A Little Panicky

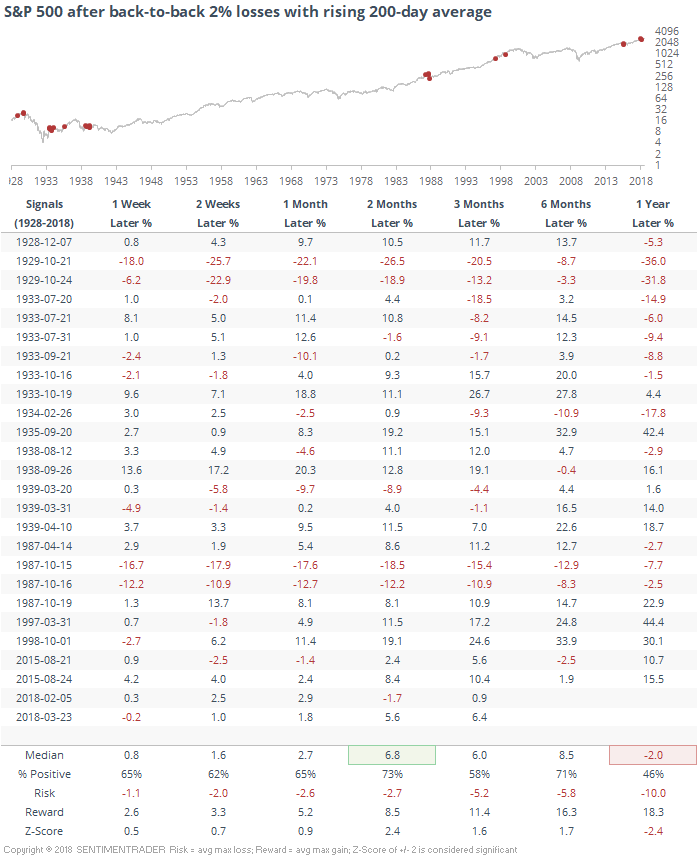

With a failed bounce attempt intraday, we're starting to register a few more signs of notable pessimism or even outright panic. It's understandable, since this would be one of the few times in modern markets when the S&P 500 suffered back-to-back 2% losses during a generally uptrending market.

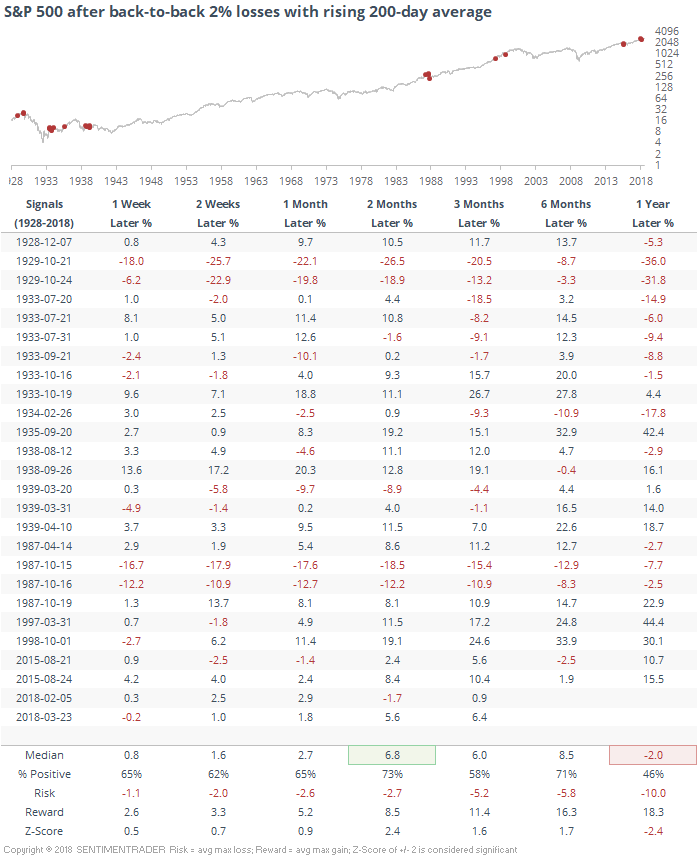

As a result of the selling, volume into inverse ETFs has exploded. Yesterday barely set a record, but today is on track to blow that out of the water. This could change quite a bit by the close, but still.

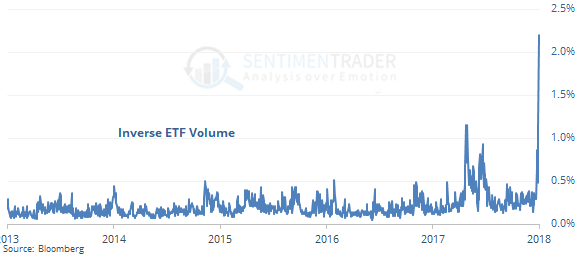

As the afternoon selling reached its climax (so far), a majority of securities on the NYSE traded on a downtick (lower than their last trade price). Nearly 1800 securities traded on a downtick vs uptick, the 2nd-most extreme reading in a decade. This suggests either outright panic on the part of investors or (more likely) a series of automated program trades.

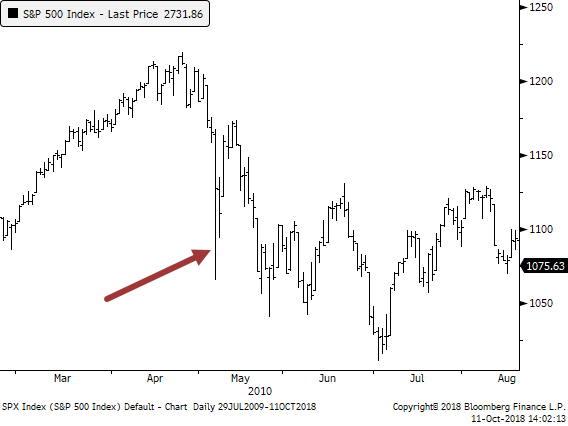

The only day with a lower TICK was May 6, 2010. The setup was fairly similar then, too, as traders panicked following what had been a steady uptrend. It led to a quick bounce, then testing of the low.

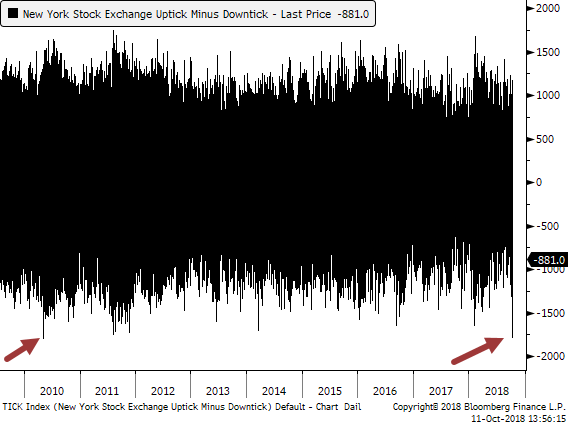

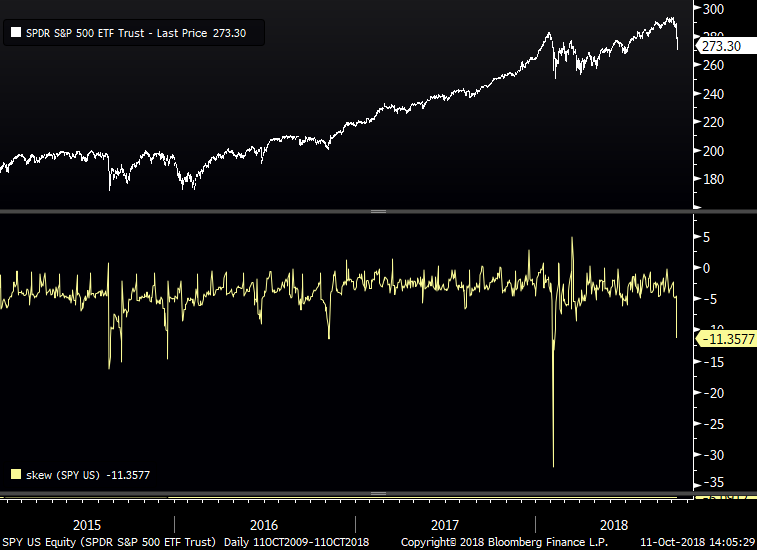

The panicky conditions are leading to a blowout in put options, with skew on SPY options widening the most since February and at one of the most extreme levels in years.

We'll have to see how the rest of the day plays out and what kinds of extremes are registered. If there is even a modest recovery, we probably won't see many. But if it picks up like yesterday, then we should be on track to record a number of historic extremes. The data yesterday suggested that another 1-2 days of selling wouldn't be unusual and would likely trigger more bullish precedents going forward, so we'll see if that's what we get today.