A Look Inside the AMC Option Craziness

Ticker AMC (AMC Entertainment Holdings, Inc.) has been arguably the hottest and one of the most heavily traded stocks in 2021. In the past 30 days, the stock has averaged over 146 million shares traded per day! In addition, over a million AMC options have routinely been traded daily of late. So the bottom line appears to be that many traders are "chasing the dream" of riches beyond the dreams of avarice by catching and riding the next "Big Wave."

Unfortunately, the way AMC options are priced greatly reduces the likelihood of achieving those dreams. So let's take a closer look at the potential pitfalls.

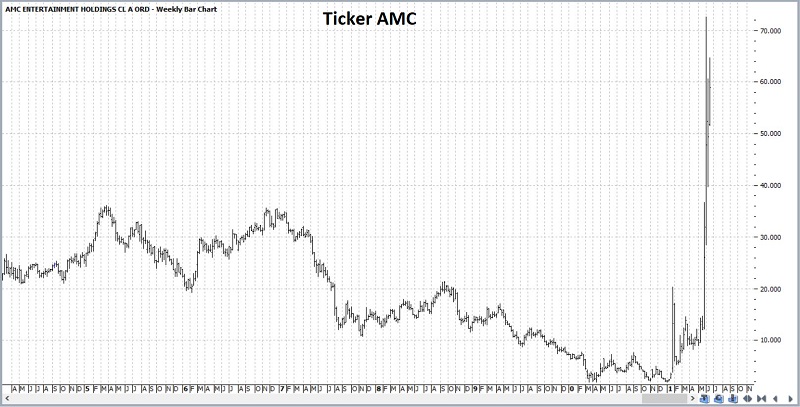

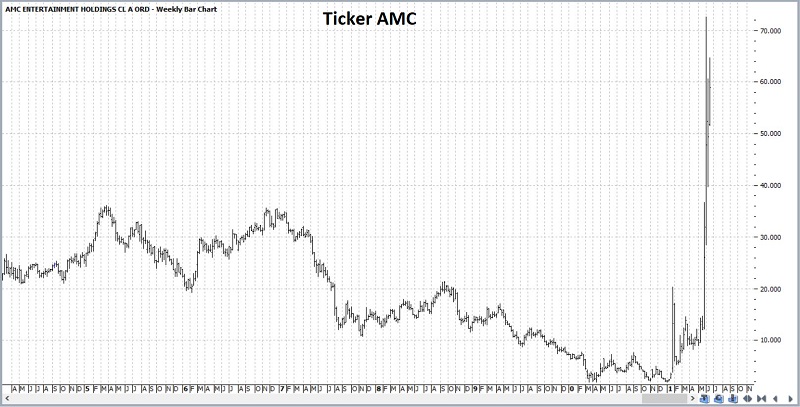

AMC: THE STOCK

Even before Covid, AMC gave the appearance of a lousy company in a lousy business, slowly working its way toward bankruptcy. Then Covid hit, and the company lost the vast majority of its source of revenue (movie theaters). So naturally, one would expect the stock to tank and the company to potentially die. So, what actually happened?

As you can see in the chart below (courtesy of ProfitSource), this:

- So many traders bet on that very scenario by selling short shares of AMC that the short interest became huge

- The Reddit crowd (primarily) determined that a short squeeze was possible

- They started buying and buying and buying to force the stock price higher

- Which in turn forced many of the short sellers to buy to cover their shorts

- And the stock exploded from a January 2021 low of $1.91 a share to a June high of $72.61

Go figure.

And the "squeeze" may not be over yet as roughly 18% of the AMC shares available for trading were still sold short - leaving a lot of potential panic buyers. In addition, in early June, the company issued another 11.5 million shares of stock, raising $587 million of capital. The good news is that this gives the company more financial strength. The bad news is that a) they are still in the same moribund business, and b) it dilutes the value of existing shares.

So far, no one appears to much care, as discerned by the aforementioned 146 million shares a day being traded.

