With stocks surging, investors give up on hedges

With stocks on a persistent rip higher, what's the point in hedging? Investors seem to be asking themselves that more and more.

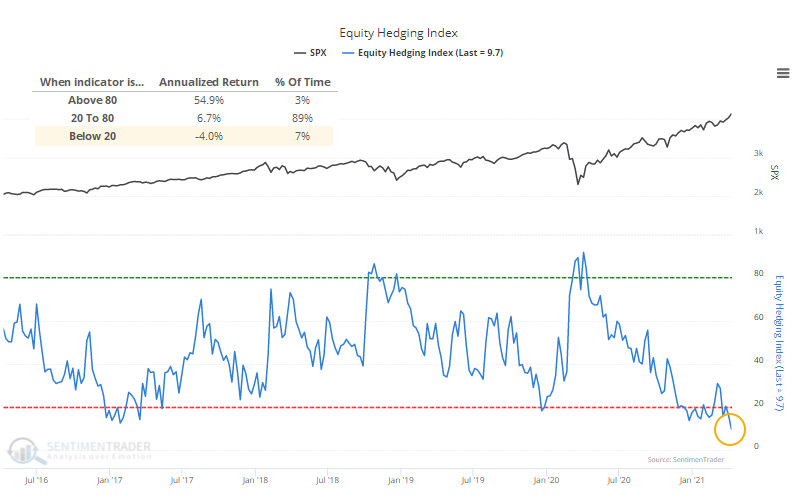

Last week, the Equity Hedging Index (EHI) dropped below 10 for one of the few times since we began calculating this nearly 20 years ago.

There are many ways in which an investor can hedge against a stock market decline, such as:

- Raise cash

- Buy put options

- Buy an inverse exchange-traded fund

- Buy an inverse mutual fund

- Sell short a futures contract

- Buy credit default swaps

The Equity Hedging Index looks at each of the factors above and compares the current level to its historical average. The more each indicator shows hedging activity, the higher the Equity Hedging Index will be.

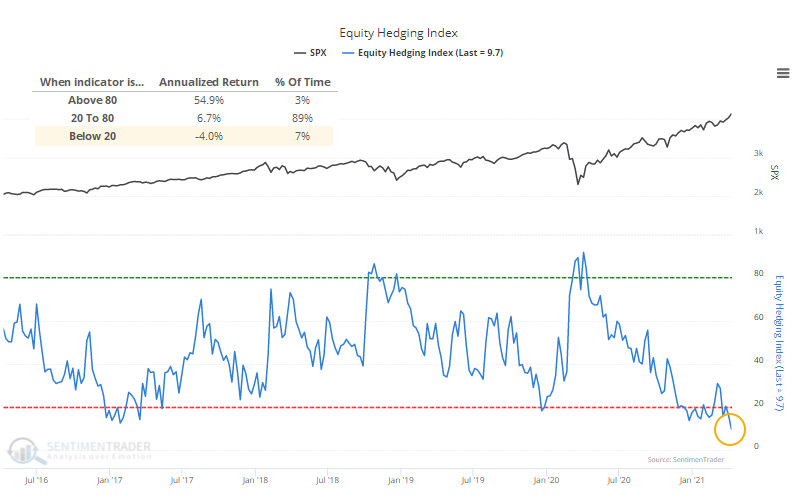

This is a contrary indicator, meaning that the higher the Equity Hedging Index is, the more likely stocks will rally going forward; the lower the Equity Hedging Index, the less likely stocks will rally, which we can see from the annualized returns in the chart below.

