252-Day High in the 10-Year Bond Yield

The 10-year yield registered a 252-day high on 2/25/21. This is the first occurrence since the last 252-day low on 8/4/20. Typically, rising interest rates reflect positive trends in the economy and operate with a lag on future growth. While the following analysis may be common knowledge, I think it's important to review the wide-ranging implications on the markets as the signals are rare.

Let's take a look at what happens to bonds, stocks, and commodities after a 252-day high in the 10-year yield with a 252-day low reset.

Interest Rate Comparison

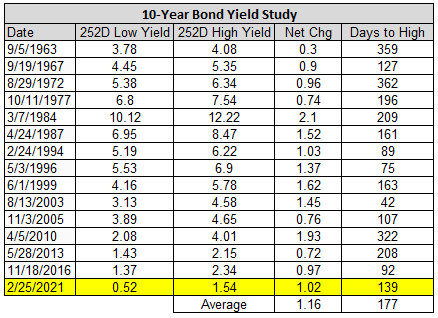

The table below contains all instances when the 10-year yield registered a 252-day high after a 252-day low reset. i.e., the first occurrence. The new signal on 2/25/21 shows a 102 bps increase in the 10-year yield in a 139 trading day time span.

Source: St. Louis Fed, Department of the Treasury, Bloomberg, CRSP, S&P, and Sentimentrader.com

Please note, the numbers in the interest rate performance tables reflect the net change in yield.

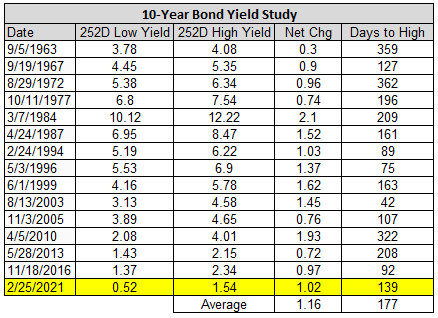

10-Year Bond Yield Performance

As the table below shows, the 10-year yield increased on a fairly consistent basis.

10-Year Bond Yield Performance with Net Change Sort (see last column for net change)

When I sort the performance table by the net change in the 10-year from the 252-day low to the 252-day high, one can see a greater tendency for the smaller basis point changes to exhibit more upside in yields over the next 6-12 months.

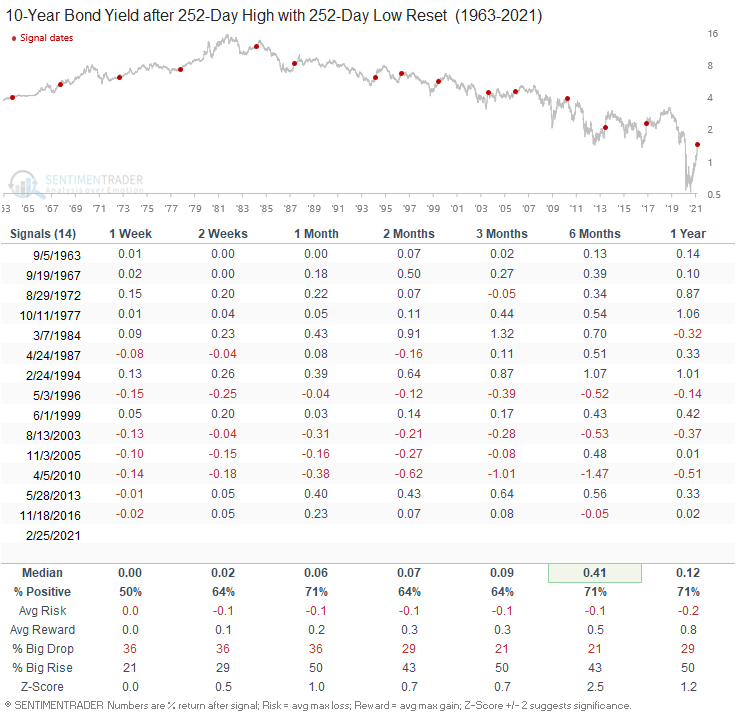

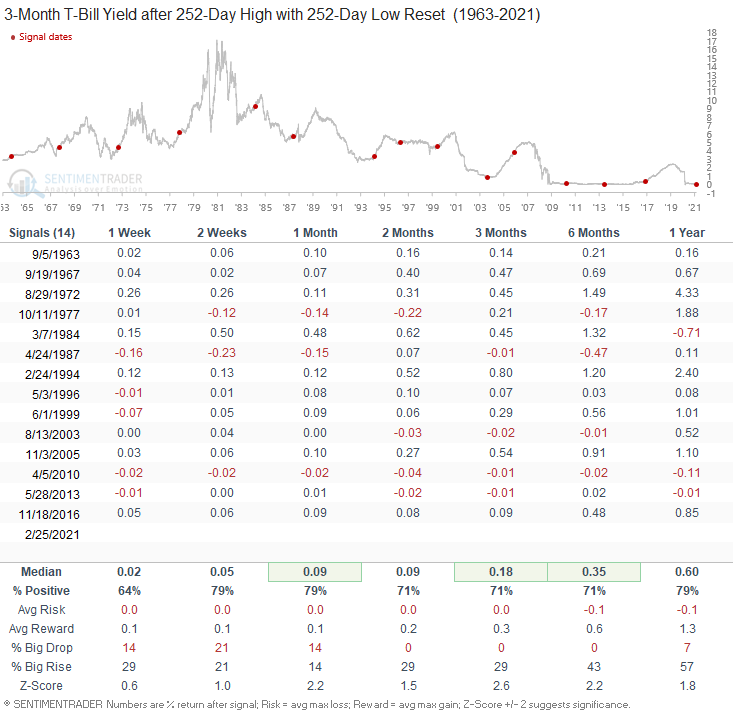

3-Month Bond Yield Performance

The 3-month T-Bill yield shows a consistent increase across all timeframes.

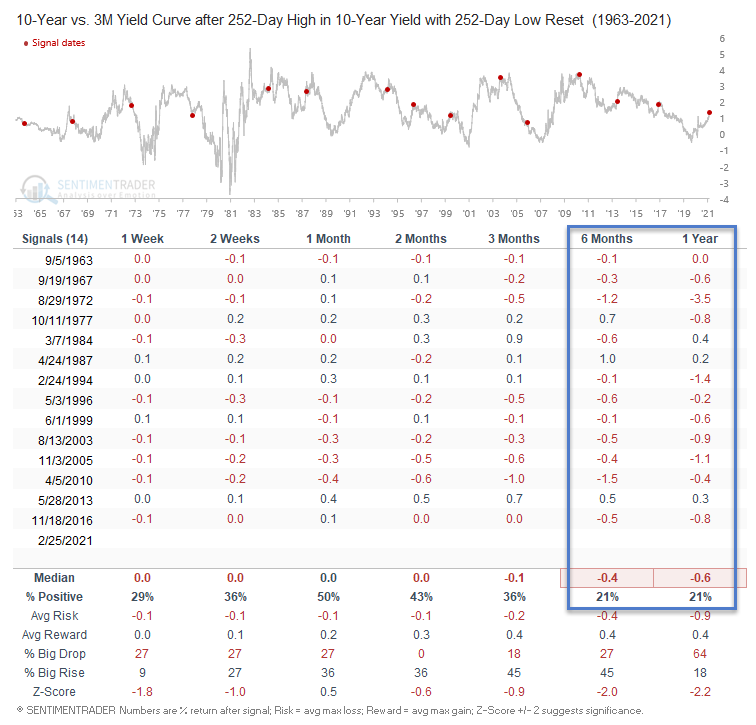

Yield Curve Performance - 10-Year vs. 3-Month Spread

The yield curve exhibits a strong tendency to flatten over the next 6-12 months.

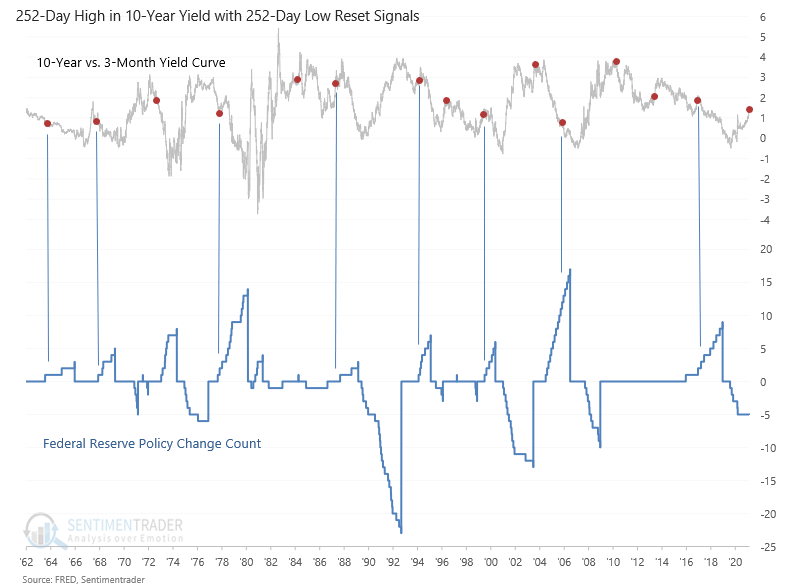

Yield Curve and Federal Reserve Policy

The following chart highlights how the yield curve's flattening can be attributed to federal reserve policy in a majority of instances. The federal reserve cycle count was rising in 8/14 cases.

