A lesson in rank speculation

Key Points

- There is absolutely nothing wrong with speculating in the financial markets

- The keys are risking only small amounts of capital and making bets that have a reasonable chance of paying off

- The example trade below is not a recommendation but serves merely as an example

The two biggest mistakes in speculation

Anyone who has ever put money into the market has felt the desire to do "something a little crazy" at least once somewhere along the way. When that urge to "jump" occurs, different traders react differently. The two most common mistakes regarding speculative opportunities are:

- NEVER allowing oneself to "take a shot": In this scenario, an individual assiduously refuses to trust their instincts, opting instead to adopt the "I don't know what I'm doing" or "I can't afford to take a loss" or "I've heard that speculating is bad," etc. mindset. So that urge to buy an Amazon or an Apple or a Tesla - or some small company on the verge of making it big - goes entirely unacted upon - and the trader spends a lot of time counting the money they didn't make

- Going overboard on a particular opportunity: In this scenario, individuals convince themselves that the opportunity they have uncovered is "The Big One" and that they really need to capitalize. And then, instead of investing a reasonable amount of capital, they "bet the ranch" - pouring a far too large a portion of their investment capital into this "great opportunity." And when that great opportunity collapses into disaster, the trader is left with a) a decimated trading account, which may take years to rebuild, and b) a shattered psyche that may never recover.

This seems like a good time to invoke the following:

Jay's Trading Maxim #108: Traders who "bet the ranch" - so to speak - invariably end up "renting a small apartment somewhere" - so to speak.

The bottom line: DO NOT be afraid to trust your instincts and act on your ideas. But allocate capital conservatively.

Laying the groundwork

A reminder that what follows is not a "recommendation" but instead as merely an example of "speculative activity."

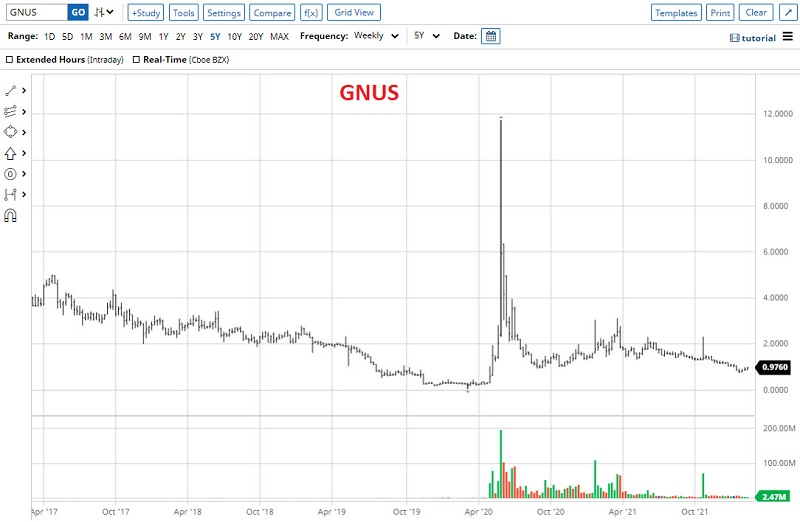

The stock we will look at is Genius Brands International (GNUS). As you can see in the bar chart below (courtesy of Barchart.com), GNUS started as a high-flyer with a lot of promise (once trading over $250 a share), and then that promise, ahem, evaporated, to say the least (stock now trading around $1).

The wholly speculative stock has traded between $0.20 and $11.73 a share in the last five years. Is there a chance it will "pop" again someday? In all honesty, it beats me. But the question to be addressed here is not "whether or not it will," but rather "if I think it might, is there are a way to bet on an up move without taking on too much risk?"

This is not the kind of stock - nor chart pattern - that most investors look for when making sound investments. But remember, we are pursuing an opportunity in speculation, nothing more, nothing less. So, let's consider an extremely speculative trade using options on GNUS.

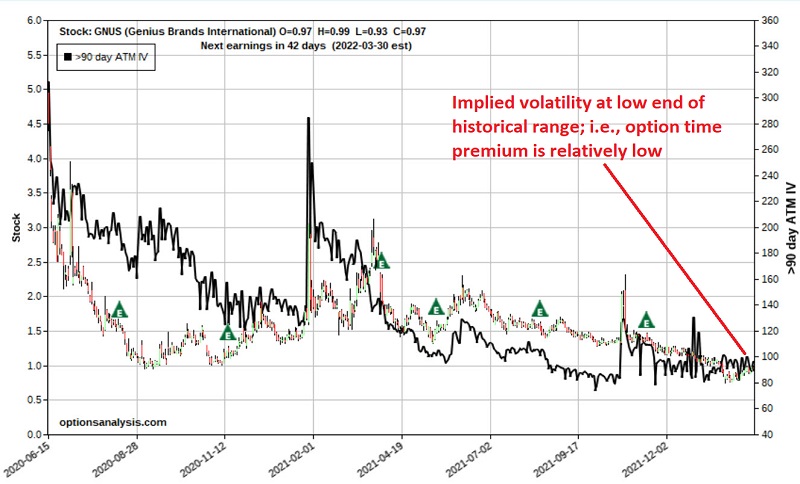

The chart below (courtesy of Optionsanalysis) shows a bar chart for GNUS along with the average implied volatility for longer-term options on GNUS. The key thing to note is that IV is presently near the low end of the historical range.

Implied volatility essentially tells us whether there is a lot, a little (or somewhere in between) of time premium built into the price of the options. High IV means there is a lot of time premium in the price of the options, and low IV means there is little time premium in the price of the options. This knowledge can matter greatly as every option will lose its time premia by expiration.

With IV for GNUS options at the low end of the historical range, it tells us that time premium is low, and the GNUS options are relatively "cheap."

Allocating Capital

The first question is how much capital to commit. My own rule of thumb is that a purely speculative trade should involve 1% to no more than 5% of one's trading capital. The bottom line - never hesitate to take a trade if you feel it will work, but DO NOT bet big. If your trade selection is good, then over time, your winnings will eventually pile up. But by avoiding any painfully large losses, you will be less likely to hesitate to take the next trade.

So, for the sake of example, let's assume a trader has a $25,000 trader account and is willing to commit 2% of capital to any one trade. So, the trader can commit $500 ($25K x 2%).

Position a trade

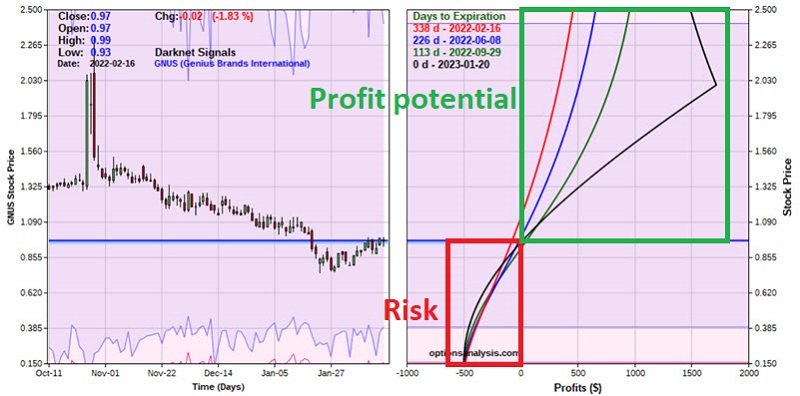

The next question is, "what do we expect" will happen with GNUS stock. While this is an example and I am not promoting any expectation, let's assume that our trader believes that GNUS could rally back up to the $1.50-$2.00 a share range sometime in the next 11 months. Let's enter a trade that can profit if this scenario plays out. Our example trade is as follows:

- Buy 25 GNUS Jan19 2024 1.50 calls @ $0.35

- Sell 25 GNUS Jan20 2023 2.00 calls @ $0.15

The particulars and the risk curves for this trade appear in the screenshots below.

Things to note:

- The cost to enter this position - and the maximum risk - is $1,000.

- In theory, the maximum profit potential is roughly $1,700 and would occur if GNUS was trading at exactly $2.00 a share at the time of January 2023 options expiration. Note that this value can change depending on whether IV rises, falls, or stays the same.

- The breakeven price for this trade is roughly $0.92 a share, which is below the stock's current price of $0.97. This number also can change based on changes in IV between now and January 2023 options expiration.

- If GNUS does begin to advance in price, profits will accrue. Note the colored risk curve lines in the chart above. Each line represents the expected profit/loss for the position based on the price of GNUS stock as of a given date. Note that the expected profit shifts higher as time goes by. This is because the short options held (January 2023) will experience time decay at a faster rate than the long options held (January 2024).

- Note that if GNUS stock trades above $2 a share before January 2023 options expiration, there is a risk of assignment of the short options. In this case, our traders would find themselves short 2,5000 shares of GNUS stock. Technically the trade could exercise the long calls to cover this requirement (i.e., buying 2,500 shares of GNUS at $1.50 and delivering them at $2.00 a share). But most traders would prefer to skip this procedure entirely.

Position Management

This position may require some patience. While that may not sound like a problem, it does run counter to how most people trade options - for short-term rewards.

When to exit with a profit: If GNUS rallies to near $2 a share before January 2023 expiration, the logical step would be to exit the entire position and take whatever profit is available at the time. The longer this takes to happen (and the higher IV at the time), the larger the likely profit. As a secondary criterion, a trader may decide that if a particular favored overbought indicator is triggered (for example, of 14-day RSI exceeds 70%), they will close all or some of the position and lock in profits at that time.

When to exit with a loss: Since the original $500 risk was within the acceptable limit for our trader, there is no urgent need to cut a loss if the stock goes south. A trader can wait to see if things turn around. That said, another possibility is to consider bailing out if the stock falls below some arbitrary level and trying to salvage whatever premium is still left in the trade.

What the research tells us…

Presently, most option trades are very short-term in nature (one week or less). Nevertheless, the potential to use options to play a longer-term scenario is great. GNUS is not on anyone's list of "high-quality companies." And the example trade above is pure, rank speculation. Whether that trade - or any other similar trade - is worthy of committing capital to is up to each trader to decide. But the keys remain, a) risking only a reasonable amount of capital on any one trade and b) entering a position that can "risk a little to make a lot."