Why the junk bond market is sending a historic signal

High-yield bonds suffer historic selling pressure

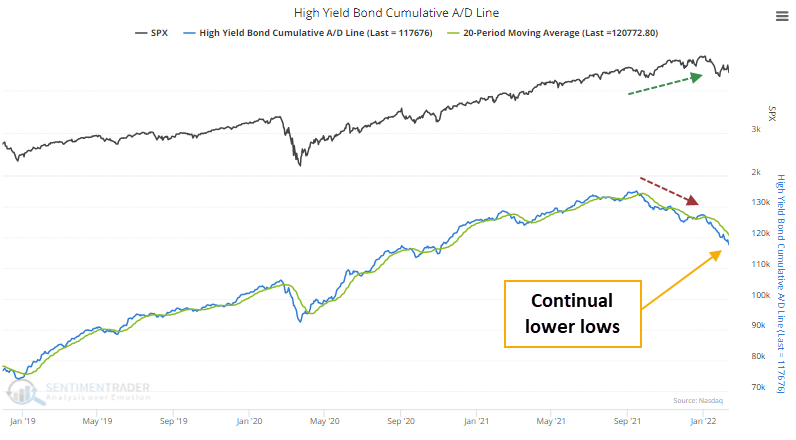

Starting in November, we looked at suspect performance in high-yield bonds as a worrying sign. The Cumulative Advance/Decline Line was diverging as more and more bonds were declining even as stocks hit new highs.

Bonds were trying to recover from mild oversold conditions, but there were concerns about its sustainability. It's gotten worse since then.

High-yield bonds made a comeback at the end of the year, but soon after, more bonds were falling to 52-week lows than rising to 52-week highs, a clear sign of risk-off behavior among some of the most sensitive and forward-looking investors.

About the only bright spot is that selling pressure has been so focused over the past month that we're nearing some historic extremes. A broad cross-section of indicators is showing broad selling pressure and widespread pessimism.

| Stat box Social media users have posted 4 times more bearish messages than bullish ones on the Dow Industrials ETF (DIA). There have been 18 other days when our Social Sentiment was above 4 on DIA, all of which happened to lead to positive returns over the next month. |

Optimism is returning in Disney

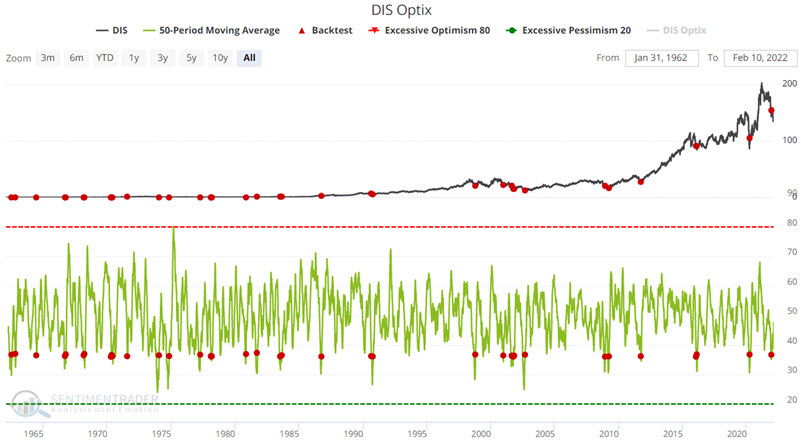

Investor sentiment regarding Disney recently bottomed out and reversed higher. Jay noted that this action tends to resolve itself with Disney stock moving higher over the next six months.

The chart below displays each occasion since 1962 when the 50-day moving average for DIS Optix crossed above 36. You can run this test in the Backtest Engine.

So, let's test out a strategy that waits two weeks after each signal before getting into Disney stock and then holds that position until six months after the signal. To emulate this approach, we will use the following rules:

- Each time DIS 50-day Optix crosses above 36, we will wait ten trading days and then buy and hold for approximately 6 months.

- If a new signal occurs while a previous signal is still active, the holding period is extended for another six months.

These rules resulted in 19 winning trades out of 22 instances.