A clear sign of an options mania

It's a mania. There's no other word for it, at least in the options market.

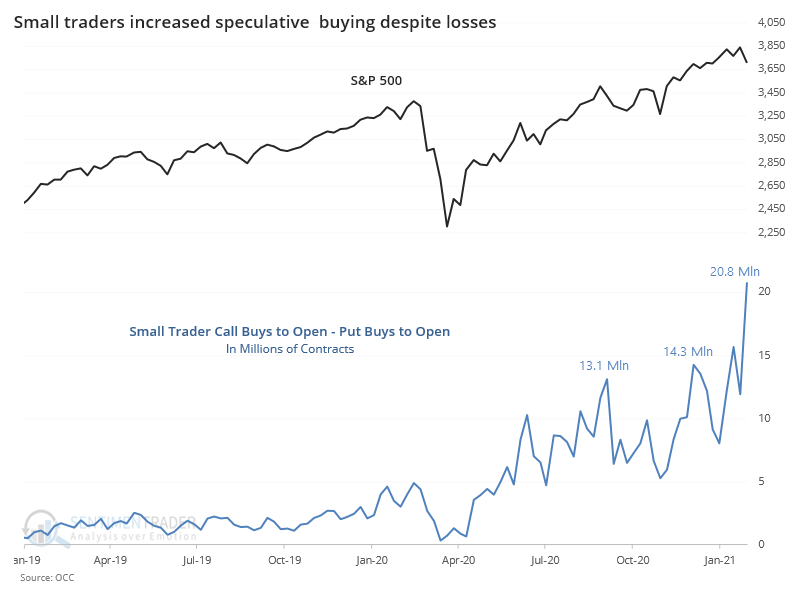

Speculative trading picked up last June, lasted through July, then exploded in August, preceding a 13%+ correction in many of the most active names in September. This go-round, it picked up in November, eased a bit in December, now has exploded again as we enter February.

It's occurred to such a degree it defies explanation, with record speculative activity among the smallest of traders. The 4-week sum has gone parabolic again.

Last week alone, the smallest of options traders increased the pace of their call buying dramatically. Overall volumes increased, but call buying overwhelmed put buying.

The premiums they spent on those calls were also extreme, with a net $10.5 billion difference between money spent on buying calls to open versus puts.

What else we're looking at

- A comprehensive look at options trading activity last week

- What happens when small traders "irrationally" buy stocks during a down week

- A long-term look at when Saturday Night Live shows skits featuring the stock market

- Dumb Money Confidence has been high for a long time, with the 200-day average now near a peak

- The "last hour" indicator is triggering a rare signal

| Stat Box Over the past 50 years, there have been 8 times when silver rallied 10% intraday to a 52-week high. Over the next 3 months, it continued to rally only once, and its median return was -44%. |

Sentiment from other perspectives

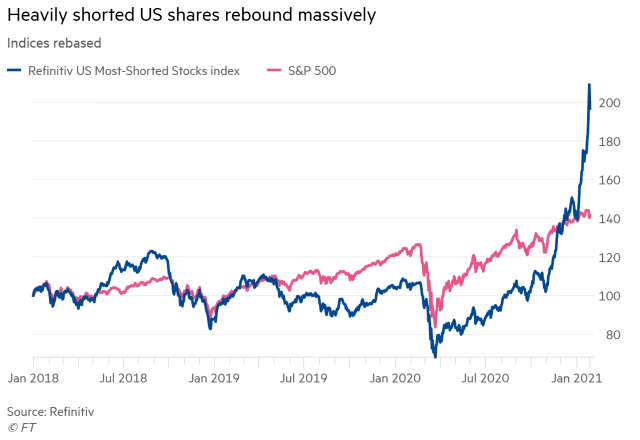

Bets against companies are nearing a record low. While short interest is an unreliable gauge of sentiment, at extremes it can be useful. And right now, the median stock in the S&P 500 has a very low proportion of borrowed shares. Source: Goldman Sachs

As shorts cover, the stocks are soaring. Various baskets of the most-shorted stocks have skyrocketed versus the broader market. Source: Financial Times

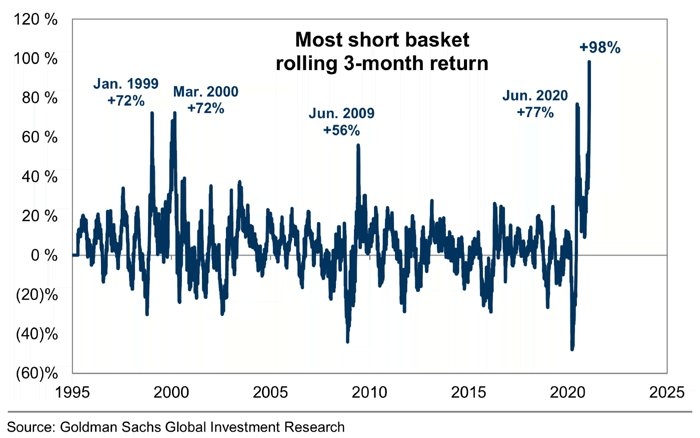

This has led to unprecedented volatility. These are the kinds of times when funds go out of business, and overall market risk tends to rise because they need to sell other shares to lower their overall leverage and exposure. Source: Goldman Sachs