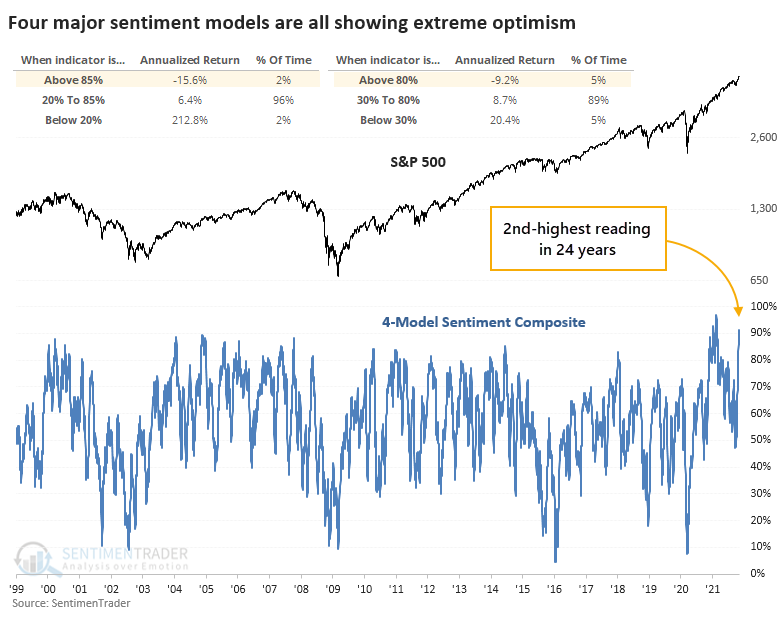

4 sentiment models are showing extreme optimism

Key points:

- Four sentiment models are all showing extreme optimism

- Combining them into a composite shows one of the highest readings in 23 years

- The S&P 500's annualized return after similar readings was -15.6%

Four major models are all showing excessive optimism

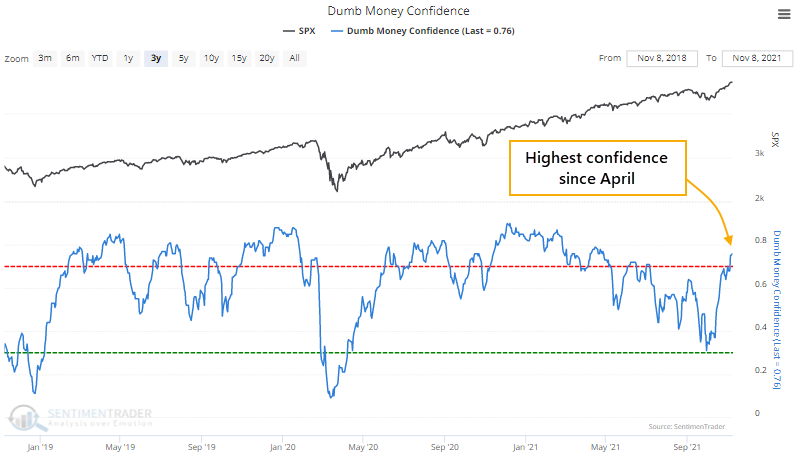

After a streak of optimism, Dumb Money Confidence turned pessimistic at the end of September. The ends of other long streaks of optimism led to higher prices, as buyers finally saw a good chance to step in.

The lack of optimism didn't last long, and now it's back to an extreme. On the lower end of that threshold, but still.

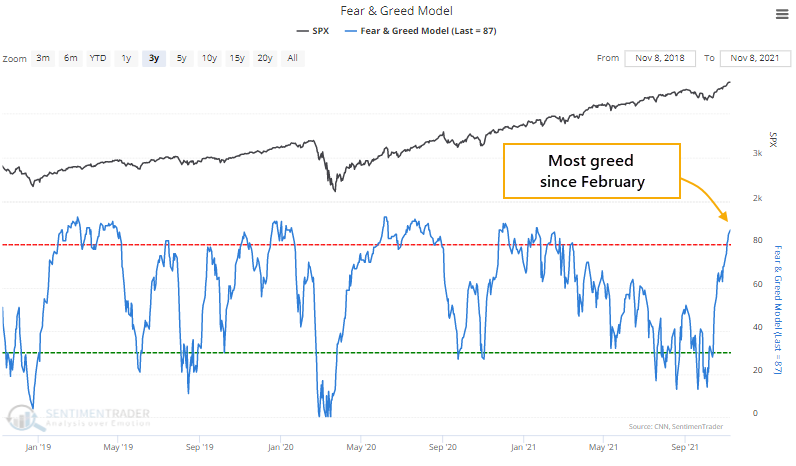

The Fear & Greed Model, based on similar inputs and methodology to the one published by CNN, has also made a furious comeback and is now pushing well into Greed.

