A Global Rising Tide of Trends Like Few Others

It's been a heckuva year for the most benchmarked index in the world. And while some securities have been struggling (mostly of the smaller cap variety), the recovery in indexes has been a global phenomenon.

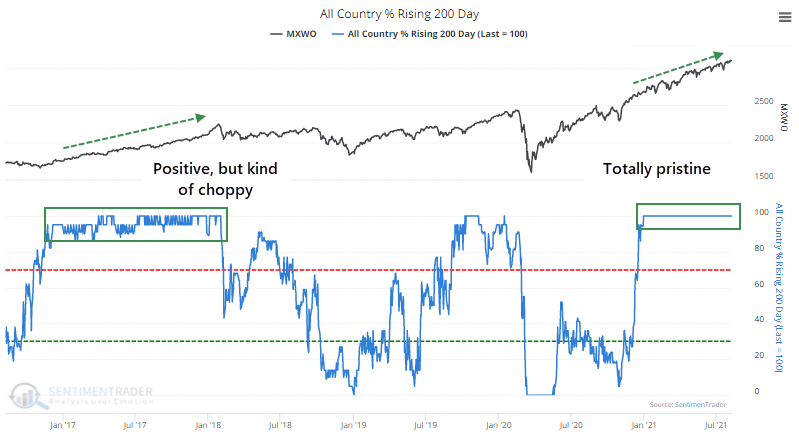

For more than 7 months now, every major world equity index that we follow has been in a solid long-term uptrend, with a rising 200-day moving average. Even the incredible momentum run in 2017 didn't see such pristine conditions, as there was usually at least one global index bucking the uptrend.

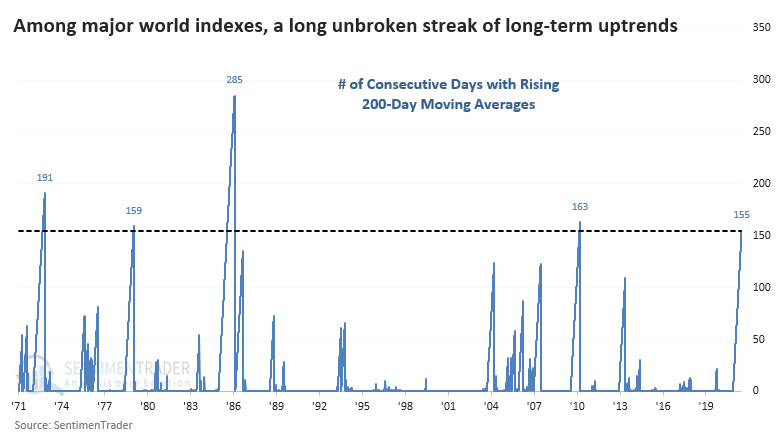

Over the past 50 years of data we have, this is now the 5th-longest streak of uninterrupted global uptrends and is creeping up on the longest in 35 years.

ONCE AGAIN, FEW PRECEDENTS

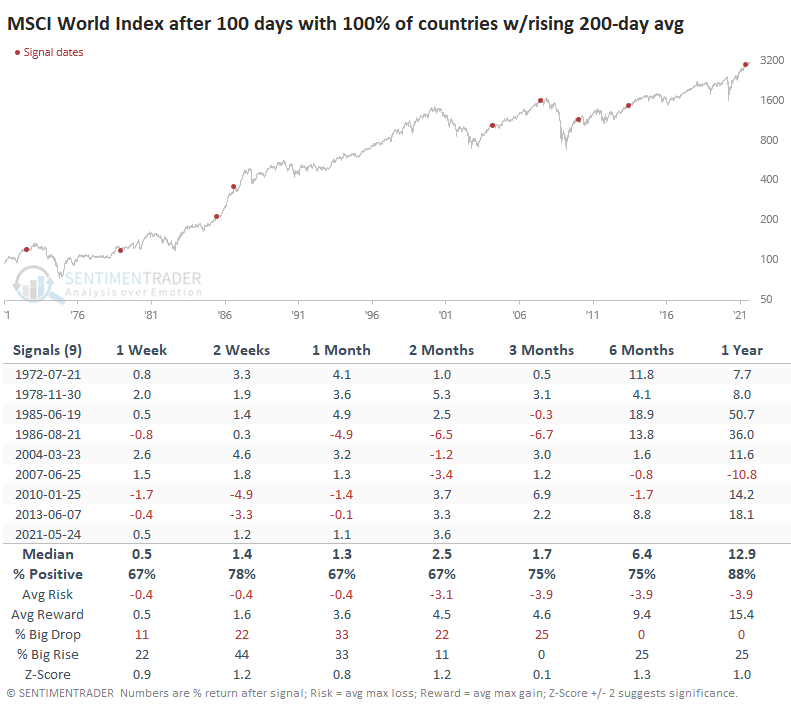

As we've seen with most momentum studies in recent months, there are few precedents.

