Yield Curve Favors Defense As ETF Investors Flee Developed Markets

This is an abridged version of our Daily Report.

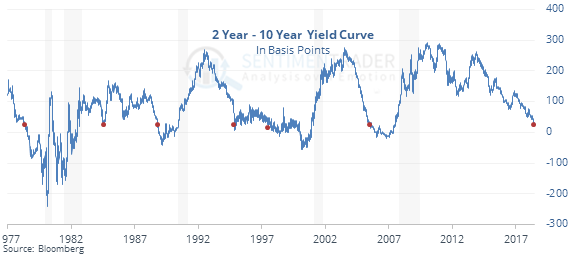

Curve favors the defense

A narrow yield curve has led to good returns in defensive sectors. By the time the spread between 2-year and 10-year Treasury yields got as low as it was in July, future returns in the dollar were muted to negative, leading to positive crude oil most of the time.

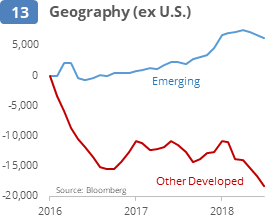

Investors leave commodities for tech

ETF flows in July show a preference for U.S. assets, especially bonds and tech stocks. Developed markets and metals have been shunned to a large degree, adding to months of outflows.

Nobody’s happy

On a day the FOMC updated its interest rate policy, stocks, bonds, and gold all declined. SPY, TLT, and GLD were all down at least 0.1%. That has happened 9 other times on a day the FOMC announced its intentions, leading to a rebound in SPY over the next four days only 3 times.

Utility surge

Among major sectors, Utilities are showing the best breadth. More than 90% of the stocks are trading above their 10-, 50-, and 200-day averages, the most of any sector, even though XLU is still more than 5% below its 52-week high.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |