A bullish breakout for the world's most-watched benchmark

Key points:

- The S&P 500 closed at an 8-month high but not a 12-month high

- Similar breakouts preceded bullish uptrends with solid returns, win rates, and z-scores

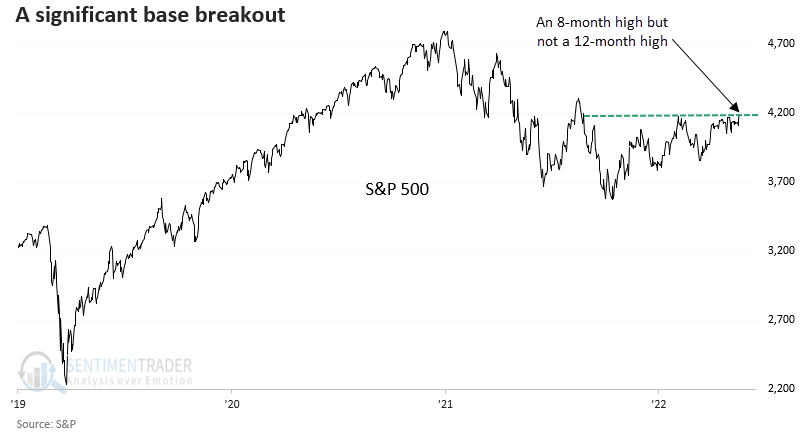

Rangebound markets eventually resolve themselves one way or another

According to a base breakout pattern triggered on Thursday, the odds of an upside resolution to the almost year-long consolidation in the S&P 500 Index look excellent.

For only the 29th time since 1932, the S&P 500 closed at an 8-month high but not a 12-month high. The previous breakout occurred in 2016, which eventually led to a steady uptrend in 2017.

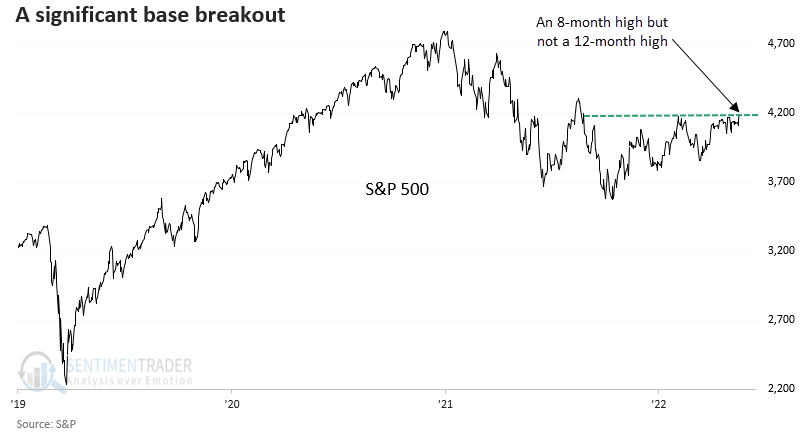

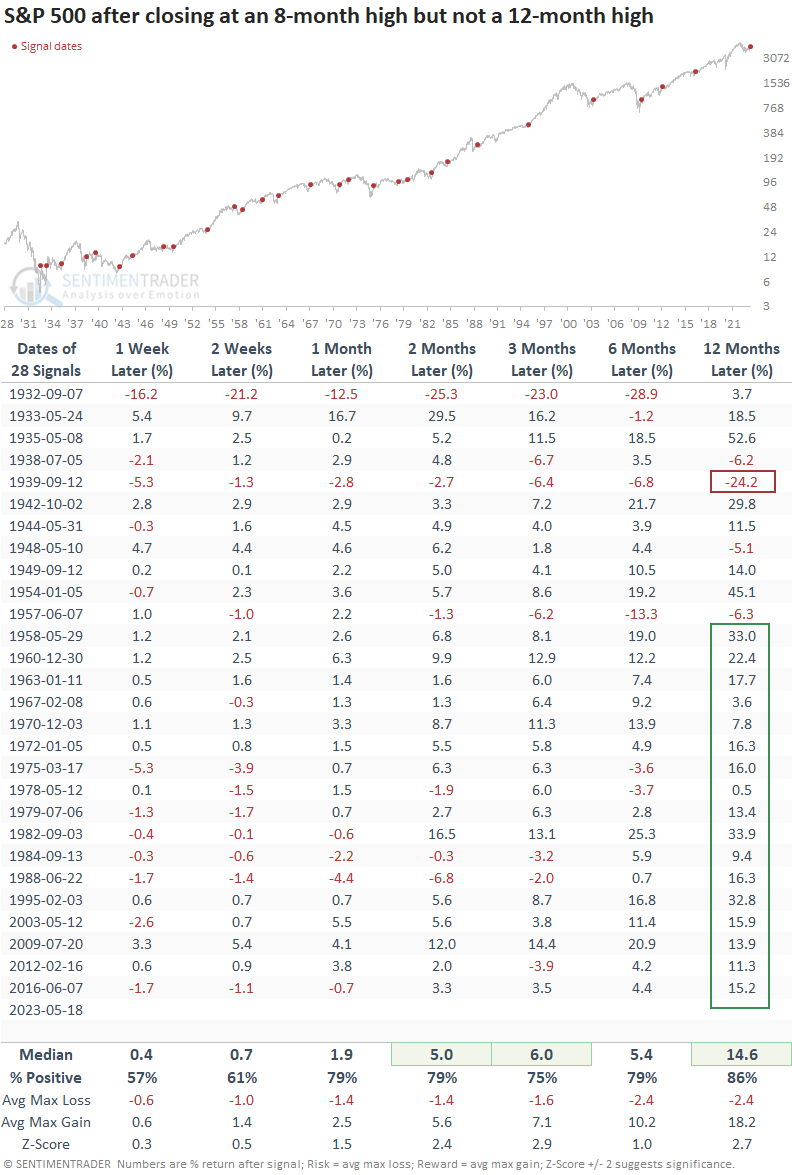

Similar base breakouts suggest a new uptrend for the S&P 500

When the S&P 500 reaches an 8-month high but remains below a 12-month high, returns, win rates, and z-scores for the world's most-watched benchmark look excellent. A year later, the S&P 500 was higher 86% of the time, with 17 consecutive winners since 1958.

Only four precedents showed a max loss more significant than -10% a year later, which all occurred before 1958.

Where should we be looking for opportunities

Market internals for groups within the S&P 500 lean bullish in growth-oriented sectors like Technology. On Thursday, the percentage of 12-month highs in Technology reached the highest level in more than a year.

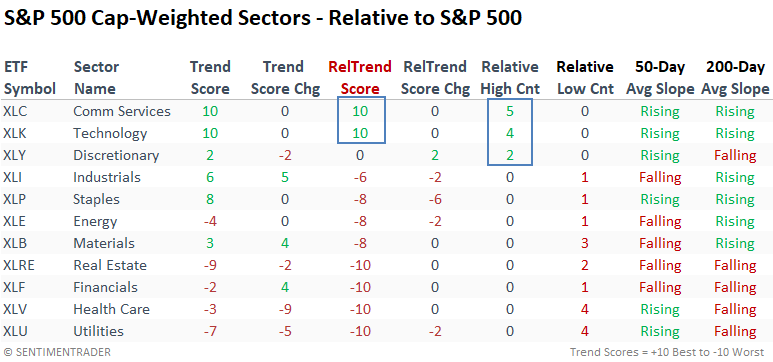

Relative Strength

Communication Services and Technology maintain perfect absolute and relative trend scores versus the S&P 500. And in the last five trading sessions, both groups registered four or more new relative highs.

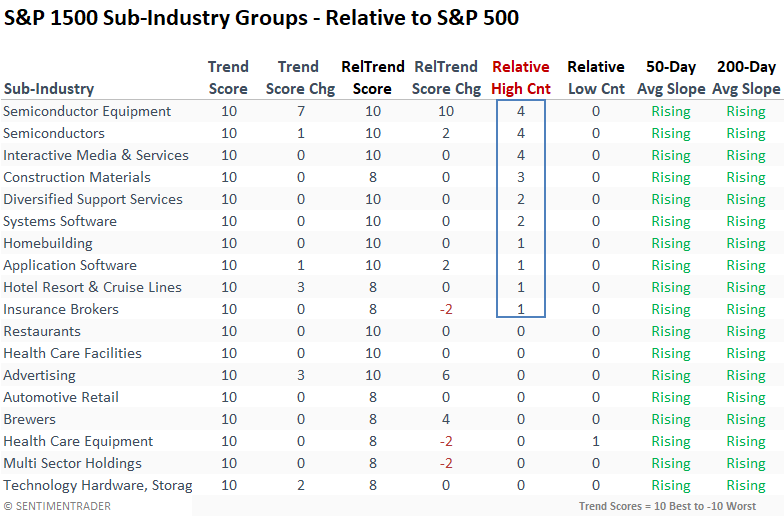

When I drill down to sub-industries, groups within Technology and Consumer Discretionary dominate the relative trend score rankings. And semiconductors are breaking out on an absolute and relative basis.

What the research tells us...

The weight of the evidence continues to suggest an upside resolution to the almost year-long consolidation. The most recent bullish development for the S&P 500 is a new 8-month high without a 12-month high. Historically, long-duration base breakouts like this have led to new uptrends for the world's most-watched benchmark. From a positioning perspective, growth-oriented groups continue to offer the best opportunity for outperformance.