What I'm looking at - volatility, utilities rotation, index put/call, Germany wholesale, SKEW

With stocks near all-time highs, here's what I'm looking at:

Volatility indices

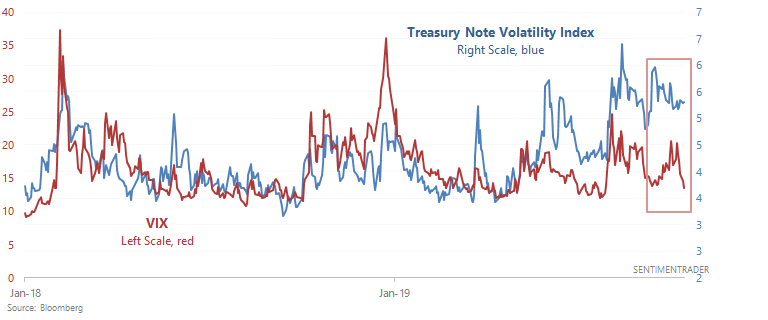

As The Market Ear noted, the stock market's volatility is much lower than the bond market's volatility right now. The Treasury Note Volatility Index remains elevated, while VIX has fallen after a brief spike:

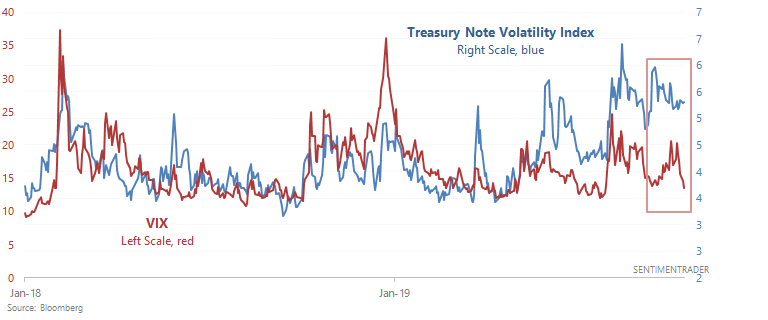

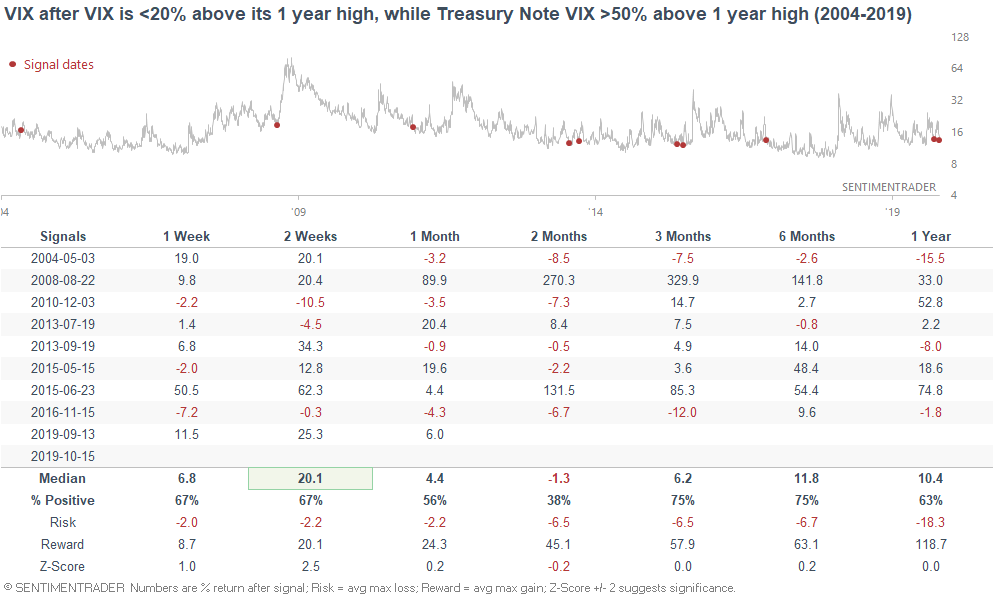

When these 2 volatility indices diverged in the past, VIX had a tendency to jump over the next 2 weeks...

