A Backtest Engine Scan to Monitor - The PE/VIX Spread

I love an indicator that tells you exactly what it is. Take the PE/VIX Spread. Any doubt in your mind what that measures? If so, please note the following from our website:

"This indicator shows the spread between the forward price/earnings multiple on the S&P 500 and the VIX volatility gauge. The higher it is, the more investors are willing to value stocks while not suffering the consequences of high volatility, which tends to lead to poor future returns. A very negative spread shows that investors may be pricing in too great of a swing in prices relative to the earnings that stocks will likely be generating."

In a nutshell, this indicator is where valuation and sentiment meet. The reason I bring it to your attention now is that it may soon be on the cusp of a potentially important signal. And unfortunately, this signal may be "one of the painful kind."

The Test

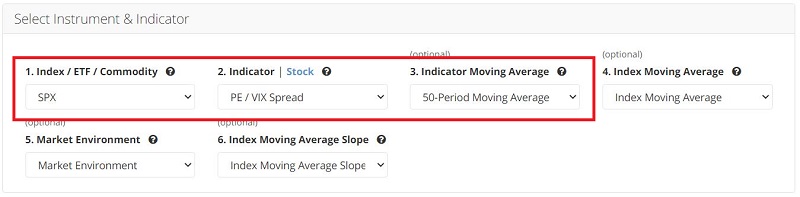

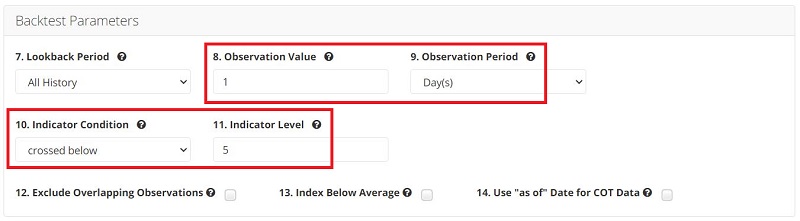

You can run the following test by clicking on this link. What this test looks for is a day when:

- The 50-day average of the PE/VIX Spread

- Drops below 5.00

It doesn't often happen, so a small sample size is a concern. Still, the intermediate-term results seem worth noting.

The input screens appear below.

THE RESULTS

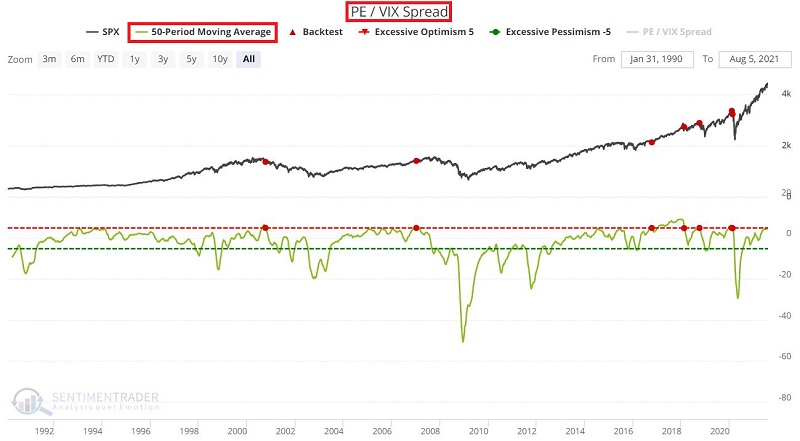

The chart below shows the previous signals from this particular test.

The table below displays the results of previous signals. The key thing to note is the deeply unfavorable results registered 2 months and 3 months after previous signals (although after that, results were much better, so we are talking about an intermediate-term indicator).

CURRENT STATUS

As you can see in the chart below, the PE/VIX Spread 50-day average is presently above 5.00. There is no way to know how long it might be before this measure drops back below 5.00. However, once it does, it might make sense for investors to "play some defense" over the subsequent few months.

You can save this test by:

- Clicking Add to Favorites

- Entering a Name (e.g., PE/VIX Spread 50-day MA drops below 5.00)

- Clicking Save Favorite