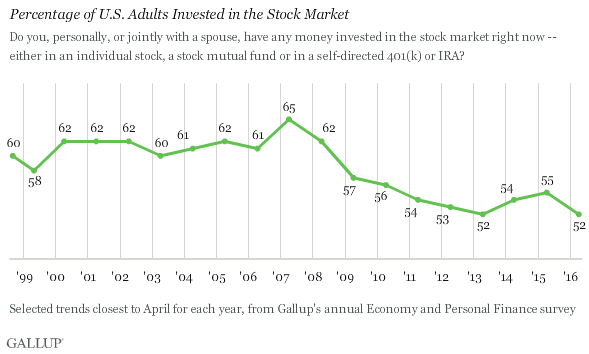

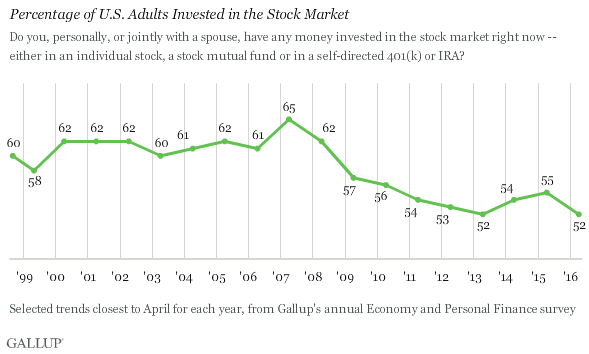

A 19-Year Low In Stock Holdings?

Americans are holding the fewest stocks in 19 years. So says a new Reuters poll, getting quite a bit of attention today.

But...

- It's a survey. People often do one thing and say another. Many don't even know that they own stocks.

- It might be misleading. The survey included about 1,000 respondents and there was a sampling error of +/- 4%. The headline number was that 52% of respondents own stocks, but the real number could be as high as 56%, which would be the highest since 2010.

- Even if it's accurate, it doesn't tell the whole story. Even if fewer Americans are holding stocks, that doesn't mean Americans in general are under-exposed. It just means that stockholdings are concentrated among fewer individuals. Is that a good thing? Forgetting the social aspect, what happens if stocks start to decline? Instead of the market being somewhat cushioned by having a broad base, it's concentrated in relatively few hands and if those hands decide to fold, then a sell-off would feed on itself.

- It may not work. If we were using this survey as a contrary indicator, then we might have been bullish in 1999 (when fewer Americans said they owned stocks) and bearish in 2002 (when a then-record high owned them).

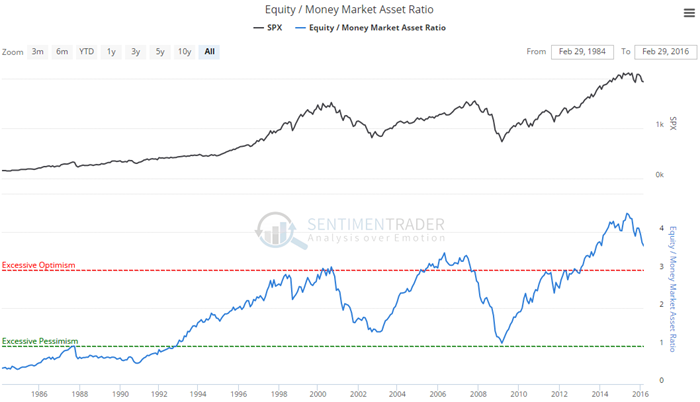

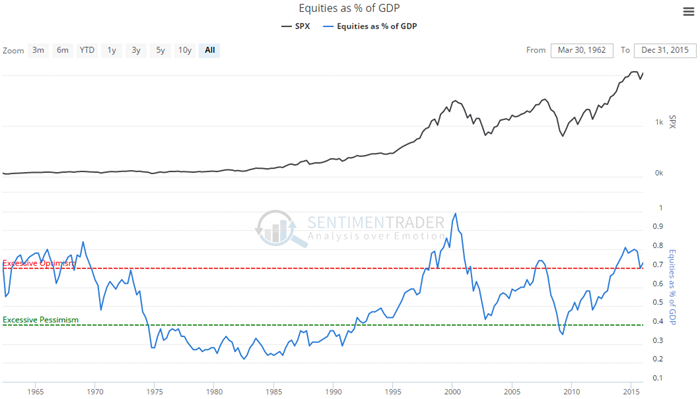

- It's a survey. That bears repeating. Instead of looking at what people say, we much prefer to look at what they do. So let's look at a couple of charts - using real money - that show how Americans are actually positioned.

According to the Investment Company Institute, American households are now holding about 3.5 times more assets in stocks than they are in "safe" money market funds. That's down significantly from the peak in 2015 but is still higher than every other peak in 30 years.

According to the Federal Reserve, household stock holdings are worth more than 70% of the U.S. GDP. That ranks among the highest levels in 50 years.

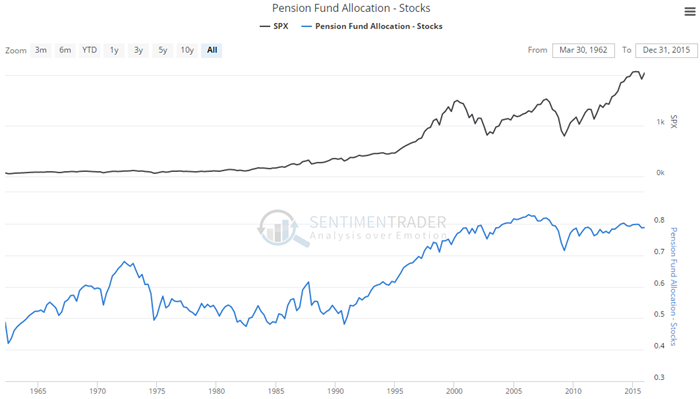

As mentioned earlier, many people don't realize they're actually holding stocks. From automatic 401k contributions to company pension funds, workers often make contributions that are automatically invested and they "set it and forget it". And those pension funds are holding nearly 80% of their (stock/bond/cash) assets in stocks.

Bottom line, it's often better to ignore surveys, especially ones with relatively small sample sizes and limited history, and instead focus on actual money. By most real-money measures, Americans are holding a near-record amount of stocks relative to other assets.