A cluster of breadth thrust buy signals bodes well for stocks

Key points:

- An advance/decline ratio for the NYSE, Nasdaq, Small-Caps, Discretionary, and Bonds surged

- The burst in upside participation triggered an abundance of breadth thrust buy signals

- After similar signals, stocks enjoyed excellent returns across most time frames

Advancing issues are outpacing declining issues, triggering a cluster of breadth thrusts

The dollar index and crude oil are down significantly from recent highs, and long-dated bond yields have fallen, albeit near multi-year highs. These factors and others have contributed to an easing in financial conditions. Typically, risk assets surge when financial conditions ease, creating breadth thrust buy signals.

The breadth thrust model I use, known as breakaway momentum, is one that market analyst Walter Deemer has written about for decades. The signal identifies when the 10-day sum of advancing issues exceeds the 10-day sum of declining issues by a user-defined ratio. The threshold level will differ depending on whether one measures exchange or index data. And all of my models use a reset condition to screen out repeats.

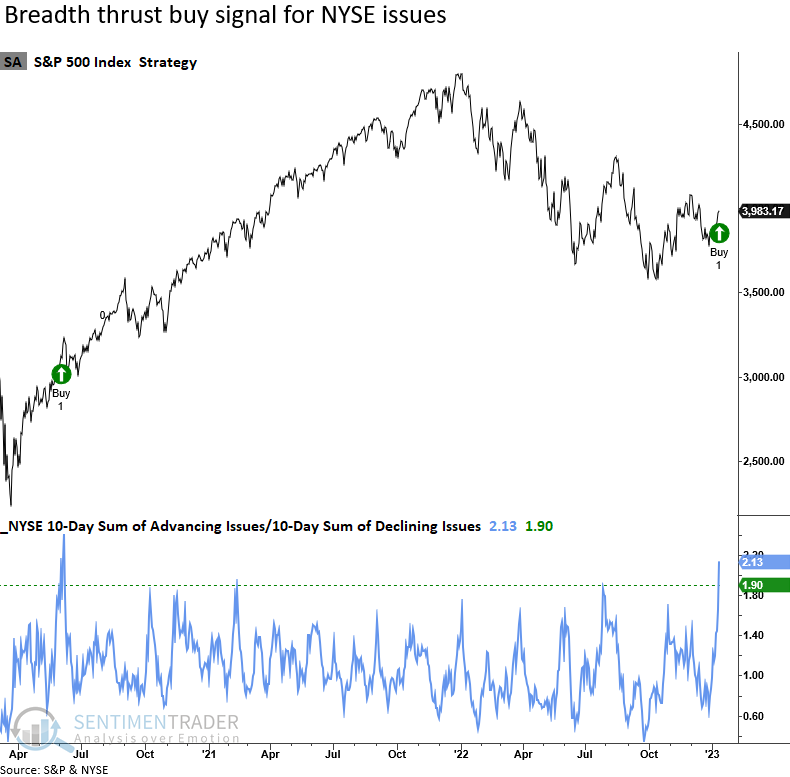

The NYSE and Nasdaq Exchanges triggered breadth thrust signals

NYSE issues generated a breadth thrust signal for the first time since June 2020. Keep in mind these are all issues traded on the NYSE. So, an exchange that contains over 3000 securities is less likely to be influenced by passive vehicles that create all-or-nothing volatility in day-to-day breadth figures.

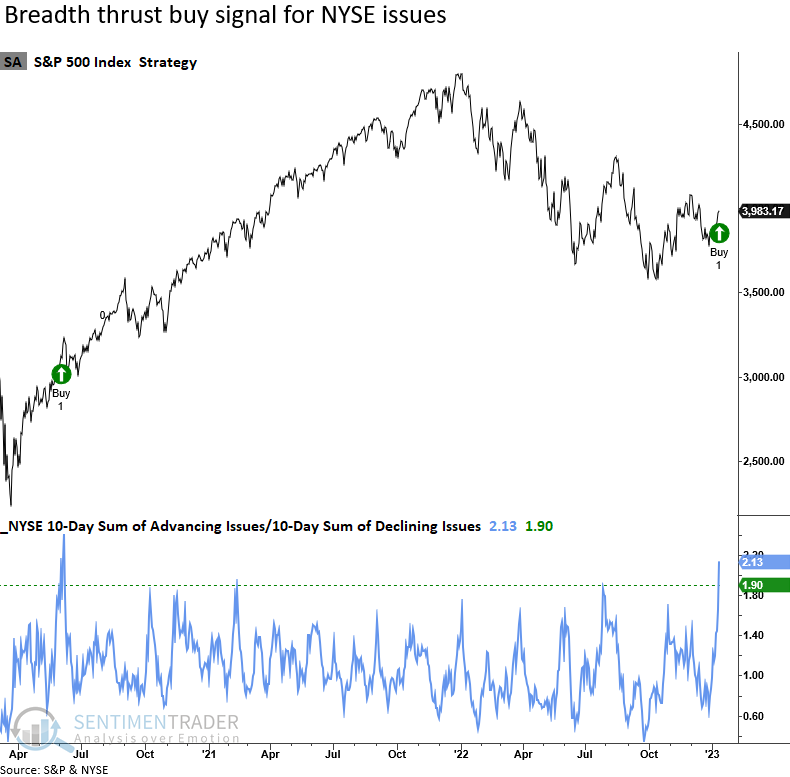

Similar surges from NYSE issues preceded solid gains

The NYSE breadth thrust model generated a signal 46 other times since 1932. Results were excellent across all time frames. Since 1942, the alert showed a gain in every case sometime in the next twelve months.