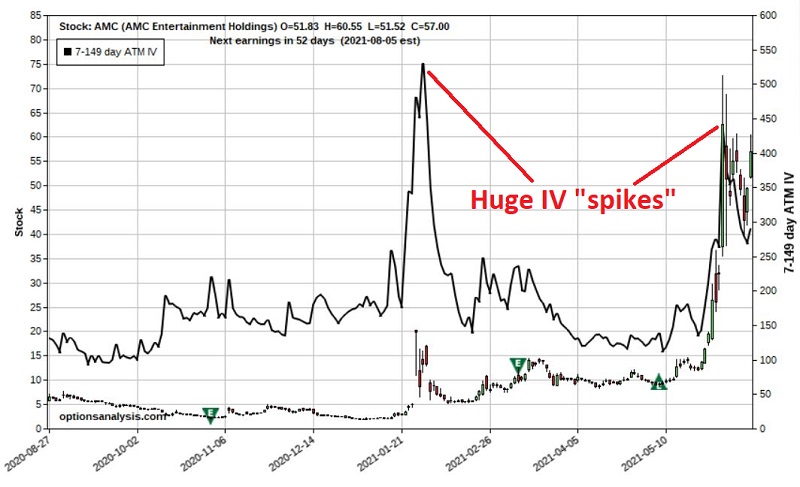

AMC: THE OPTIONS

Huge stock price volatility almost invariably results in huge option volatility. This is true in spades for AMC, as evidenced in the chart below (from www.Optionsanalysis.com), which highlights the huge increases in option implied volatility (the black line) that unfolded.

Options that typically traded at a volatility of 100% to 150% twice soared north of 400%. The net effect of higher IV is a massive increase in the amount of time premium built into the options - i.e., all options become more "expensive."

This type of price and options volatility has several profound implications for traders:

- For option buyers, the movement in the price of the underlying stock itself required to allow them to generate a profit on their call or put option increases dramatically - and in turn, their probability of success decreases

- For option sellers, the potential to take in a lot of premium increases greatly; however, in most cases, it involves assuming more risk than the potential reward (we will illustrate this in the example trades below)

In a nutshell, option buyers have:

- Increased cost of entry

- Greater risk of loss

- And lower probability of profit

The hope for an option buyer is for another massive move in the stock price to overcome these obstacles.

In a nutshell, option sellers have:

- Greater profit potential

- A high probability of profit (typically)

- But more dollar risk (typically) than potential profit

- Greater vulnerability if the stock moves against them

The hope for an option seller is that the stock will not move too far in the wrong direction.

BUYING PREMIUM EXAMPLE

The trades below are not intended to be buy and/or sell recommendations (also note these trades are based on closing prices at the end of 6/15). Instead, they are merely intended to illustrate the unique state of affairs prevalent in a high volatility situation such as AMC.

First, let's assume Trader A wants to bet on a selloff in AMC in the months ahead and decides to buy an at-the-money August put option in hopes of profiting from what he or she sees as an inevitable price collapse.

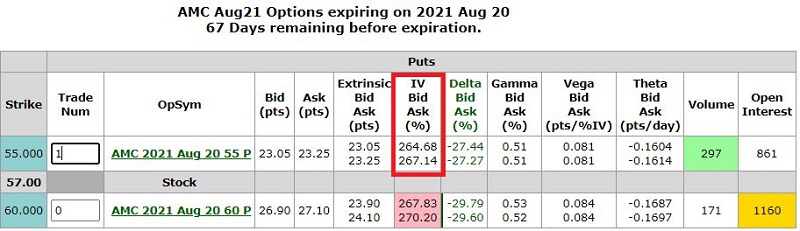

Unfortunately for Trader A - and as you can see in the screenshot below - the August 55 put is trading at an implied volatility of 264.68% at the bid price of $23.05 and 267.14% at the ask price of $23.25.

Assume Trader A gets filled at the midpoint of the bid/ask spread ($23.15). The particulars of this trade and the risk curves appear in the chart below.

AMC is trading at $57 a share, and the option has 67 days left until expiration. The key thing to note is this:

- The breakeven price at option expiration is $31.85(!)

This is calculated as strike price ($55) minus option price ($23.15). Thus, to put it as bluntly as possible, AMC stock must decline -42% by August options expiration for this trade to show a profit (although a drop in AMC sooner than later can generate profits more quickly).

- In addition, this trade has a "Vega" of $8.12. This means that if IV fell from 267% to 167%, this position would lose $812 of time premium (100 volatility points x $8.12) due solely to the change in volatility - even if AMC's stock price remained unchanged.

Now there is certainly a chance that AMC could, in fact, collapse before August expiration. And IV could increase instead of decrease (which would inflate the amount of time premium built into the option price). But the bottom line is that long-term trading success typically evolves from putting the odds as far in your favor as possible each time out.

Buying calls and/or puts when IV is extraordinarily high CAN end up being profitable. But in no way does it qualify as "putting the odds on your side."

SELLING PREMIUM EXAMPLE

Let's assume Trader B wants to take advantage of the extraordinarily high implied volatility by selling options and that - like Trader A above, expects AMC stock to decline in the days ahead. Of course, there are many potential trades, and the one highlighted below should not be considered "the definitive" trade. Instead, it merely serves as one example of a way to play and highlights the pros and cons an option seller must assume.

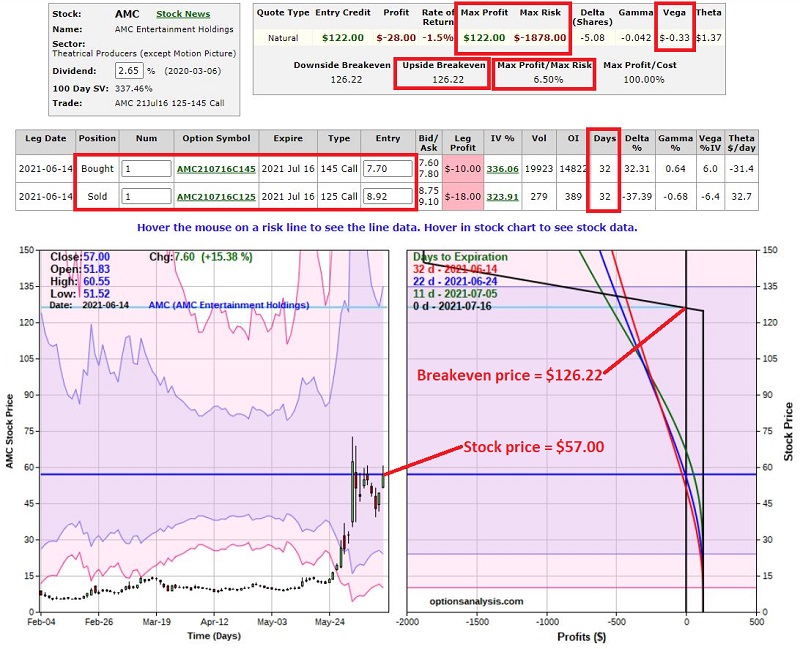

Trader B:

- Sells the July 125 call @ $8.92

- Buys the July 145 call @ $7.70

We will assume a limit order is used and that Trader B gets filled at the midpoint of the bid/ask range for each option. The particulars of this trade and the risk curves appear in the chart below.

Things to note:

- AMC stock is trading at $57 a share, and the breakeven price for this trade is $126.22 (in other words, as long as AMC is below $126.22 at July options expiration 32 days from entry, this trade will show a profit)

- The trade takes in a credit of $122 on a 1-lot

- The margin requirement and maximum risk is -$1,878 (which would only be realized if the trade is held to expiration and AMC stock is above $145 at that time)

- This represents a profit potential of 6.5% in 32 calendar days

One other hidden danger with ANY bear call spread: If AMC stock moved above $125 a share, it is possible that the short option could be exercised. This could leave a trader short 100 shares of AMC and long a $145 strike price call. For this reason, Trader B would need to make some decision - preferably before entering the trade - about taking some stop-loss action if AMC stock approaches $125.

Clearly, this is an entirely different type of trade than the long-put example above. In this case, Trader B is simply betting that AMC will NOT rally 121% from $57 a share to over $126.22 over the course of the next 32 days. Is this a good bet? Given AMC's price movements so far this year, the answer to that question is clearly in the eye of the beholder.

But the bottom line is this:

- The maximum profit potential is much greater for Trader A, but Trader A's probability of success is much lower

- The maximum profit potential is much lower for Trader B, but Trader B's probability of success is much higher

SUMMARY

Given that over a million AMC options a day have been traded of late, clearly, many traders see opportunity in this situation. And with a stock that can make such massive movements in price, potential money-making opportunities exist. Nevertheless, as illustrated in the examples above, traders may be wise to consider any trade involving AMC options as "high risk, high reward" situations.