A low-cost antidote for the fear of missing out

Key points:

- Evidence is piling up on the favorable side of the ledger

- Many investors holding cash are wondering if they should jump back in

- A simple options strategy can allow an investor to regain market exposure without a large dollar risk

In hopes of a year-end rally

After months of depressed sentiment, stocks stabilized in October and then shot higher this week.

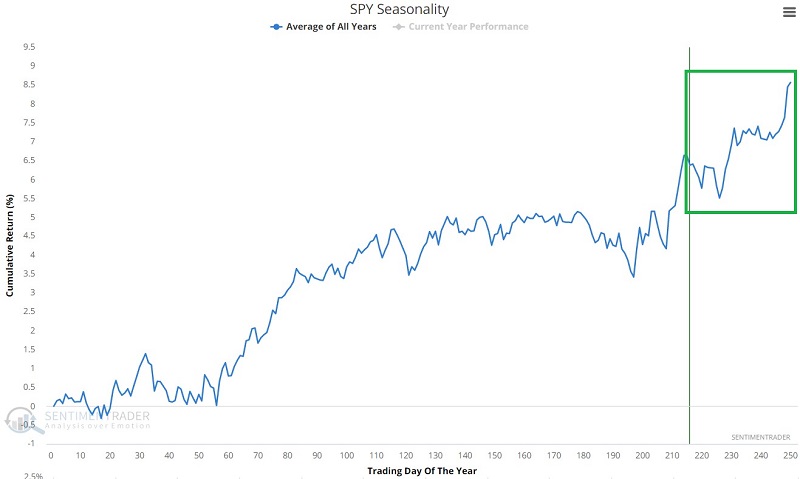

If we combine the markets' hopeful reaction to the lower CPI print, a variety of favorable indicator signals recently, and the seasonal chart below, it would not be surprising to see a lot of investors who are still holding cash to start squirming and wondering if they should pile back in so they don't miss out.

However, until the major indexes - and a majority of stocks - establish a new bullish trend, the risk remains that this is just a rally in a bear market. So an investor may be experiencing FOMO (Fear Of Missing Out) but also anxiety about returning to a fully invested position.

Using options as a potential antidote for FOMO

FOMO became a phrase during the long bull market following the 2009 bottom and again after the COVID-19 low of 2020. Investors with cash shove aside any concerns about a market decline and pile back into the market. That's great when the rally continues, but it can leave an investor fully exposed if things do not go as planned.

Following the lower CPI print and the subsequent surge, investors with cash are again wondering if they are about to get left behind. An option strategy that may help investors in this predicament is the out-of-the-money calendar spread.

Let's consider the following example:

An investor with a $50K account has spent 2022 with 50% in stocks and 50% in cash. They are presently comforted by having missed much of the market decline. Still, they are now a) thinking that the market may take off between now and year-end but b) still concerned about the overall unfavorable macro picture. If they put their $25K in cash into the market and the market reverses back to the downside and declines, say -10%, the investor will lose -$5K from their portfolio.

One possible alternative is the following:

