Best June In Decades Is Hated By Wall Street

A good month

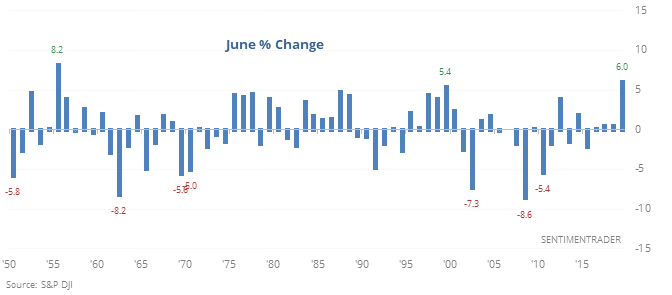

The S&P 500 enjoyed its best June gain since 1955, with 1999 being the only other year with more than a 5% gain. It also managed to hit a multi-year high during the month.

Since 1928, this has had a strong tendency to lead to a good start to July, but not so much after that. For the Nasdaq Composite, it was the 3rd best June in its nearly 50-year history. Like the S&P, big gains tended to bleed into the beginning of July, then got more difficult.

Earnings worries

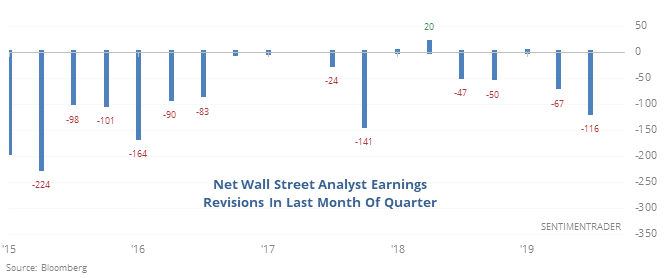

Wall Street analysts don’t seem to be very optimistic about stocks’ ability to positively surprise investors when they start reporting next month. They’ve lowered earnings estimates on more than a net 100 stocks in the S&P 500 this month, the most since September 2017.

Their pessimism has usually not panned out. Granted, there was a bull market during most of this time, but even so, the S&P’s returns were well above random.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers have quickly reversed in a couple of contracts. In the major equity indexes, they’ve gone from a $20 billion net long position to $40 billion net short this week. Other times they went from +$20 to -$40 were Sep 18, 2012, and Jul 19, 2016, which led to a poor risk/reward over the next 2-3 months.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.