... while Treasury volatility usually fell over the next 6-12 months:

Utilities

Over the past few weeks we noted the nonstop strength in utilities (defensive sector), while the broader stock market languished. But while stocks rallied over the past few days, utilities fell 4 days in a row.

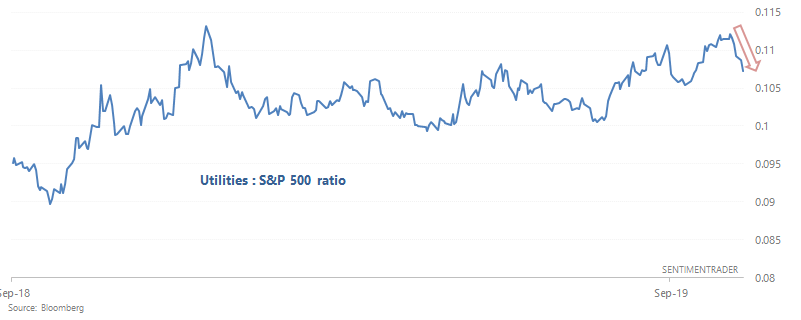

The following chart illustrates the sudden change in relative performance. The S&P 500 utilities sector vs. S&P 500 ratio reached a multi-month peak, and then dropped 5 days in a row:

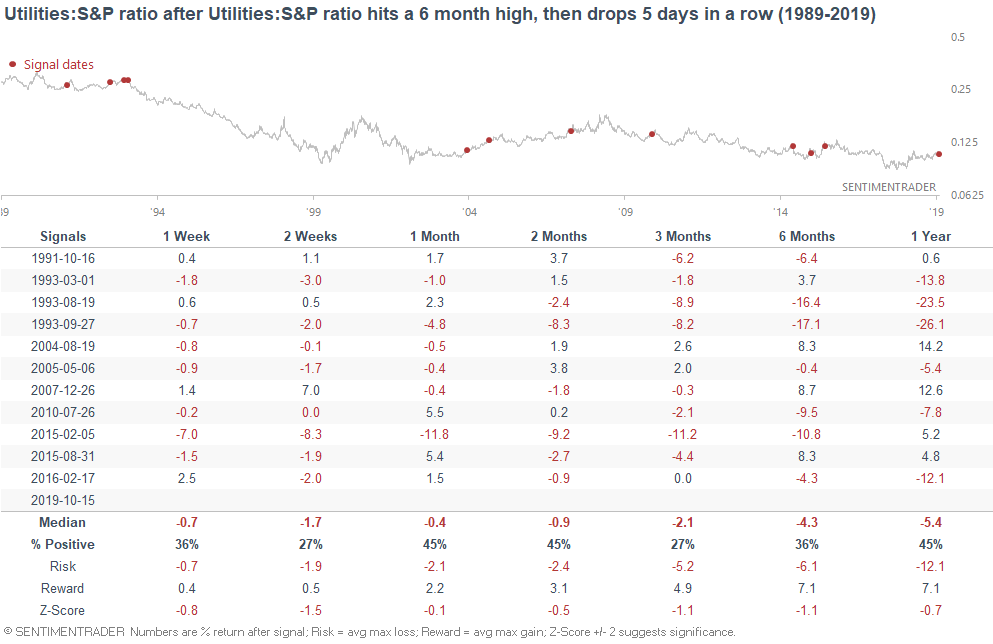

When this happened in the past, utilities usually continued to underperform the broad stock index over the next 3-6 months as investors and traders continued to shift away from defensives:

