A historic drop in uptrends

Earlier this week, there were some dangerous signs underlying stocks' internal participation. Despite major indexes hitting new highs, some shorter-term breadth measures were showing rare and mostly troubling lags.

When stocks tumbled on Wednesday, the overwhelming number of declining issues pushed the McClellan Oscillator further below zero, to the point where it's already suggesting oversold conditions.

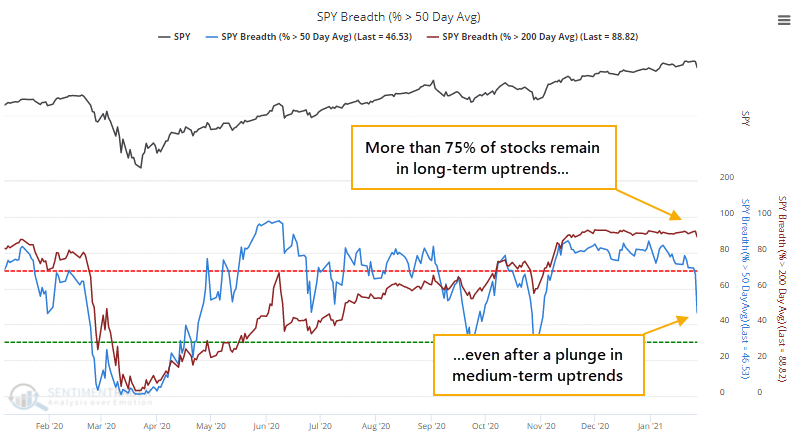

There was also a dramatic drop in the percentage of members in the S&P 500 holding above their 50-day moving averages. It plunged more than 20% on Wednesday alone, one of the largest single-day drops in medium-term trends in years. Even so, well over 75% of stocks are still holding long-term uptrends, trading above their 200-day moving averages.

Looking at similar behavior since 1928, a swift correction in medium-term trends within the context of long-term uptrends has usually resolved to the upside, especially over the next 3-6 months. Three months later, there was only a single small loss, and the risk/reward was excellent.

What else we're looking at

- What happens when the McClellan Oscillator gets oversold within only a few days of stocks sitting at new highs

- Full returns following a drop in members above their 50-day moving averages but most of them above their 200-day averages

- Investors still aren't totally in risk-off mode - there are relatively few defensive stocks outperforming the S&P 500

- Despite a jump in the VIX, high-yield credit spreads aren't blowing out

- What happens when investment managers suddenly reduce exposure

- There has been a quick change in the % of stocks at 1-month highs vs lows

- As we near the end of winter, two commodities show vastly different seasonal tendencies

| Stat Box A survey of active investment managers from NAAIM showed that professional investors reduced their net exposure to stocks by nearly 30% in a single week, one of the largest declines in the history of the survey. The only time it occurred in the same week stocks hit a 52-week high was at the end of August 2014. |

Sentiment from other perspectives

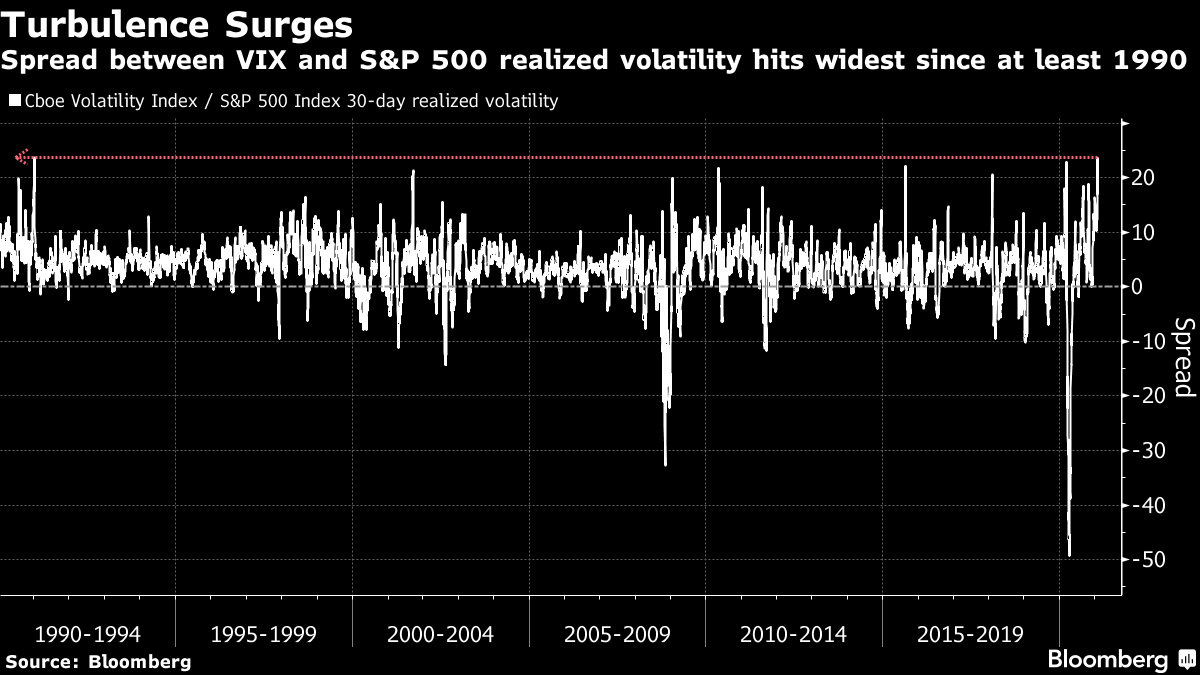

Volatility jumped this week, but implied volatility jumped even more. Options traders are pricing in bigger moves than the S&P 500 is currently undergoing, bringing the VIX close to levels that can see spillover to credit. Source: Bloomberg Weekly Fix

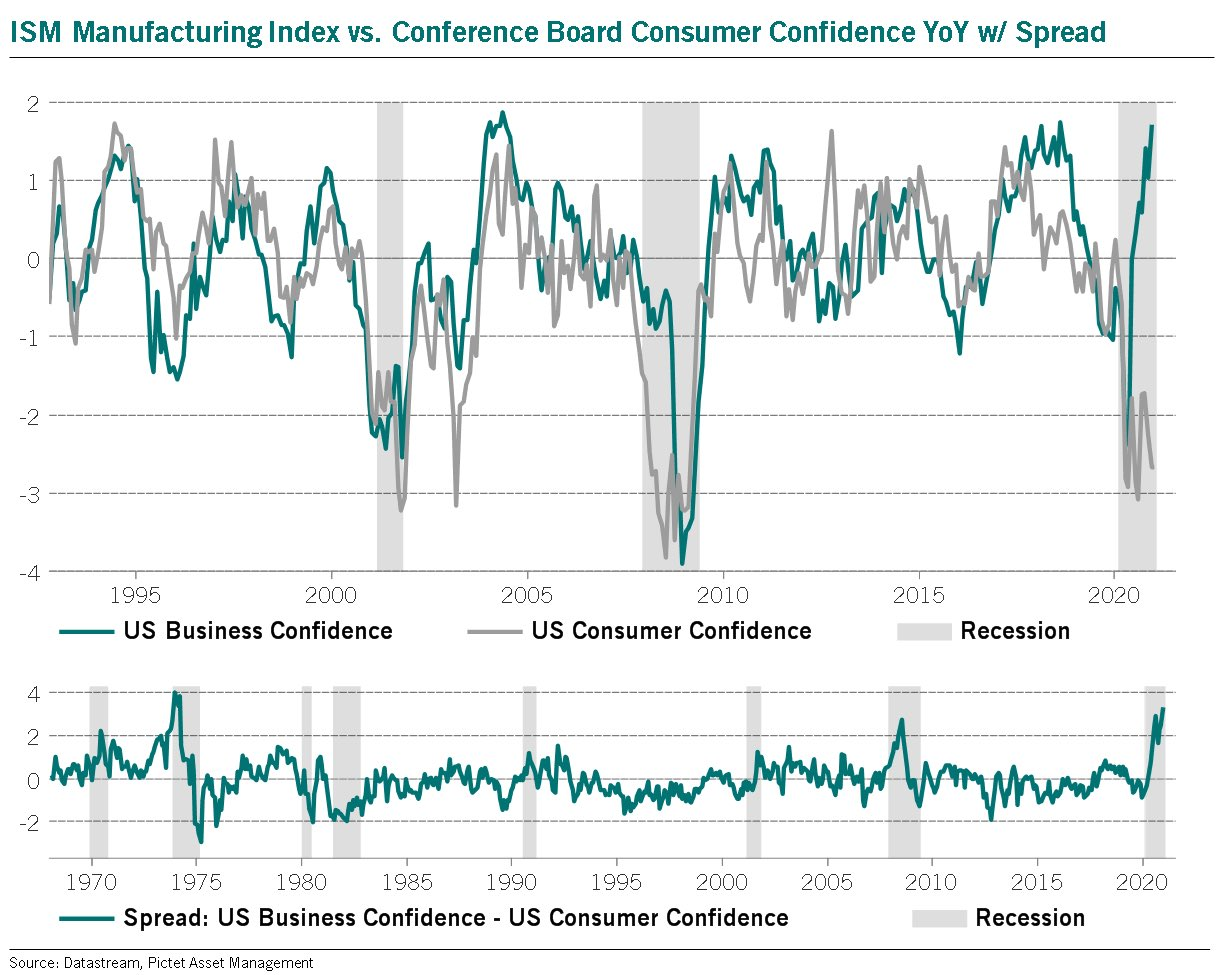

Businesses have never been more confident while consumers were so negative. Trends in sentiment between the groups have never been wider. Source: Pictet

It's easy to say "this will not end well," but this will not end well if history is any guide whatsoever. Source: WSJ, NY Post, Apple Store