When Sugar is Not So Sweet

I recently made the silly, er, I mean bold assertion that the two most important commodities in the world are NOT crude oil and copper, but rather coffee and sugar. I am confident that a fair number of readers are silently nodding their heads in knowing agreement. And yet despite this "core belief" I still must acknowledge that there are times when sugar "is not so sweet."

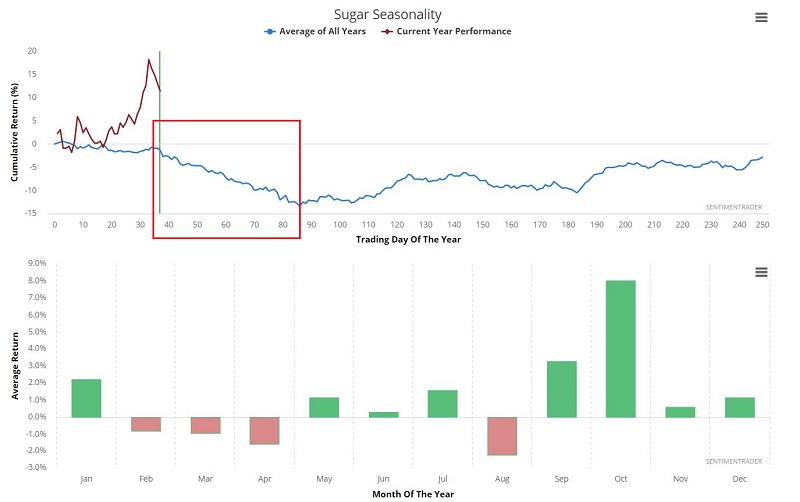

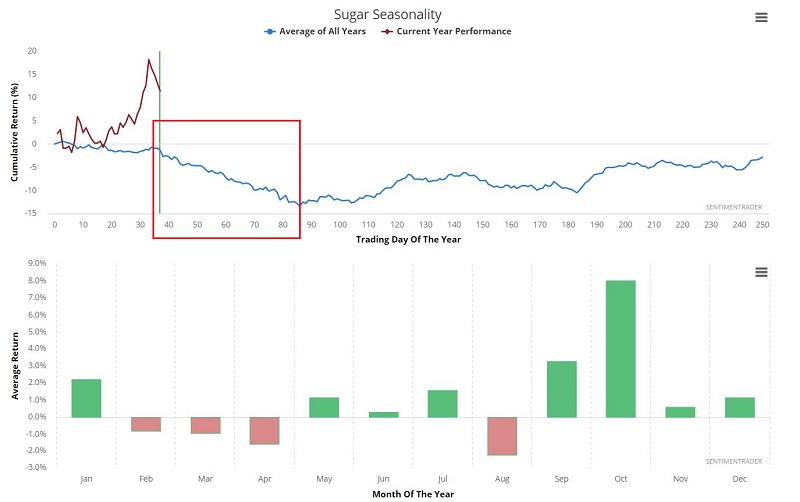

To wit, the chart below displays the annual seasonal trend for sugar futures. The period marked with the red box highlights Trading Day of Year #35 through Trading Day of Year # 86.

A close look at the chart above reveals that the period between Trading Day of the Year #35 and Trading Day of the Year #86 has historically been a period of weakness for sugar prices. While sugar futures have been quite strong so far in 2021, they appear to have topped out right on schedule. Whether a further decline is in the offing this time around remains to be seen. But the results below suggest that the long-term odds favor the more bearish trader.

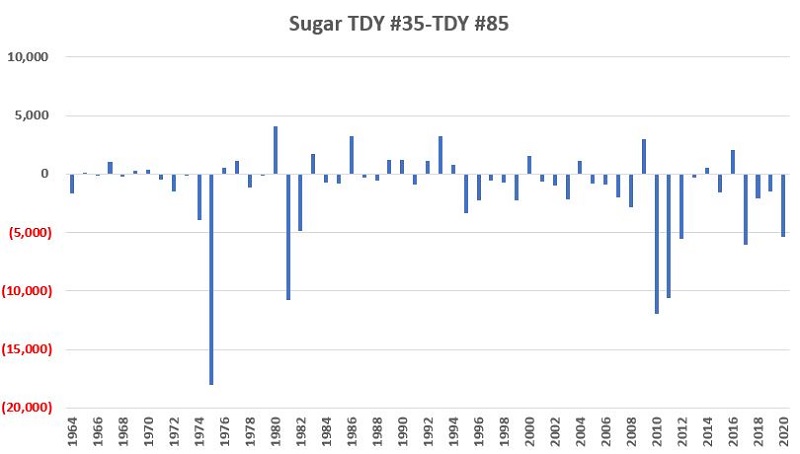

The chart below displays the hypothetical $ +(-) achieved by holding a long 1-lot position in sugar futures ONLY during this seasonally unfavorable period each year since 1964.

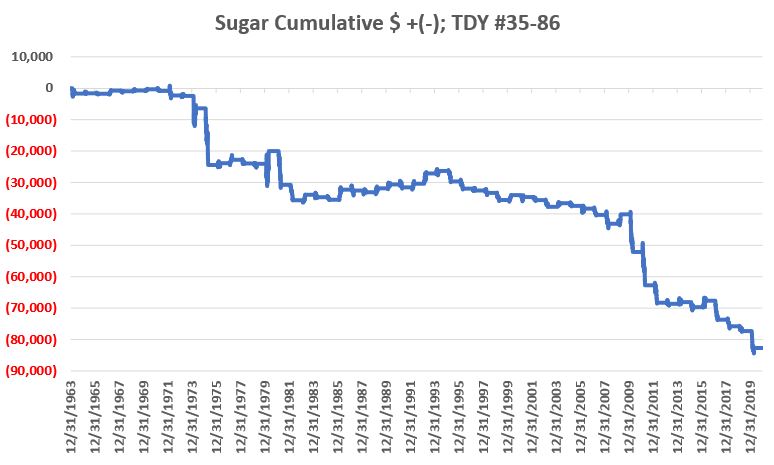

The chart below displays the cumulative hypothetical $ +(-) achieved by holding a long 1-lot position in sugar futures ONLY during this seasonally unfavorable period each year since 1964.

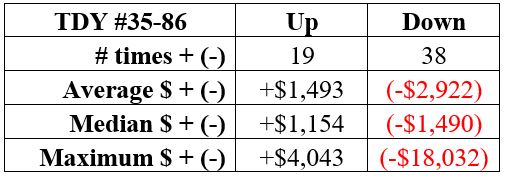

It's not a pretty picture. But the reality is also that it is NOT the straight-line decline it appears to be at first blush. In fact, in 1 out of every 3 years sugar has made money during this period. The relevant numbers appear below.

The bottom line:

The bottom line:

- The winning percentage has been 33%

- The average losing period has been twice as big as the average winning period

For 2021 this unfavorable period extends from the close on 2/23/2021 through the close on 5/7/2021.

The caveat here is the same as it is for any seasonal trend: There is NEVER any guarantee that a given seasonal tendency will play out as expected "this time around." So, the real message here is NOT to short as many sugar futures contracts as possible. The real message is "if you are allocating capital, does a long position in sugar seem like your best play at this moment in time?"

Which leads directly to:

Jay's Trading Maxim #27: No one knows for sure what will happen next. As a result, putting the odds in your favor as much as possible and as often as possible is the true path to trading success.