5 Trades Show Flight-To-Safety

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

A concerted flight to safety

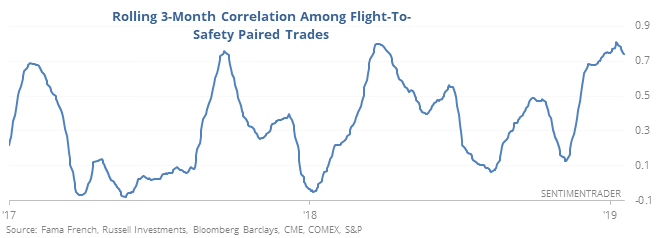

Looking at a handful of different flight-to-safety trades, it’s evident that there has been a lot of risk-off positioning in recent months.

Ratios of the following four paired trades have had an extremely high positive correlation over the past 3 months:

- Defensive / Cyclical

- Large Cap / Small Cap

- Inv Grade / High Yield

- Gold / Copper

- Low Volatility / High Beta

The correlations among the various is to a point that has typically coincided with extreme risk-off behavior among investors.

Over the past 30 years, when the correlations became this high, it typically led to good longer-term returns, though there were two large outliers.

S&P 500 Value Index

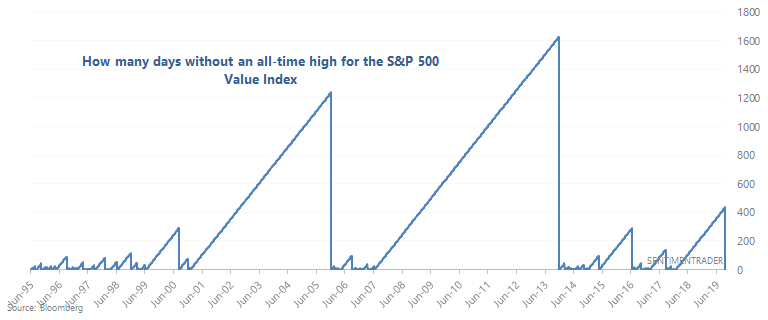

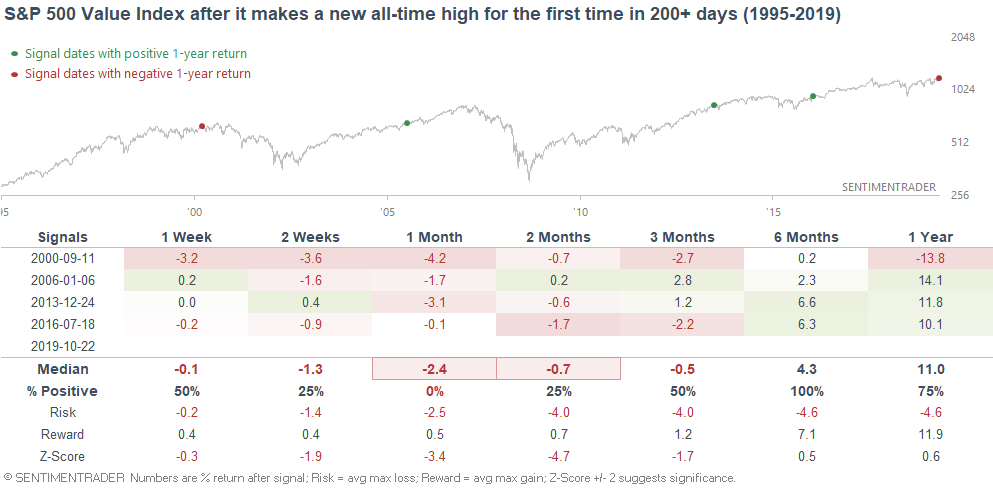

As Bloomberg noted, the S&P 500 Value Index has broken out to a new all-time high. It's the first one in well over a year.

When the Value Index rallied to a new all-time high for the first time in 200+ days, it typically faced weakness over the next 1-2 months, even if it rallied further over the next 6 months.

Keep in mind that the sample size is small.