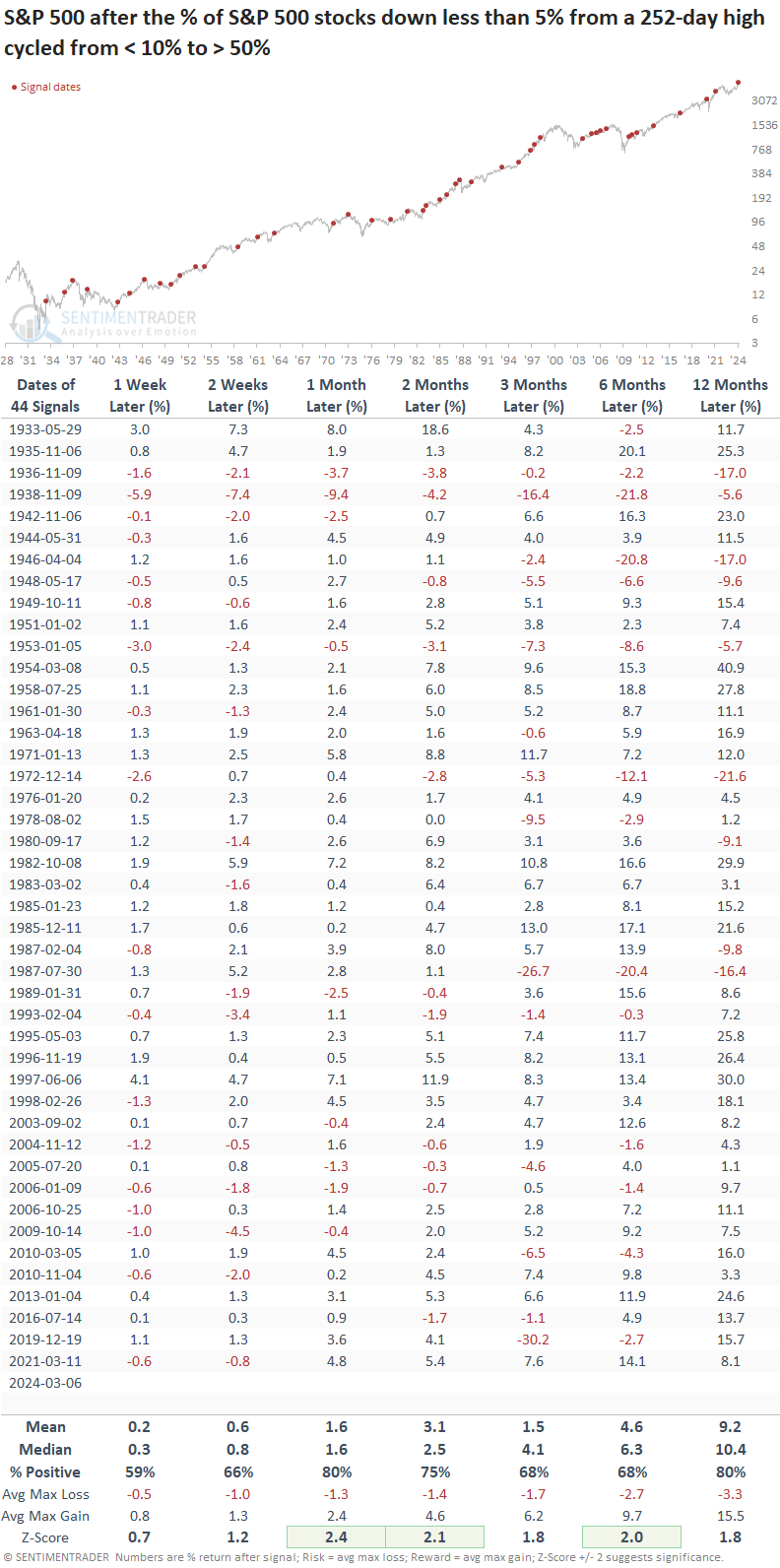

A breadth indicator with a perfect record triggered a buy signal

Key points:

- A majority of S&P 500 stocks closed within 5% of their respective 252-day highs

- Similar long-term trend conditions preceded a 100% win rate over the subsequent month

