A Long Correction As Bond Yields Hit Overbought

This is an abridged version of our Daily Report.

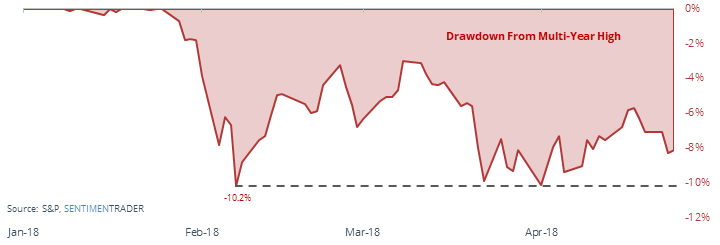

The correction that won’t end

Rallies keep failing, and the S&P is now more than 50 days into its correction.

A lengthy time in correction territory has led to some severe declines, but even more rallies. Times when the S&P recovered quickly from a correction led to significantly worse longer-term returns.

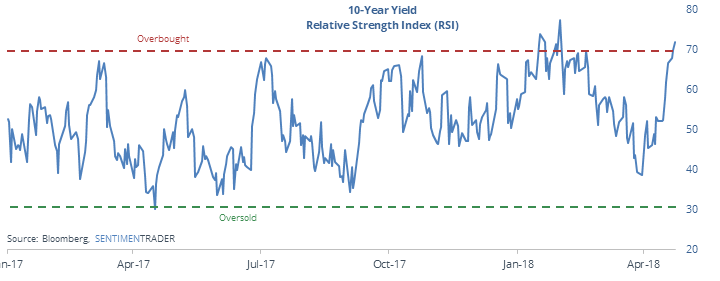

Overbought yields trigger caution

The yield on 10-year Treasury notes hit a one-year high and have become overbought according to the RSI.

How yields behaved in the short-term were a good indicator for how they would respond in the long-term. Defensive sectors tended to hold up better in the months ahead, while the dollar still struggled.

Swiss cheesed

The Swiss franc is the most-hated currency with an Optimism Index that has dropped into pessimistic territory below 30. Currencies are different beasts when it comes to sentiment and can trend for far longer than other markets tend to.

Gassed

The 10-day Optimism Index on the Oil & Gas fund, XOP, has started to curl down out of excessive optimism territory.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |