10 Reasons to Believe the Correction May Not Be Over Yet

At this point, many investors are struggling to decide if they should (once again) "buy the dip" or if the investment landscape might finally have changed a bit from the "slow, steady, easy money" mode we have been in over the prior 18 months.

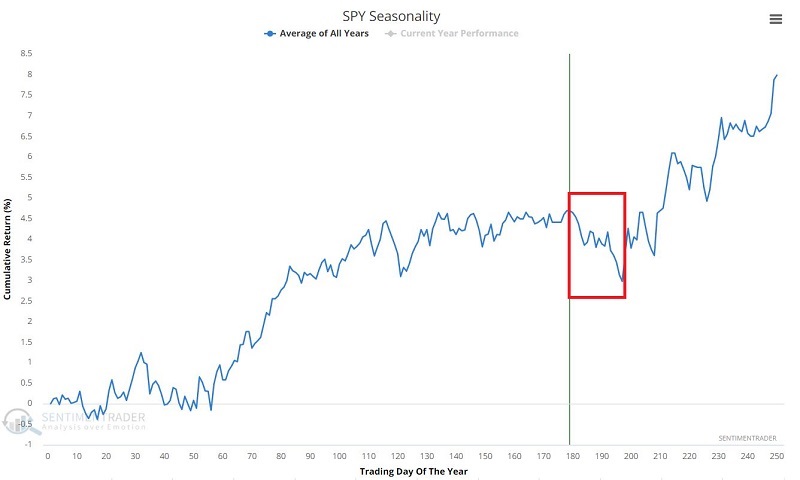

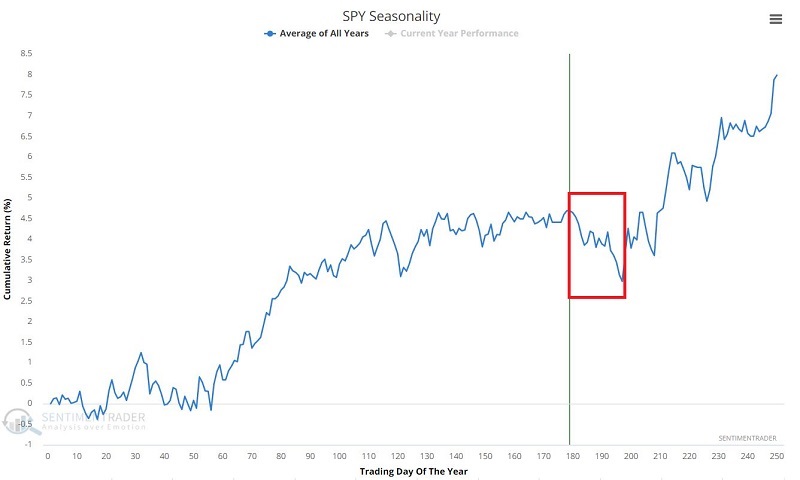

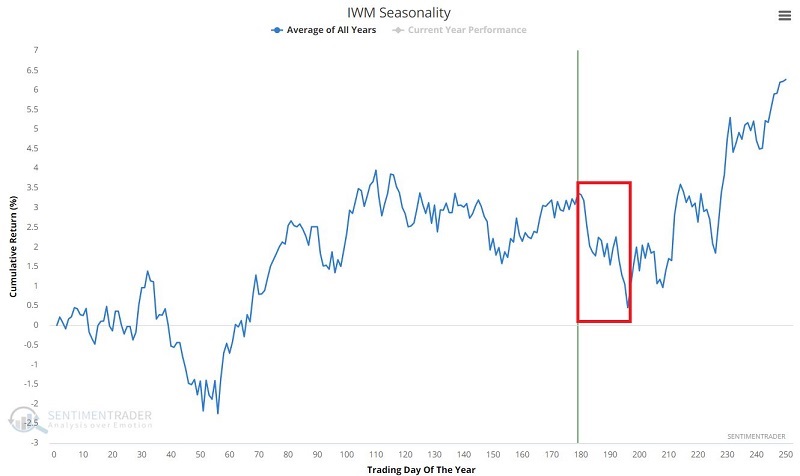

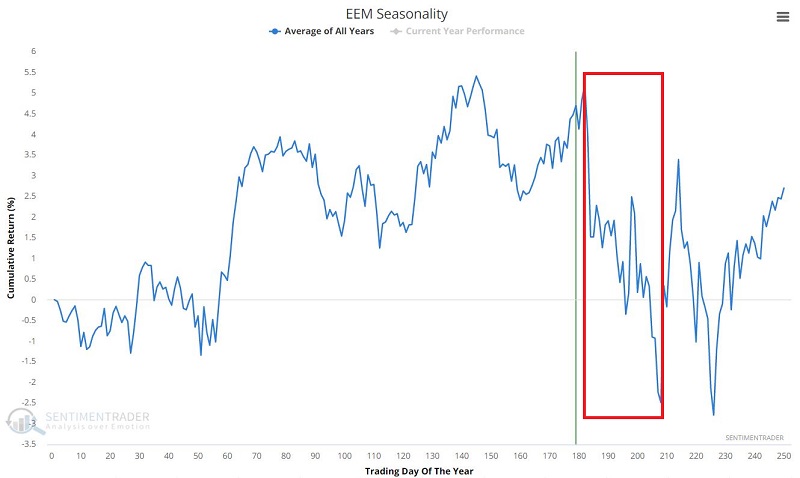

Seasonality is only one factor that influences the stock market. And no matter how reliable a given trend may have been in the