A broad breakout

There's a whole lot of recovery going on.

Whatever your opinion on politics, it's hard to deny that the preliminary (?) election results on Saturday followed by the Pfizer vaccine news introduced a massive shift in psychology. As a result, we saw yet another wave of overwhelming buying pressure.

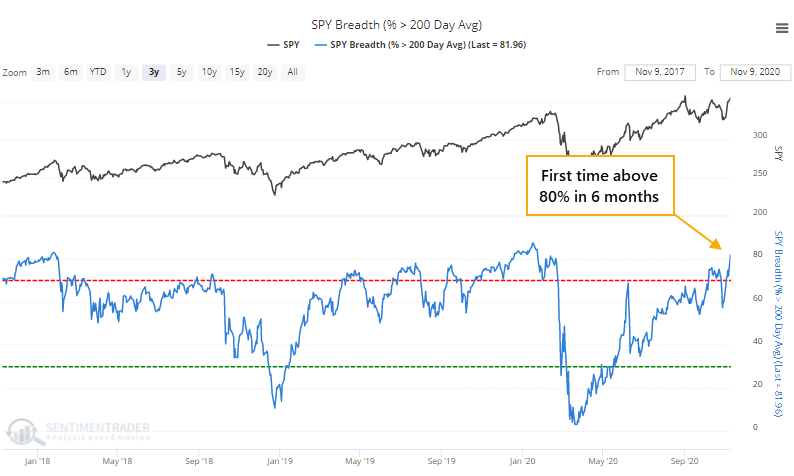

It was broad-based, too. For the 1st time in nearly 9 months, more than 80% of stocks in the S&P 500 managed to close above their 200-day moving averages.

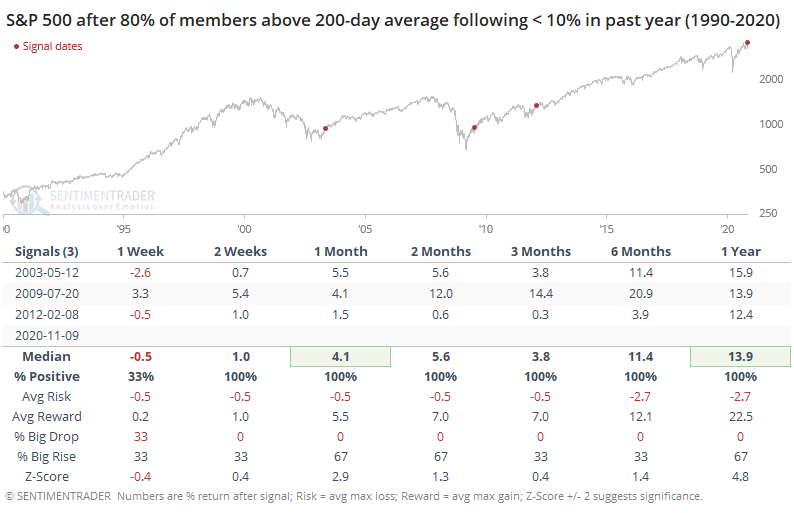

That marks a recovery from a point when fewer than 10% of stocks in the index were in uptrends. Over the past 30 years, such a cycle within a year's time has happened only 3 times, all of them very positive for forward returns.

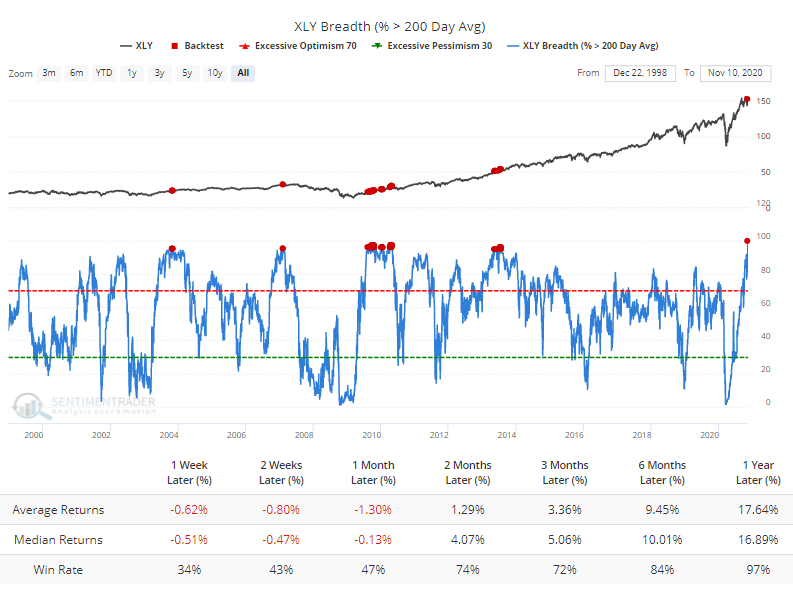

Among major sectors, every member of the Consumer Discretionary group managed to close above their 200-day average. Going back to 1990, that's never happened before. The handful of times more than 95% of the stocks did, the sector pulled back in the short-term but showed very good long-term returns according to the Backtest Engine.

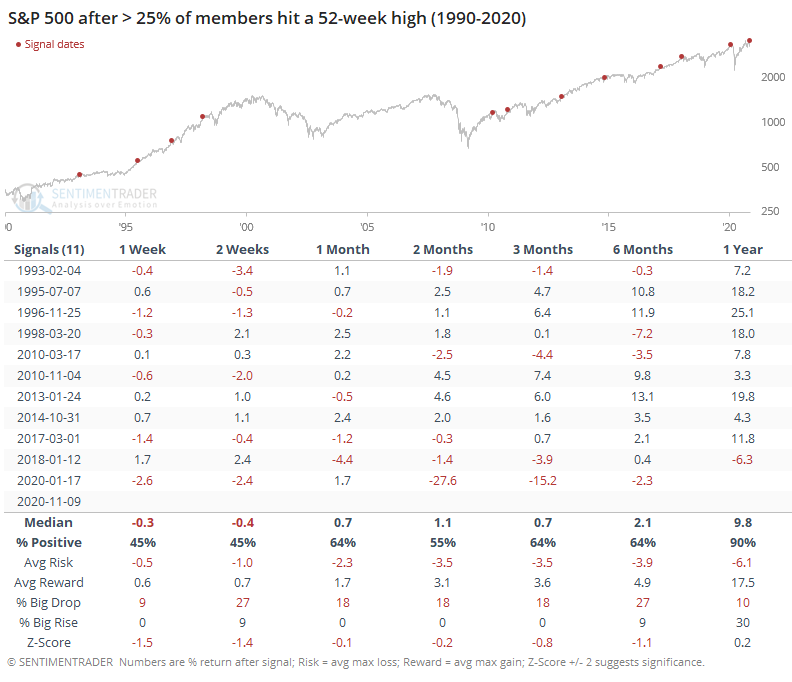

Monday's jump also triggered a wave of 52-week highs in more than a quarter of stocks in the broader S&P 500 index. A surge in new highs is usually a short-term negative as traders need to digest the gains, but when it's the first big reading in months, it has generated fairly positive long-term returns.

The biggest failure was earlier this year, when a surge in new highs not only led to a short-term pullback, it preceded an outright crash. That had never happened before. Granted, no other signal had to deal with a global pandemic, but we don't like to make excuses for indicators.

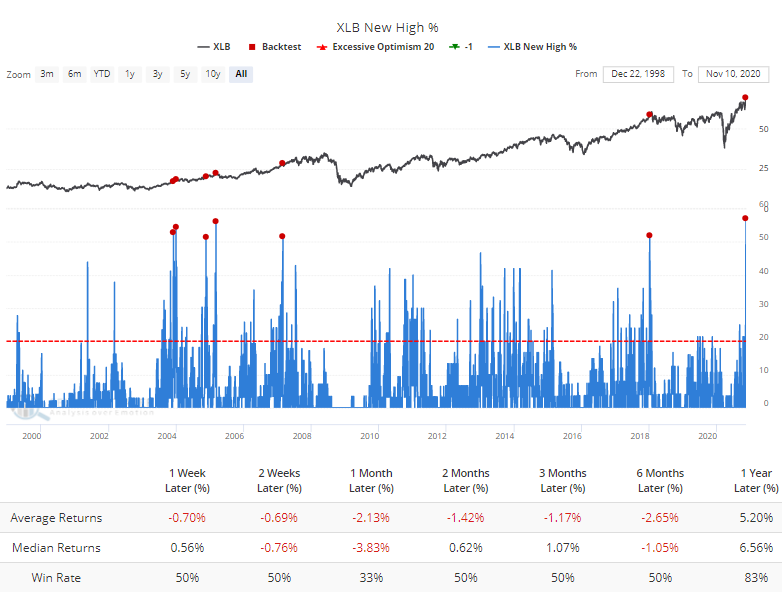

Among sectors, the most notable jumps in new highs were in Materials and Industrials. For Materials, the Backtest Engine shows some struggles after surges like this.

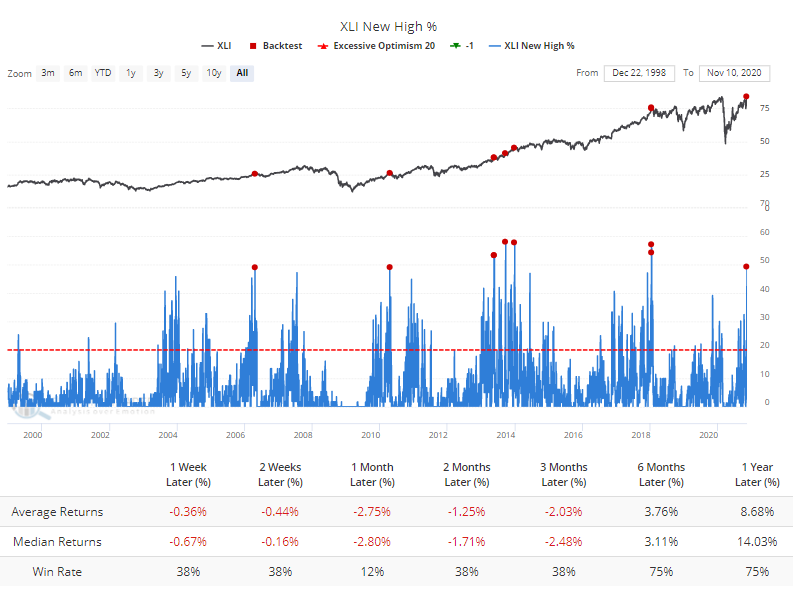

It was even harder for Industrials to add to their gains, with the Engine showing only 1 win out of 8 attempts over the next month.

There is the potential that the major news events over the past few days are enough to qualify for a "this time is different" situation. That's an awfully high hurdle, so we'll have to see how things shake out - so far, there is some very early evidence that it might be. As it stands, the jump on Monday should be a long-term positive, but the short-term is riskier, especially for some of the formerly staid sectors that saw a sudden surge in interest among investors.