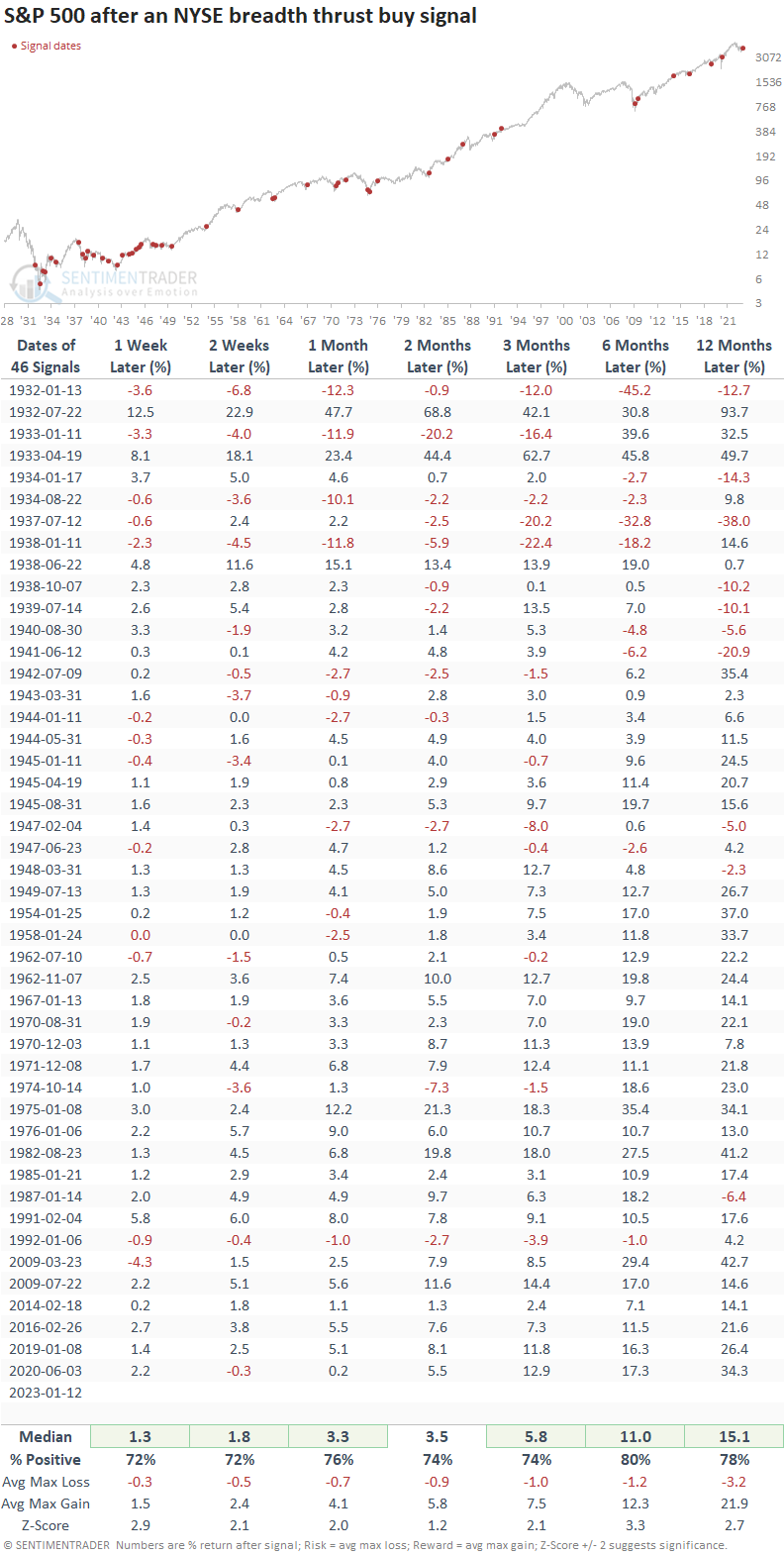

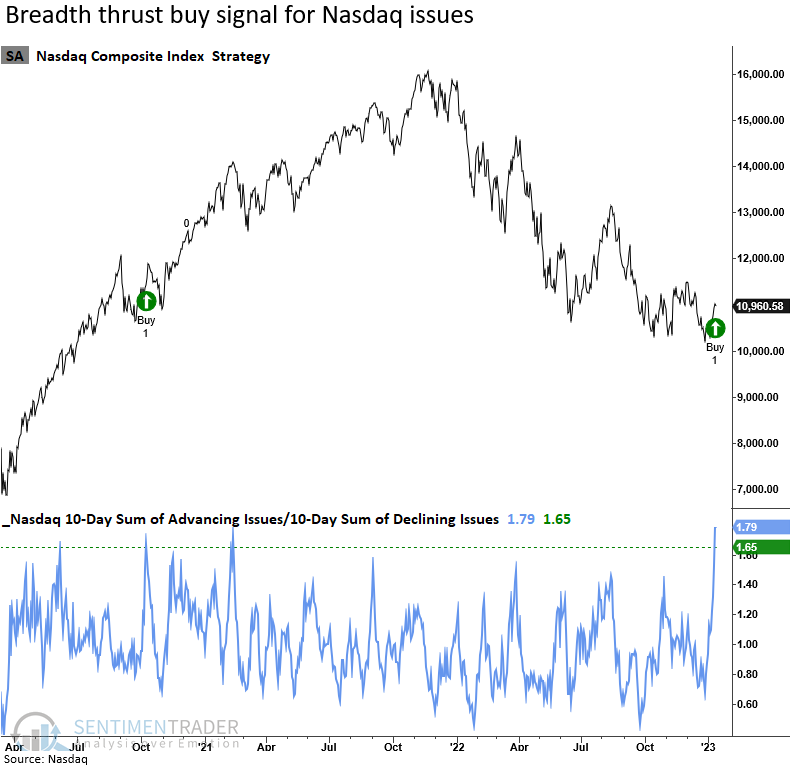

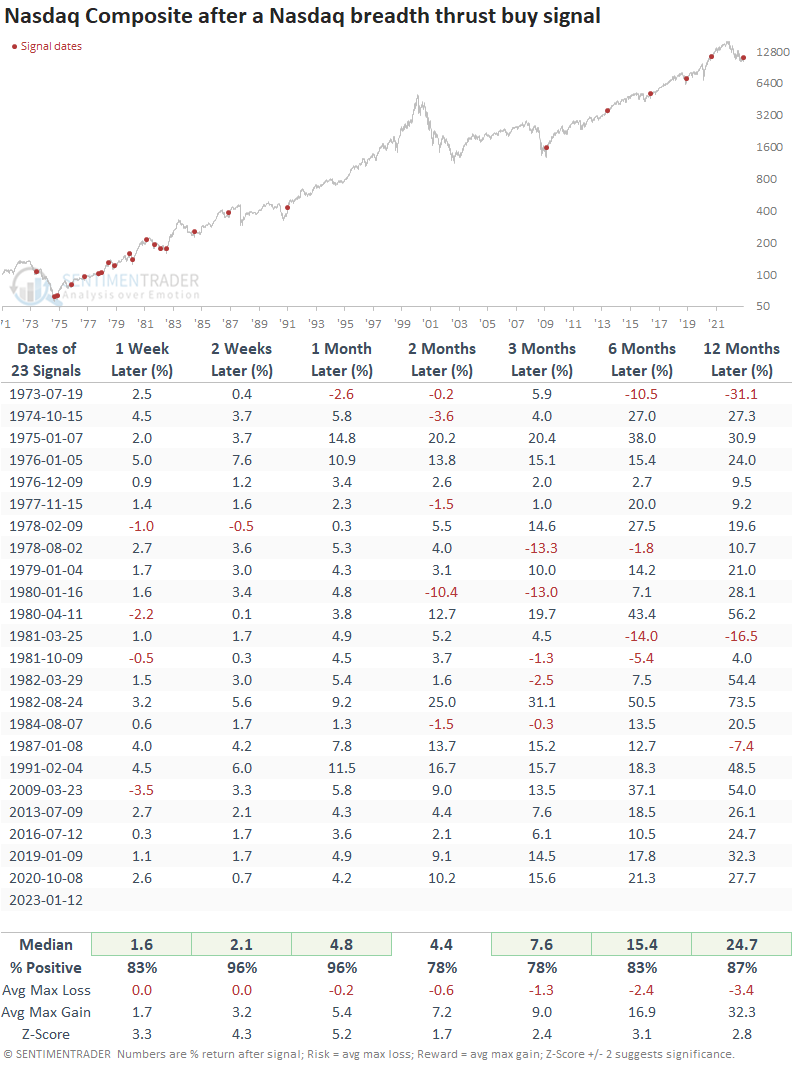

Nasdaq exchange members, which contain most of the hypergrowth stocks hammered in 2022, triggered its first breadth thrust signal since October 2020.

Similar surges from Nasdaq issues preceded excellent results

The breadth thrust model for Nasdaq issues generated a signal 23 other times over the past 50 years. While the history is limited relative to the NYSE data, one can't argue with the results. They are nothing short of spectacular. When the members on a lower-quality exchange surge in unison, take note.

