A key to a healthy environment is turning positive

Key points:

- The NYSE McClellan Summation Index has moved above zero after a long time below

- The same has occurred on the Nasdaq exchange, ending a historic streak in an unhealthy environment

- Only the global financial crisis exceeded the past six months in terms of the length in a broadly unhealthy market

A key to a healthy market environment is moving into place

We've seen lately how an improvement in individual stocks has pushed several breadth measures into impressive recoveries. These have typically occurred after the concluding phases of major declines.

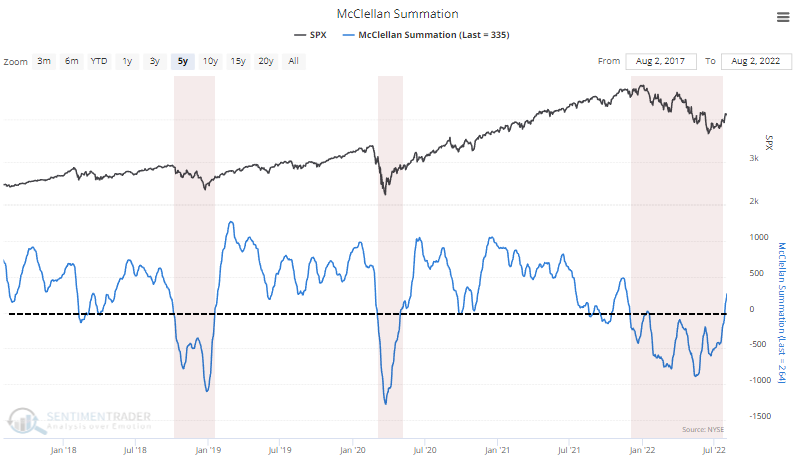

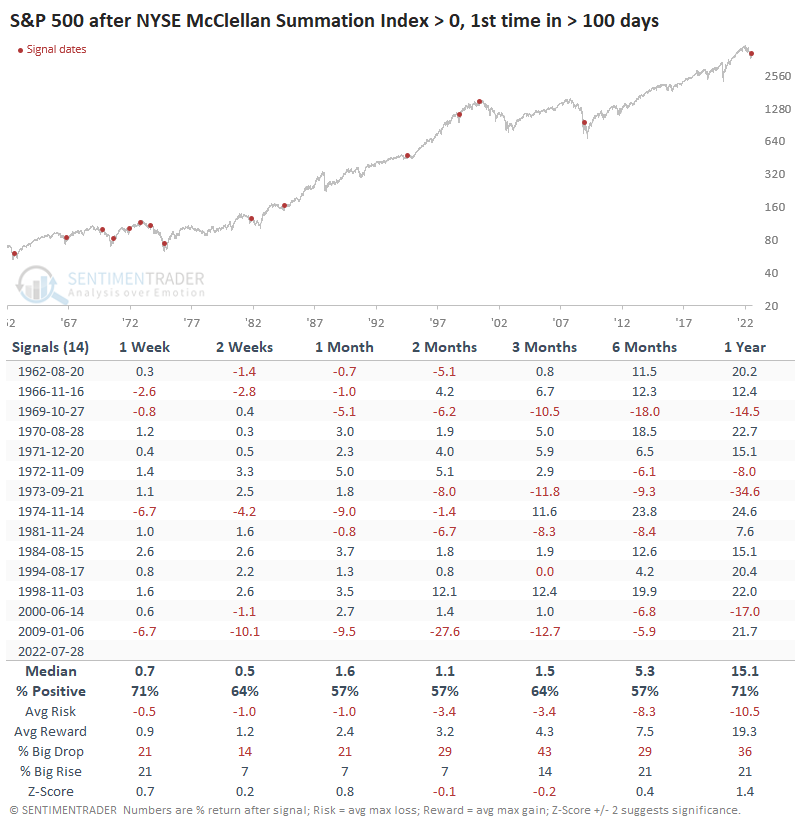

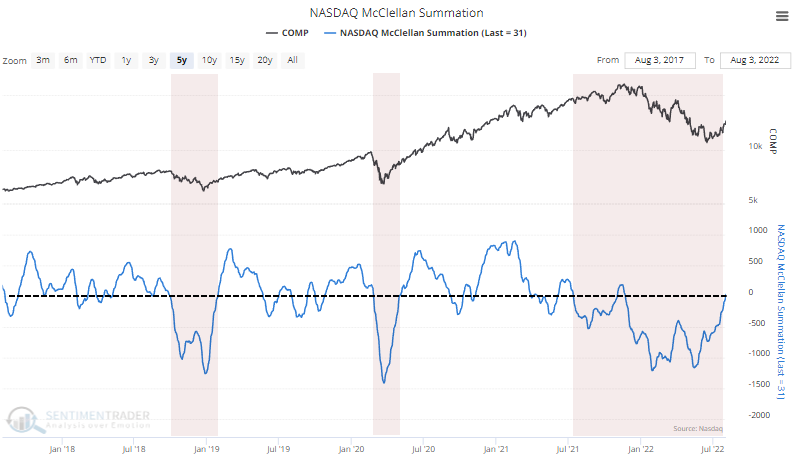

The fact that most stocks haven't fallen back much has helped improve some longer-term measures of internal momentum. The NYSE McClellan Summation Index has managed to claw back above zero. A positive and rising Summation Index is one key sign of a healthy market environment.

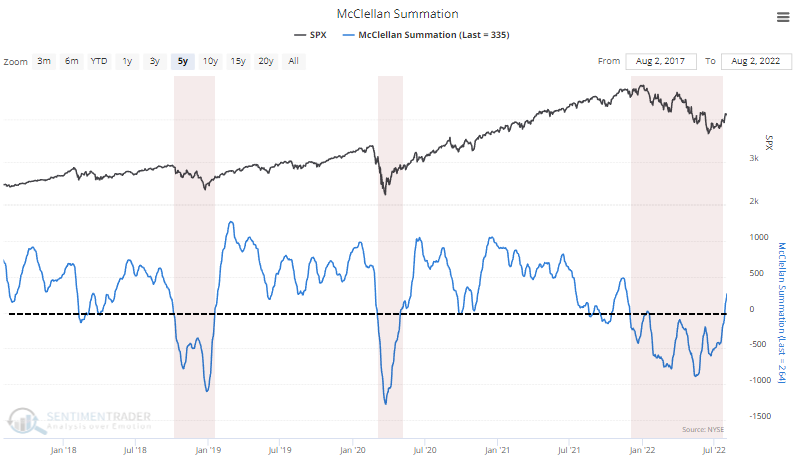

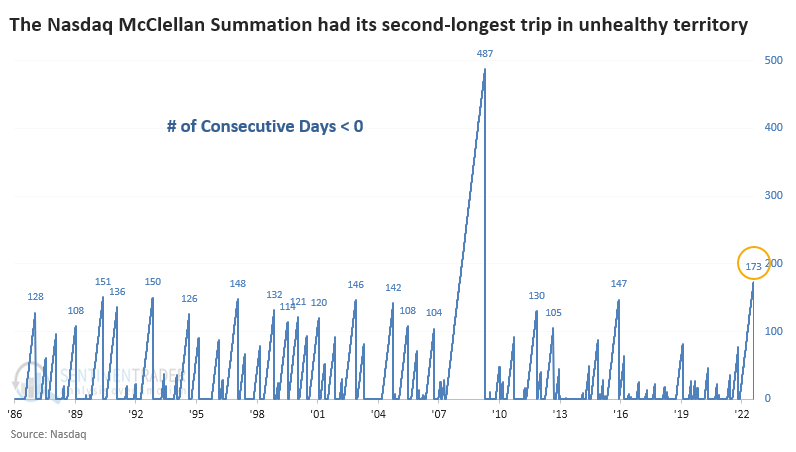

The return to a healthy state ended one of its longest-ever stays below zero.

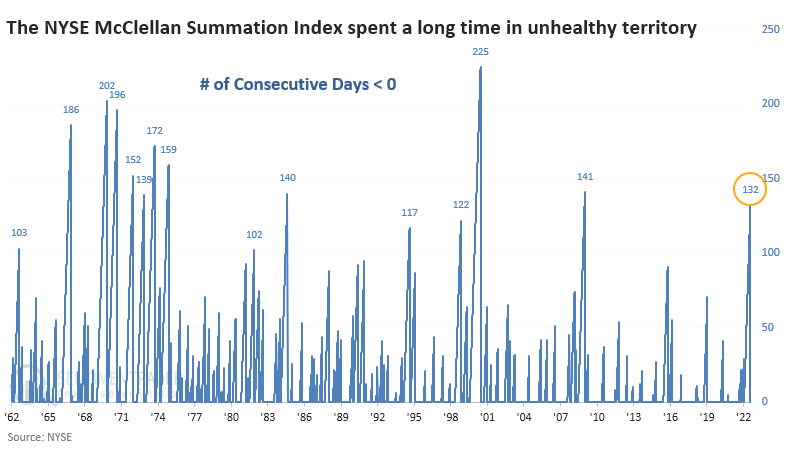

A recovery in the Summation Index after a long period below zero wasn't necessarily an all-clear signal. While forward returns were consistently positive, they weren't much better than random. The main culprits were failures in 1969, 1973, and 2000. It was also very early in 2009.

While it was a decent sign that a bear market was over, or nearly so, there were too many false positives to have much confidence in it.

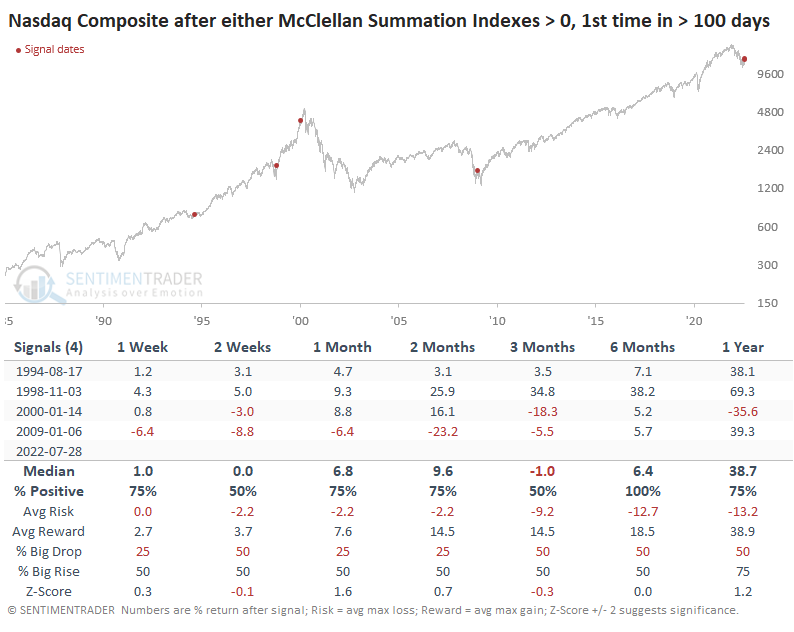

A recovery on the Nasdaq, too

The Nasdaq exchange is more heavily populated by some of the technology and speculative stocks that took the brunt of the selling pressure this year. So, it has been an even longer stretch for the Nasdaq McClellan Summation Index below the zero threshold.

At 173 days, it was the second-longest stretch below zero for that indicator in nearly 40 years. Only the devastatingly unhealthy global financial crisis beat it out.

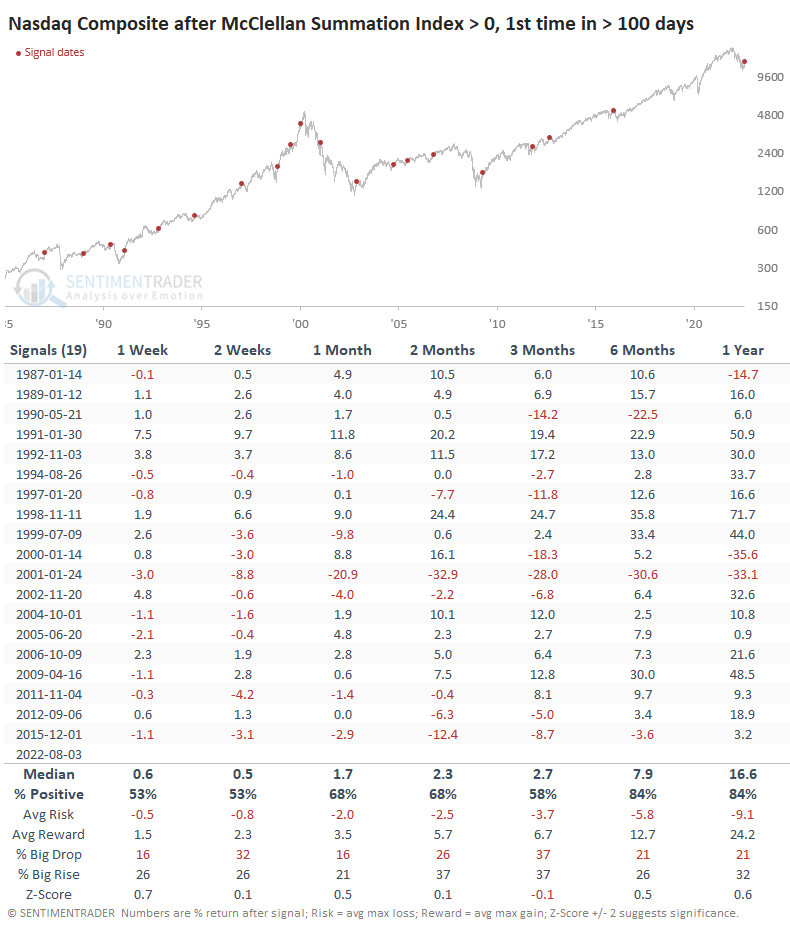

Internal recoveries on the Nasdaq were better for long-term returns. The Composite showed a gain six and twelve months later after 16 out of 19 signals. All but one of them sported a gain either six or twelve months later. The only exception was a failed rally after the pricking of the internet bubble in 2001.

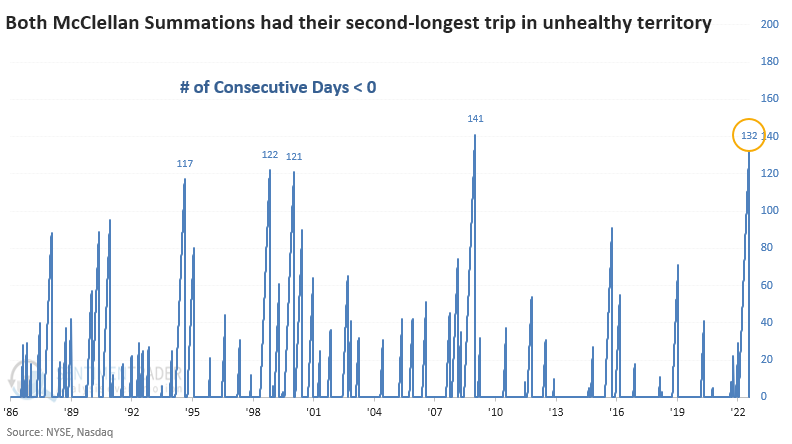

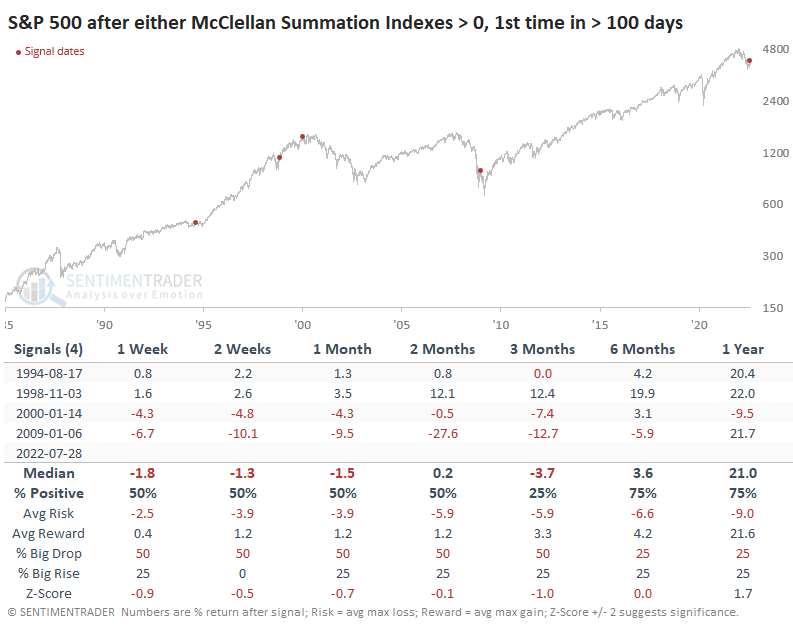

All together now

When we look at both Summation Indexes together, it was also the second-longest streak below zero, just eclipsed by the financial crisis.

That's a pretty remarkable fact - that in the past ~40 years, only the worst market anyone has experienced since the Great Depression was (barely) worse than the past six months.

The Nasdaq responded well after the few precedents.

It wasn't as positive for the S&P 500.

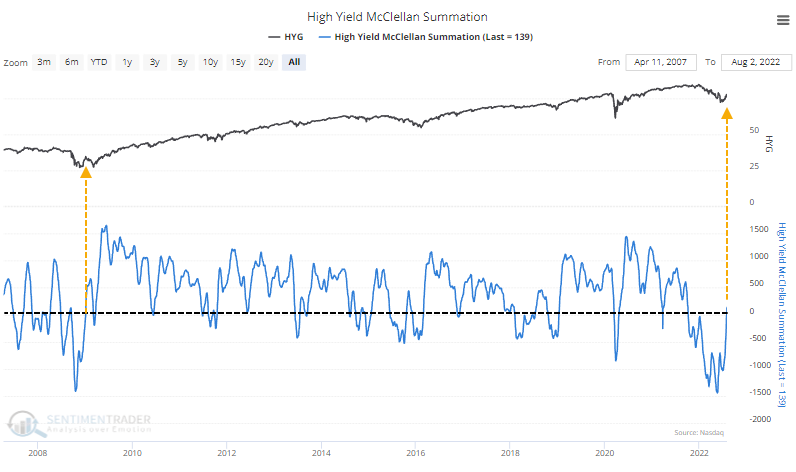

As an aside, both Dean and I have outlined recent thrusts in the high-yield bond market (here and here). Because of the recovery in many junk bonds, that market's Summation Index has recovered, too. This ends its longest-ever streak below zero, exceeding even the financial crisis.

What the research tells us...

A positive and improving measure of internal momentum across a broad swath of stocks is necessary for a bull market. It's something that has been lacking for most of the past six months but has recently changed. While it's not enough of a signal in and of itself to suggest that stocks are in the clear, it is a demonstrably good sign, especially when occurring on the heels of impressive breadth thrusts that have only triggered before year-long advances.