A limited risk example using UNG options

Key points

- In this piece, we highlighted the potential for a reversal and rally in natural gas in the months ahead

- Relying solely on seasonal has inherent risks; also, trading natural gas futures can involve a large amount of dollar risk

- One way to limit risk on a natural gas-related position is to trade options on the ticker UNG

Natural Gas prices could advance in the months ahead

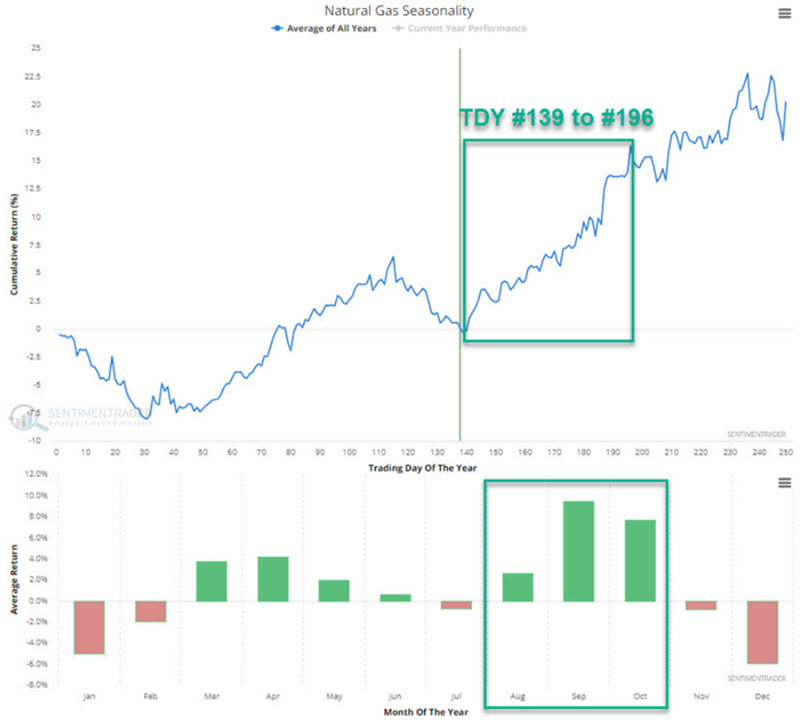

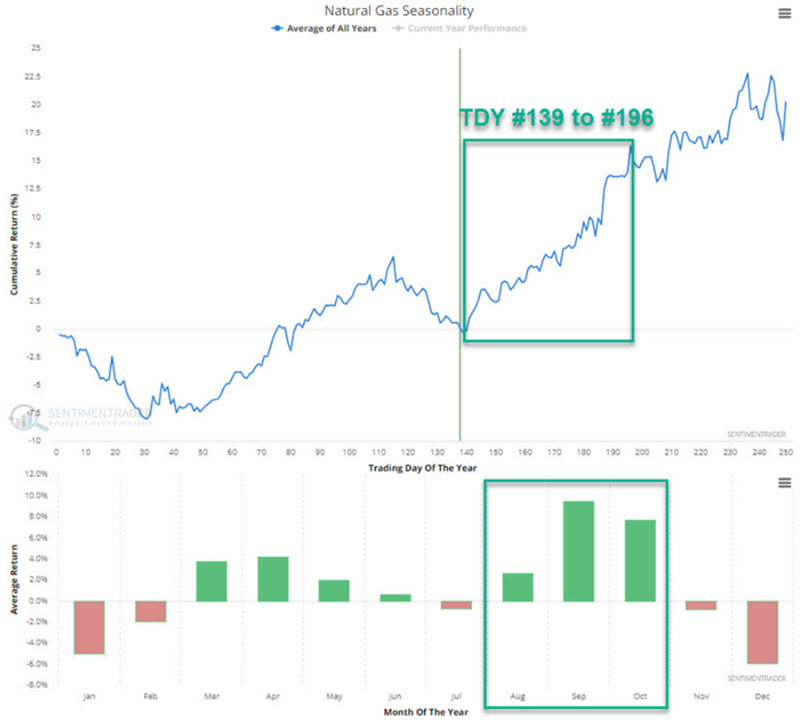

For the full setup, please refer to this article dated 2024-07-15. In a nutshell, the premise is that natural gas has tended to show significant strength between mid-July and early October, as shown in the figure below.

Typically, the best time to trade based on seasonality is when price action and seasonality are in agreement. That is not the case with natural gas at the moment. However, at times, the next best time to trade seasonality is when seasonality is turning favorable, and the market or index in question is deeply oversold (and theoretically "due" for a bounce). That is the case now with natural gas. The problem is that this action can be tantamount to trying to "catch a falling safe." Hence, limiting risk as much as possible is key in these cases.

So, at this point, we are looking for a way to bet on higher natural gas prices while also limiting our risk to an acceptable amount. The United States Natural Gas LP ETF (ticker UNG) is intended to track the price of natural gas futures. A trader can buy and sell shares of UNG just as they would shares of stock. Options are traded on ticker UNG. In this piece, we will highlight one example of trade. Note that the example trade is not intended as a specific "recommendation" but as an example of "one way to play."

