Why Beans Should Bounce

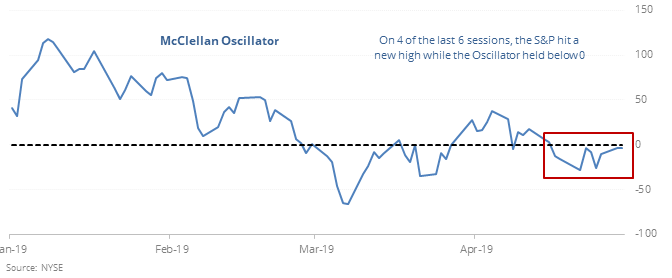

No oomph in Oscillator

The McClellan Oscillator hasn’t been able to get above zero even as the S&P 500 and other indexes tick to new highs on multiple days.

Over the past 57 years, this has been a negative sign of underlying weakness for stocks, though the sample is small, and the most recent signal was a failure.

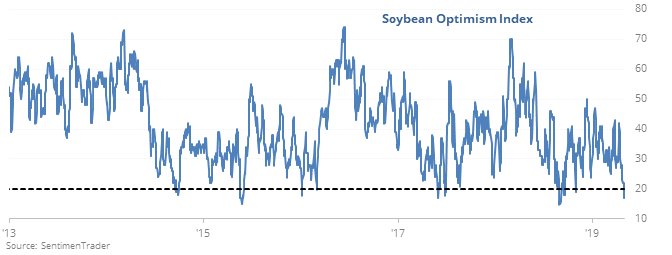

A single grain of optimism

Grains have been sold relentlessly lately, and it’s being reflect in sentiment. In soybeans, the Optimism Index has dropped below 18 for one of the few times in 28 years.

Every time optimism has been this low, beans have rebounded over the next two months. Even when sentiment was a bit less extreme, it still had a strong record.

Nearing a record

Dumb Money Confidence moved up to 85% on Tuesday, nearing the record of 88%. According to the Backtest Engine, there have been 19 days with a reading as high as it is now, with only 6 of them leading to a gain in the S&P 500 over the next two weeks. Some higher-risk indexes like the Russell 2000 and emerging markets often fared worse. You can test them by changing the Index in the first box of the Backtest Engine.

Rolling over

The McClellan Summation Index for the Hang Seng and Shanghai Composite have dropped below +500 after recently hitting +1,000. Both indexes have struggled to hold any gains over the next 1-3 months after similar conditions in the past 17 years.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.