Small caps recovery

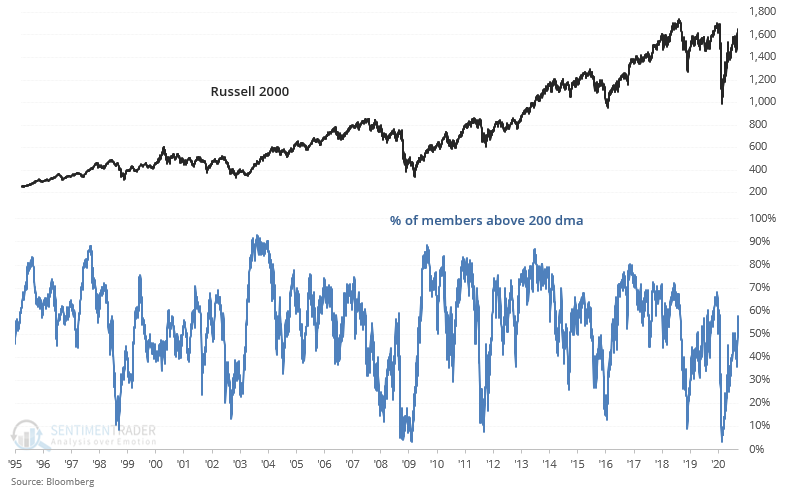

One of the biggest concerns over the past few months has been the lack of broad participation in small caps. That is starting to change as the Russell 2000 approaches its all-time high.

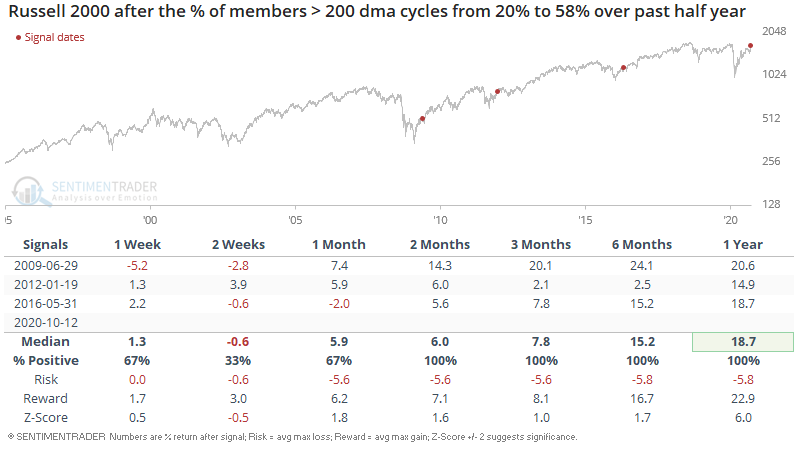

When the % of Russell 2000 members in a long term uptrend cycles from less than 20% (typically in a stock market crash) to >58% over the past 6 months, the Russell 2000 usually pushed higher over the next year:

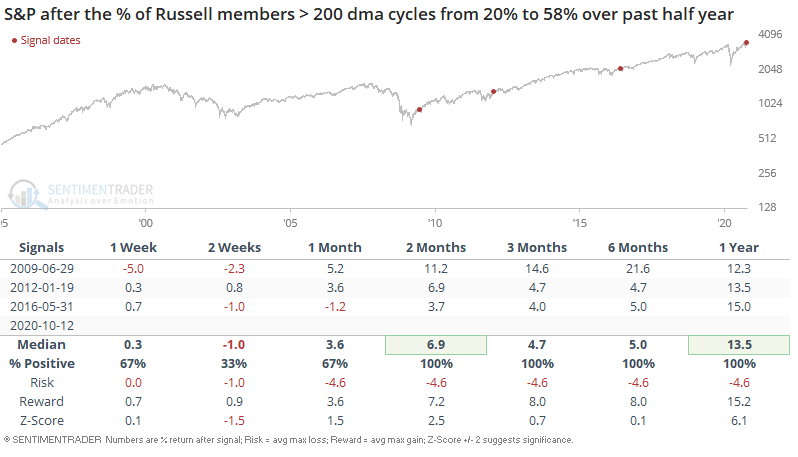

Since these 3 historical cases all occurred post-GFC, the S&P 500 pushed higher over the next year as well:

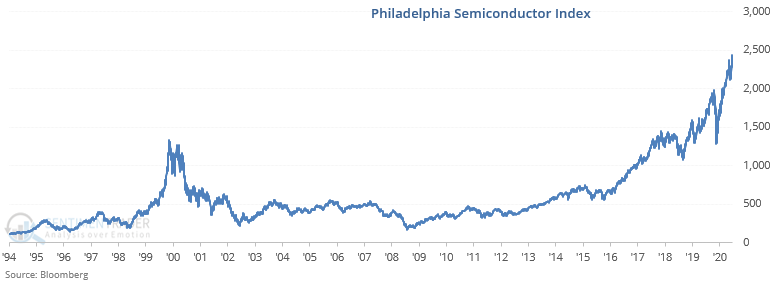

Tech stocks continue to surge. The Philadelphia Semiconductor Index is making new all-time highs and rallied more than 1% for 4 days in a row:

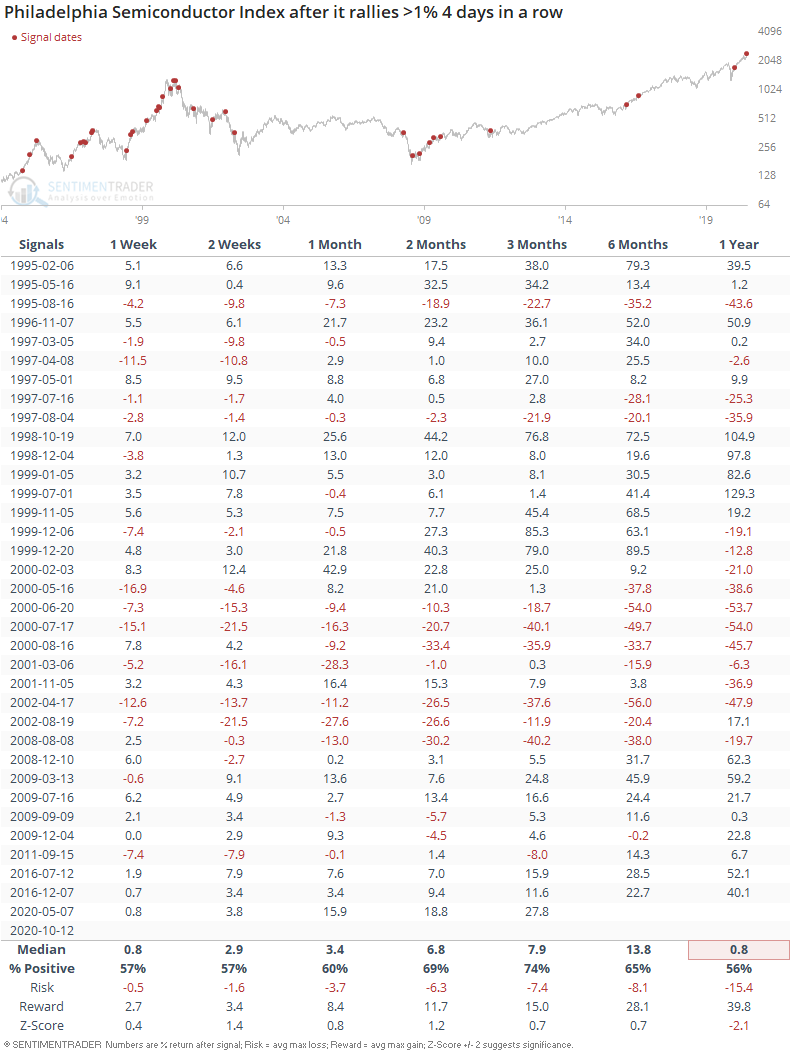

When this happened in the past, the Semiconductor Index's returns over the next year were more bearish than random. This is primarily due to the abundance of historical cases in 1999 and 2000:

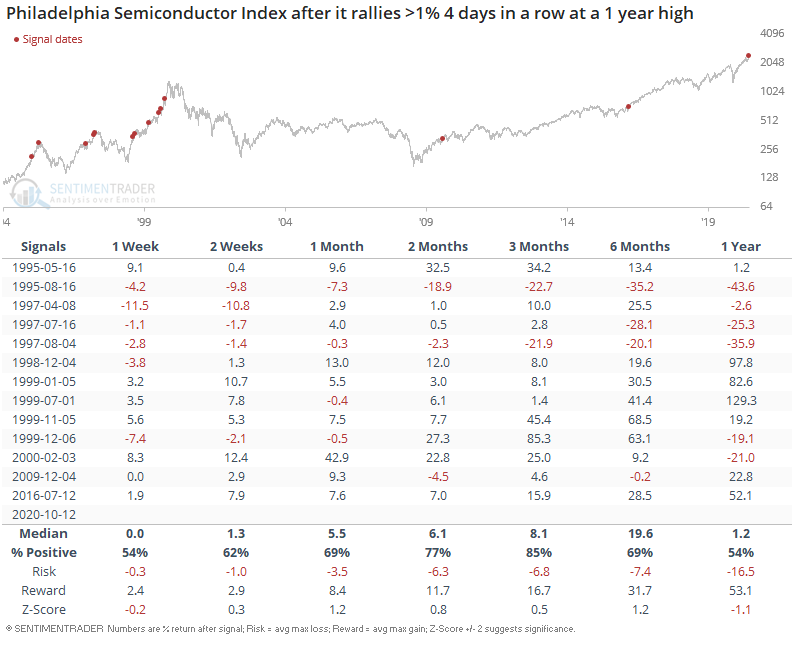

If we isolate for historical cases that occurred at a 1 year high, the S&P's forward returns over the next year were still more bearish than random:

