A New All-Time Closing High for The S&P 500 - How Does it Compare to History with Regards to Market Breadth?

The S&P 500 Index closed at a new all-time high on 8/18/2020 following the Pandemic crash. The Index has subsequently recorded 20 new all-time highs, with the most recent occurring on 1/7/21. In today's note, I want to assess how current market breadth conditions compare to other historical readings since 1928 when the S&P 500 Index records a new all-time high.

Breadth Composite

Market breadth, otherwise known as internal participation, can be measured in several different ways across various time series and indicators. Participation-based indicators provide a look beneath the surface of an Index to quantify the underlying strength or weakness. For today's study, I plan to use a large-cap breadth composite that contains six measures with durations ranging anywhere from 10 to 252 days.

The composite includes the following:

- Percentage of issues above the 10-day moving average

- Percentage of issues above the 50-day moving average

- Percentage of issues above the 200-day moving average

- Percentage Spread Between 21-Day Highs and Lows

- Percentage Spread Between 63-Day Highs and Lows

- Percentage Spread Between 252-Day Highs and Lows

The individual component values are summed and divided by six to arrive at a single composite value. Please note, composite values can turn negative during corrections and bear markets as new lows overwhelm new highs in the spread calculation.

Breadth Composite Study

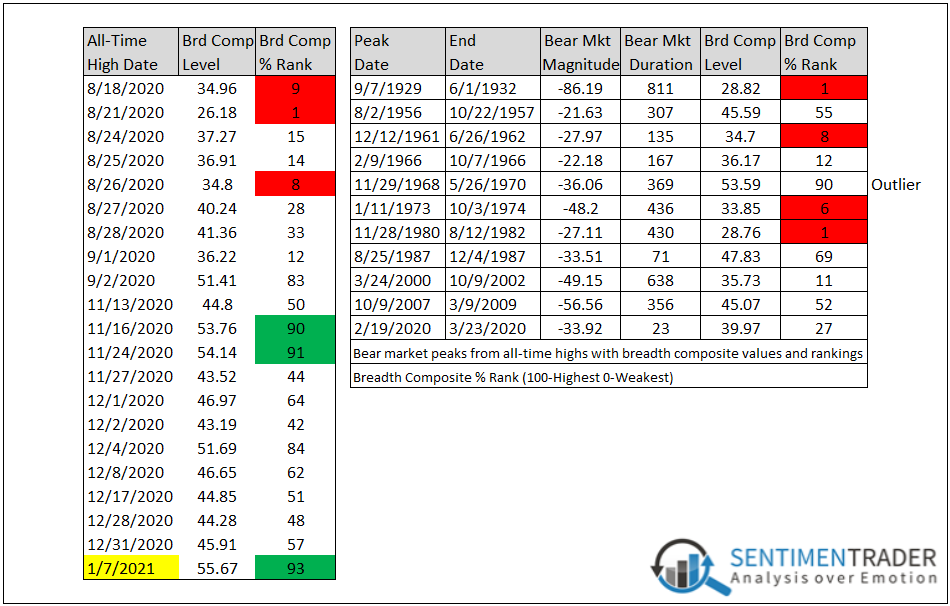

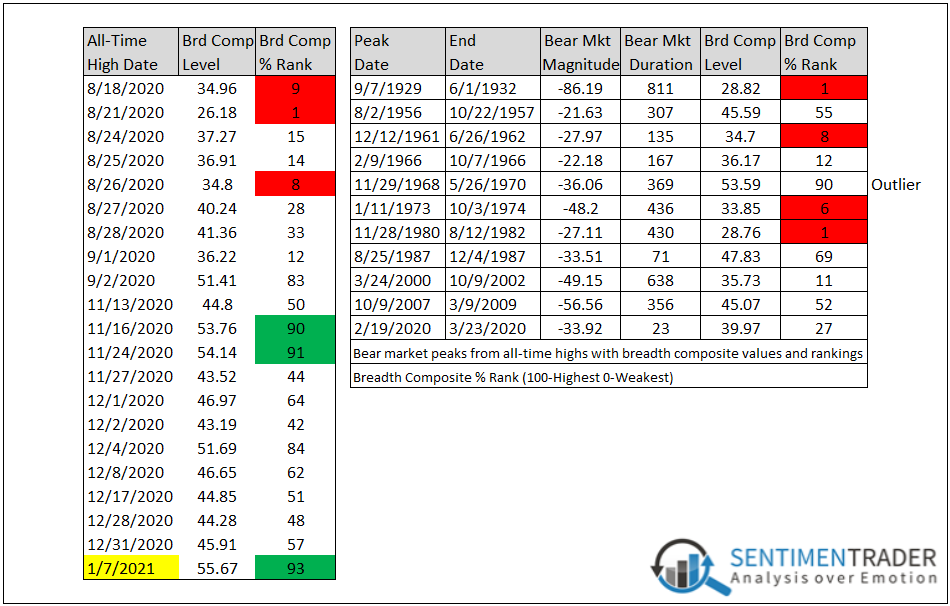

I first identified every single all-time closing high in the S&P 500 Index since 1928. According to my calculation, there are 1,276 instances. I then ranked each breadth composite value on the day of the all-time closing high. Rankings range from 100 (strongest) to 0 (weakest). By ranking each all-time high, I can now make an apples-to-apple comparison throughout history.

Composite Breadth Comparison

The first table below shows the initial all-time highs starting in August exhibited weak breadth rankings compared to other instances since 1928. After a multi-month consolidation in the market, the S&P 500 surged in early November, and the rankings spiked into the 90th percentile. Following some softening in December, breadth strengthened again with a level back in the 90th percentile on the 1/7/21 close.

Conclusion: Breadth remains firm and nowhere near the levels associated with bear market peaks, as exhibited in the second table.