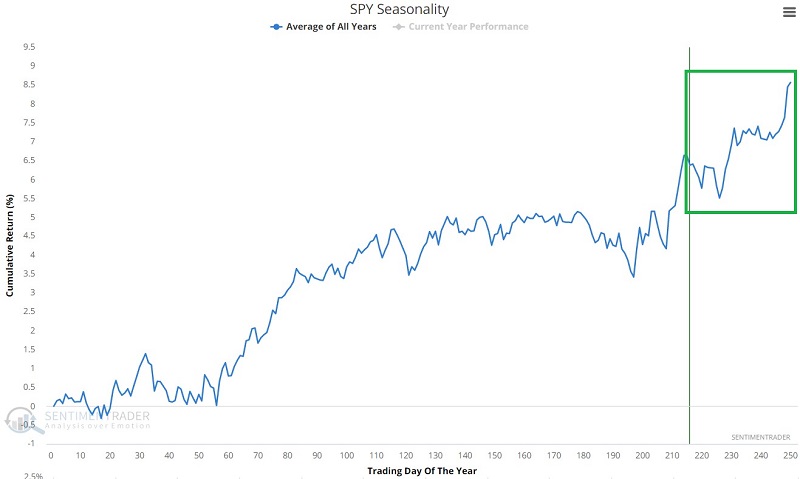

- Buy the SPY Feb17 2023 455 call @ $1.76

- Sell the SPY Dec30 2022 455 call @ $0.30

The maximum dollar risk for a 1-lot is $146. Let's also say that the trader will commit roughly 2% ($1,000) of their capital to the trade. A 7-lot of the trade above would cost $1,022. The table and chart below (courtesy of Optionsanalysis) display this trade's particulars and risk curves.

The $1,022 cost to enter a 7-lot is also the maximum risk on the trade. If SPY declines instead of advances, the worst case is -$1,022, or roughly -2% for our hypothetical $50K investor.

The S&P 500 must advance between now and year-end for this trade to show a profit and the expected break-even price at expiration is $414.32, or roughly 5% above the current price for SPY.

Managing the options trade

Here are some potential ways to manage an option spread like this.

If SPY rallies:

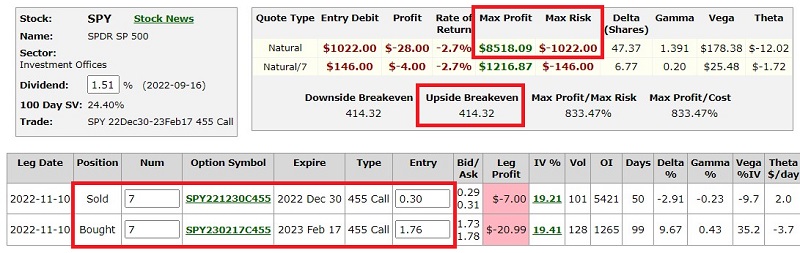

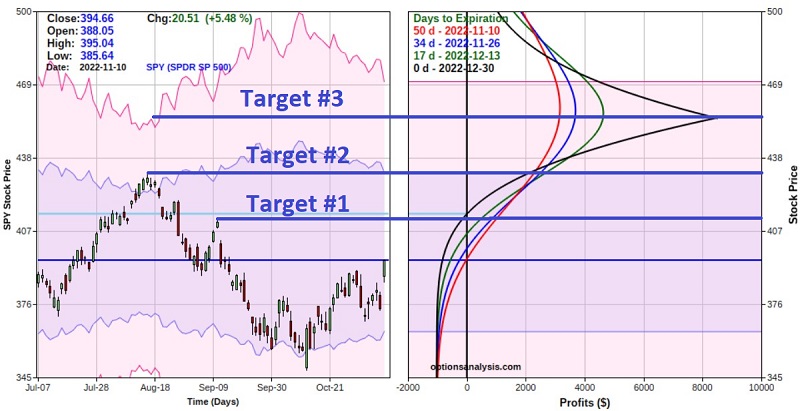

- If SPY rallies back to its September high of $411.78 (Target #1), the expected return ranges from +$982 to -$163, depending on whether the target price is reached sooner or later.

- If SPY rallies back to its August high of $431.73 (Target #2), the expected return ranges from +$2,500 to +$2,000, depending on whether the target price is reached sooner or later.

- If SPY manages to rally to the 455-options strike price (Target #3), the expected return ranges from over $8,000 to +$3,150, depending on whether the target price is reached sooner or later.

If SPY declines:

- Close the position early and try to harvest any remaining premium

- Hold on until the Dec30 options expiration in hopes of a strong year-end rally

Remember that even after the short Dec30 455 call expires, the investor can continue to hold the Feb17 2023 455 strike price call, which will still have another 49 days left until expiration.

What the research tells us…

As always, the abovementioned trade is an example and not a recommendation. The risk in this trade is that SPY will not rally sufficiently between now and year-end to generate a profit. The advantage, however, is that it allows an investor to gain decent profit potential if the market does rally while simultaneously limiting the amount of downside risk.