past, there is never any guarantee that a given security, index, or sector will do "what it's supposed to do" the next time around. That said, several key stock market indexes and sectors have entered - or will soon enter - a period of significant seasonal weakness.

The charts below will give you a general idea.

LARGE-CAP STOCKS: Ticker SPY (SPDR S&P 500 ETF Trust)

SMALL-CAP STOCKS: Ticker IWM (iShares Russell 2000 ETF)

EMERGING MARKETS: Ticker EEM (iShares MSCI Emerging Markets ETF)

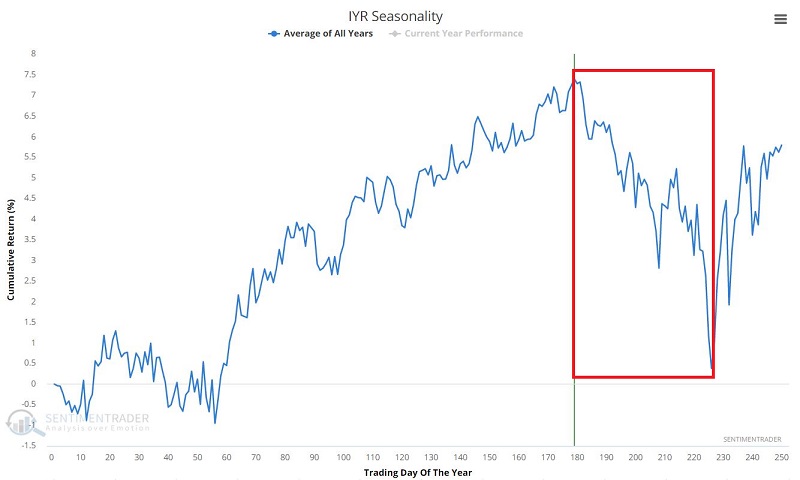

REAL ESTATE SECTOR: Ticker IYR (iShares U.S. Real Estate ETF)

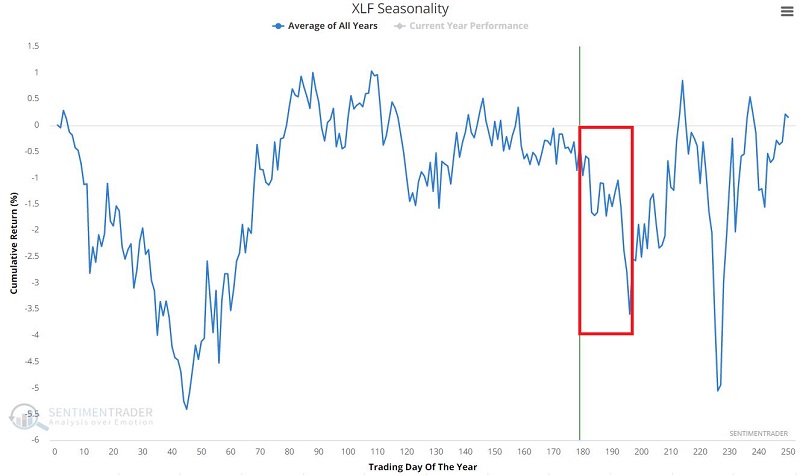

FINANCIAL SECTOR: Ticker XLF (Financial Select Sector SPDR Fund)

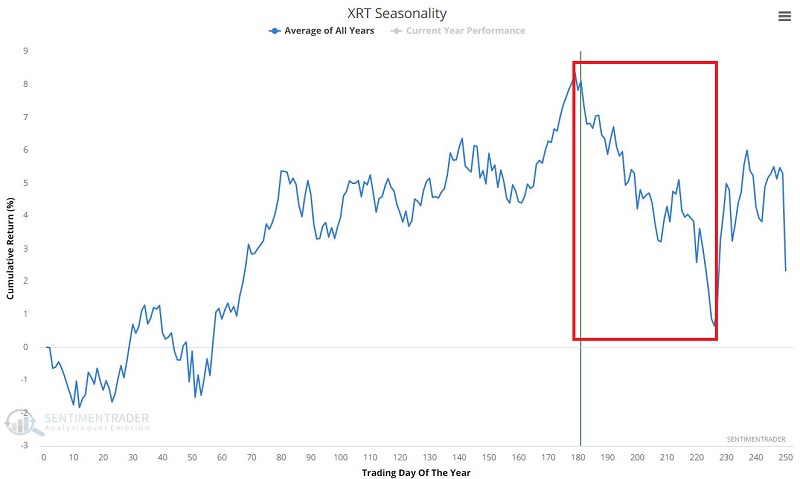

RETAILING SECTOR: Ticker XRT (SPDR S&P Retail ETF)

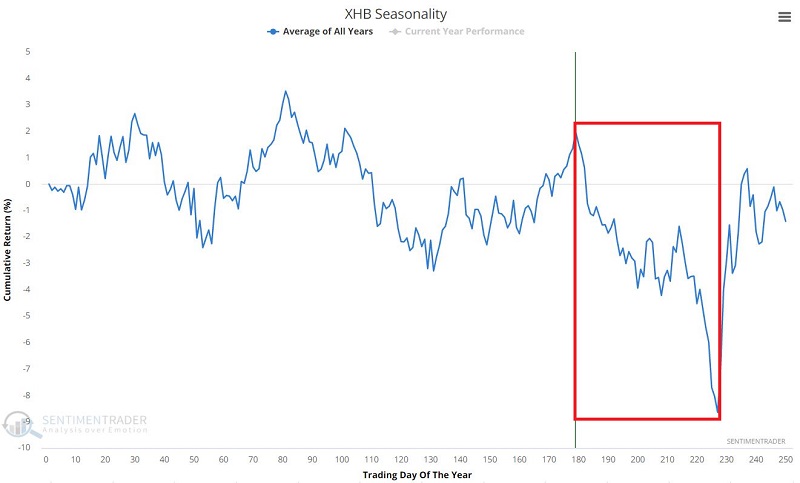

HOMEBUILDING SECTOR: Ticker XHB (SPDR S&P Homebuilders ETF)

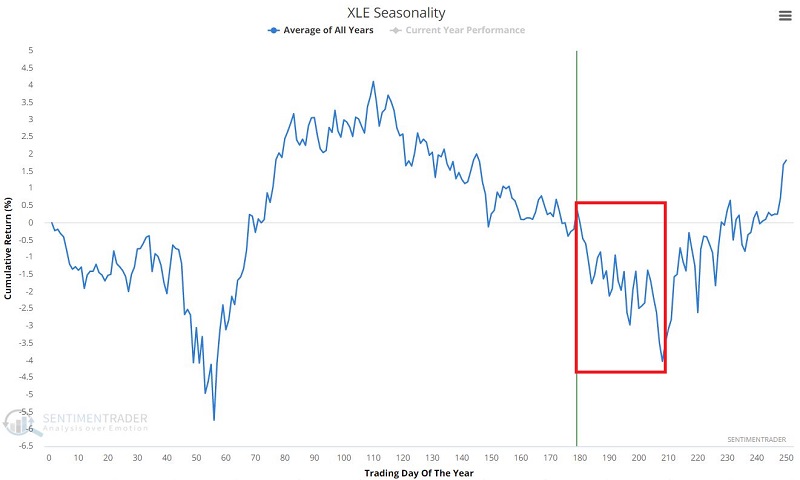

ENERGY SECTOR: Ticker XLE (Energy Select Sector SPDR Fund)

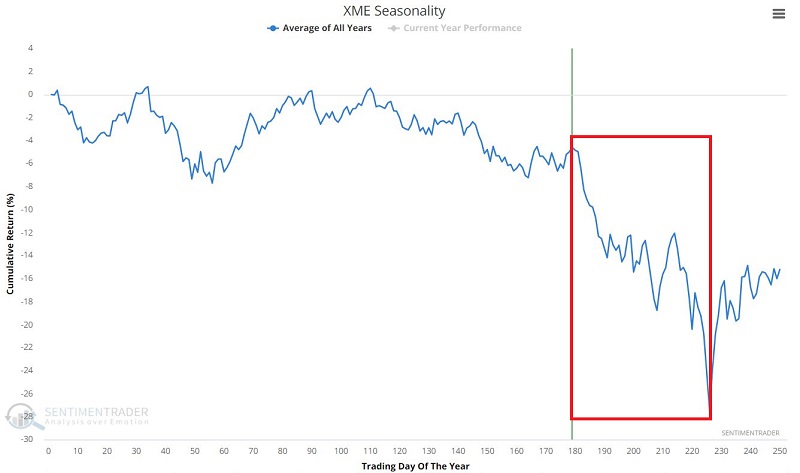

METALS AND MINING SECTOR: Ticker XME (SPDR S&P Metals and Mining ETF)

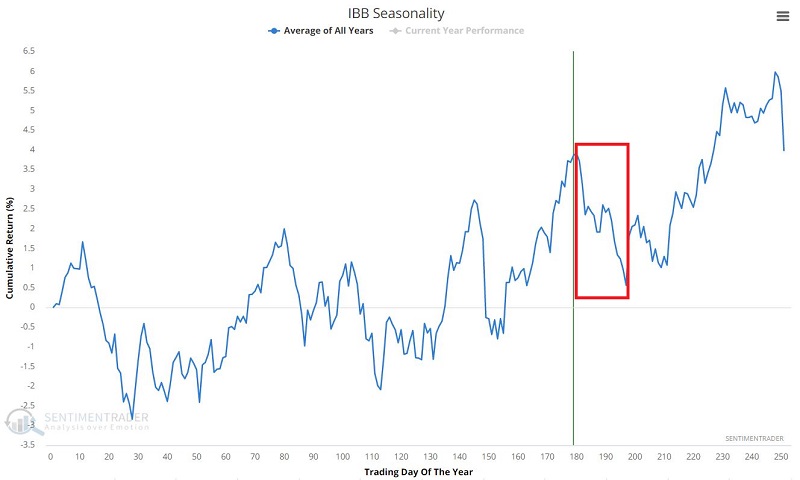

BIOTECH SECTOR: Ticker IBB (iShares Biotechnology ETF)

SUMMARY

So do the charts above imply that the market is "doomed" to trade lower? Not at all. Year-to-year performance can be pretty random. Nevertheless, after ten consecutive months with higher closes by the major market indexes, a period of typical seasonal weakness may be as good a time as any to expect some consolidation at the very least.