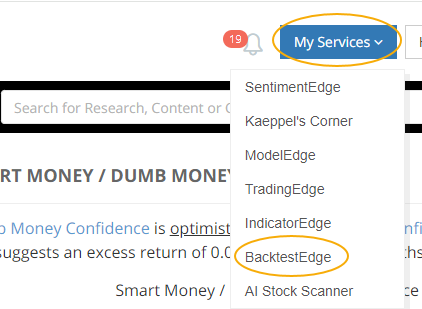

On the Sentimentrader homepage, click on My Services and select BacktestEdge.

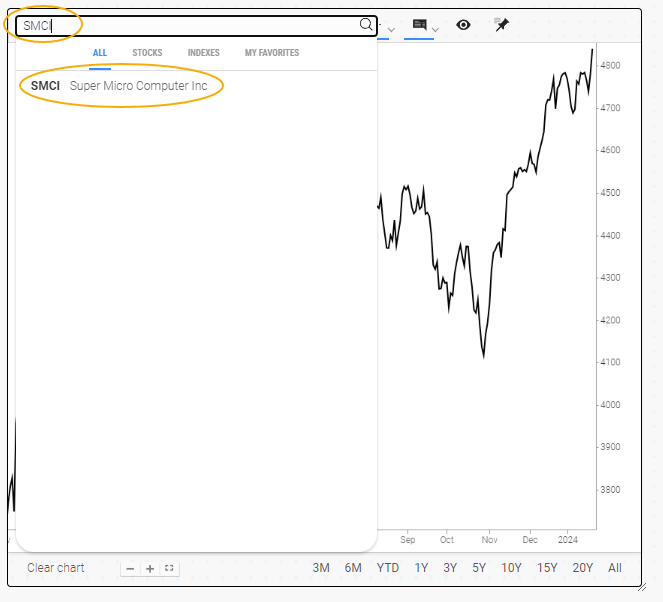

In the Search Box, type the stock symbol SMCI and select Super Micro Computer Inc.

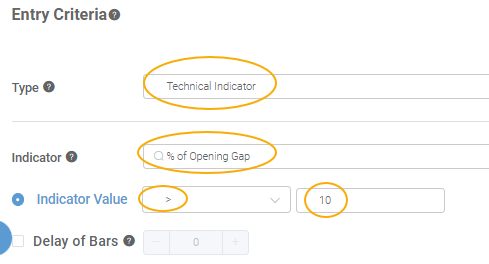

In the Entry Criteria section, select Technical Indicator, % of Opening Gap, greater than (>), and type in an indicator value of 10.

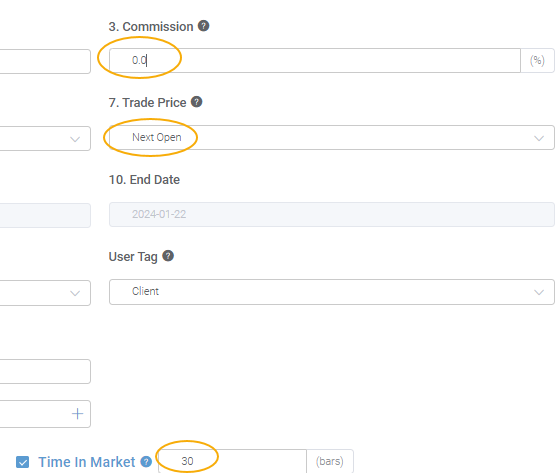

I will make a few adjustments to the preformatted Set Up section. First, I will modify the Commission to 0.0 because most retail traders no longer pay commissions. Second, I will adjust the Trade Price to the next day's opening for a more realistic signal assessment. Finally, I will set the Time in Market to 30 bars. I like to use 15 or 30 bars because those are two short-term time horizons not included in the outlook table that spans from one week to a year.

Assessing the risk/reward for a potential trade idea

Once the Backtest engine completes the test, we have three options for viewing the results.

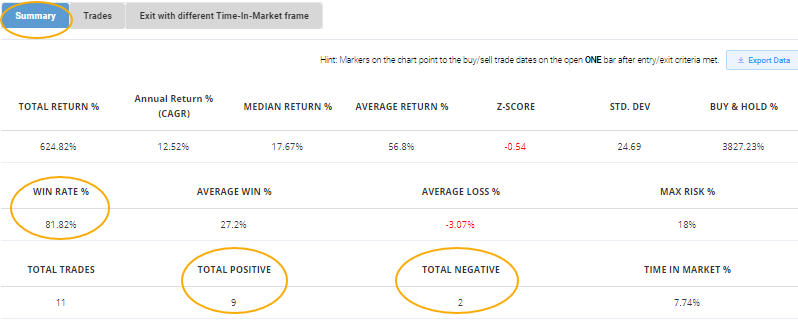

In the Summary section, users can see trade details based on the user-defined exit condition. In the case of SMCI, I used a time-in-market condition of 30 bars, which shows nine winners and two losers for an 82% win rate.

