The chances for an imminent correction just cratered

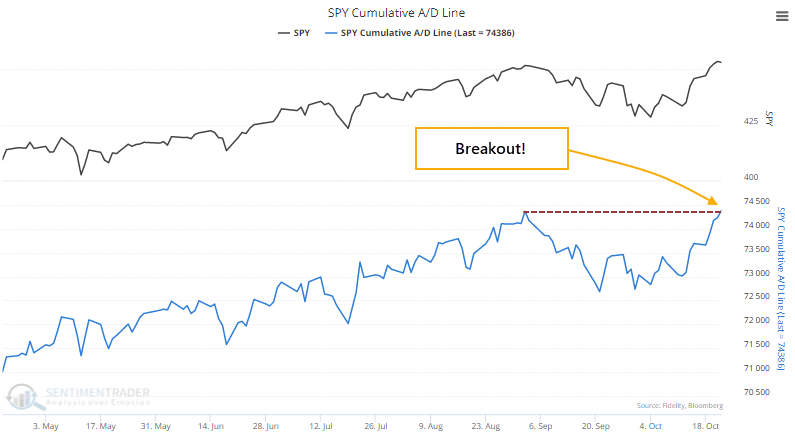

The most benchmarked index in the world is trying to hold a breakout to record highs. Supporting its case is the fact that most of its stocks have been rising, and breadth within the index confirms its good performance.

Even though the S&P 500 settled back a bit on Friday, most of the stocks in the index gained ground. That was enough to push the S&P's Cumulative Advance/Decline Line to a new high, the first in more than 30 sessions.

Among other major indexes, the Nasdaq 100 has also seen a breakout in its Advance/Decline Line but other indexes have not.

Many times over the past couple of decades, we've discussed the idea that stocks are less likely to suffer a large drawdown in the following months when the advance/decline line breaks out to a new high.

Since 1928, the S&P 500 was three times more likely to suffer a 10% decline at some point within the next three months if the S&P's Advance/Decline Line was not at a multi-year high. When it did break out to a new high, there was only a 4.6% probability of a 10% or greater decline within the next few months.

What else we're looking at

- More details on the Advance/Decline Lines for other indexes

- Probabilities of various sized declines after the S&P's A/D Line makes a new high

- The S&P just triggered an ATR reversal signal

- Why the Consumer Staples sector looks interesting right now

| Stat box The VNQ real estate ETF has averaged an inflow of more than $100 million per day over the past week, the 15th time it has crossed that threshold in the past decade. |

Etcetera

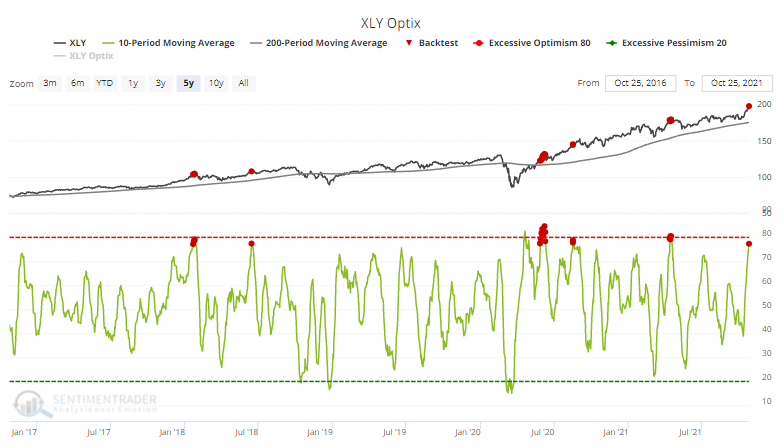

Discretionary spending. Investors are paying up for Consumer Discretionary stocks, and the 10-day Optimism Index has climbed above 77%. That ranks among the top 50 days since the fund's inception when the XLY fund was in a defined uptrend.

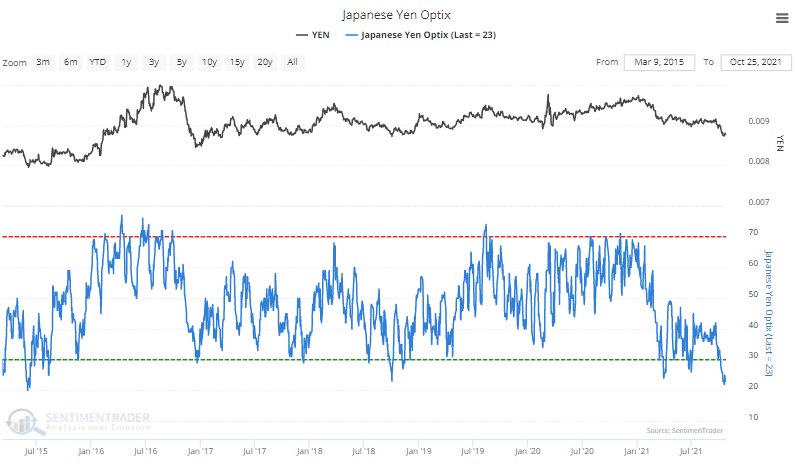

Nippon nipped. The Japanese yen has been mired in a downtrend and pessimism is rampant. The Optimism Index on the yen, near 20%, is the lowest since 2015.

No fear. Options traders have basically given up on betting on a quick, severe decline in stocks. That lack of concern has caused the implied volatility of shorter-term options to be significantly less than longer-term ones.