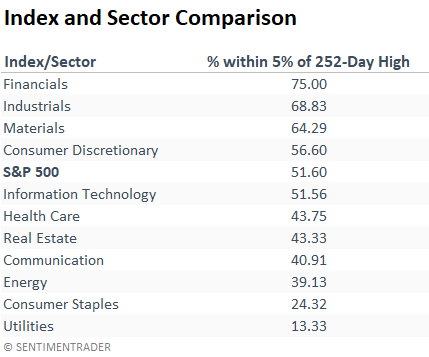

- Financials, Industrials, Materials, and Consumer Discretionary stocks maintain the highest readings

The big-picture backdrop continues to exhibit bull market behavior

Last week, as I was enjoying some time away with the family, one of the long-term breadth indicators I monitor generated a new buy signal.

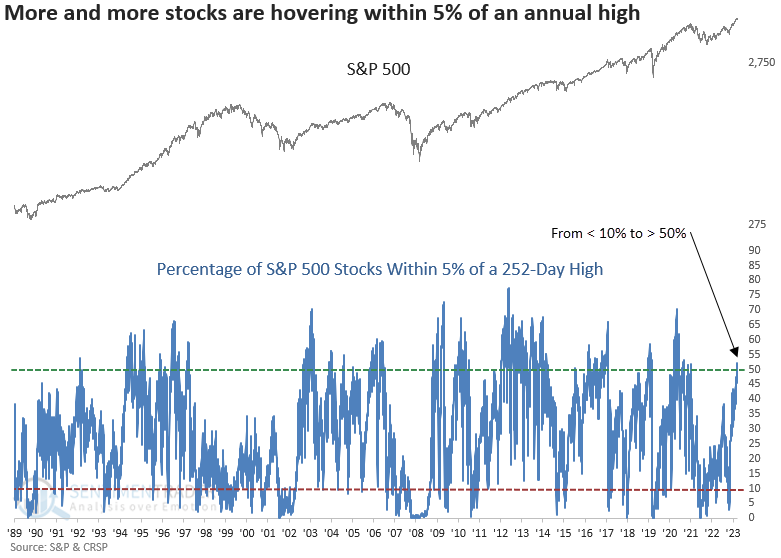

The indicator gauges the proportion of S&P 500 stocks trading within 5% of their 252-day high, offering a slightly different breadth-based assessment of long-term trend conditions.

A signal triggers when the indicator cycles from less than 10% to greater than 50%.

The previous alert occurred in March 2021, resulting in a 14% gain over six months. More importantly, that precedent occurred well in advance of the S&P 500's January 2022 peak, a common trait when participation is broadening, like now.