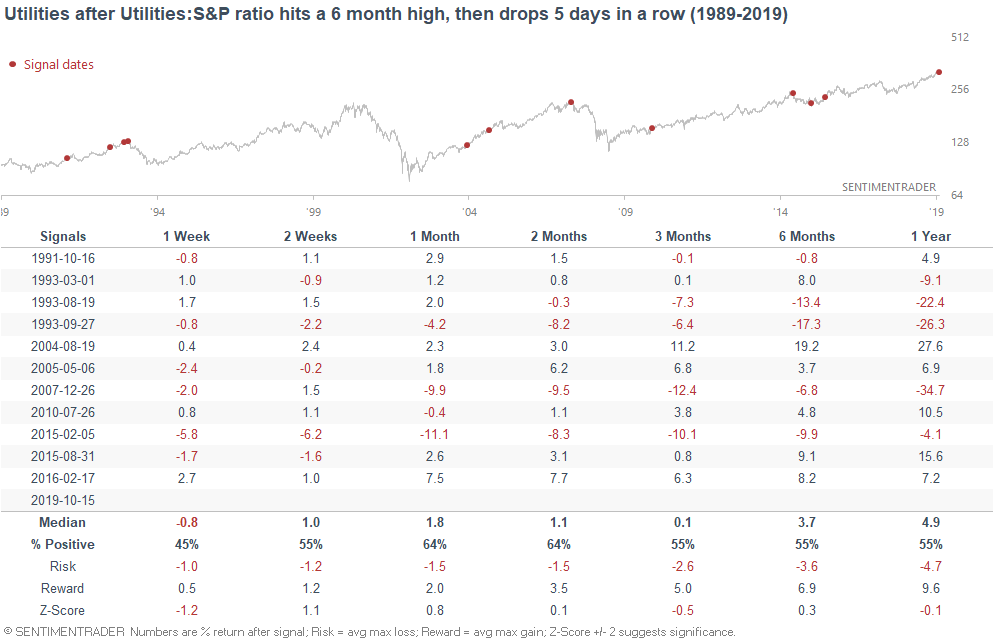

Here's what happened next to the S&P 500 utilities sector:

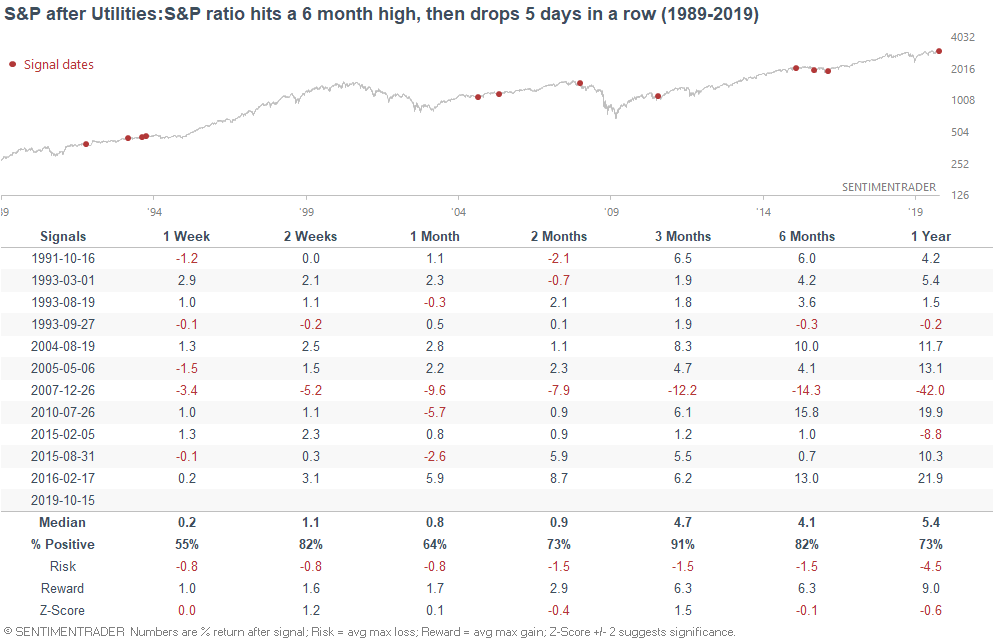

Here's what happened next to the S&P 500:

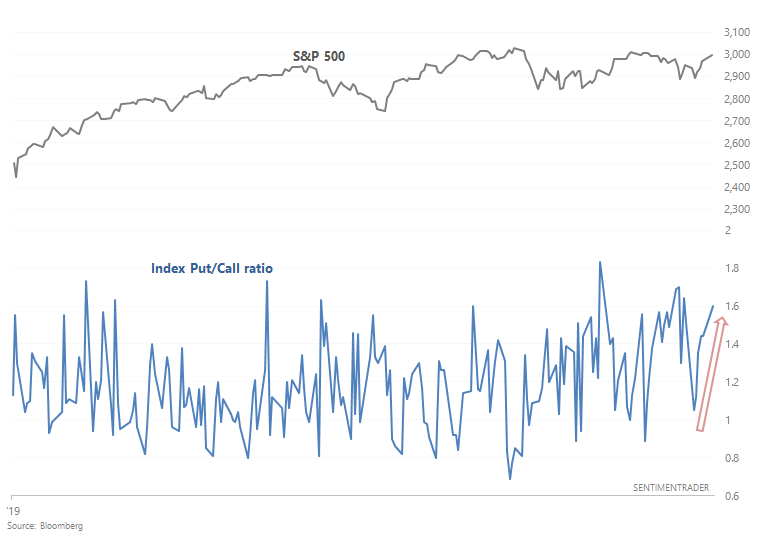

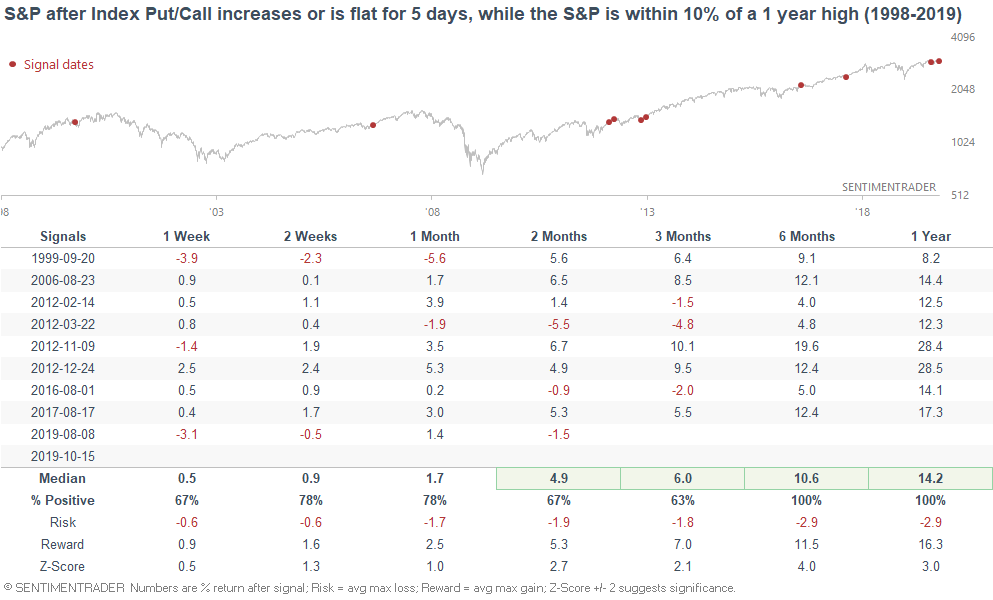

Index Put/Call

Traders continue to be skittish, at least by some measures. While the stock market rallied 4 of the past 5 days, the Index Put/Call ratio also rose 4 of the past 5 days (with the 1 other day being flat). This is highly unusual, because more often than not the Index Put/Call ratio and S&P 500 move in opposite directions:

When the Index Put/Call ratio consistently went up over the past 5 days, while the S&P was close to an all-time high, the S&P usually rallied over the next 6-12 months.