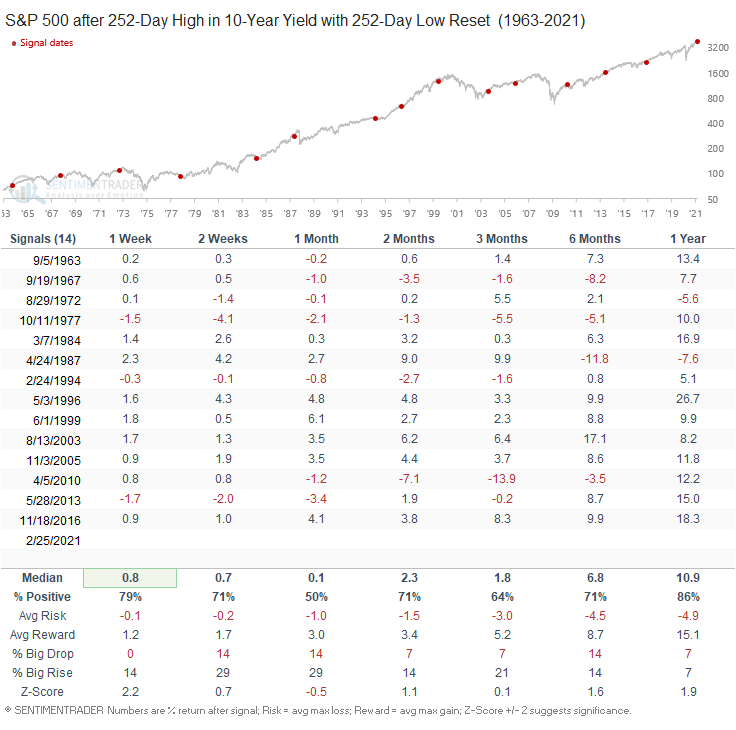

S&P 500 Index Performance

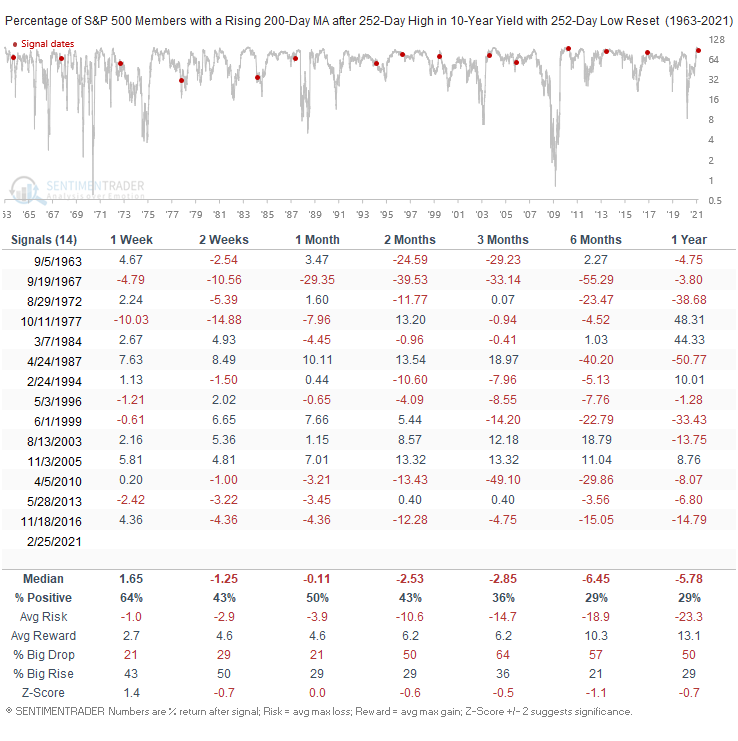

Large-Cap Market Breadth Performance

The percentage of S&P 500 members with a rising 200-day moving average weakened consistently. While most of the instances started from a high level, higher rates will impact certain industries.

Please note, the numbers in the breadth table reflect the net change in the percentage of members with a rising 200-day moving average.

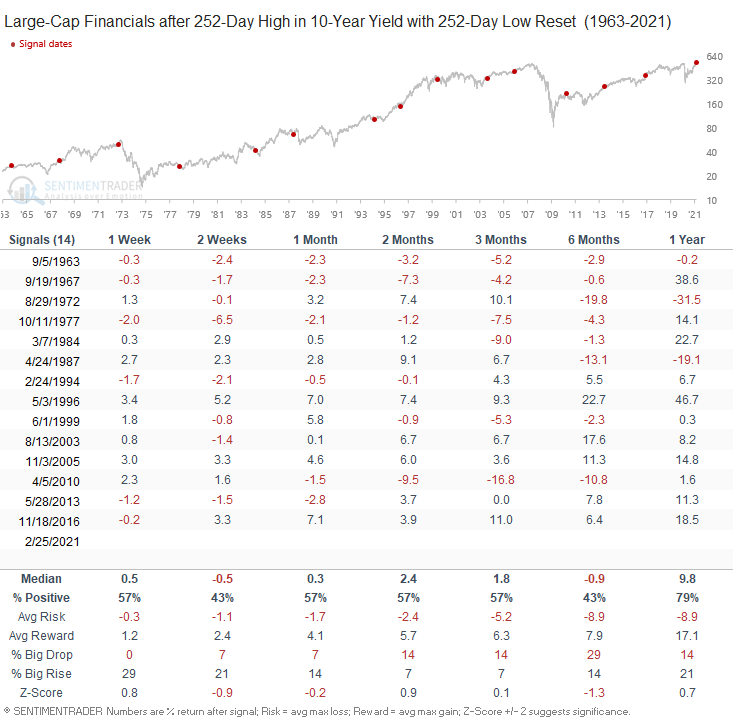

Large-Cap Financials Performance

Historically, financials are impacted by the flattening yield curve. One has to wonder if that will be the case anytime soon.

