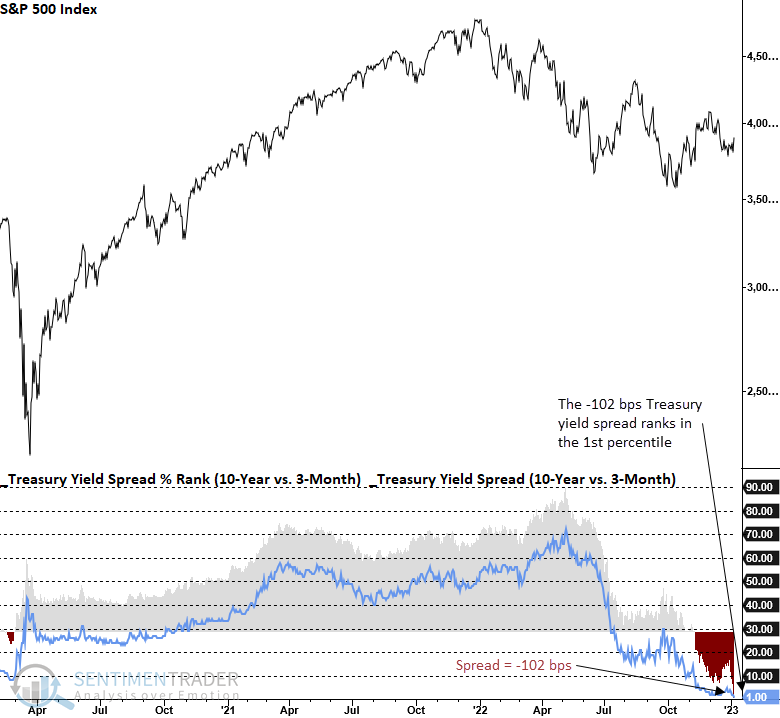

A historic collapse in the yield curve

Key points:

- The 10-year to 3-month Treasury yield spread contracted by -54 bps in four days

- After similar downticks, stocks were negative across most time frames

- The four-day slump pushed the overall spread to -102 bps, which ranks in the 1st percentile

- Historical yield spread rankings in the 10th percentile or less suggest unfavorable stock returns

The yield curve continues to flash warning signs

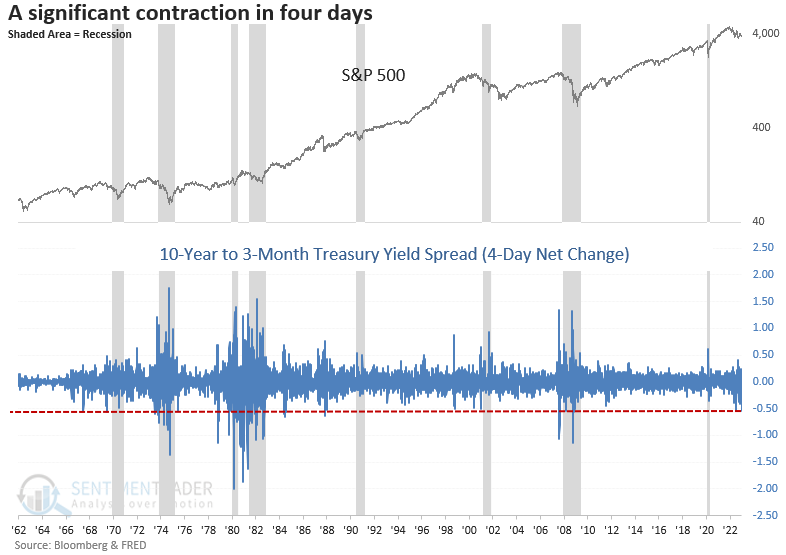

Bond traders wasted no time in the new year bidding up the 10-year bond price in the holiday-shortened first week of the year. The increase in price means the bond yield declined, and in doing so, the widely followed 10-year to 3-month Treasury yield spread contracted by -54 bps in four days.

The decline in the spread inverted the yield curve to a historic -102 bps, which ranks in the 1st percentile relative to all other readings since 1962.

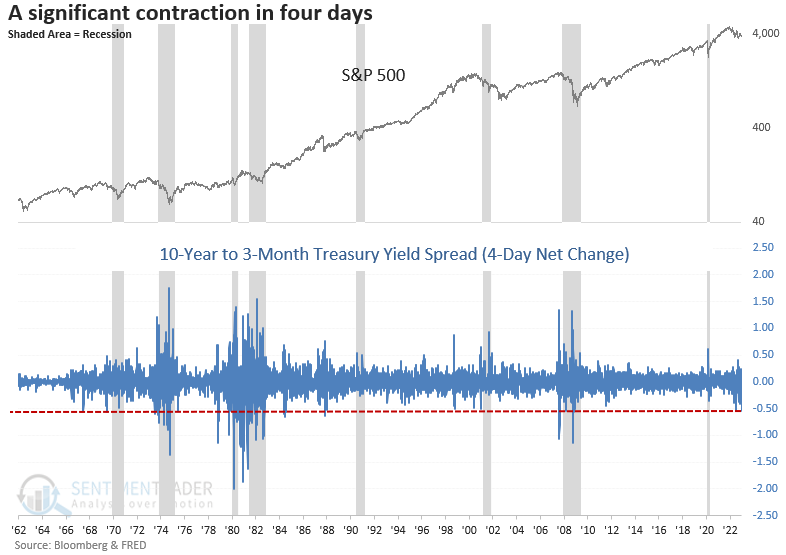

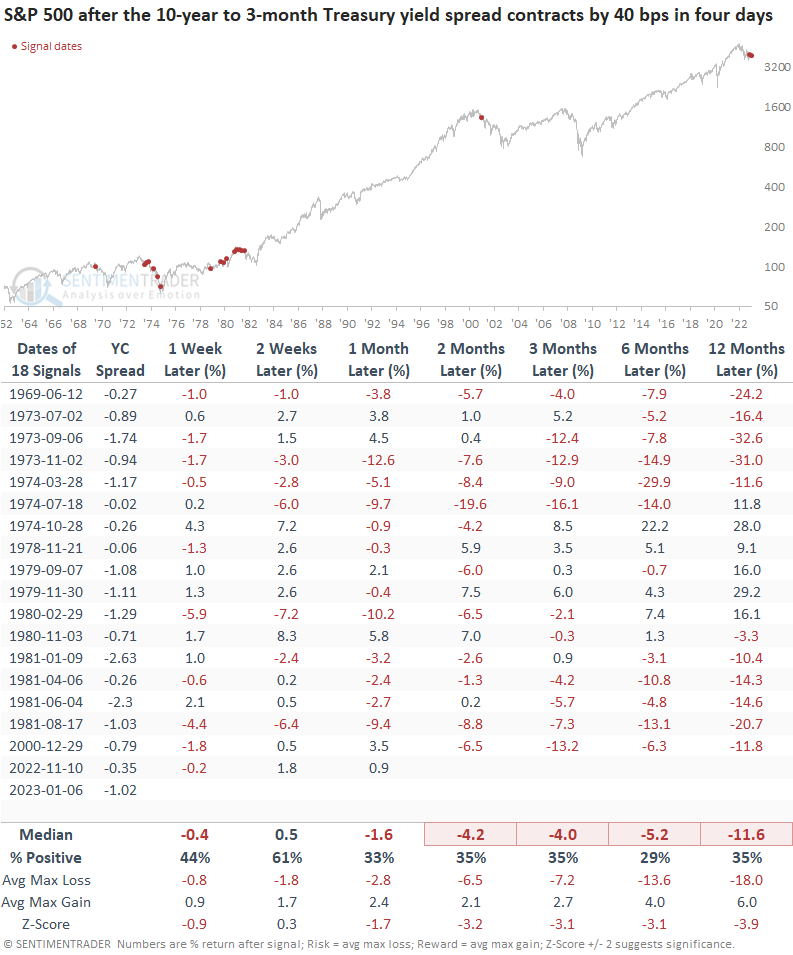

Let's assess the outlook for stocks when the 4-day net change in the 10-year to 3-month Treasury yield curve contracts by -40 bps. I loosened the net change level to capture more historical instances. And for context, I will identify signals that occurred when the curve was inverted, which is the case now.

