2 Participation Problems

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Dearth of uptrends

Most of what we've looked at in recent months has suggested higher prices for stocks. There are maybe 1-3 times per year where pretty much everything lines up and points the same direction, but this is not one of those times. Despite the new highs in stocks, there are some niggling issues.

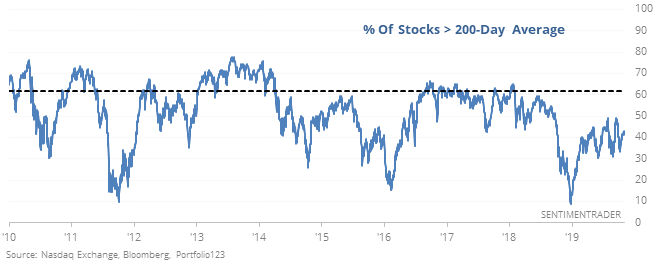

Like too many securities on the Nasdaq still stuck in downtrends.

The Nasdaq Composite has broken its previous record high, yet fewer than half of stocks on that exchange are even above their 200-day moving averages. This is well below the 60%+ that are normally in uptrends when the Nasdaq sets a new high.

Other times since 1999 when the Nasdaq hit a high with less than half of stocks on the exchange in uptrends, it preceded weak returns in both the Nasdaq and the broader market, particularly over the next 1-2 months.

More participation problems

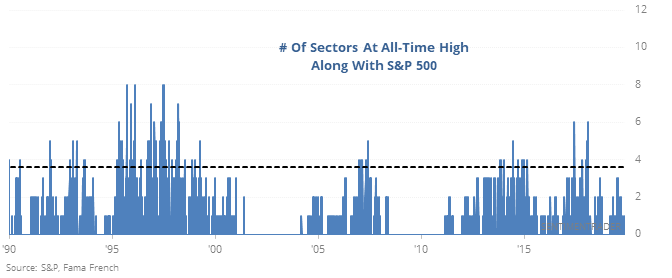

While an increasing number of stocks and sectors are getting close to breaking out to all-time highs along with the S&P 500, relatively few have actually done so. When the S&P broke out to an all-time high earlier last week, and even when it did so again on Friday, only one of its 10 major sectors followed suit. On an average breakout, 3-4 sectors also hit new highs.

In the shorter-term, it led to more losses than further gains. Even up to three months later, the risk/reward was poor.

The 6-12 month returns were generally okay, thanks to the bevy of signals in the early- to mid-90s.