A Boring but Consistent January Portfolio

If we were to name three things that encompass most investors primary desires they would likely be:

- Return

- Consistency

- Low volatility

Each investor must decide for themselves what priority to put on each of the above. In these days of "Bitcoin/Tech/Tesla/Growth", it seems that "return" is the "Belle of the Ball." As such, what follows may not "float a lot of people's boat." This is because we are going to talk about a consistent, low volatility two fund portfolio built solely for the month of January. Still, there is something to be said for consistency and low volatility.

The "January Two"

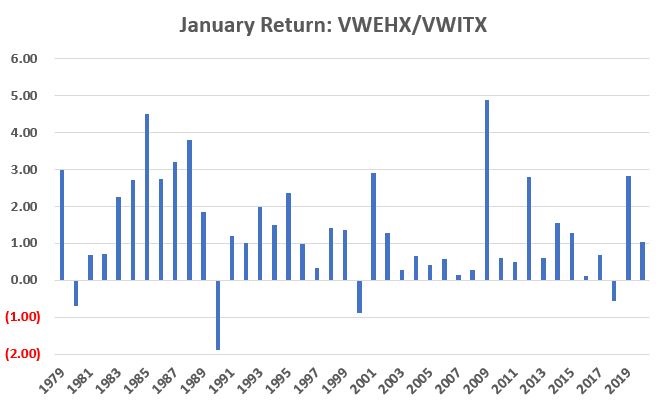

For testing purposes, we will use Vanguard High Yield (ticker VWEHX) and Vanguard Intermediate-Term Tax-Exempt Fund (VWITX) because we have data going back to 1979. Because of switching restrictions, for actual trading purposes one would more likely be better served with an ETF such as MUB for municipal bonds and HYG or JNK for high yield bonds (other potential proxies in this "correlated to the stock market" space include tickers CWB and ANGL).

The Test

For testing purposes we will assume a hypothetical 50/50 split between VWEHX and VWITX every year (using monthly total return data) ONLY during the month of January. The year-by-year results appear below.

For the record, the Junk/Muni Combo:

*Showed a gain 38 times in 42 years (90.5% of the time)

*The average return was +1.36% (which works out to 17.4% annualized)

*The "worst" January was 1990 which showed a loss of (-1.30%)

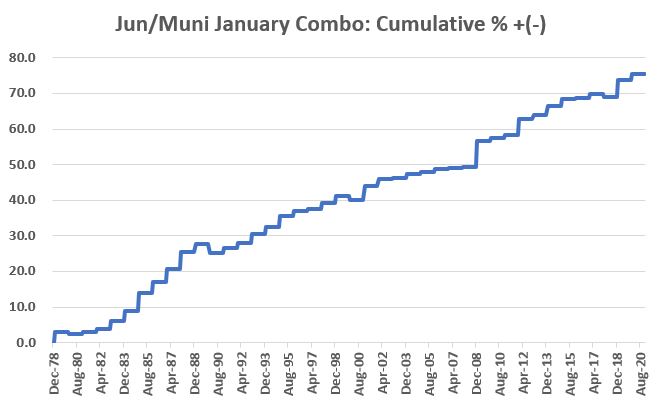

The chart below displays the hypothetical cumulative gain achieved by holding these two funds only during the month of January every year starting in 1979 through 2020.

Is this a viable, actionable idea? Well, that's not for me to say. It's only a 1-month trade and the returns are good on an annualized basis but not "eye-popping" on a raw 1-month basis.

Still, anything that is 90% accurate over 40+ years is probably at the very least worth knowing about.

So now you know.