4 Reasons Why A Volatility Event Is On The Horizon

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Volatility event

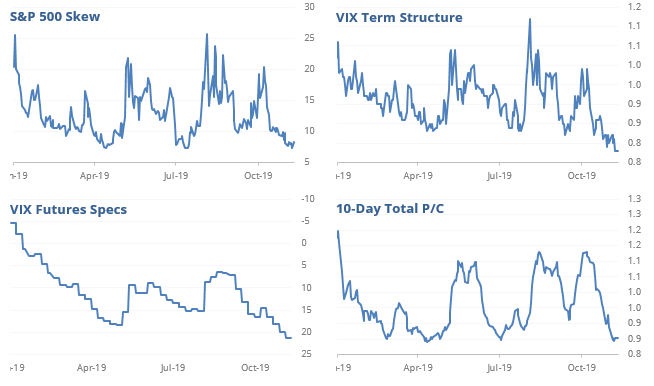

Several indicators influenced by the options market are throwing off concerning readings, showing that traders have become complacent about the current trend.

We’re currently seeing weeks of low put/call readings, with low premiums being paid for put protection, very low expectations for an imminent volatility event, and heavy betting against a rise in volatility by speculators.

If we combine the four factors above by looking at where each of them is compared to their range over the past year, then they’re all in the bottom 3% of their ranges. Since 2007, no other time has seen all four of them so compressed at the same time. There have been a handful of days that saw a low average reading, though, even if they weren’t all extreme at the same time.

While that hasn’t led to a consistent drop in stocks, it has almost always preceded a big jump in the VIX within the next two months. Over the next two months, the VIX rose every time but once – and that was the time it spiked more than 50% immediately after this signal in 2016, then settled back in the months afterward.

Yardeni's Fundamental Stock Market Indicator

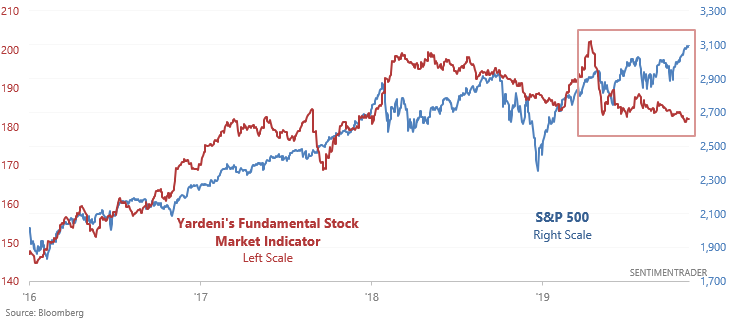

There is a yawning divergence between stocks and fundamentals. And it's getting worse.

The divergence is between the S&P 500 and Yardeni's Fundamental Stock Market Indicator. This indicator looks at Consumer Comfort, commodities, and initial claims.

This indicator tends to decline during recessions. However, it wasn't quite a leading indicator: declines tended to occur along with stock market declines.

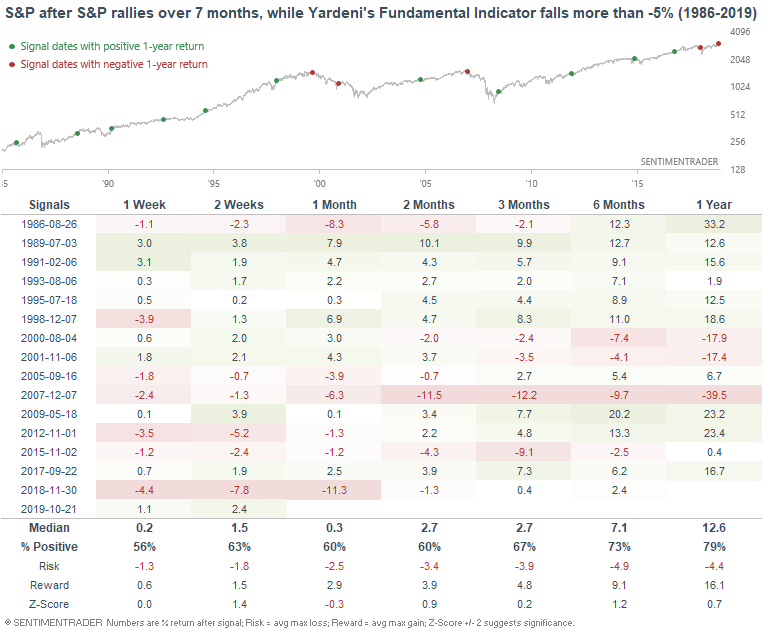

With that being said, are these divergences bearish? The following table looks at cases in which the S&P went up over the past 7 months, while Yardeni's Fundamental Indicator fell more than -5%.

Overall, this is not consistently bearish for the S&P. The Fundamental Indicator tends to fall along with the S&P 500. Its decline does not usually precede declines in the S&P 500.