Similar long-term trend conditions preceded a positive outlook for stocks

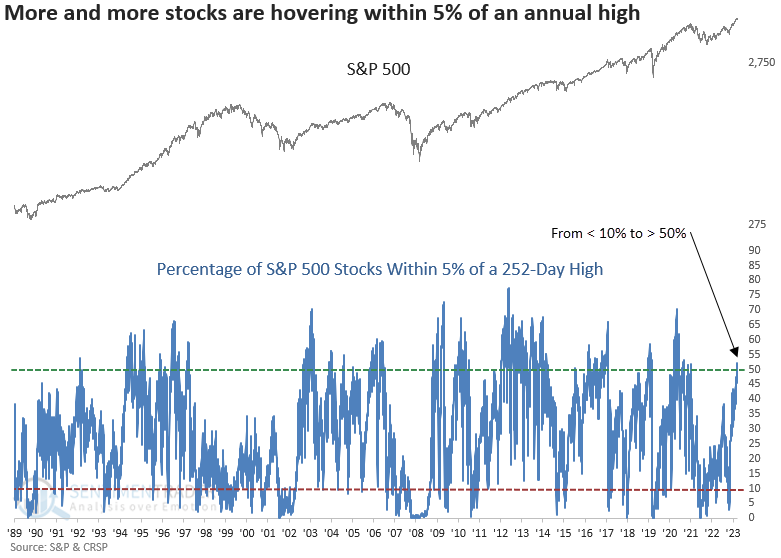

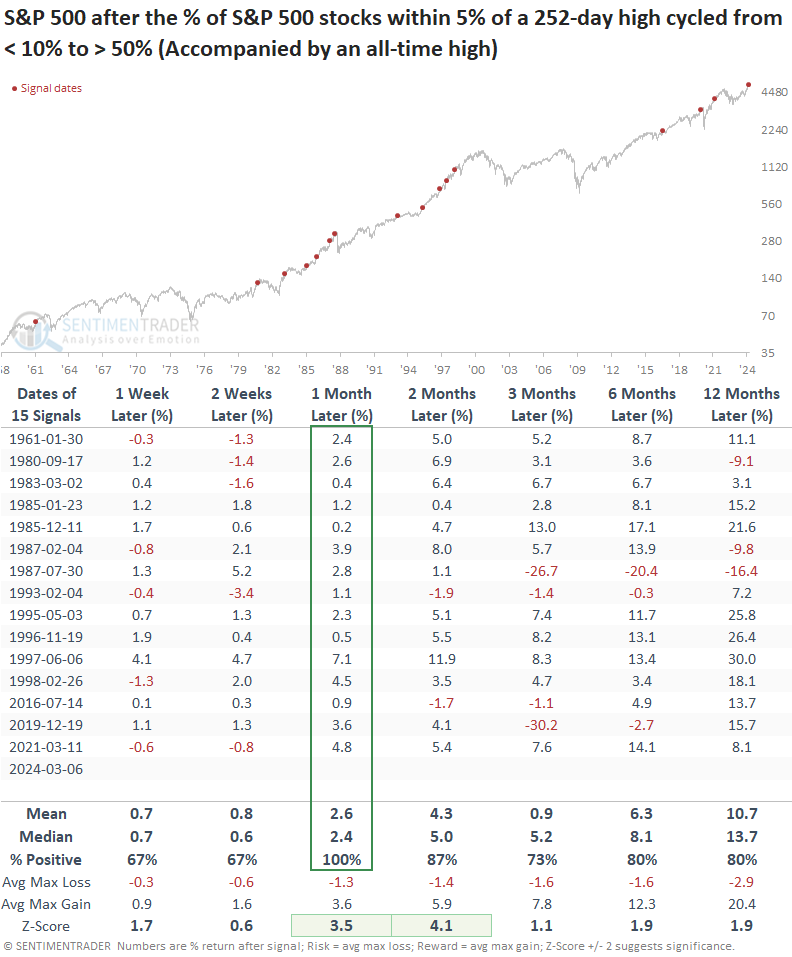

Whenever the percentage of S&P 500 stocks trading within 5% of their respective 252-day high shifted from under 10% to over 50%, in tandem with the index reaching an all-time high, the world's most benchmarked index exhibited outstanding returns and win rates across all time horizons. That was especially the case in the near term, with the S&P 500 registering a gain 100% of the time over the following month.

Despite the worrisome signals in 1987 and 2019, it's crucial to remember that crash events are exceptionally rare.

Meaningful drawdowns were conspicuously minimal in the ensuing two months, with no precedent surpassing a maximum loss of -5%.

This outlook table offers a comprehensive view of all signals, excluding the all-time high condition. While it delivers solid results, I thought it was worth highlighting that the win rates and returns for these signals lagged behind those observed at an all-time high. When trading signals coincide with an all-time high, performance typically experiences a drop-off.

This is why I really like this indicator/signal.

The percentage of S&P 500 Technology stocks within 5% of a 252-day high peaked in December 2023 after increasing to 68.75%. While Technology has faltered, other cyclical sectors have flourished and filled the void.

What the research tells us...

The S&P 500 and other widely followed indexes continue to march higher, exhibiting healthy price and participation trends. From a big-picture perspective, the backdrop increasingly resembles the steady uptrends exhibited in 2013 or 2017. The latest indicator to add credence to this scenario is the percentage of S&P 500 stocks trading within 5% of their respective 252-day high. When it shifts from less than 10% to greater than 50%, the S&P 500 trended upward over the following year. While near-term results show an undefeated record and minimal drawdowns, the market has come a long way over the last four months. Sometimes, equity indexes correct internally via sector rotation, with limited damage to the overall index. That could be occurring now with technology and semiconductors.