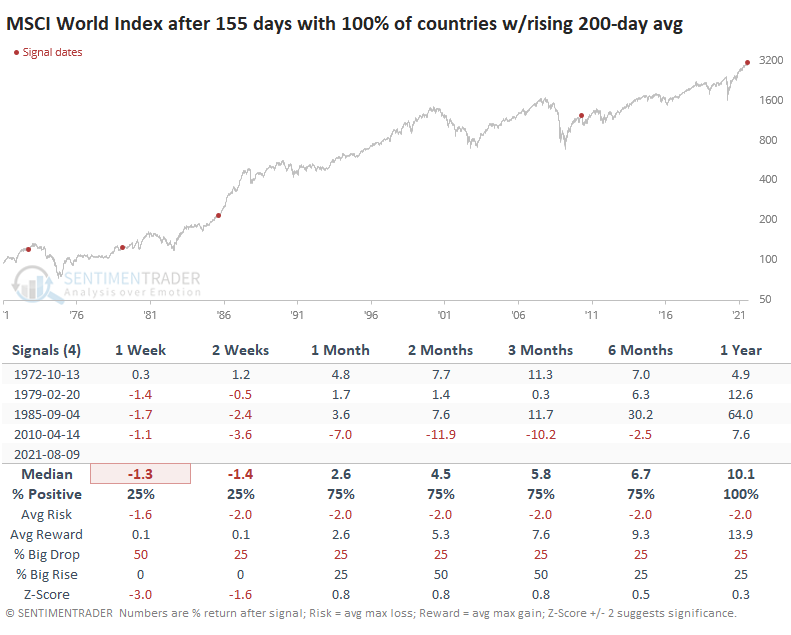

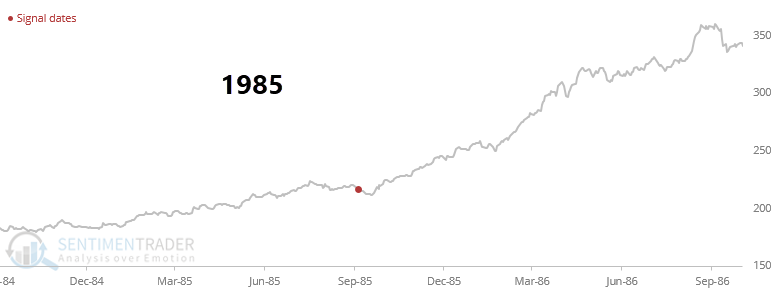

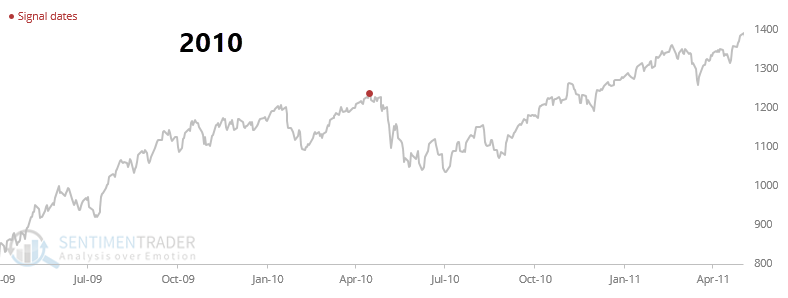

The general pattern after the few times this occurred is shorter-term weakness but medium- to long-term strength. The MSCI World Index saw one double-digit pause following the 2009-10 recovery. The other three all saw consistent and impressive gains.

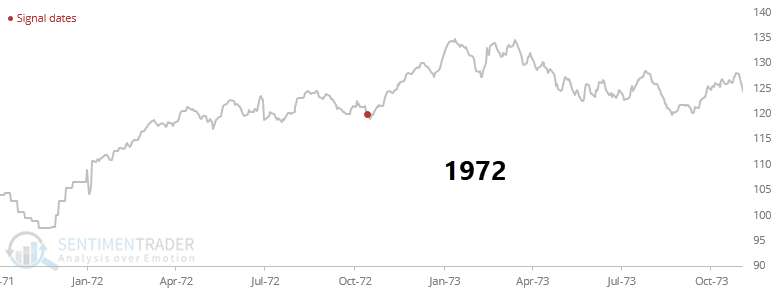

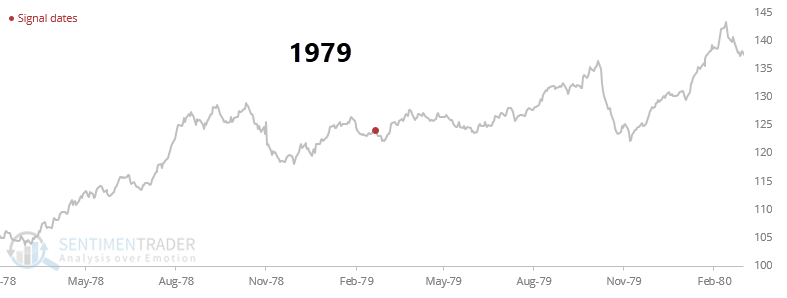

The charts below show the path of the MSCI World Index after each signal in more detail.

MORE SIGNALS, GOOD LONG-TERM RETURNS

It's hard to rely on such a small sample size, which is an increasing issue in 2021 as the year blows past many historical precedents. Even so, if we look at lesser extremes, the long-term positive ramifications remain.

Even when there was a streak of "only" 100 days with every major global index in a sustained positive long-term trend, there were few medium- to long-term losses in the future, and only one big pullback (well, that was a crash, in 2008).

This has been a year like few others, and that has typically meant good things when viewed over a 6-12 month window.