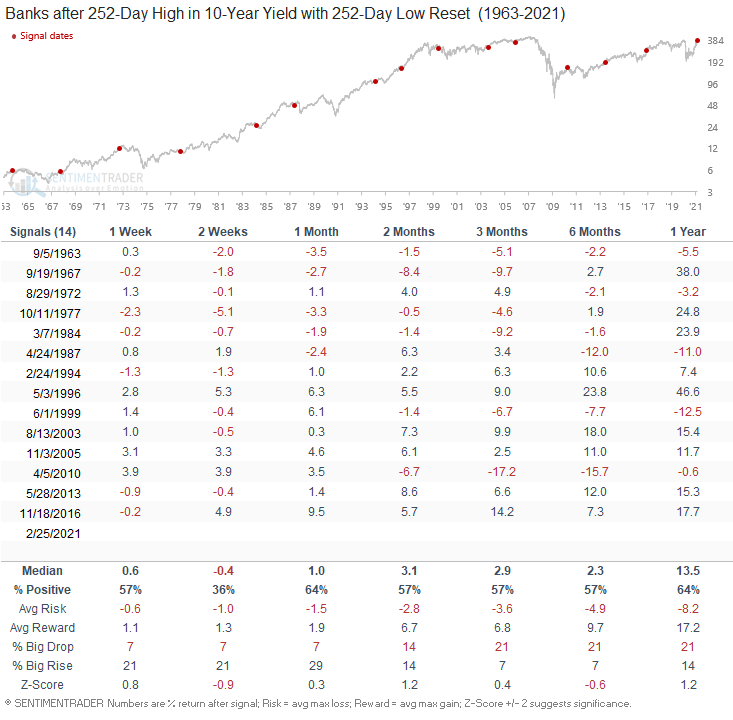

All-Cap Bank Performance

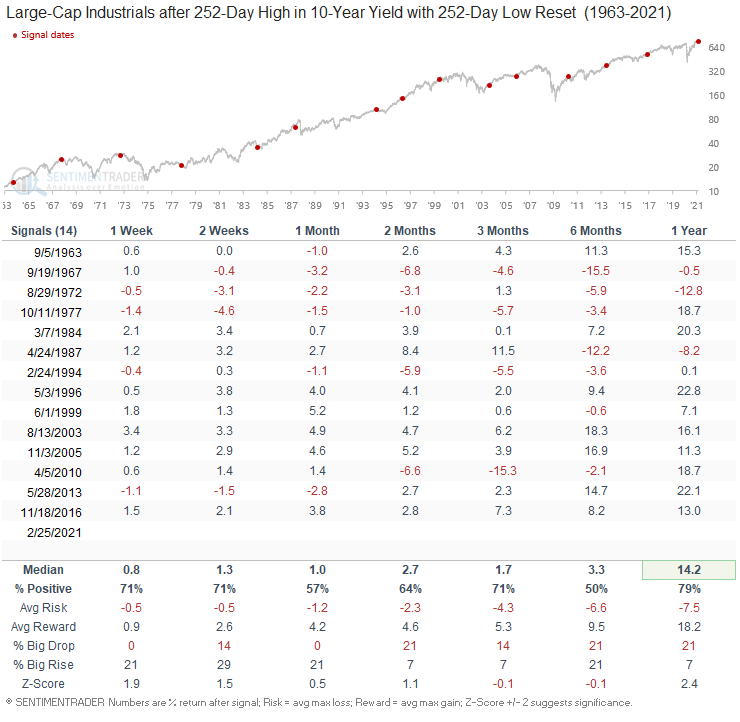

Large-Cap Industrials Performance

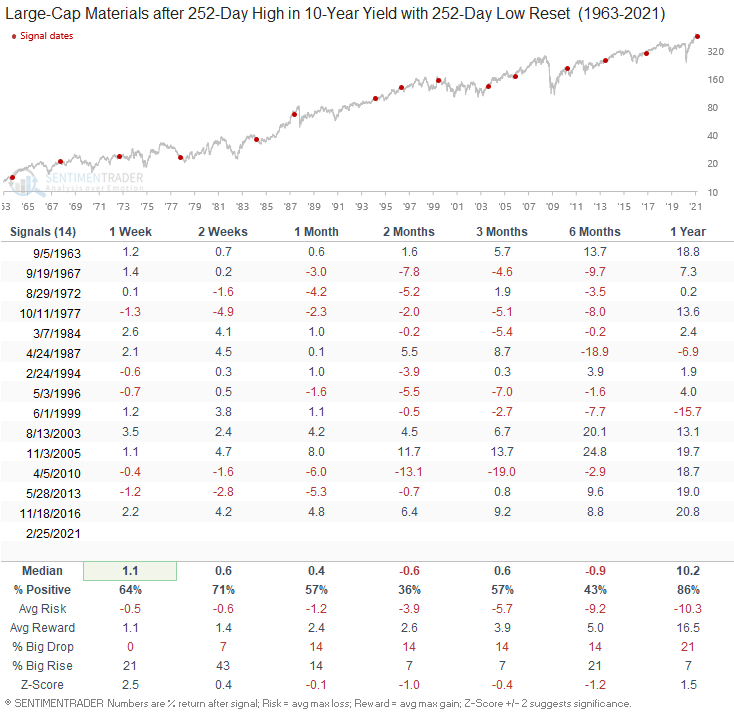

Large-Cap Materials Performance

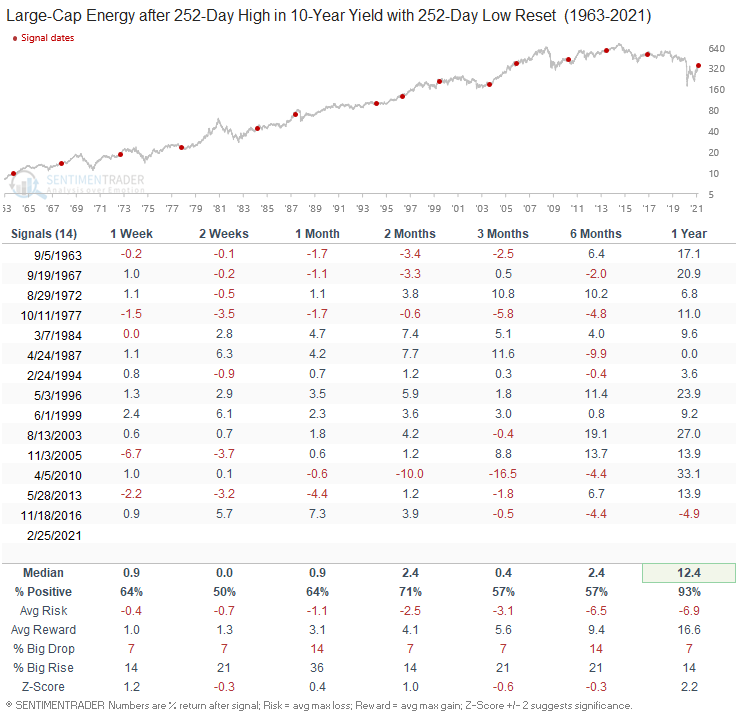

Large-Cap Energy Performance

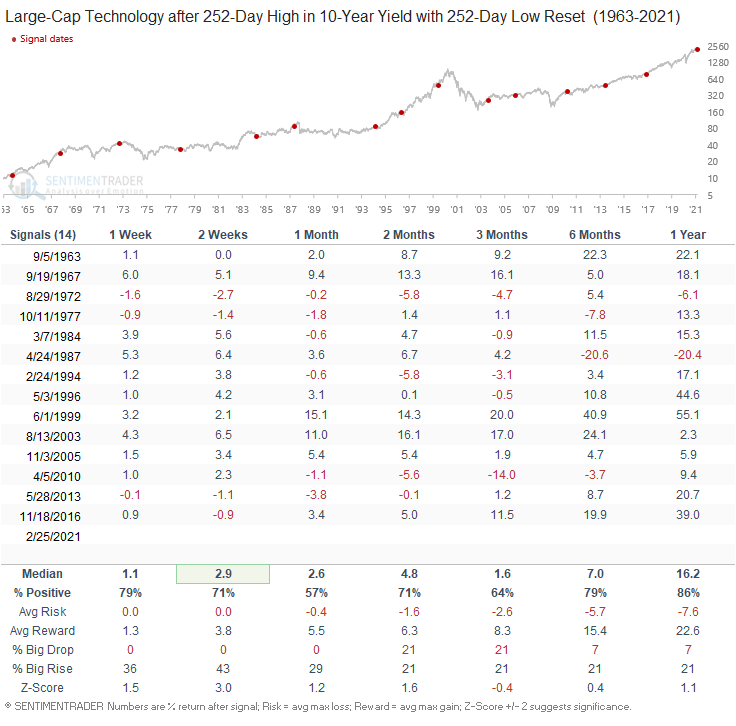

Large-Cap Technology Performance

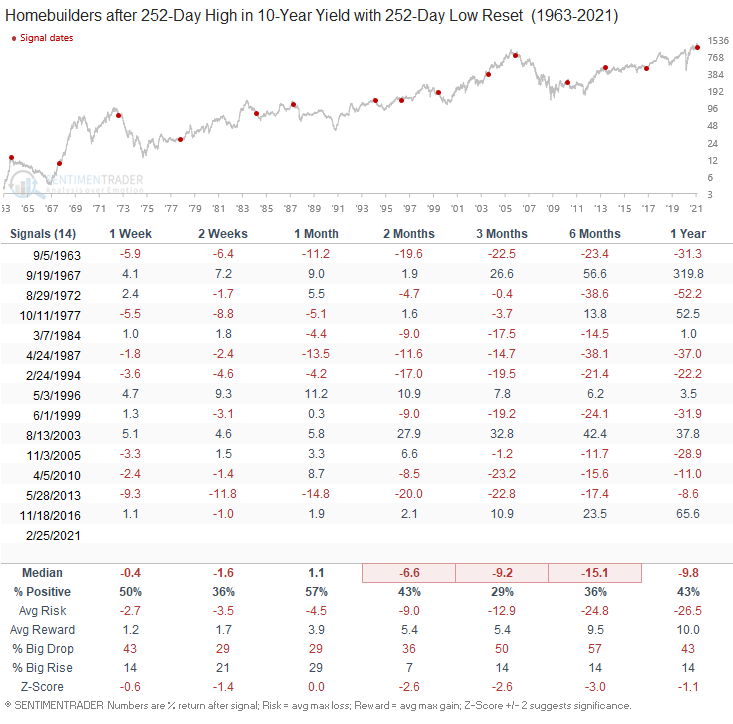

Homebuilders Performance

While there are other interest-rate-sensitive groups, the homebuilders provide a good example of how higher rates impact the business cycle.

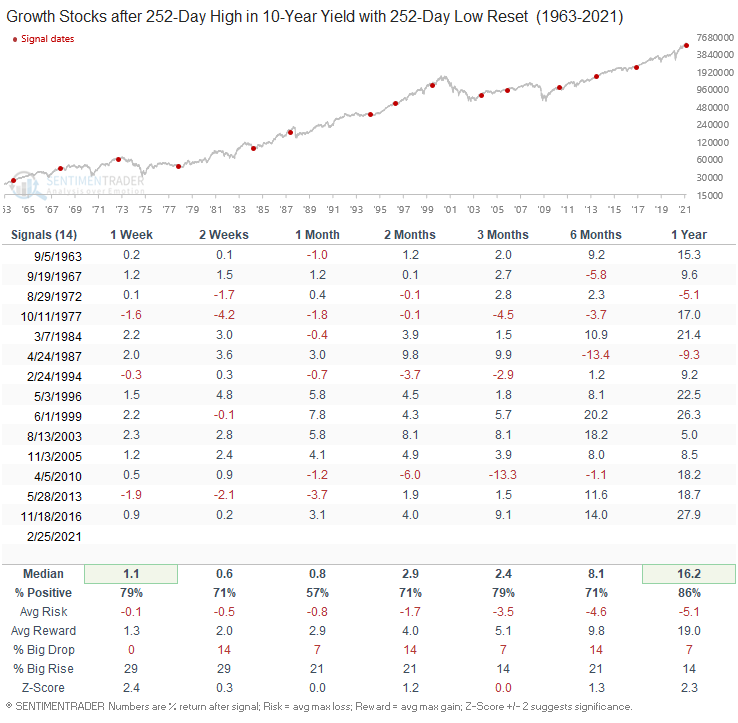

Growth Stock Performance

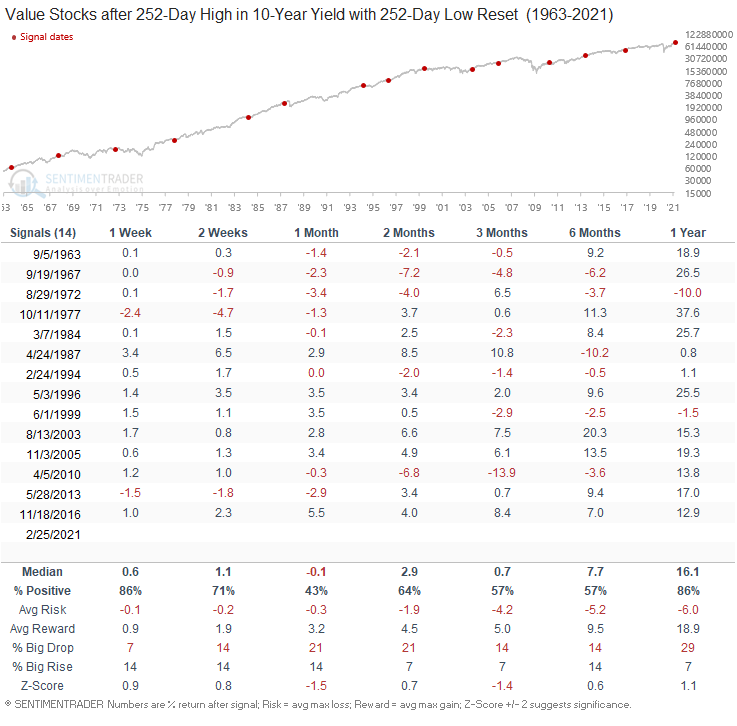

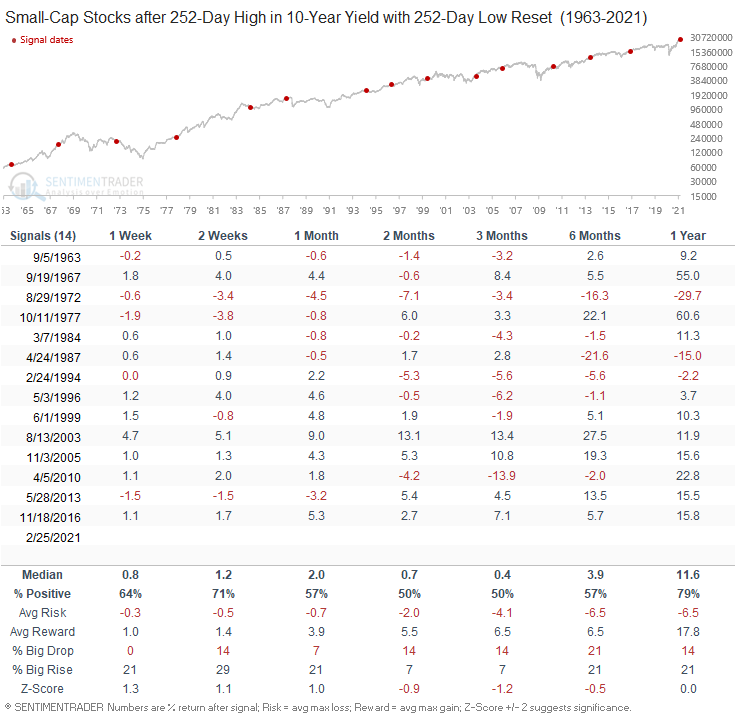

Please note, the growth, value, and small-cap performance numbers are derived from total return indices.

