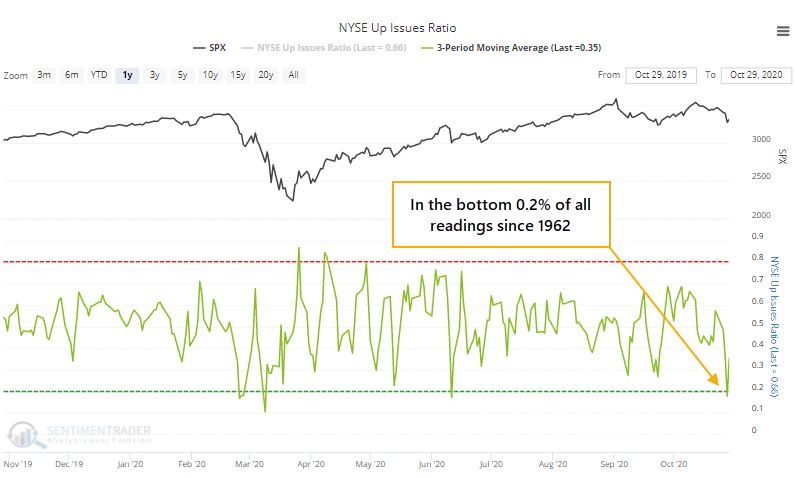

A couple of days with overwhelming selling

On Monday and Wednesday last week, selling pressure was overwhelming enough that most securities fell, and most of the volume on the NYSE was focused on those issues.

The 3-day average of NYSE Up Issues and Up Volume both dropped to below 20%. That shows wholesale, get-me-out selling pressure. Often, we'll see a lot of down issues, but maybe not a lot of volume. Or maybe there will be a lot of volume flowing into relatively few declining stocks.

Earlier this week, it was both. The 3-day average of NYSE Up Issues dropped to within the lowest 0.2% of all readings since 1962.

It's not all that unusual to see extremely depressed breadth over a multi-day period during a bear market. It's rarer to see it when stocks have been holding up fairly well.

Overall, this kind of behavior has typically led to some shorter-term give-back of whatever gains helped to push the Up Issue and Up Volume Ratios above 20%. But over the next 1-3 months, there was a strong tendency to see gains following the selling pressure that was extreme enough to push them both below 20% in the first place.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- What happens when short-term breadth recovers during various market environments

- ETF traders have pulled out of dividend funds, and piled into momentum

| Stat Box The S&P 500 ended up with a loss of more than 1% in October, after setting a multi-year closing high at some point in the past few months. When this happened during any year since 1928, the S&P rose over the next 3 months 10 out of 12 times, with both of the losses being smaller than -3.5%. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

1. Speculators in S&P 500 futures contracts pushed their net long position to the highest in almost 2 years - Bloomberg

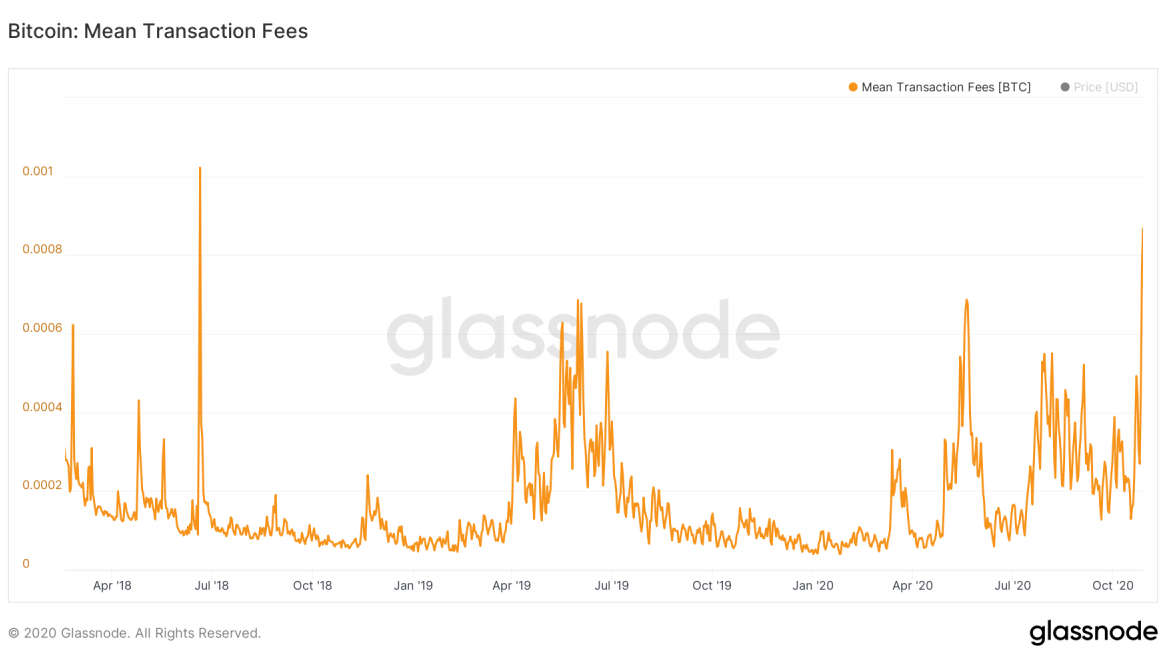

2. The cost of a bitcoin transaction has surged, which usually happens when demand is high (and prices struggle after) - Coindesk

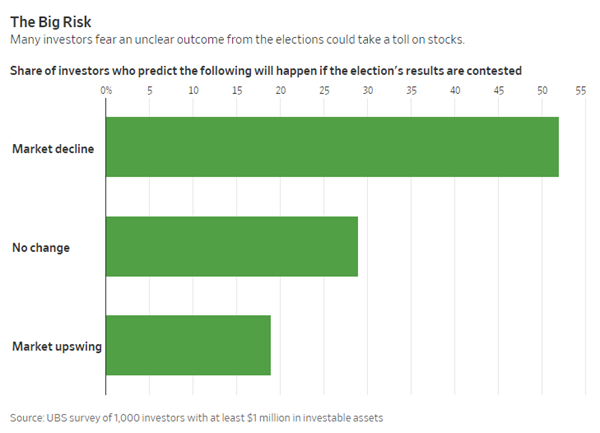

3. Rich people think stocks will drop if we don't have a clear winner on election night - Wall Street Journal