A Gap Down Monday

Stock futures have taken a turn lower and it looks like we'll be seeing a gap down of last least 0.5% before the open on Monday, though that could easily change with such volatile conditions.

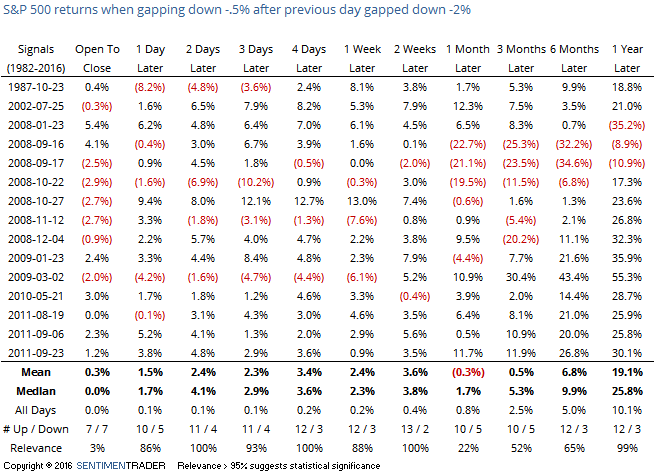

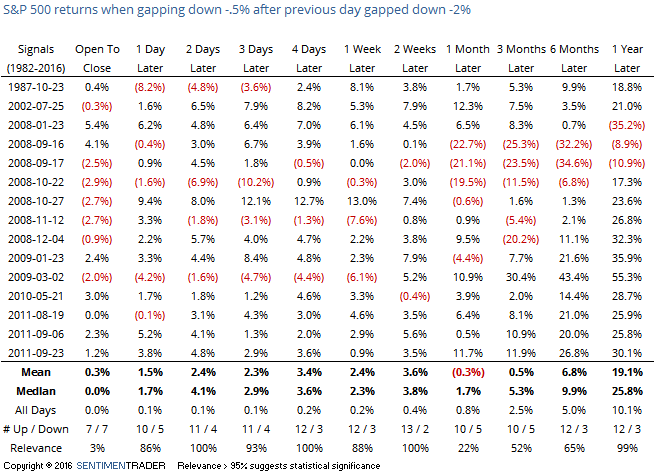

If we do, it will be the 16th time since 1982 that stocks have gapped down at least 0.5% the day after a gap down of at least 2.0%. That suggests a level of emotional trading that is rarely matched.

The table below highlights S&P 500 performance following the open of the second gap down day.

The best performance was two weeks later, with 13 winners out of 15 trades and only one of the losses was of any magnitude. There was some major periods of self-doubt in several of them, as stocks slid in the short-term before recovering over the next couple of weeks.

It happened only twice before on a Monday (2008-10-27 and 2009-03-02), but they led to diverging short-term paths.

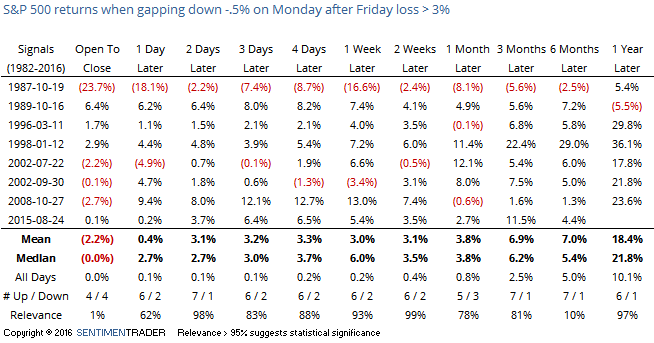

If we look at gaps down of 0.5% or more on a Monday after Friday suffered a large closing loss of 3% or more, then we get the following:

The best short-term results were were over the next two days, as the S&P rallied 7 out of 8 times from Monday's open through Wednesday's close.

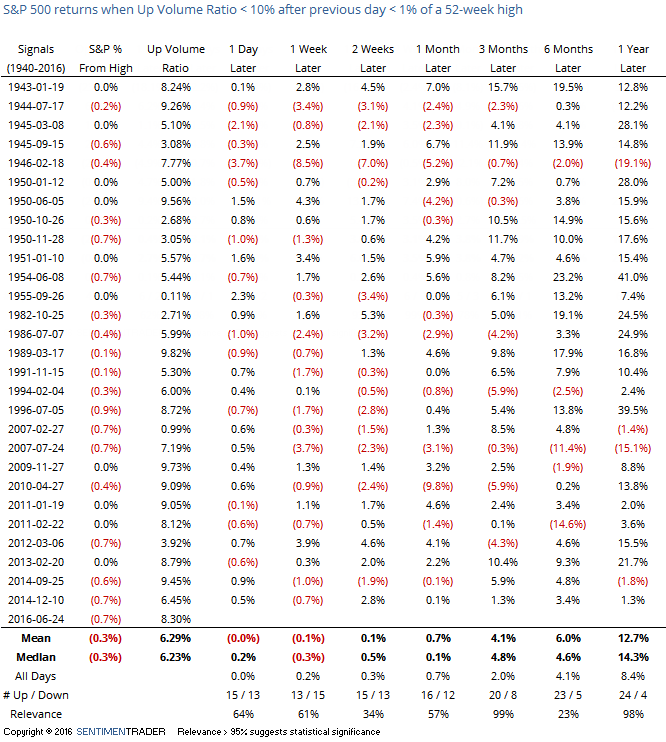

One caveat is that Friday saw a negative breadth thrust day, with more than 90% of NYSE volume occurring on the downside. We took a look at the opposite of this kind of thrust coming out of the February low, so it's far to invert this pattern and see how it played out. The following table shows S&P 500 returns since 1940 when it suffered a 10% or lower Up Volume Day when the previous close had been within 1% of a 52-week high.

Returns over the next week were poor, with only 13 gains out of 28 instances. Most of the losses were relatively tame, however. By three months later, there were 20 winners and the average return was positive enough to be significant.

When stocks have suffered a large loss on a Friday and then follow through with that loss on a Monday, there is a strong tendency to see a rebound into Tuesday/Wednesday, so we'll be looking for that tendency to occur this week as well. Buying an opening gap on Monday is less reliable, with returns improving if waiting until the close.

Whenever there is a downside thrust like this, there is also a strong tendency to see some testing of the panic low levels in the weeks ahead, so on a multi-week timeframe the bullish argument loses some luster. There is a stronger tendency to see positive returns in the medium-term of a couple of months and longer.