A massive breakout for Japanese stocks

Key points:

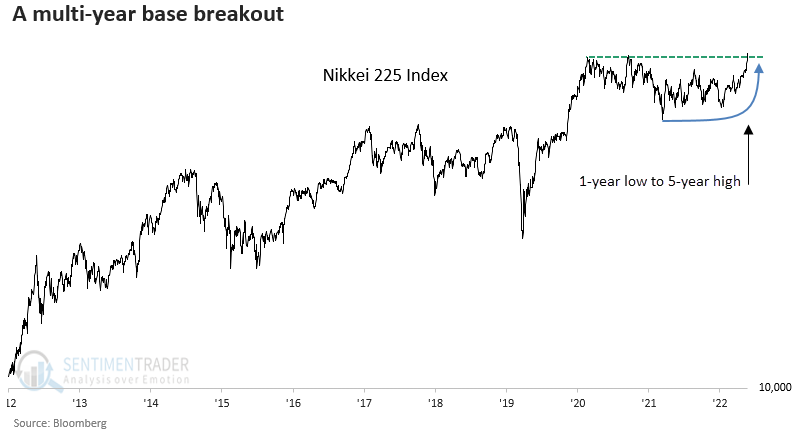

- The Nikkei 225, a widely followed Japanese Index, closed at a multi-year high

- The new high is the first instance after falling to a 1-year low

- Similar breakouts preceded excellent results over medium and long-term horizons

A massive base breakout for a Japanese Index

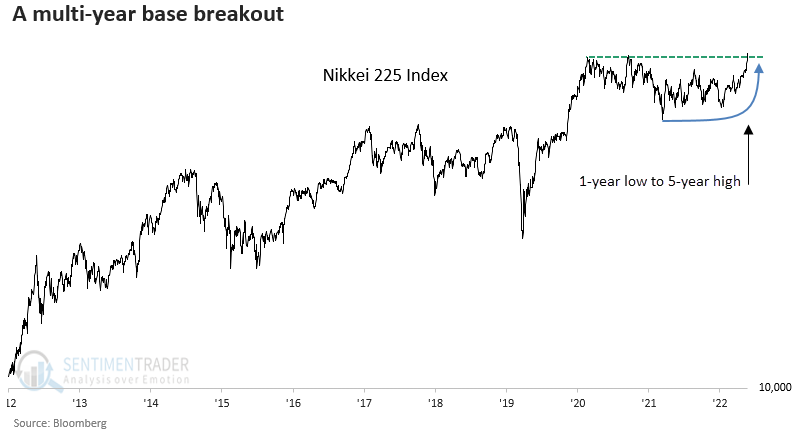

While the Nikkei 225 Index remains -20% below its 1989 all-time high, the bellwether Japanese Index closed at a three-decade high on Friday.

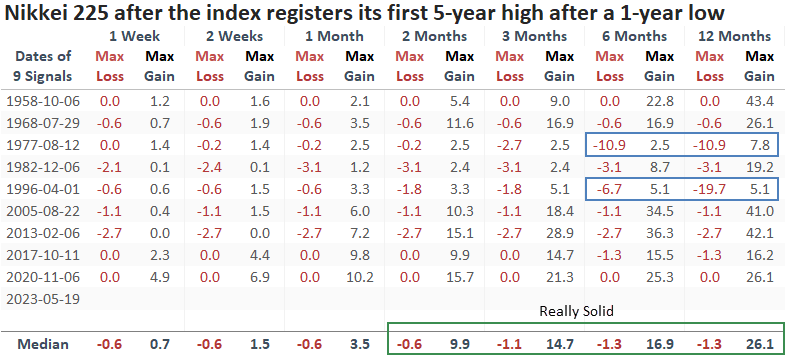

Long-duration breakouts like this one are rare. So, I adjusted the conditions to identify the first 5-year high after a 1-year low to capture more precedents with a similar context to now.

The previous breakout occurred in 2020, leading to substantial gains over the next three months.

Despite a three-decade breakout, the Nikkei remains below the all-time high achieved in 1989.

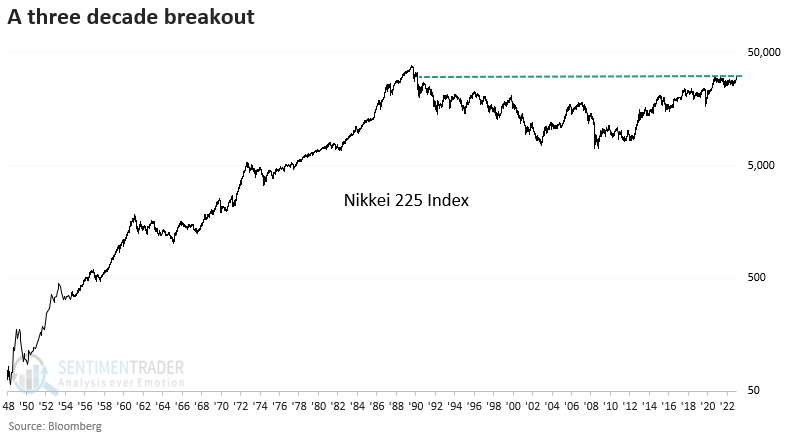

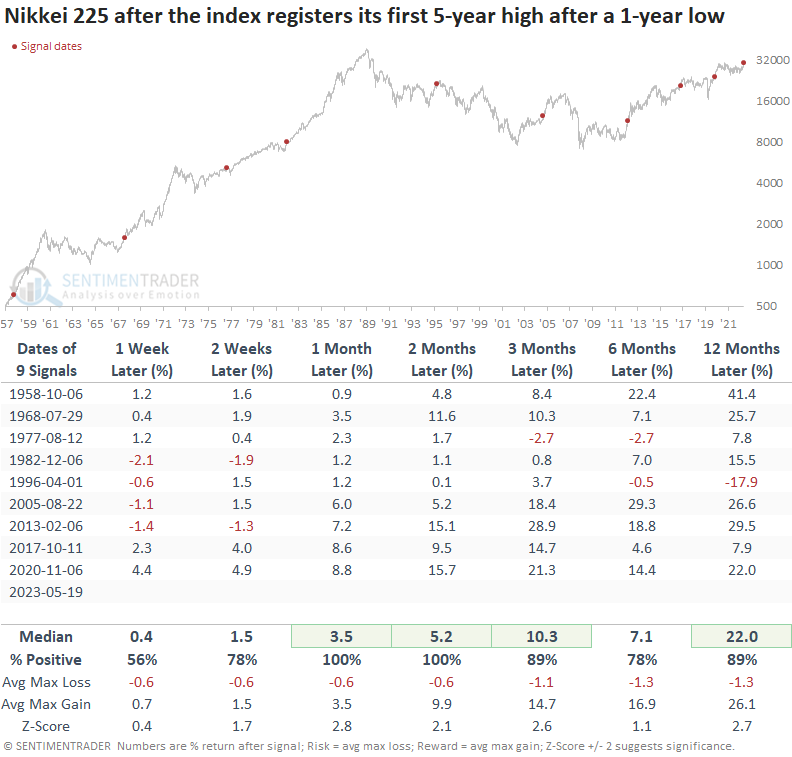

Similar breakouts preceded excellent returns

When the Nikkei 225 Index registers its first 5-year high after a 1-year low, forward returns and win rates are outstanding, with several time frames showing significance.

The median max gain was significantly better than the median max loss across most horizons, especially a year later.

A currency-hedged ETF might be the best option to play the breakout in Japan

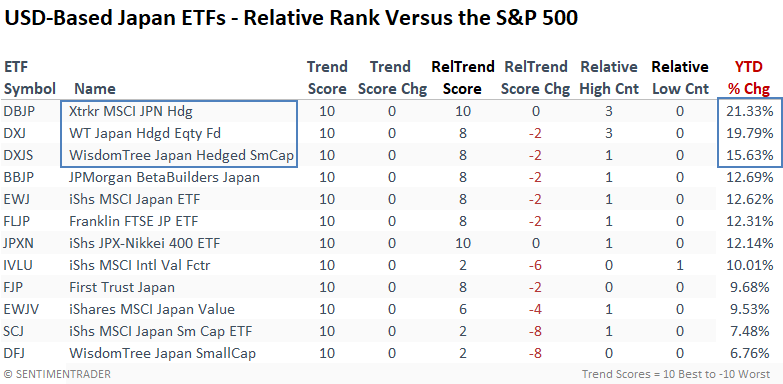

When allocating globally, investors must always be mindful of the impact of currency. While the Nikkei 225 closed at a new high in local currency terms, the Index remains more than -20% below its high when priced in the U.S. dollar.

The impact of currency is notable on a YTD basis, with Japan ETFs that hedge their currency easily outperforming the ones that do not.

What the research tells us...

The Nikkei 225 Index, a widely followed Japanese benchmark, surged to a new high. After similar breakouts, Index returns, win rates, and z-scores were outstanding across medium and long-term horizons. USD-based investors might consider a currency-hedged ETF as one way to play the breakout.