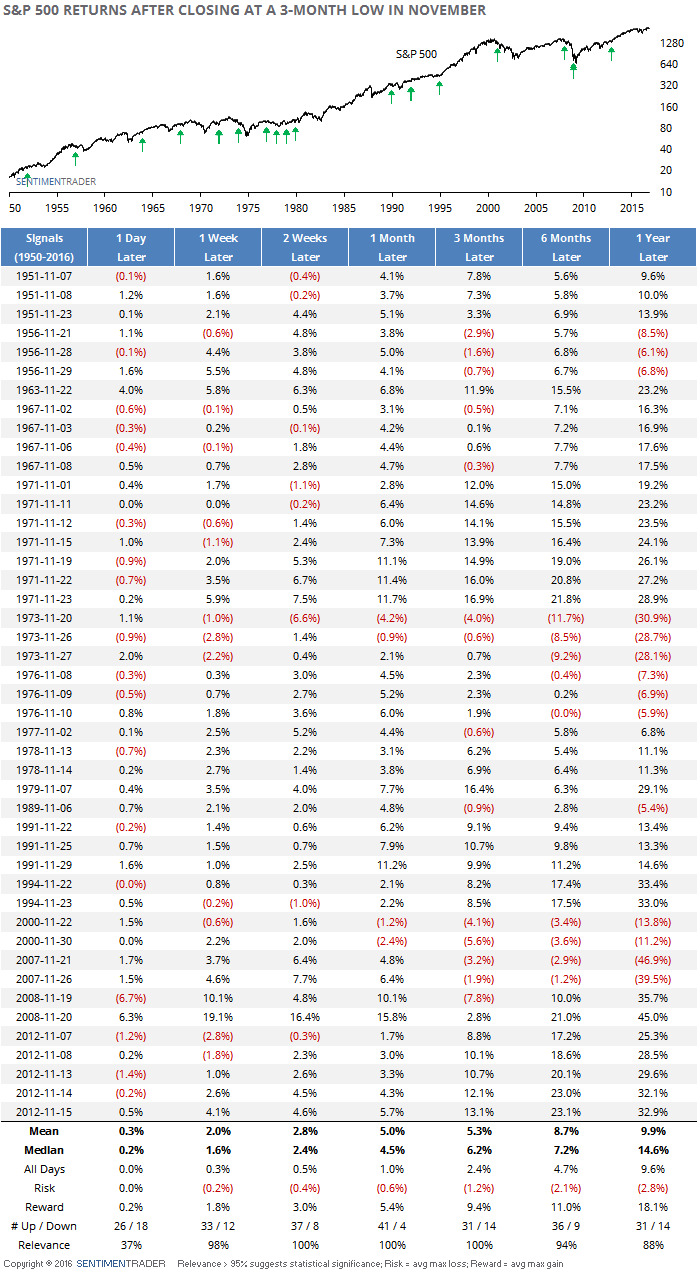

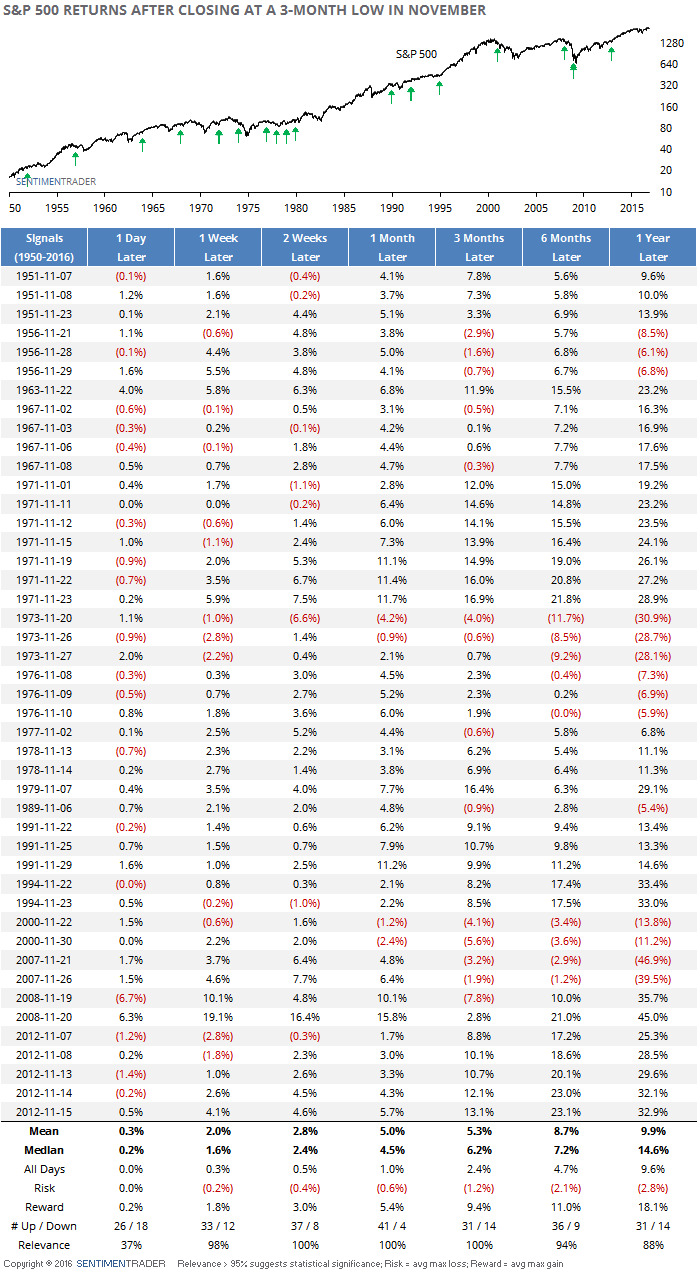

3-Month Lows In November

As stocks continue to sell off into the afternoon, the S&P 500 is in danger of doing something it hasn't done in four years - close at a multi-month low in November.

Most of us have heard about how November through April is the most seasonally positive time of the year, and we're already passed the scary September/October time frame. So multi-month lows in November are relatively rare.

Since 1950, the S&P has closed at a 3-month low on any day in November 45 times, including consecutive days. Remarkably, the S&P rebounded over the next month after 41 of those occurrences, with a nearly 10-to-1 reward-to-risk ratio. All dates are shown below.

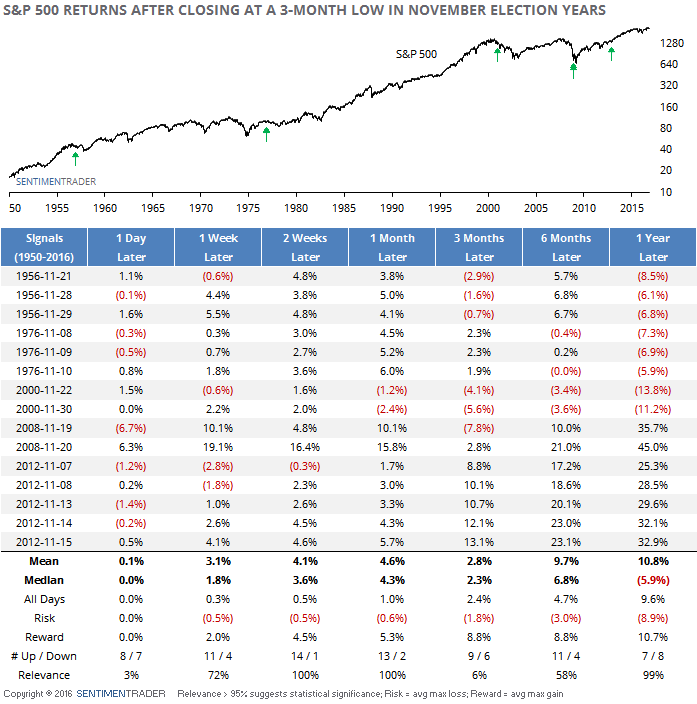

If you look at the recent dates, something else sticks out - most of them were election years. Here's the same table, but filtered for election years.

Over the next couple of weeks, the S&P rebounded after 14 of the 15 dates, though most of these occurred AFTER the election and not the week before.

It's also rare to see volatility increase like this at this point in the year. The VIX has jumped 30% or more in a week during November only four other times (1991-11-15, 2007-11-07, 2008-11-20, and 2015-11-13), all leading to rebounds over the next month.

It's anyone's guess how the next week is going to unfold with rapidly changing polling numbers. The probability seems high the volatility will remain elevated with high risk in stocks, both ways. But once the initial wave of uncertainty is passed after the election, we'd be looking at weakness as an opportunity to finally add back some stock exposure.