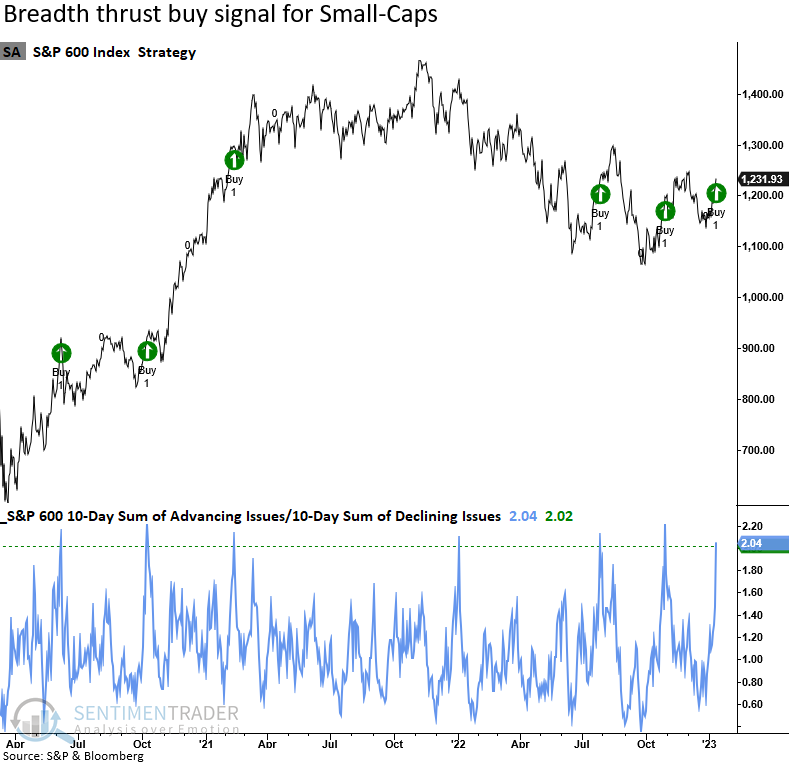

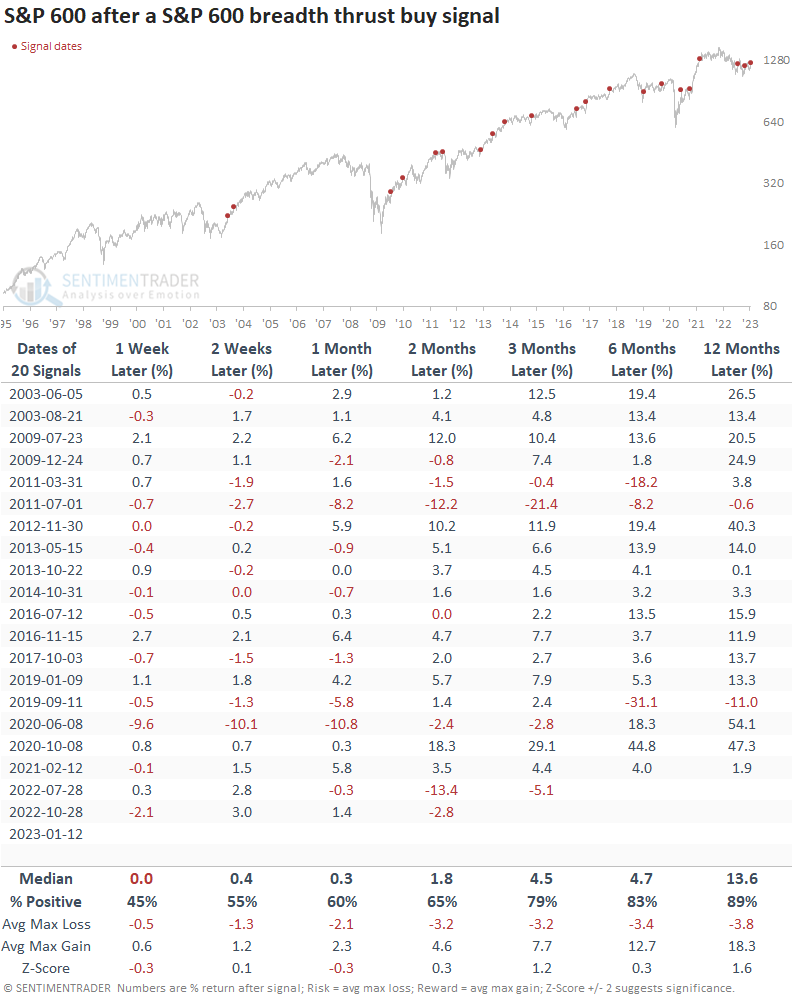

Small-cap stocks triggered a breadth thrust signal

The economically-sensitive S&P 600 Index registered its third signal in the ongoing bear market.

The breadth thrust model for the S&P 600 generated a signal 20 other times over the past 20 years. Results were mixed over the next month and significantly better across long-term time frames. Interestingly, the S&P 500 has a 100% win rate a year later when I apply the small-cap signals to an outlook table for the S&P 500. So, what's good for small caps is good for large caps.

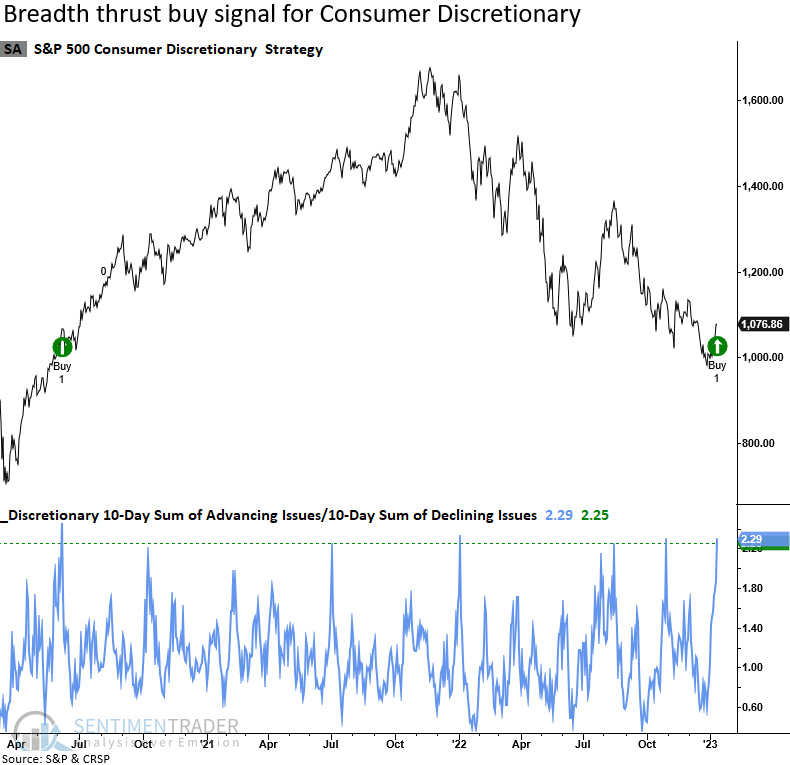

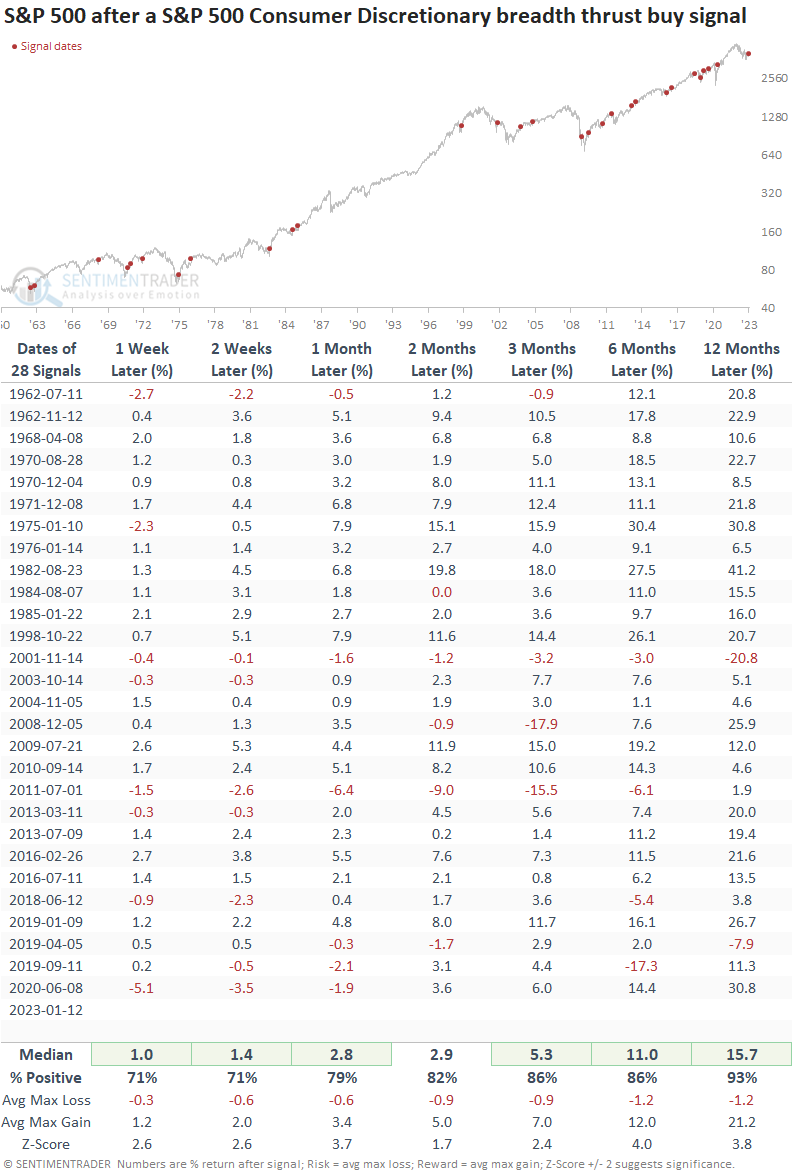

An early cycle consumer cyclical sector triggered a breadth thrust signal

On Thursday, I shared a study that showed an impressive recovery in Consumer Discretionary stocks. While I usually don't measure ratio-based thrust signals for individual sectors due to high correlation amongst members, the Discretionary sector is one exception.

The sector triggered its first thrust signal since June 2020.

Except for one hiccup in 2001, which occurred after a monster countertrend rally from the 9/11 low, the outlook for stocks is impressive when the Consumer Discretionary sector triggers a breadth thrust buy signal. I applied the alerts to the S&P 500 to see how a cyclical consumer sector impacts the broad market.

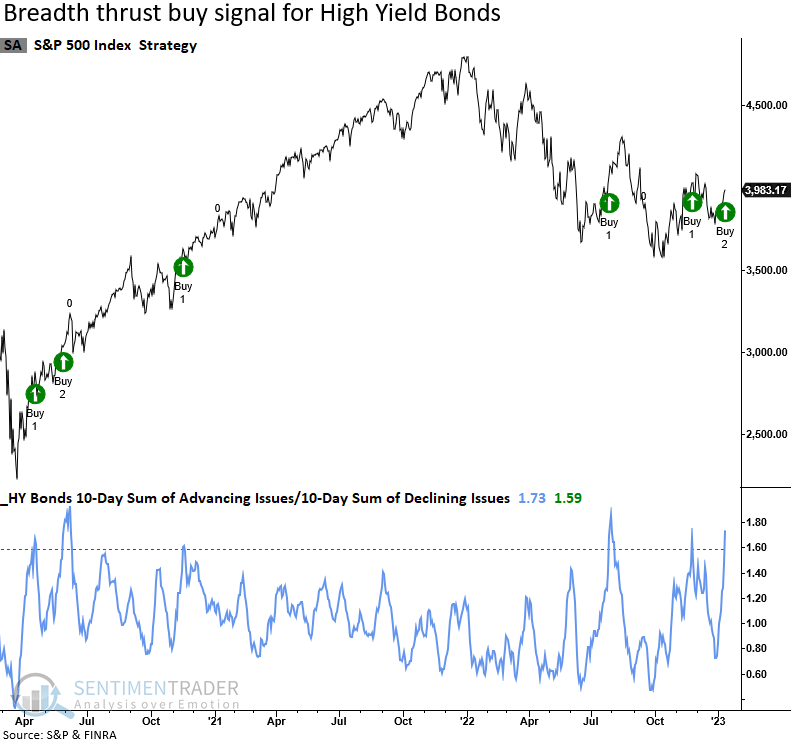

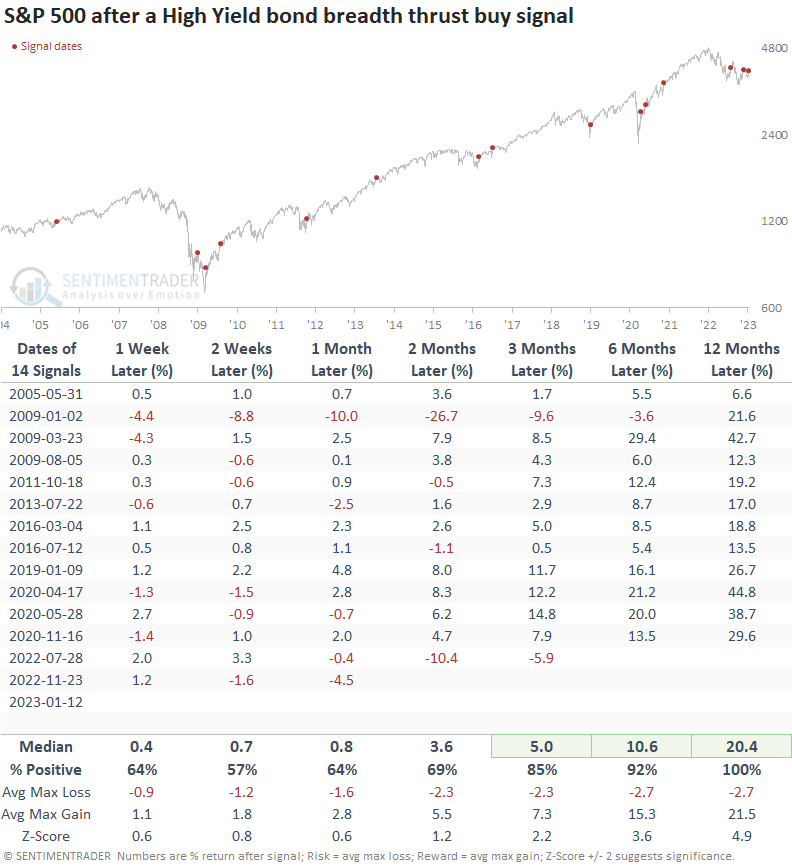

Economically sensitive bonds joined the party

High Yield bonds, which act similarly to the economically sensitive small caps, triggered their third breadth thrust signal in the current bear market.

While the history is limited, the S&P 500 performs exceptionally well after high-yield bonds surge, especially a year later.

What the research tells us...

The weight of the evidence continues to build in favor of a potential trend change for the broad market after several significant breadth thrust signals triggered in the last few days. The surge in participation from exchange members and economically sensitive groups suggests that this time is different.