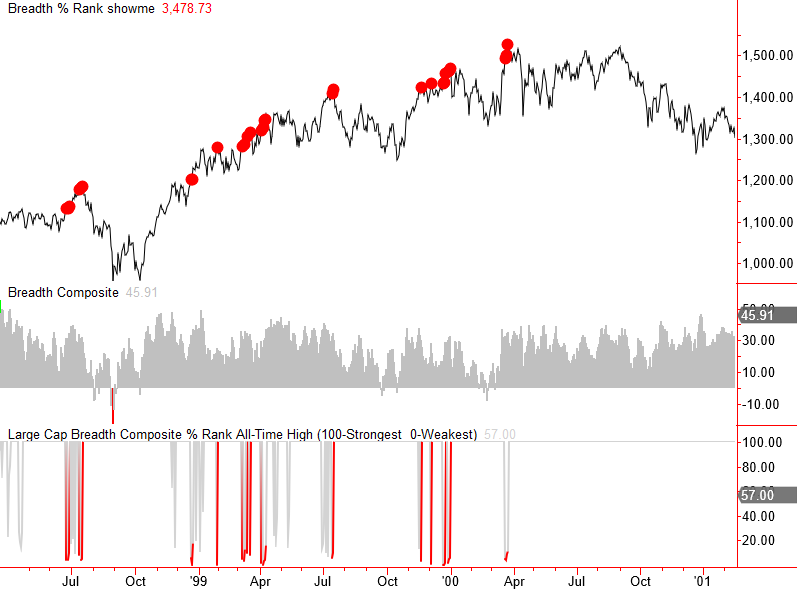

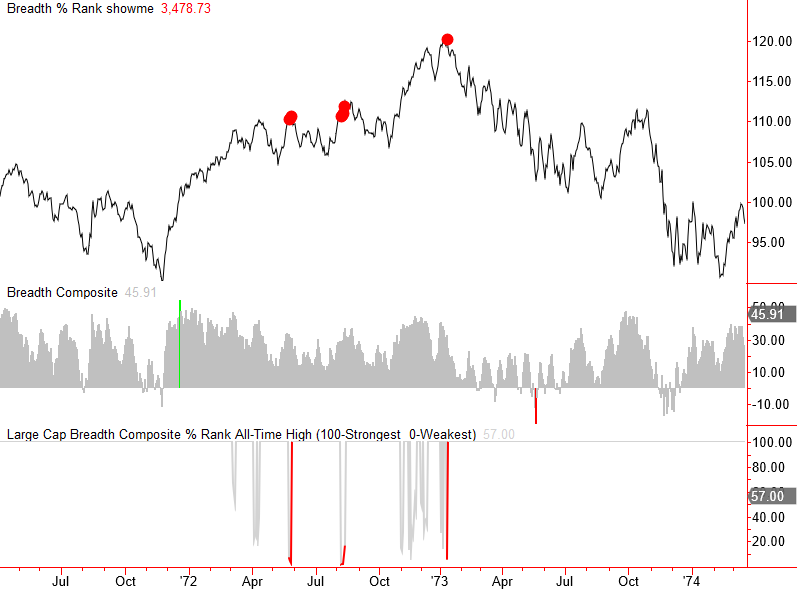

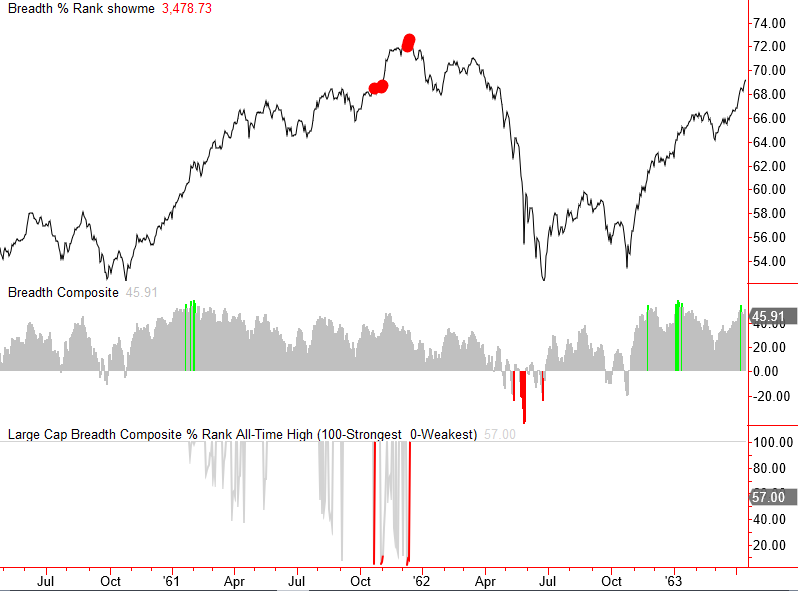

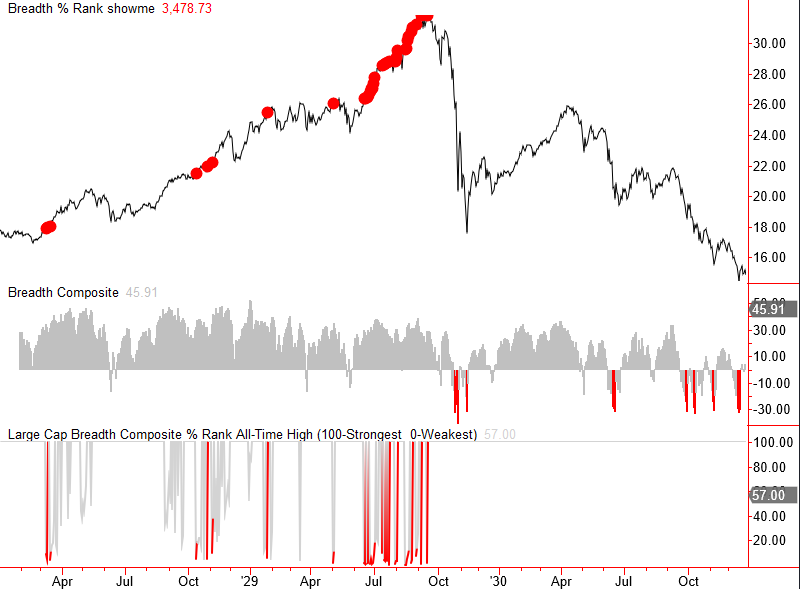

Sample Charts

The charts in the study contain the following three indicators:

- The breadth composite value

- The relative % rank for breadth composite values at all-time highs

- A red dot to indicate a rank of 10% or less (weak breadth at a high)