A Historic Split Between Haves and Have-Nots on the Nasdaq

Since the speculative peak in February, the stock market has become more bifurcated between winners and losers. That's normally a bad sign for the overall market, but 2021 has steamrolled every "bad sign" so far.

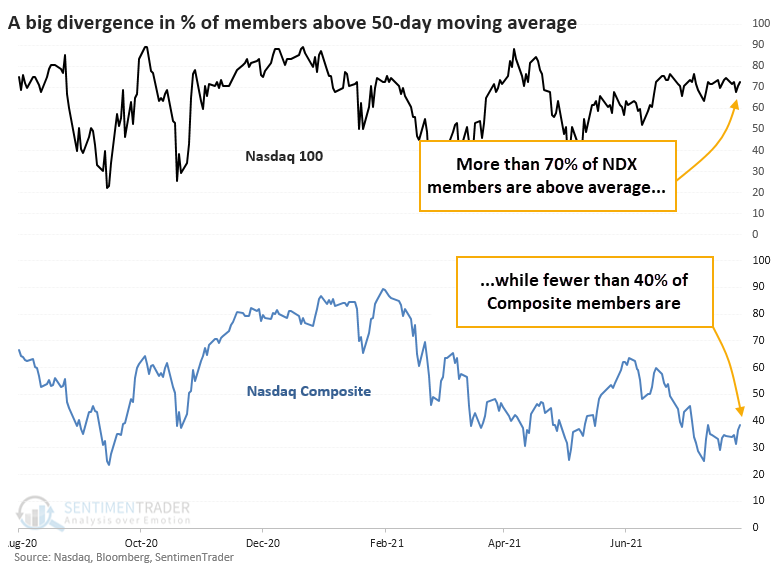

This winner-vs-everyone-else divergence is especially evident on the Nasdaq. In recent days, more than 70% of stocks included in the Nasdaq 100 index have closed above their 50-day moving averages. But within the broader Nasdaq Composite index, fewer than 40% of stocks are above those trendlines.

There are 102 stocks in the Nasdaq 100, and they have a median market capitalization of $58 billion. There are 3,423 securities in the Nasdaq Composite, with a median market cap of $471 million. Many of the smaller stocks in the broader Composite are dragging the internal breadth figures lower.

The 5-day average of the spread in breadth between those indexes is now among the widest in 20 years. Looking at the ratio between indexes, these extremes in the medium-term trends tended to coincide with shorter-term blowoff peaks in the Nasdaq 100 to Nasdaq Composite ratio.

What else we're looking at

- Full returns in the Nasdaq 100 and Composite after wide spreads in breadth

- What these spreads meant for the ratio between indexes, and for the S&P 500

- A look at gold's flash crash

- Two options trade examples that would profit on a summer swoon

- There is currently an extreme in the ratio of the S&P 500 equal-weight vs cap-weight indexes

| Stat box There are only 79 million shares outstanding in the JNK high-yield bond fund, the lowest since April 2020 and nearing the lowest level in 3 years as traders leave for other funds or the asset altogether. |

Etcetera

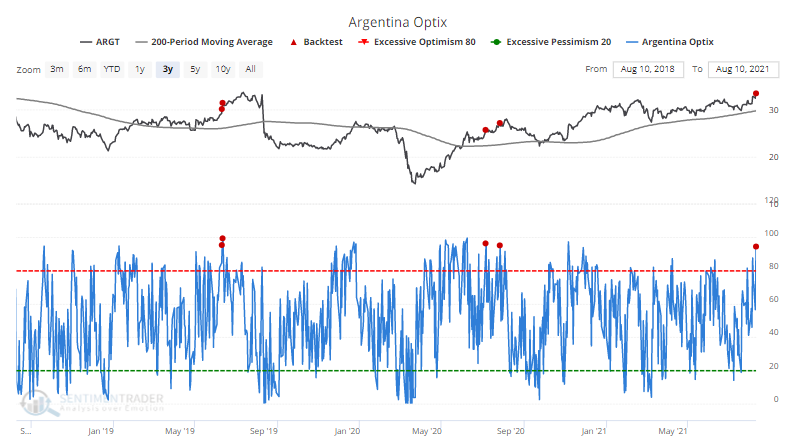

¡Caray! Optimism is high for Argentina at the moment. The Optimism Index on the ARGT fund has soared to one of its highest levels in 3 years. Our Backtest Engine shows that the fund continued to gain only 31% of the time when optimism has been this high since the fund's inception.

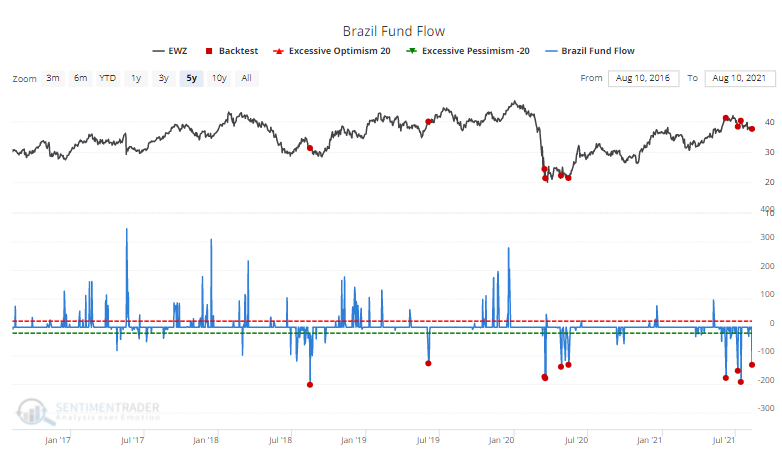

Less enthusiasm to the north. Unlike in Argentina, traders in the EWZ Brazil fund have been leaving in droves, with more than $125 million being pulled from the fund on Tuesday alone.

No love for miners. Nearly 30% of gold mining stocks have careened to a 52-week low. That's among the most in the past 2 years.