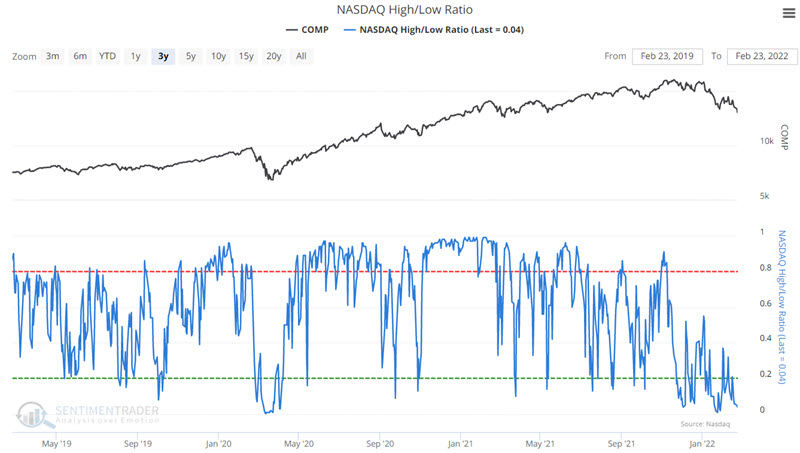

Why the Nasdaq looks washed out

Nasdaq high/low ratio has been washed out

New highs are the number of NASDAQ issues that reached a new 52-week high today. New lows are the number of NASDAQ issues that reached a new 52-week low today. Jay looked at an indicator that is a breadth ratio constructed from these two values and is expressed as the number of issues that closed at a new high as a percentage of the total number of stocks making new highs or new lows.

The chart below displays the daily readings for the last three years.

He then went on to construct a trading strategy using the recent extreme in this measure, and what kind of drawdown could be expected relative to prospective gains in the months ahead.

| Stat box Thursday marked only the 3rd time in the 40-year history of S&P 500 futures that there was a gap down open of more than 2%, falling to a 6-month low, then a reversal to close up by more than 1%. The others were July 24, 2002, and September 16, 2008. |

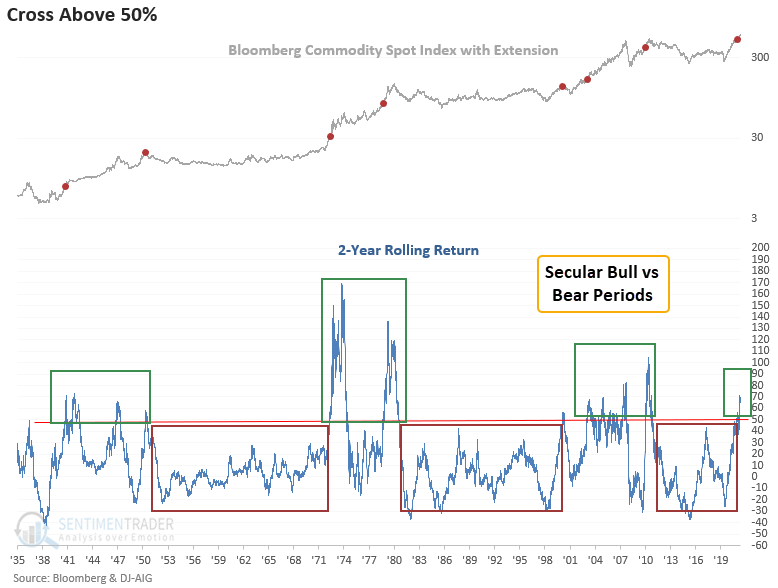

Commodities continue to roll

Dean looked at the continued surge in commodities, using an absolute performance of a broad index, breadth within the commodity space, and returns relative to equities.

In a note published last October, Dean assessed the outlook for commodities when the 2-year rolling return for the Bloomberg Commodity Spot Index exceeds 50% for the first time. The 2-year rolling return continues to climb, which suggests the secular case for commodities remains constructive.

With the Bloomberg commodity spot index up 12% since the signal date, the odds of a 1951 or 2000 peak look less likely.