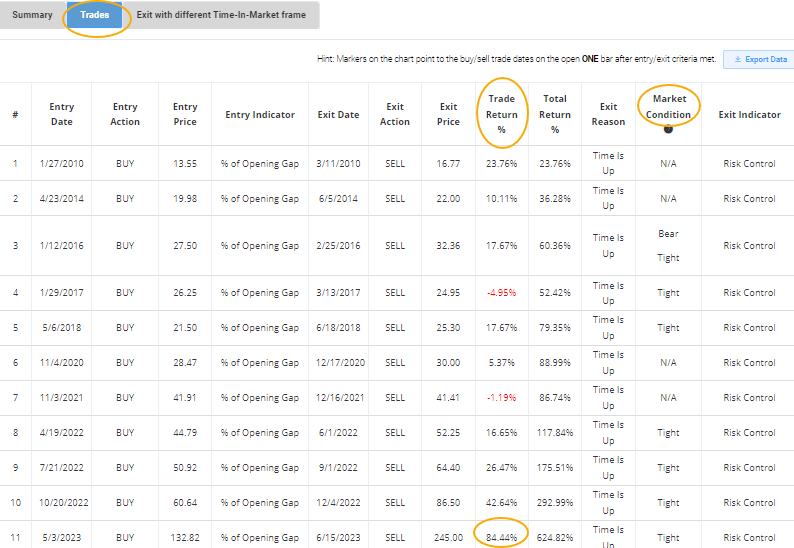

In the Trades section, users can see the individual returns for each trade. The previous +10% gap-up open from May 2023 shows a remarkable gain of 84% over our 30-day holding period.

A new column in this section is Market Condition, which provides context for trading signals. Current conditions include bull and bear markets, recessions, and Fed policy.

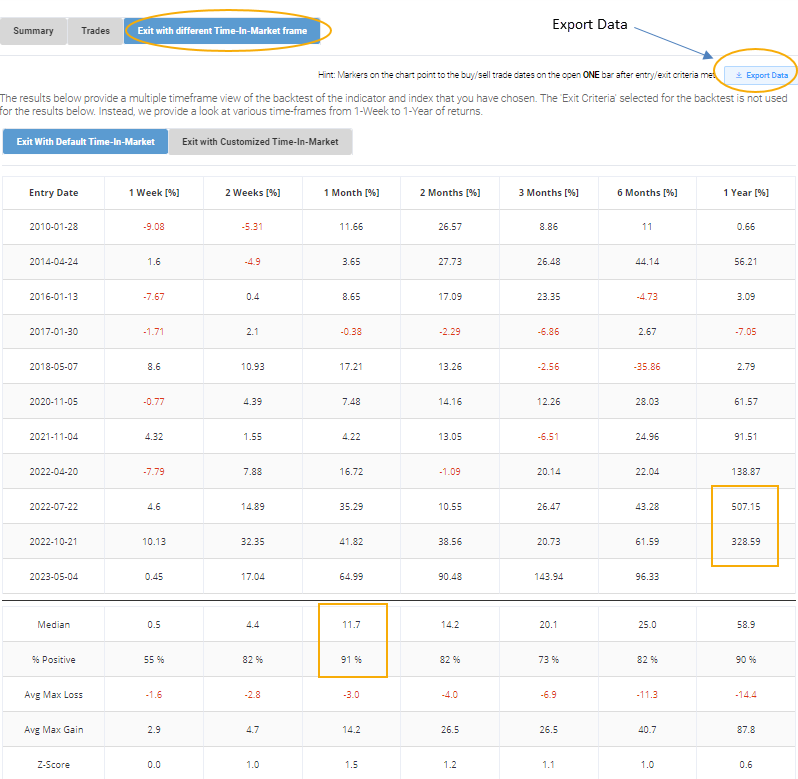

The Exit with Customized Time-In-Market section provides the outlook table subscribers have grown accustomed to in our daily research publications. After similar gap-up openings, SMCI was higher 91% of the time over the subsequent month, with a median gain of 11.7%. More recent signals show extraordinary gains over the following year.

Users can export trade details to Excel with a single click for further analysis.

What the research tells us...

Super Micro Computer Inc (SMCI) opened 11% higher on Friday due to bullish fundamental news from the company. After similar price patterns, the upside momentum tended to persist, with the stock displaying a median return of 11.7% and a 91% win rate over the subsequent month. Subscribers can leverage our new and improved Backtest engine to evaluate the risk/reward profile of price-based events similar to the one outlined today instead of making trades solely based on intuition.