A bullish backdrop for the Nasdaq 100

Key points:

- The Nasdaq 100 triggered a bullish long-term price momentum signal

- After similar signals, the NDX 100 was higher 100% of the time a year later

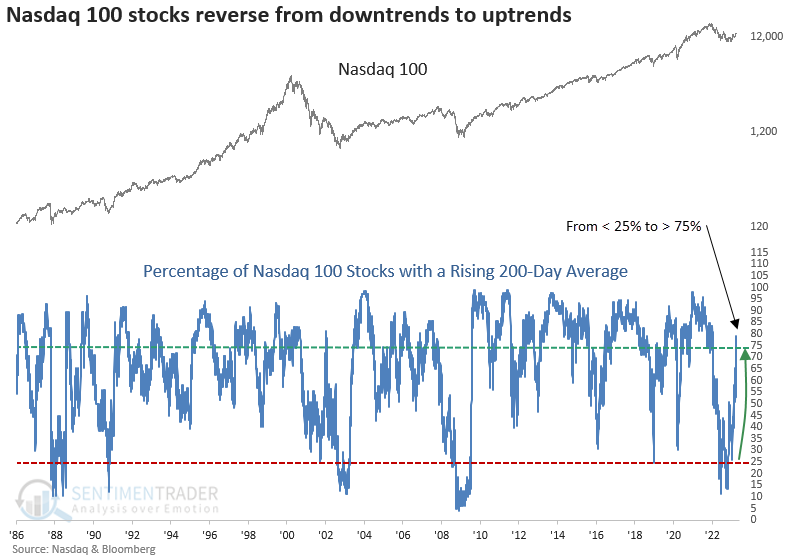

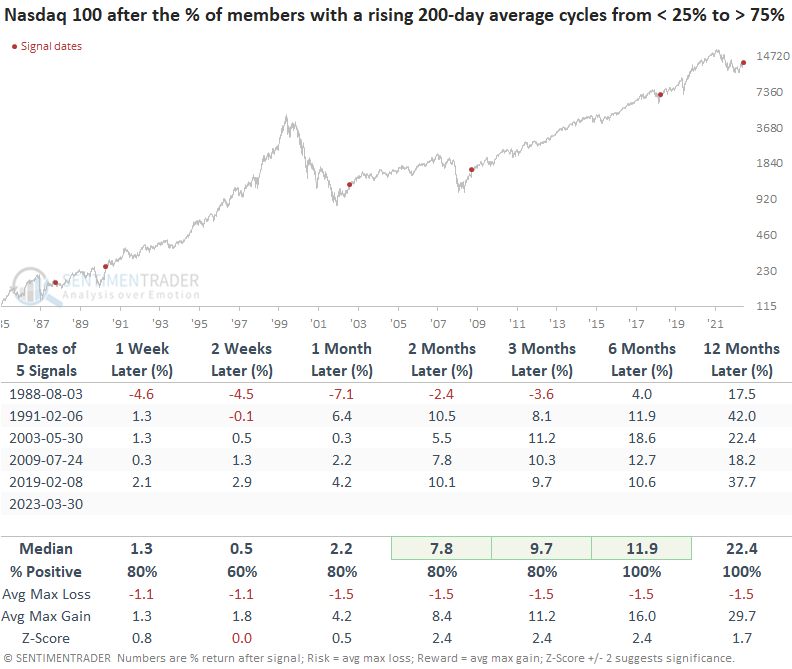

- The percentage of Nasdaq 100 members with a rising 200-day average cycled from < 25% to > 75%

- When NDX members cycle from downtrends to uptrends, the index is higher a year later every time

External and internal price trends for the NDX 100 turn favorable

The Nasdaq 100, which one can trade via the QQQ ETF, is one of the more popular indices in the world, especially in recent years, as a handful of mega-cap Technology stocks dominate the index weightings.

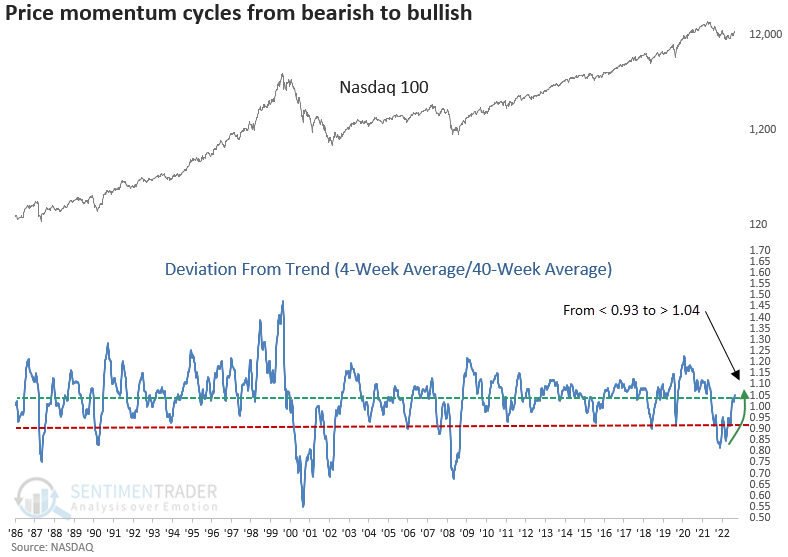

For only the 10th time since 1985, the Nasdaq 100 registered a deviation from trend buy signal. The system measures the 4-week moving average for the index relative to the 40-week average. An alert occurs when the ratio between the two averages cycles from less than 0.93 to greater than 1.04.

I highlighted a buy signal for the equal-weighted Technology sector in February using the deviation from trend concept.

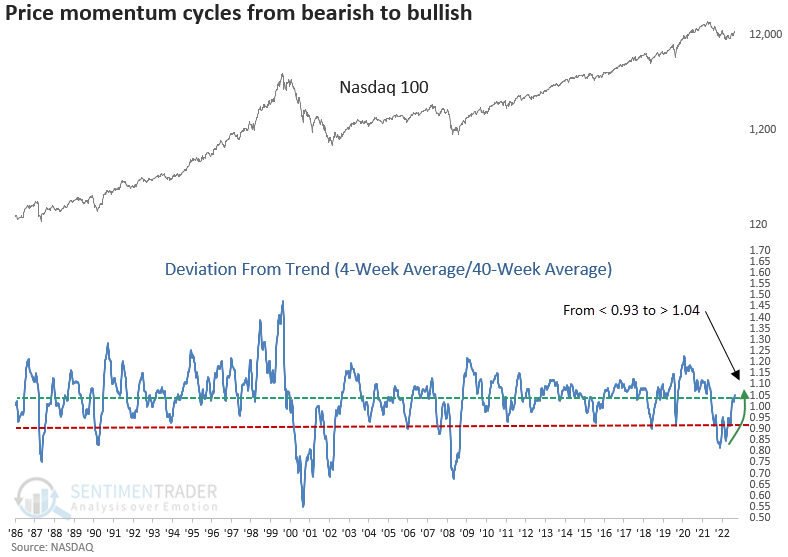

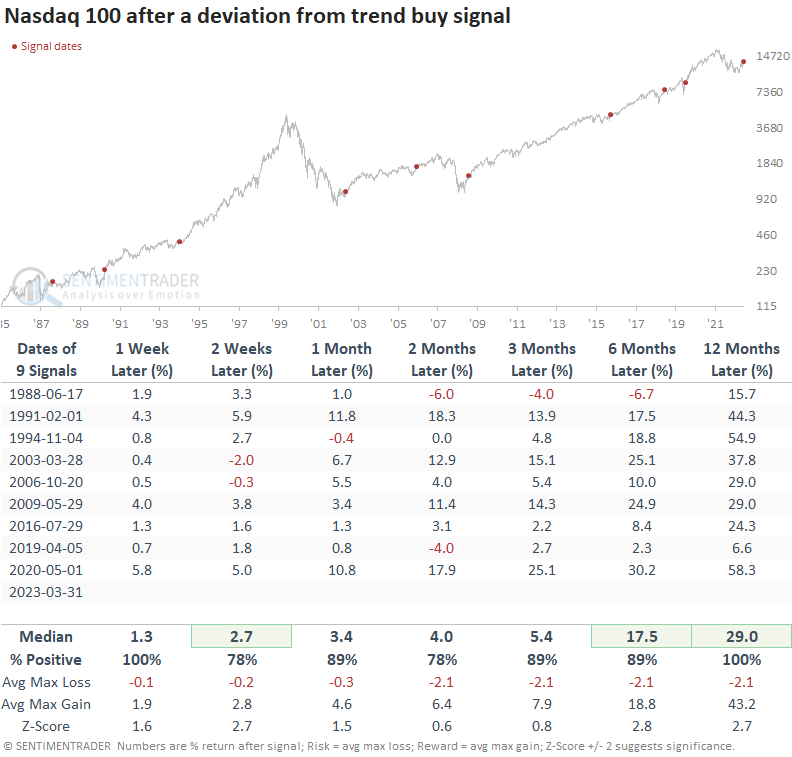

Similar reversals preceded positive returns for the Nasdaq 100

When the ratio between the short and medium-term moving average for the Nasdaq 100 cycles from < 0.93 to > 1.04, the NDX 100 shows excellent results across all time frames, especially a year later. And drawdowns were remarkedly low in the first three months with a median loss of -2.1% and a max loss of -8.5%.

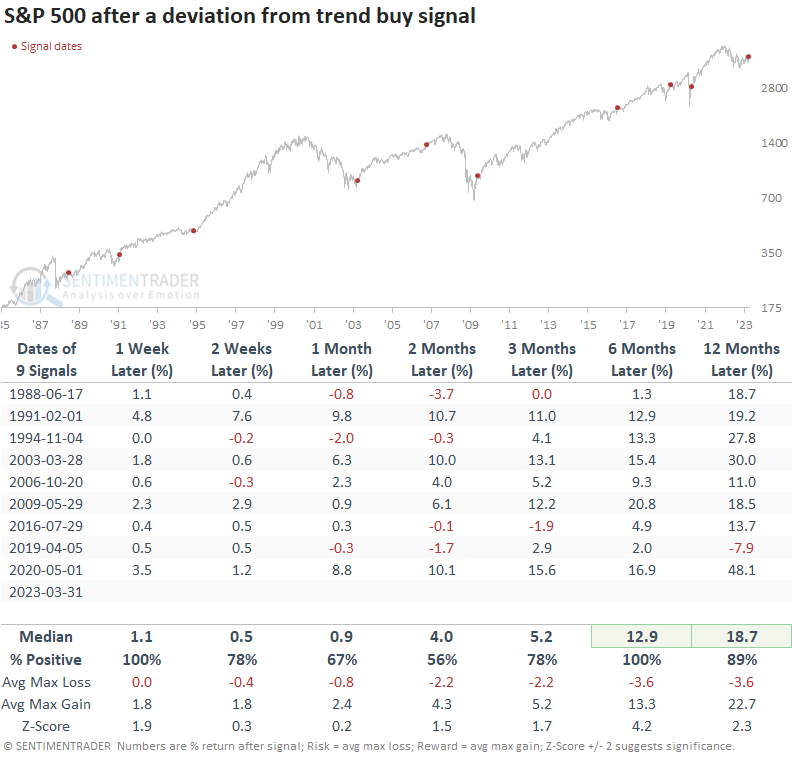

When I apply the Nasdaq 100 signals to the S&P 500, the results look equally impressive on a long-term basis.

Most Nasdaq 100 members are in long-term uptrends

With so much buzz about how a handful of mega-cap stocks are driving the positive performance for capitalization-weighted indexes this year, it's interesting to see most Nasdaq 100 members maintain a rising 200-day average, similar to what I showed last week for the S&P 500 Technology sector.

When the percentage of Nasdaq 100 stocks with a rising 200-day average cycle from < 25% to > 75%, the index showed a consistent upward bias across most time horizons, with excellent long-term results. While the sample size is small, once again, drawdowns were minimal.

What the research tells us...

Price momentum at the index level and long-term trends for index members turned favorable for the Nasdaq 100. After similar precedents, the NDX 100 was higher a year later every time, with reasonably benign drawdowns. Remember, in long-term uptrends, we want to buy oversold conditions or identify stocks in a consolidation where we can define our risk/reward for a trade setup.