A few reasons why the Silver ride may get a little bumpier

Key points

- Silver has followed gold's lead and shot higher in recent weeks

- It is dangerous to short Silver when it is rallying hard

- That said, traders might be cautious about chasing Silver at the moment

Silver has spiked

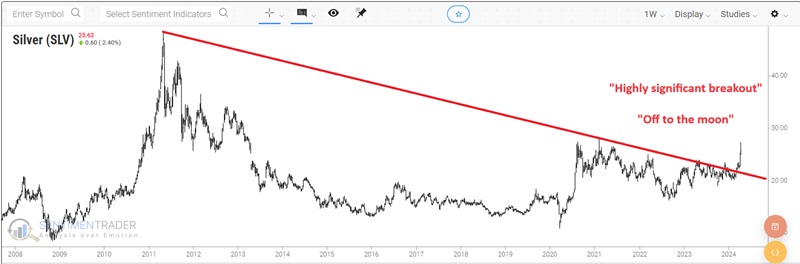

Gold broke out to a new all-time high in March, and Silver spiked higher and threatened three-year highs. This has led to the usual division of opinion among pundits regarding Silver. Some prefer to draw the trendline in the chart below and make wildly bullish forecasts.

But of course, with charts, individuals can often see "what they want to see." Another pundit may look at the horizontal lines in the chart below and forecast much tougher sledding for Silver.

So, who will be correct, and who will be wrong? Most of us will instinctively favor one or other of the charts above. But the reality is that "only time will tell." Silver's momentum is strong, and if it can break out above its 2021 high, then a much higher price could be in the offing. Nevertheless, unless and until that happens, there are a few yellow signs to consider before throwing caution to the wind.

Seasonality may become a headwind

I would never suggest selling short a soaring silver market solely because of seasonality. That said, it could influence a slowdown in the ascent rate or portend a period of more choppy and volatile price action.

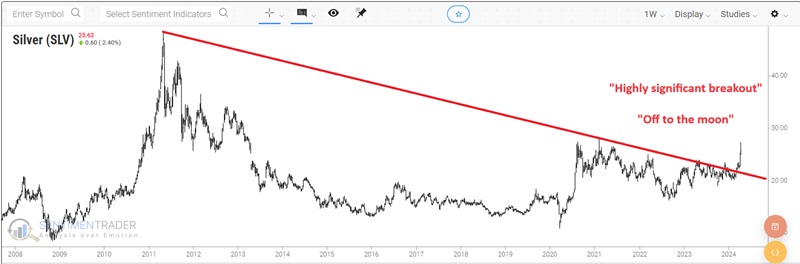

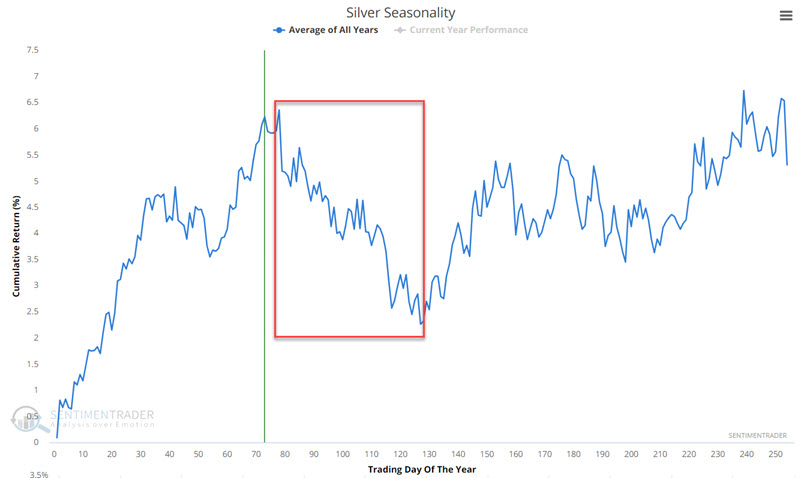

The chart below displays silver futures seasonality (blue line), with this year's action represented by the brown line.