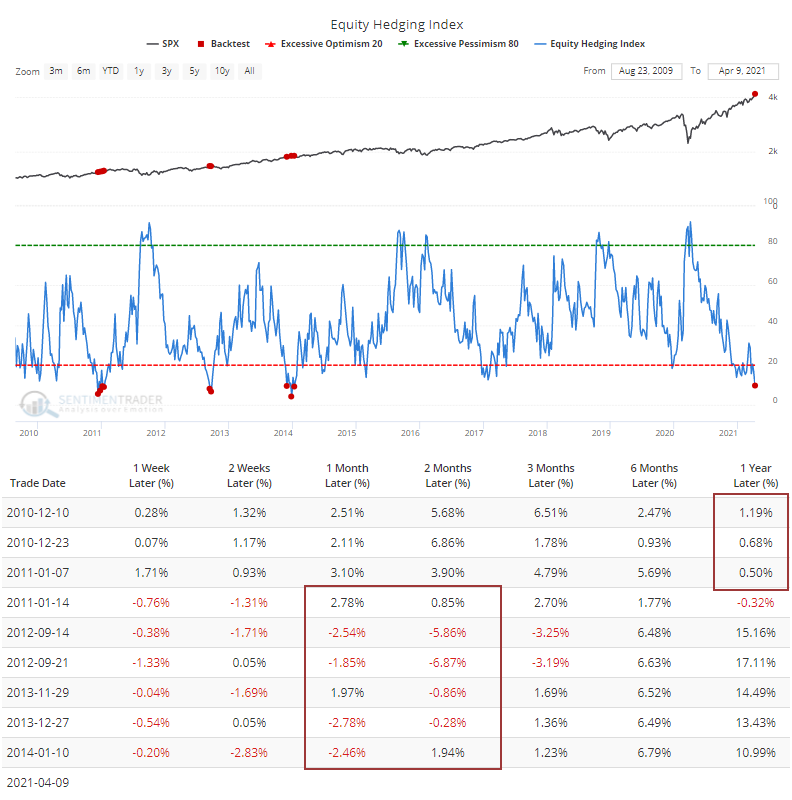

In that entire history, there have been only 9 other weeks with an EHI as low as this according to the Backtest Engine. All of them preceded weak medium- to long-term returns.

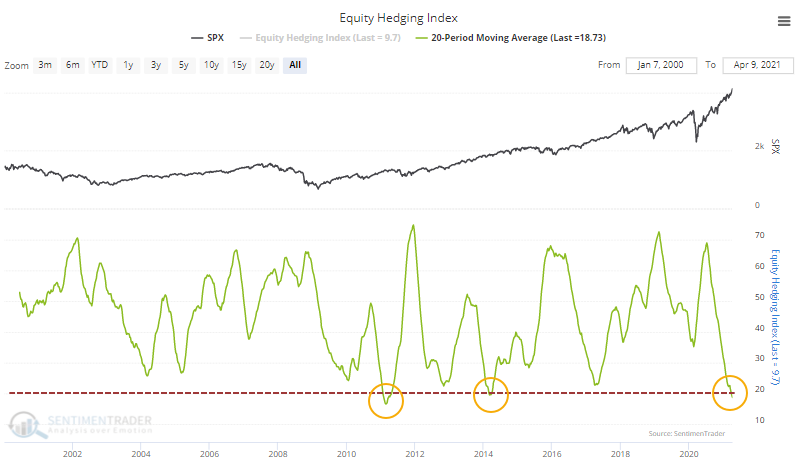

This comes after months of only sporadic bouts of interest in any kind of hedging activity. Which has been a good thing for investors, since hedges have only served to be a drag on returns. The 20-week average of the EHI has dropped below 20 for only the 3rd time ever.

Dean showed late last week that individual stocks are showing impressive resilience, with more than 90% of S&P 500 components holding above their 50-day moving averages, a fairly unique situation with the S&P itself moving to a 52-week high. That didn't prevent some double-digit declines following other signals, but that certainly wasn't the base case.

Last week, we saw the highly unusual - perhaps unprecedented - situation of massively positive medium- to long-term breadth thrusts not just among individual stocks, but also industries, sectors, and global indexes. This is happening despite many warnings from extended sentiment readings like the Equity Hedging Index. We've never really seen such a large and protracted tension like this, with the suggestion continuing to be that it's risky for late buyers, and also risky to bet against the momentum.