A 1% Gap Up Following Down Days

As stocks prepare to gap up more than 1% after consecutive days of selling pressure, the concern is always that this is a temporary bounce before more selling pressure. It's a valid concern because that's not an unusual pattern.

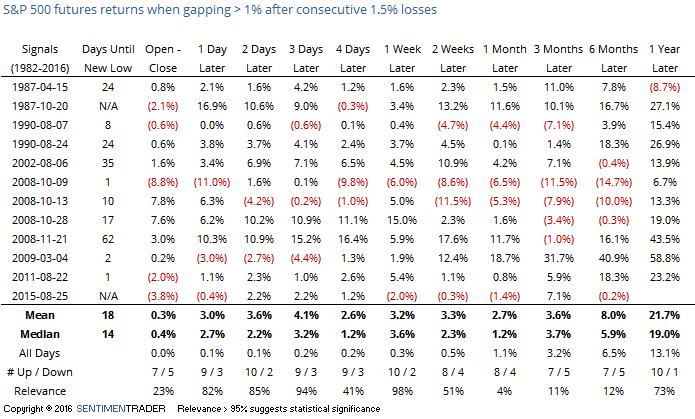

It often takes a while, however. Of the 12 times the S&P futures have gapped up 1% or more following consecutive 1.5% declines, it took a median of 14 days to close below where stocks gapped up (in our current case, a close below Monday's close). There was wide variability, however, ranging from 1 day to nearly 3 months (or never, in two cases).

Returns over the next week tended to be good, with 10 of the 12 being higher than the gap up open a week later. It bodes well for continued short-term upside, though most of the studies we looked at yesterday pegged the highest probability rally only at 2-3 days long.

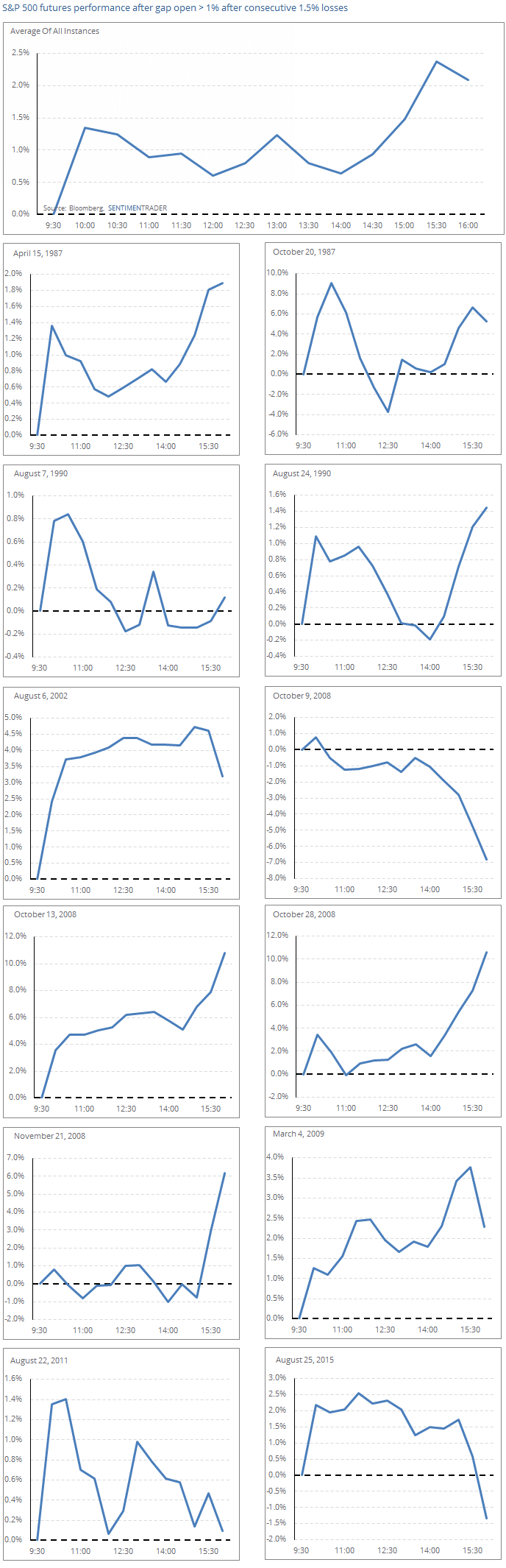

Here is how the futures performed intraday after these types of gaps. Most of the gains came early, on the gap open, flatlined during most of the day, then a ramp higher into the close.