Value Stock Performance

Small-Cap Stock Performance

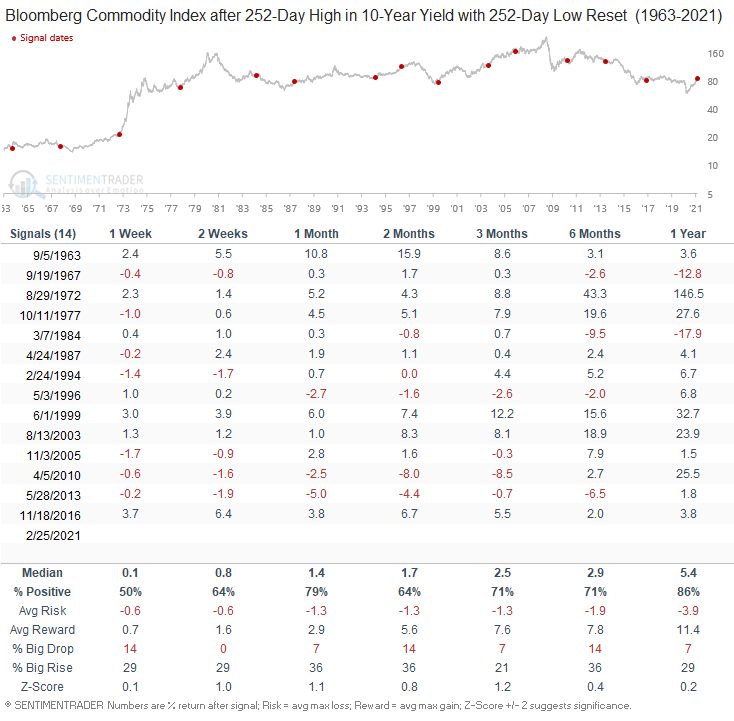

Commodity Performance

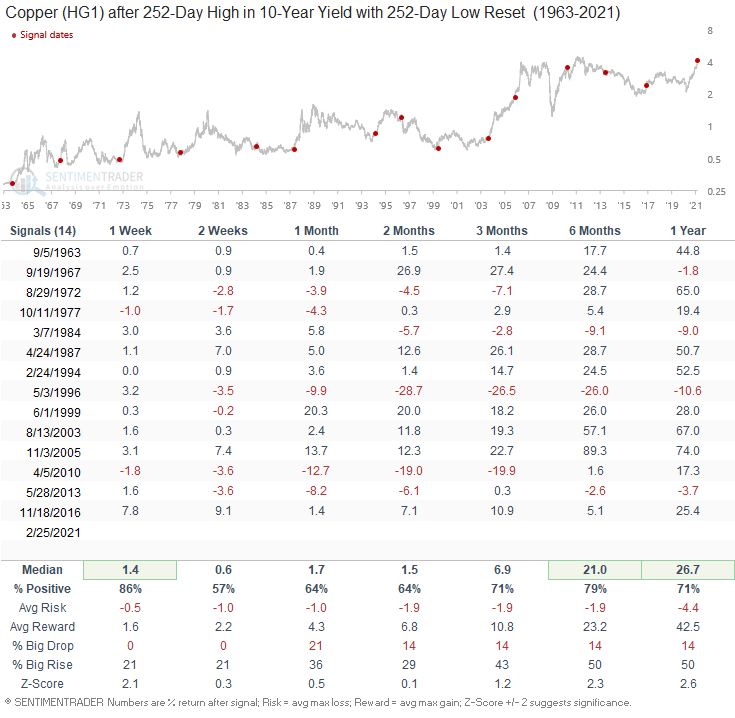

Copper Performance

I highlighted the strength in copper last week, and Jay had a note out this week. Performance looks solid.

Conclusion: With policy rates on hold and the Fed conducting QE, it will be fascinating to see what happens with rates and the yield curve over the next 6-12 months. The implications for asset allocation could be profound.