Using UNG options to play natural gas

For a non-futures trader wishing to play the long side of natural gas, the most straightforward approach would be buying ticker UNG shares. As this is written, shares are trading at $14.62 a share. So, a trader could buy 100 shares of UNG for $1,462. Another approach - and the one we will address here, is to trade options on ticker UNG.

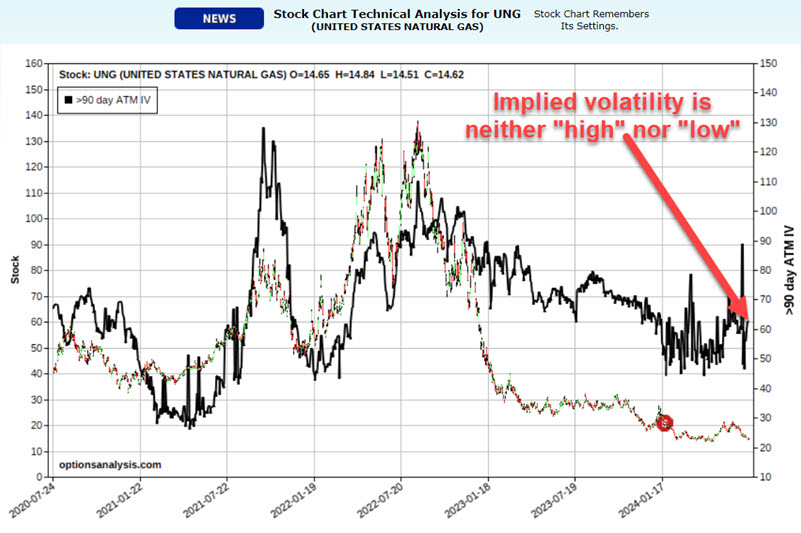

The chart below (and all charts below) is courtesy of www.Optionsanalysis.com. This chart shows UNG price action over the last five years and the action of implied volatility for UNG options.

For call options with a strike price below the share price, the option price is comprised of intrinsic value (the difference between the strike price and the price of the shares) plus extrinsic value (more commonly referred to as "time premium"). Call options with a strike price at or above the share price are referred to as "out-of-the-money" options, and their price is comprised solely of time premium. The critical thing to note is that options lose all of their time premium by option expiration. This is referred to as "time decay."

Implied volatility tells us whether the time premium built into a securities option price is presently "high," "low," or somewhere in between. The higher the implied volatility, the more time premium there is built in, and the more "expensive" the options are. Conversely, the lower the implied volatility, the less time premium is built in, and the more "cheap" the options are. A close look at the black line in the chart above reveals that implied volatility for UNG options is "somewhere in between." UNG options are not "cheap," but they are also not terribly expensive.

To play a potentially bullish scenario, we will use a "modified bull call spread."

Playing UNG with call options

For our example trade, we will buy some UNG call options with a strike price close to the price of UNG shares and sell fewer UNG call options with a strike price that is further out of the money. The purpose is to use the proceeds from the options we sell to help pay for the options we buy.

Our example trade involves:

- Buying 4 UNG Oct18 2024 15 strike price calls @ $1.82

- Selling 3 UNG Oct18 2024 20 strike price calls @ $0.52

The figure below displays the trade particulars.

The chart below displays the risk curves (i.e., the expected $ P/L based on the price of UNG shares as of four different dates leading up to option expiration. Note that the position has unlimited profit potential, but limited downside risk.

Things to note:

- The cost to enter this trade is $572, which is the maximum risk on the trade

- Profit potential is unlimited as we hold more long calls than short calls

- The position has an initial "Delta" of 149.14. This implies that the position is roughly the equivalent of holding long 149 shares of UNG

- The position has an initial "Gamma" of 16.825. This implies that for each $1 increase in the price of UNG shares, this position will gain 16.825 Deltas and vice versa

- The position has an initial "Vega" of $5.03. This implies that for each 1.00 increase in implied volatility, the position will gain $5.03 and vice versa

- The position has an initial "Theta" of-$1.66. This implies that with UNG shares at their current price, this position will lose $1.66 in value in one day due solely to the time premium. Note that if the price rises, Theta will change, and the time premium can begin to work in favor of this position.

Position Management decisions are a trader's responsibility

Note that there are no "hard and fast rules" about managing this position; only decisions are to be made, and plans are to be followed. On the upside, a trader might consider a target level at which they might either take a profit or adjust the initial position to lock in a profit while still allowing for the potential of more significant profit.

On the downside, a trader must decide what to do if UNG declines in price instead of rising. One possibility is to ride it out, knowing that no more than the initial cost of $572 can be lost. An alternative might be to close the position and try to salvage some premium if UNG falls below its April 2024 lows.

What the research tells us…

As explained in the original article, there is no guarantee that natural gas futures - and, by extension, ticker UNG - will rise between now and early October. However, seasonal history suggests the odds are favorable that they will. The example trade highlighted above should be considered as an example of a highly speculative bet that natural gas will follow its seasonal tendency in 2024 and move higher in the months ahead. The option position is also an example of an alternative way to play the natural gas market without assuming the risk associated with futures trading and simultaneously limiting the maximum amount of dollar risk.