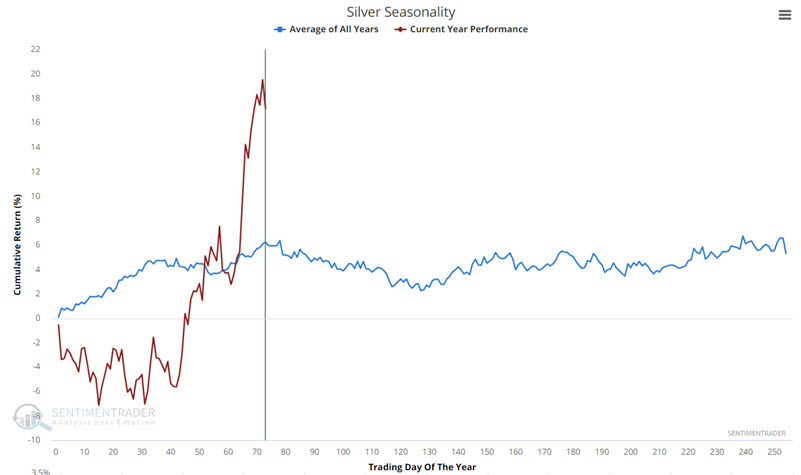

Before we zero in on this specific period, the chart below notes that May and especially June are generally some of the weakest months of the year for Silver.

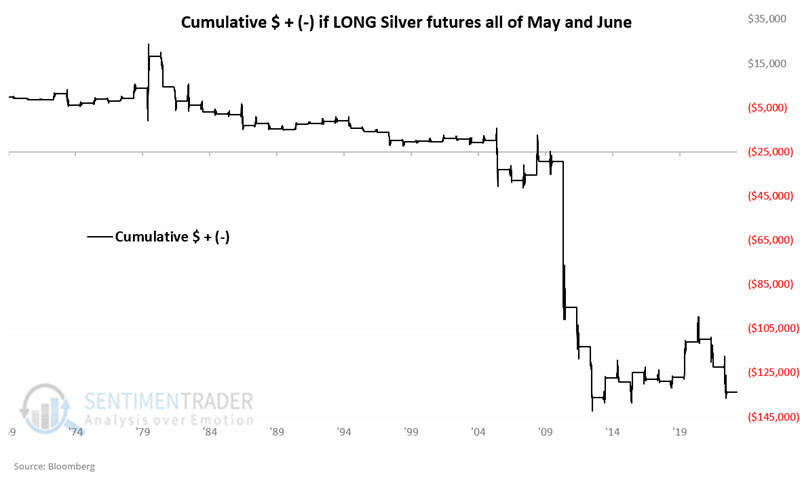

The chart below displays the hypothetical $ +(-) from holding a long position in silver futures yearly since 1970, only during May and June.

Two things jump out. First, Silver does not decline every year during May and June, so it might not be accurate to categorize them as "bearish." On the other hand, it certainly seems like a risky time of year to bet on a bullish position.

Zeroing in a little closer

The chart below displays the annual seasonal trend for Silver. Note that we are close to a period that tends to experience seasonal weakness. This period extends from the close of Trading Day of Year (TDY) #78 through TDY #127. For 2024, this period extends from the close on 2024-04-19 through 2024-06-21.

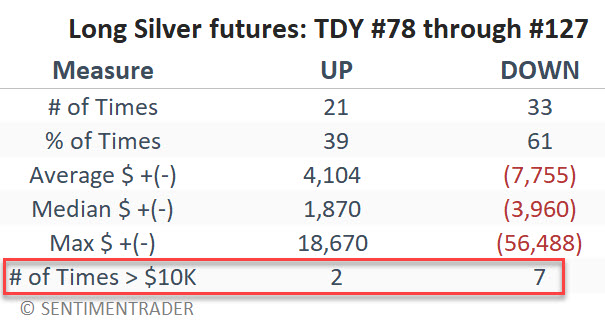

The chart displays the hypothetical $ +(-) from holding a long position in silver futures every year since 1970, only from TDY #78 through TDY #127.

The overall results are pretty steadily unfavorable. The table below summarizes silver futures' performance during this period.

A 39% Win Rate means that a decline in the price of Silver during this period is very far from a "sure thing." Nevertheless, the size of the average, median, and maximum decline is a warning sign of the potential risks of pressing the long side during this period. Silver has also experienced seven losses over $10,000 during this period versus only two 10K+ gains.

