A Historic Battle Between Smart and Dumb Money

Speculative options activity is near records, but somebody, somewhere, is hedging against a big fall.

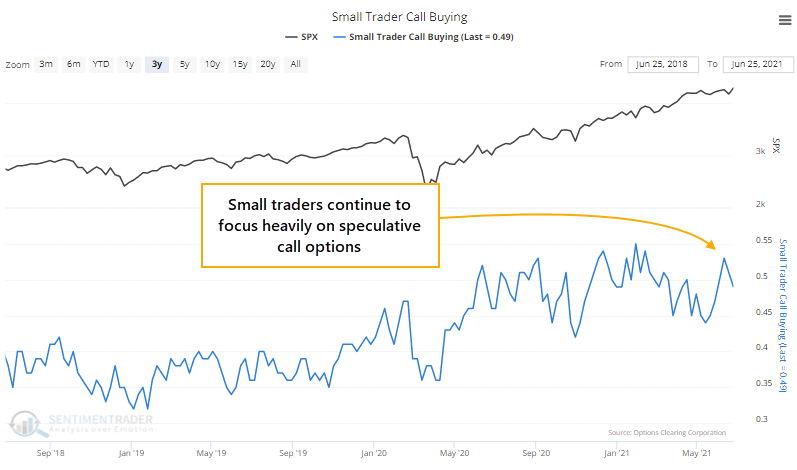

A couple of weeks ago, we saw that options volume was exploding to the speculative side again, with few indications of hedging activity anywhere. That hasn't changed much, with small traders still focusing nearly 50% of their total volume on buying call options to open.

That's down a bit from the recent peak but still among the highest readings in over 20 years.

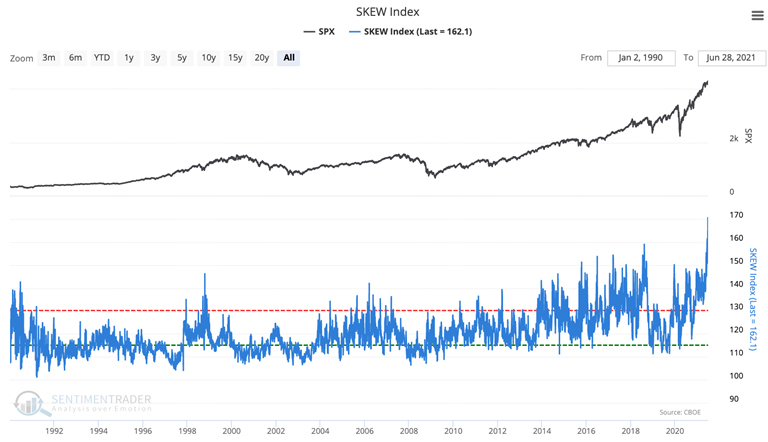

At the same time, there is a big spike in the SKEW Index. At its core, it tries to measure the price of far out-of-the-money puts versus calls, with high readings suggesting a higher probability of a crash-type event within the next 30 days.

Now, there's a lot wrong with this index and this approach. Some awfully smart folks have torn it apart, and this Twitter thread is as good of a schooling as any, so if you care about why you might NOT want to put a lot of weight on SKEW, check it out.

If ignore the issues and take it for what it's supposed to be, then what we have right now is a bunch of the smallest options traders in the market betting heavily that stocks are going to keep soaring, at the same time that (probably) sophisticated (probably) hedge funds are (probably) betting on a quick, big drop.

What else we're looking at

- Future returns in the S&P 500 when small traders are buying calls while the SKEW is high

- What happens after the opposite scenario, when small trader call buying and the SKEW are both low

- Taking a look at Dow Industrials seasonality in July

- Not even 10% of Consumer Staples stocks are outperforming the index - what that means going forward

| Stat box This is becoming the norm, but on Wednesday the S&P 500 closed at a new high with fewer than 50% of its stocks above their 50-day moving averages. This has triggered on 4 out of the past 5 sessions, the largest cluster since 1927. |

Etcetera

Skewed perspective. The SKEW Index is at an all-time high, as noted above. This suggests a heightened probability of a ‘black swan' type event in the next month....theoretically.

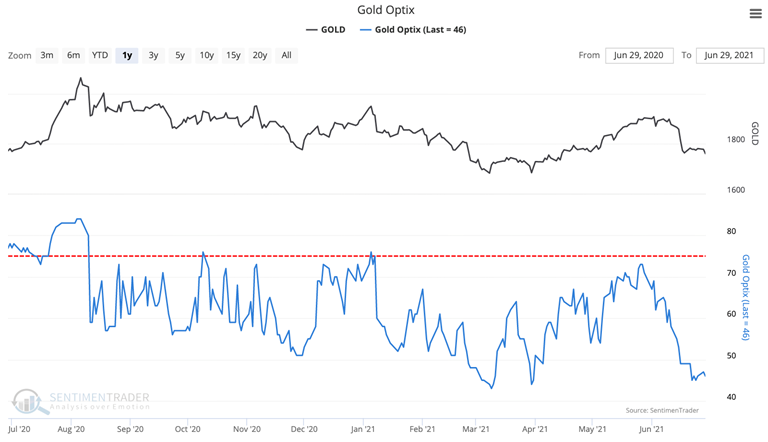

Gold rush. The Gold Optimism Index (Optix) has dropped significantly in the last month, losing close to half its value from the peak in May.

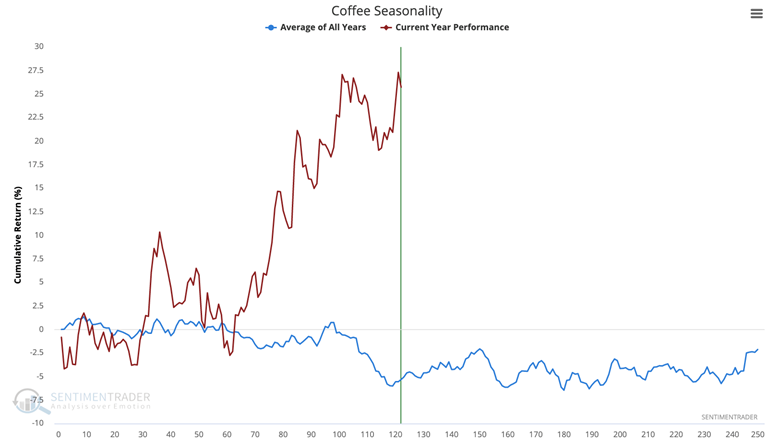

Café contradiction. Coffee seasonality suggests it should be near it lowest point of the season, while this year's return is nearly 30%. The average this time of year is -5.3%.