Similar sharp contractions preceded negative returns for the S&P 500

When the Treasury yield spread declines by -40 bps in four days, and the spread is inverted, the outlook for the S&P 500 is grim across most time frames. Historical signals typically occur within the context of stock market drawdowns, especially during the 1966-82 secular bear market period when the Federal Reserve was fighting elevated inflation similar to the current environment.

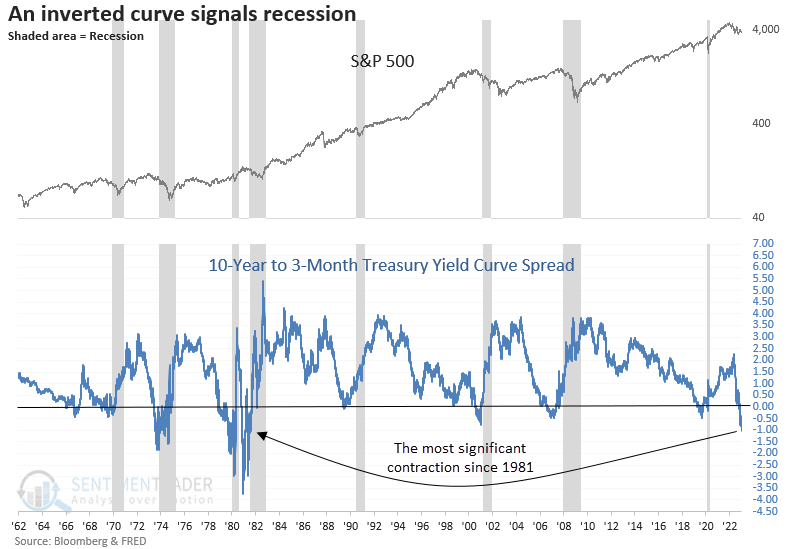

With the Treasury yield spread falling to the lowest level since 1981, we need to consider the 1966-82 secular period in terms of similar analogs for the current environment. If the Federal Reserve remains higher for longer and the economy softens further, the yield spread can fall further.

When I assess the 10-year to 3-month Treasury yield spread relative to all other historical levels, the spread ranks in the 1st percentile, which means 99% of all other readings are higher.

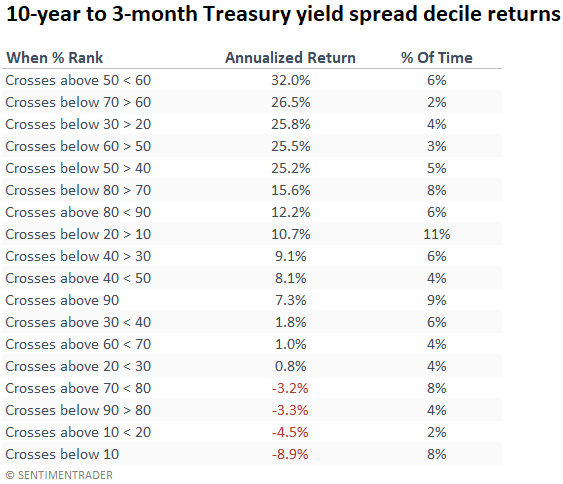

The Treasury yield spread crossed below the 10th percentile in November 2022. After similar decile bracket signals, the S&P 500 annualized at -8.9%, the worst return for any yield spread shift. And, should the curve steepen from here and cross above the 10th percentile, returns remain unfavorable.

What the research tells us...

Whether a sharp four-day contraction or a historic inversion, one must be mindful of the top-down macro environment as the yield curve continues to flash warning signs for stocks and the economy. Interestingly, economist Campbell Harvey, a pioneer in the research of the yield curve, was interviewed this morning on CNBC. Mr. Harvey said it's different this time as other factors don't point to an economic contraction. i.e., the curve is sending a false signal, and there will be no recession. We agree with Mr. Harvey on one thing. A research approach that weighs multiple factors is more desirable than depending on a single indicator.