A possible warning from Gold Optix

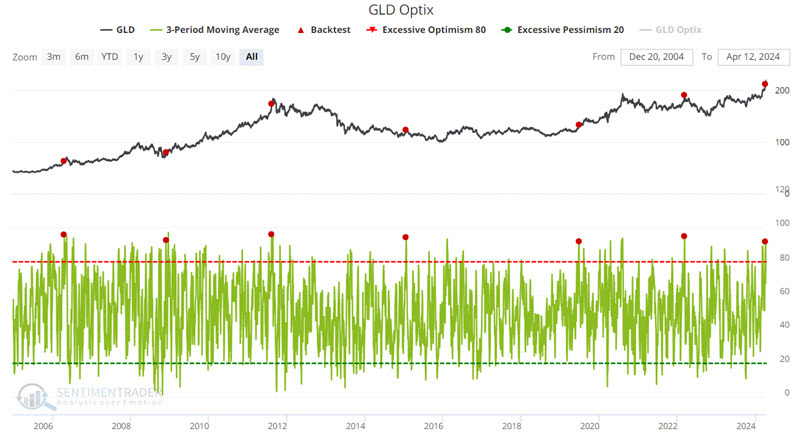

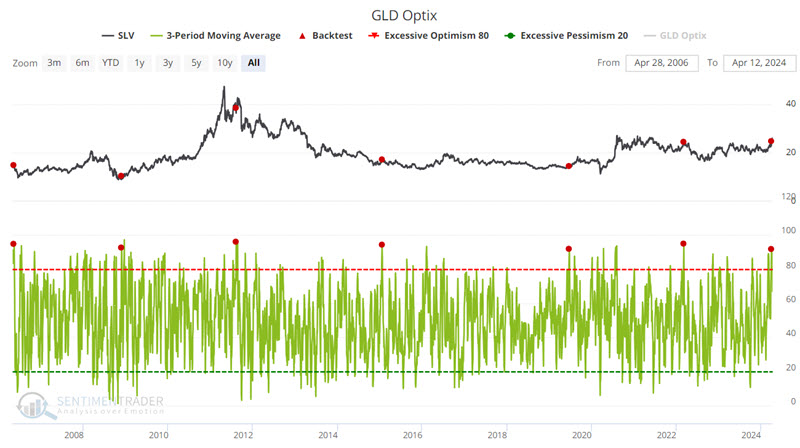

It is not a secret that Silver often follows gold's lead. A recent signal in a gold indicator flashes yellow for both gold and Silver. The chart below displays those dates when the 3-day moving average of our GLD Optix indicator crossed above 92 for the first time in six months. The most recent signal occurred on 2024-04-03.

The table below displays the subsequent performance for the iShares Gold Trust (ticker GLD).

Now, let's apply the same signal to Silver. The chart below displays those dates when the 3-day moving average of our GLD Optix indicator crossed above 92 for the first time in eighteen months versus the iShares Silver Trust (ticker SLV).

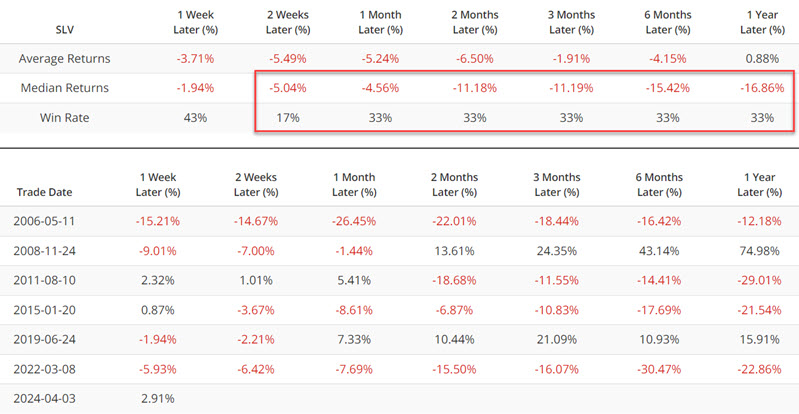

The table below displays the subsequent performance for ticker SLV.

Again, this one indicator signal is not enough reason to panic and automatically abandon a bullish position in Silver and/or sell short. But it is a reason not to fall in love with the "Silver to the Moon" swan song.

What the research tells us…

The message in the information above is not that Silver is about to experience a massive reversal and that an aggressive short position is warranted. The real message seems to be more of a cautionary tale about chasing the long side of Silver at this moment in time. A period of choppy price action often follows a rapid advance, and the information above raises the potential for just that. Bullish silver traders might do well to temper their expectations in the near term and remember:

Jay's Trading Maxim #52: Patience is a virtue - and also a pain in the rear.