A major breakout in recovery sector stocks

Earlier this week, financial stocks enjoyed a broad breakout, with nearly 30% of stocks in the sector breaking out to at least a 52-week high.

It's only gotten better from there. And they've been joined by a bunch of recovery-sector buddies, too.

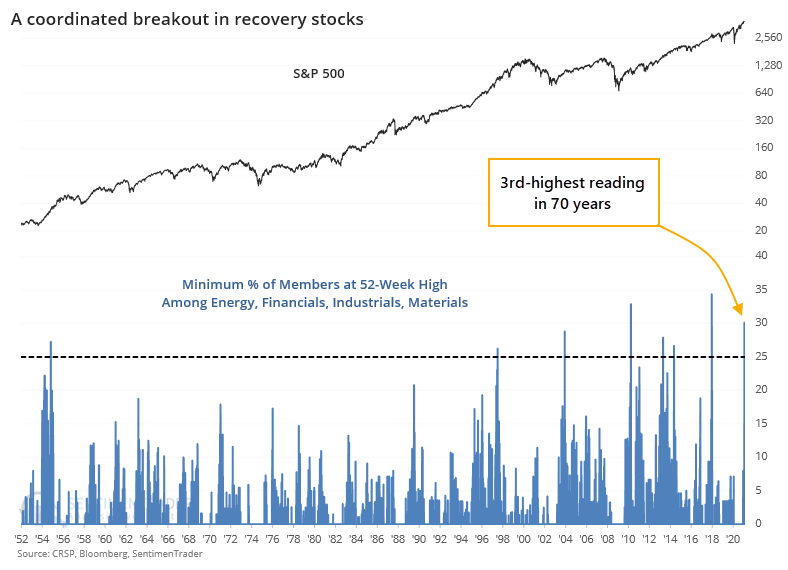

Among all indexes and sectors, the four horsemen of a recovery - Energy, Financials, Industrials, and Materials - are leading the charge. At least 30% of member stocks in all four of those sectors reached a new high on Wednesday. That's among the most impressive breakouts in 70 years for sectors geared to an economic recovery.