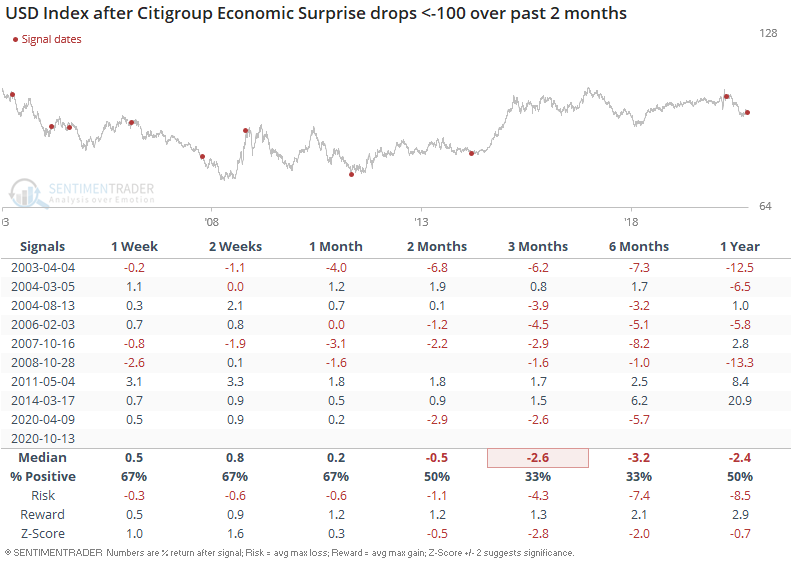

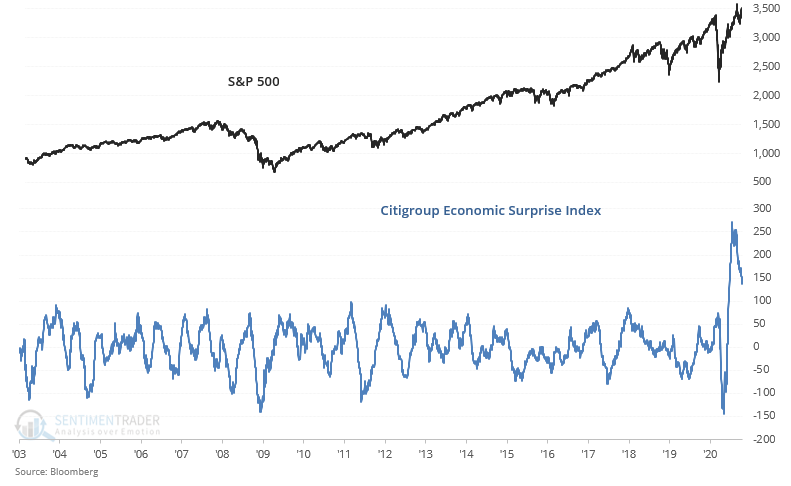

And lastly, the Citigroup Economic Surprise Index is retreating after the biggest spike in this data series' history.

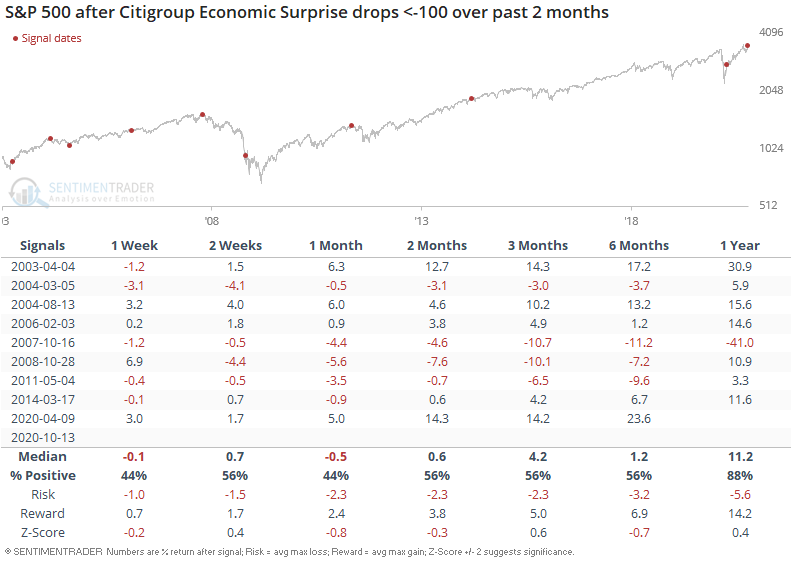

When the Citigroup Economic Surprise Index dropped rapidly in the past, the S&P's returns over the next month were slightly more bearish than random:

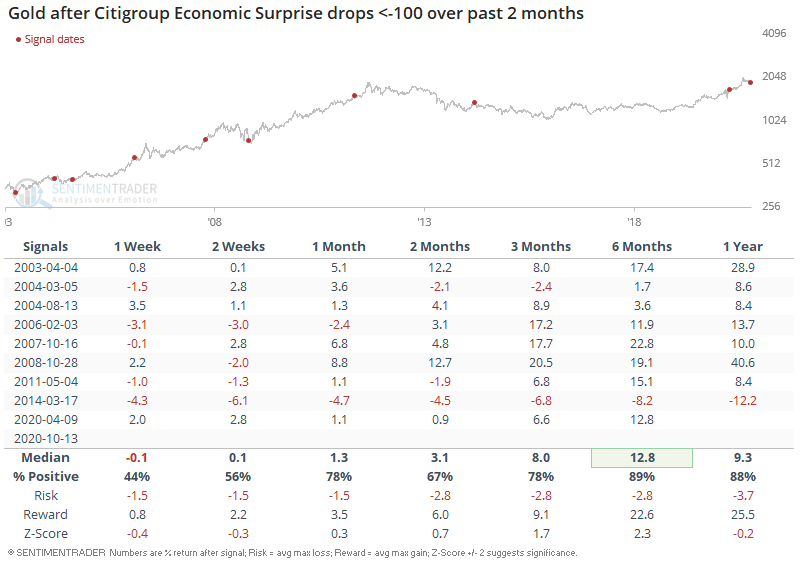

Gold's returns over the next 6 months were consistently bullish:

And the USD Index usually retreated over the next 3-6 months: