Where inflation is and what it means

From Jay...

The word on everyone's lips these days is "inflation" (cue the scary music!). The conventional wisdom is pretty straightforward:

- The Fed is printing money in unprecedented fashion

- Therefore, inflation is destined to soar

- All kinds of bad things will follow

- Hence all the hype regarding inflation

Did I miss anything? I don't think so. In fact, I think that sums up the current state of affairs pretty succinctly. The bottom line is that "Everybody Knows" that inflation - possibly of the significant kind - is just around the corner. Of course, there are at a minimum two potential problems here:

- Conventional wisdom doesn't always turn out to be correct (who knew?)

- Beyond all the fear and loathing what does a rise in inflation really mean for the markets?

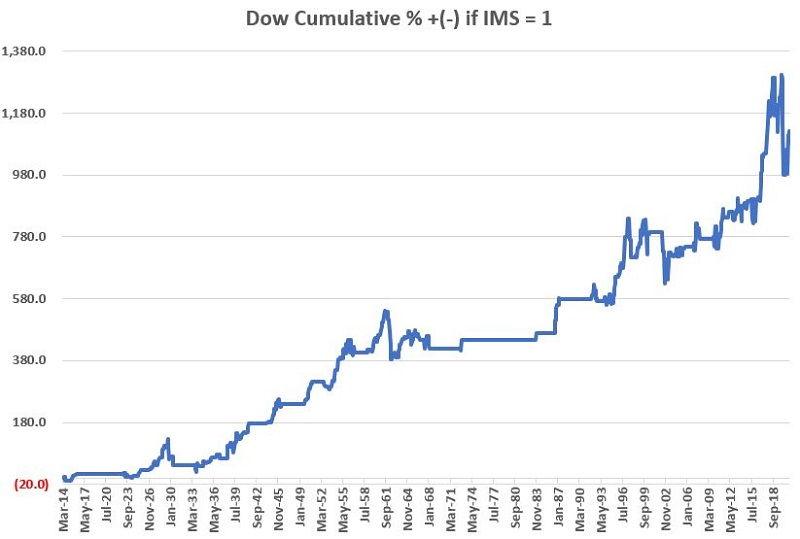

After we define what inflation is, how to measure it, and some of the caveats, we can design a model that looks at market returns during various regimes. The keys are whether inflation is positive or negative, rising or falling, and the rate of change.

My model ranges from 0 to +3. Historically, forward returns when the model was 0 were the best, and when it was +3, they were the worst.

As of the end of February 2021, my Inflation Model for Stocks stood at +1. So, despite all of the endless chatter, blather, hand-wringing, and fear and loathing of late regarding any "inevitable" burst of inflation, for the time being, anyway, you might be better off worrying about something else.

What else we're looking at

- A more in-depth look at inflation, how to measure it, and returns during various regimes

- An interesting setup has triggered in Brazillian stocks

- Stocks have seen record flows in the past 5 weeks (but there's a caveat)

- What happens when active managers in the NAAIM survey become less optimistic

| Stat Box "Smart money" commercial hedgers in gold are holding 43.9% of contracts net short. That's a lot historically, but it's the 2nd-least amount since June 2019. |

Etcetera

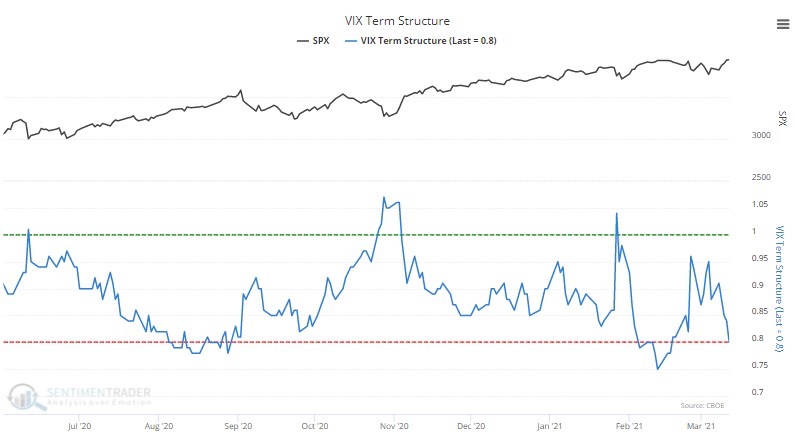

No fear here. All of a sudden, options traders are pricing in significantly less chance of a sudden move in stocks in the short-term relative to the longer-term. The Term Premium is back to one of the lowest levels of the past year.

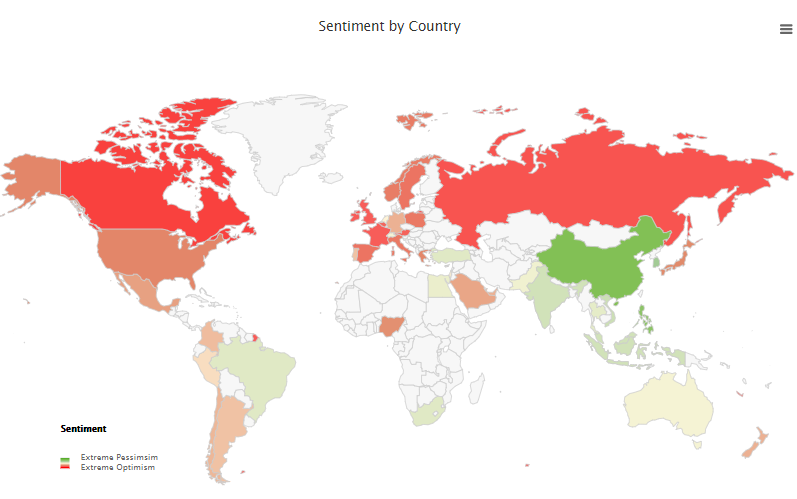

Where is there fear? About the only place in the world where investors are showing some pessimism is China. The Optimism Index Geo-Map shows that that's one of the few "green" countries. The deeper the green, the more pessimism there is.

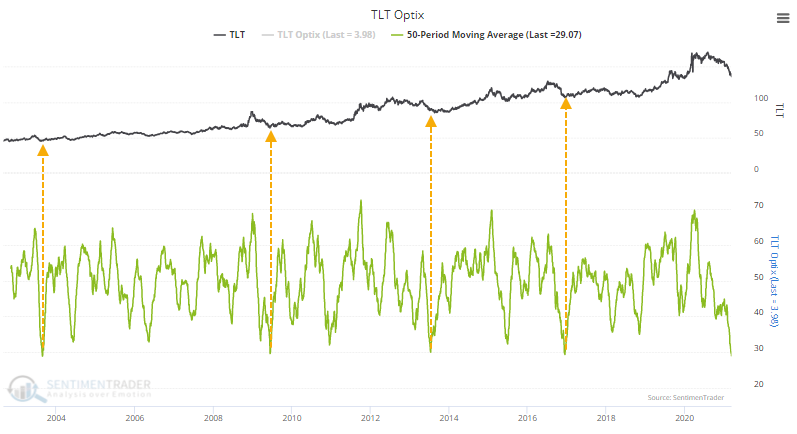

Well, bonds, too. A 50-day average of the Optimism Index for the 20+ year Treasury bond fund, TLT, is nearing a record low.