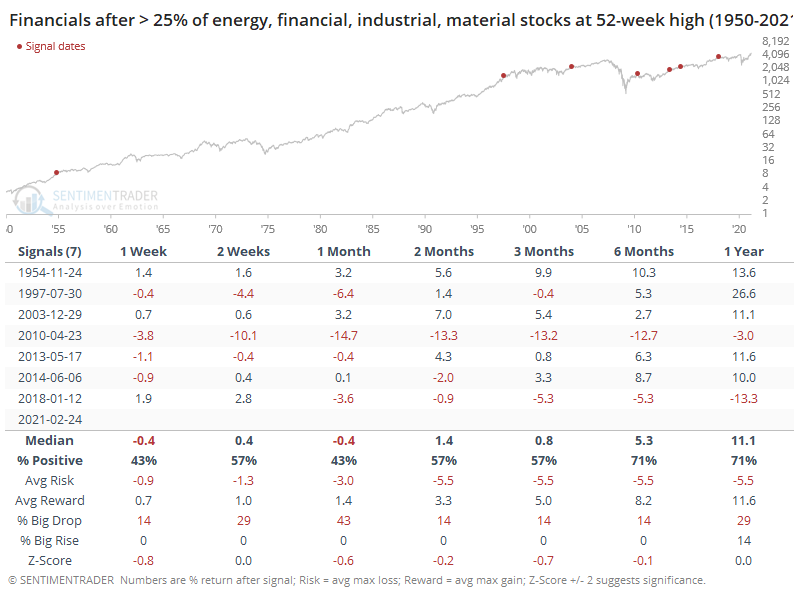

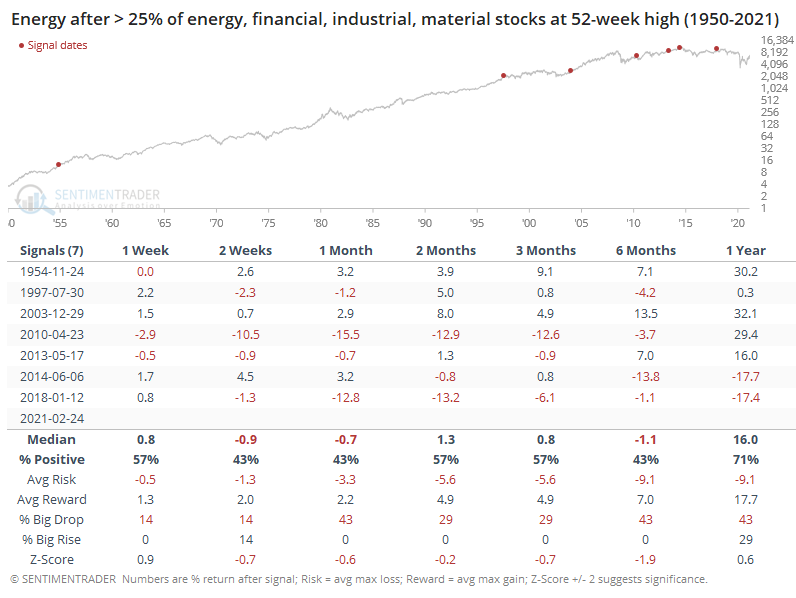

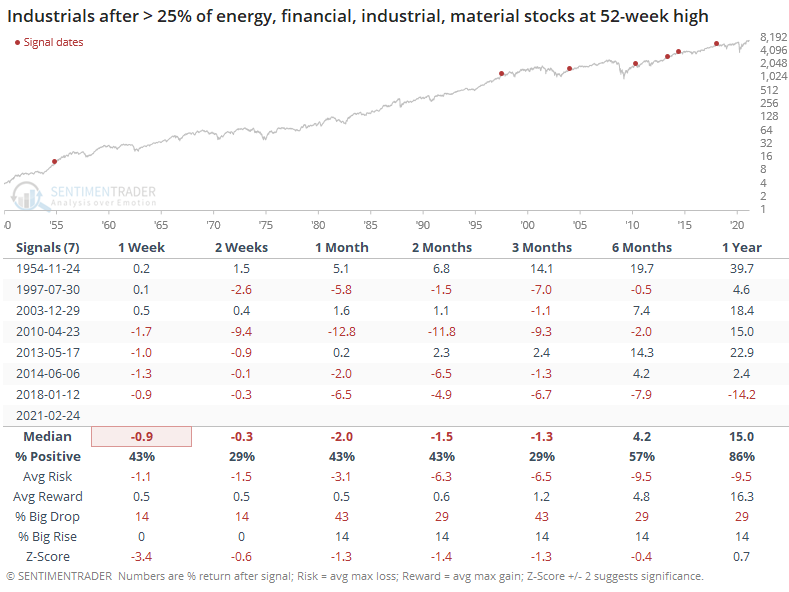

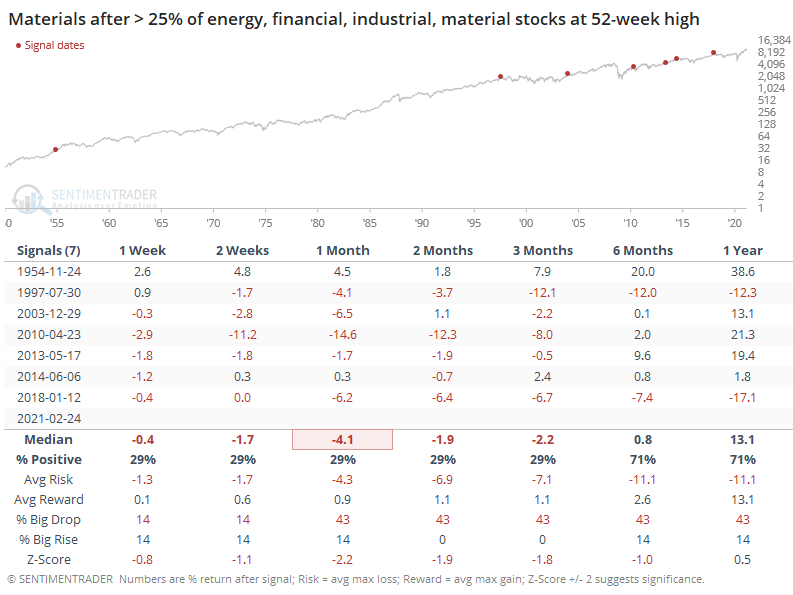

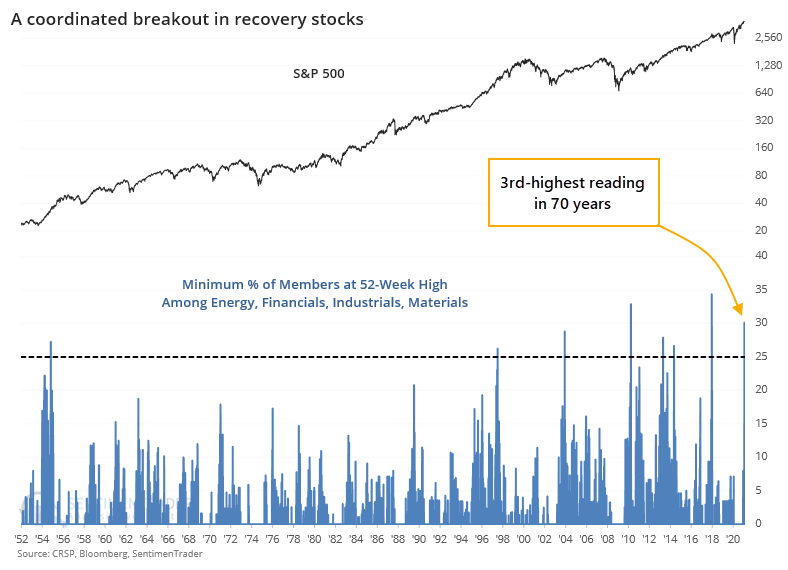

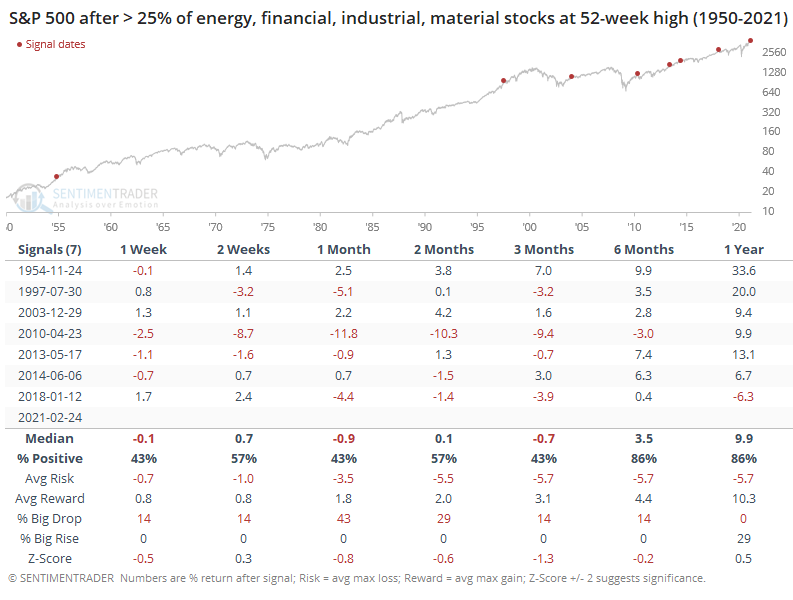

Let's check to see whether other coordinated breakouts from these sectors have preceded consistent returns. The table below shows forward returns in the S&P 500 (price only) following any day when at least 25% of members in all four of those sectors hit a 52-week high.

Over the short- to medium-term, returns weren't great. The S&P's median return was well below random, risk was higher than reward, and it had a greater chance of suffering a big drop than enjoying a big rise. That started to change after a few months, and by a year later, things were looking better.

We can see returns for each of the four sectors below. These are total return, so it includes price change and dividends. Among them, Financials generally held up the best, Energy was next, then Industrials and Materials brought up the rear. It was rare for the latter two to show gains at all over the next few months.

The story surrounding these breakouts sounds great, and the news is looking good. Of course, it was the exact opposite scenario 11 months ago, and look where we are now. After some spotty days in January, the extreme (maybe even record) speculative activity we've seen in recent months has not preceded internal deterioration. Breadth and momentum remain strong, and that bodes well longer-term. In the interim, the biggest negative is just that things have been so positive for so long, they rarely keep going uninterrupted over a 2-3 month time frame.