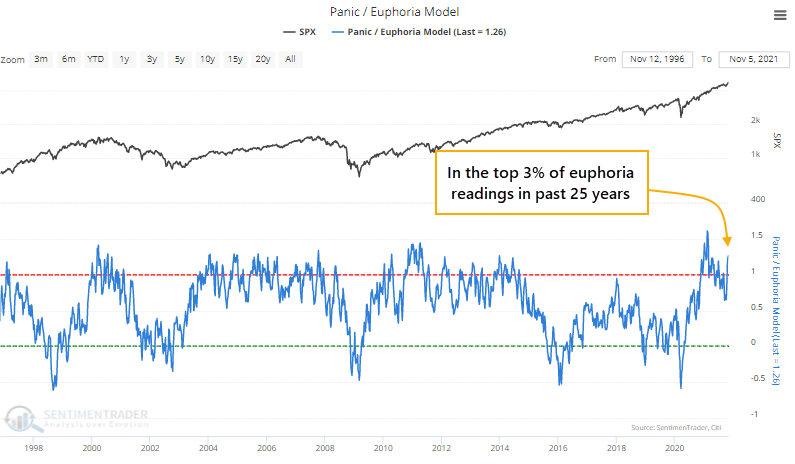

The Panic/Euphoria Model, constructed using a methodology described by Citigroup in public posts, has rebounded and is once again above its "euphoria" threshold.

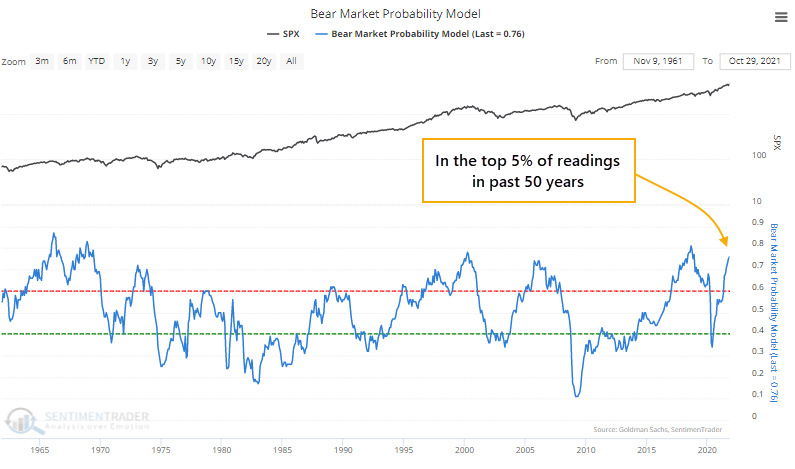

And the Bear Market Probability Model, described in interviews by Goldman Sachs, has soared to one of the highest levels in 50 years.

A combined model shows abysmal annualized returns

If we combine all four models into one, we can see how a broad cross-section of sentiment-related measures compares versus other periods. And there are almost no precedents.

This composite model never got above 90% from 1998 through 2020. Then speculative orgy at the start of 2021 thrust it above 90% in January and February.

Clearly, such high optimism had no long-term impact on the prospects for stocks. A 5-year-old child could point to an S&P 500 price chart and tell that it's still going up and to the right.

Even so, choppiness among stocks within indexes pushed the composite model below 50% in late September. Now, enthusiasm is back, and the model is above 90%, challenging the highest readings in 23 years.

The chart shows us that the S&P 500's annualized return when the composite model was above 80% was a miserly -9.2%. When the model was above 85%, accounting for about 2% of all days since 1998, that return was a horrid -15.6%.

What the research tells us...

At the end of September and early October, most of what we looked at showed a high probability of higher stock prices. Momentum streaks were ending, and sentiment showed hints of pessimism during a seasonally favorable time. The "easy" call was for prices to rise in line with historical behavior.

Now, we're back with the unpleasant conflict of positive momentum, new breakouts, and still-positive seasonality, but the potential headwind of excessively optimistic sentiment. This has been among the least effective years ever in terms of sentiment analysis, with extremes from January and February having limited impact on the S&P though higher-risk areas saw bigger and longer-lasting declines. There are few signs that the environment has changed, so it may be riskier than usual be use excessive optimism as the sole reason to sell. We'd be leery of becoming too aggressive with long positions just now, however, especially in high-beta sectors.