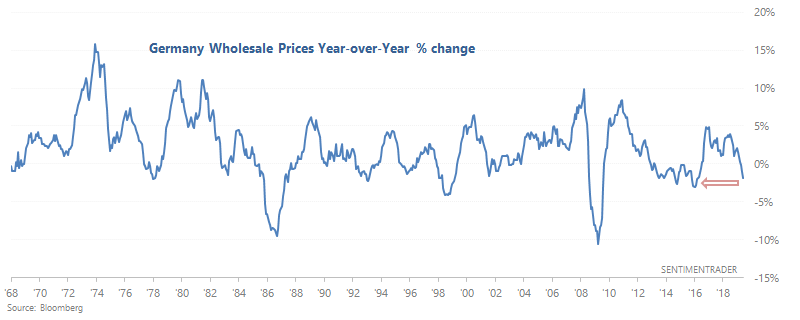

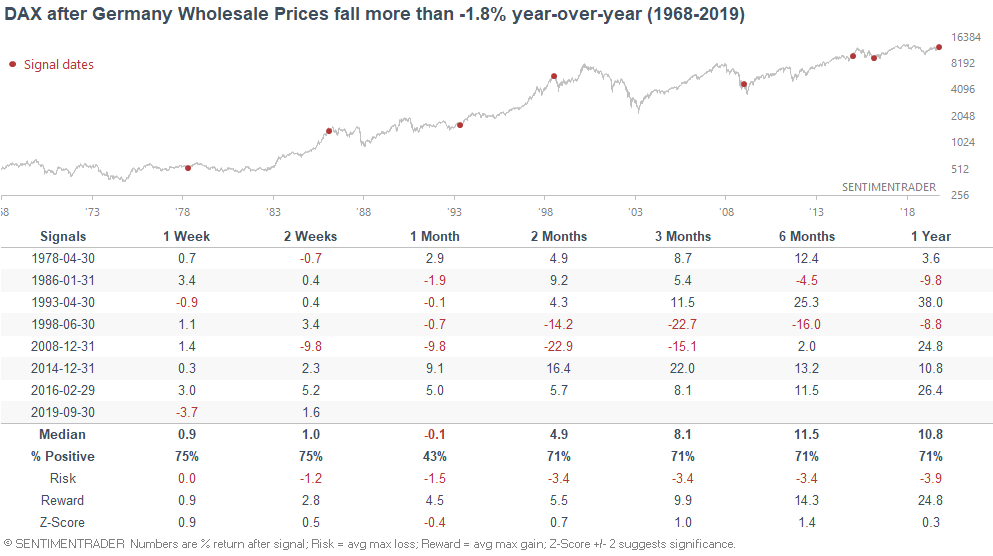

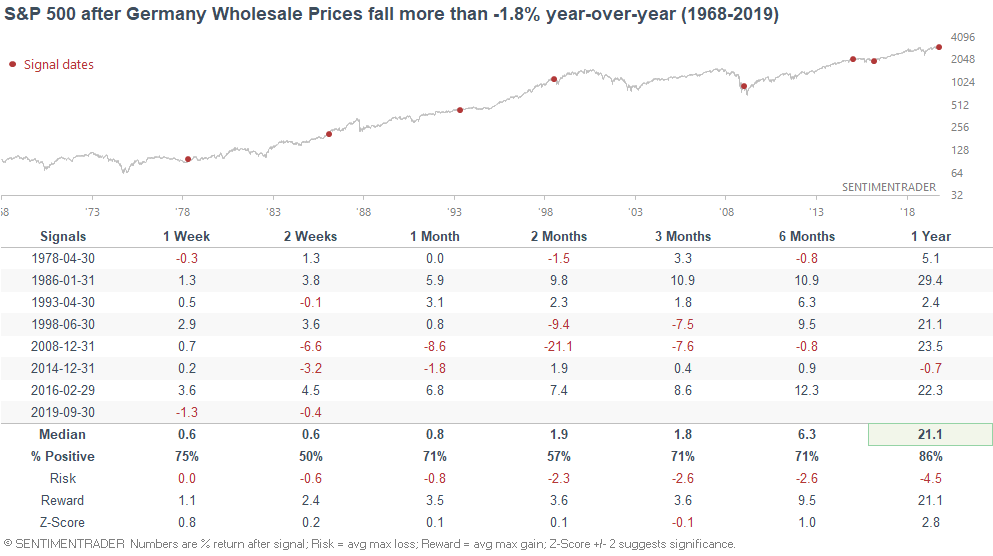

Germany Wholesale

With the German economy on the brink of a recession, German Wholesale Prices have fallen -1.9% over the past year.

While this may generate scary headlines, it's not clear if this is bearish for German stocks. The following table looks at similar cases and what the DAX did next:

Sure, there were some large stock market crashes over the next 2-3 months (e.g. 1998 and 2008). But there were also plenty of false alarms.

For what it's worth, here's what the S&P did next:

*I wouldn't use German economic data to trade the S&P 500.

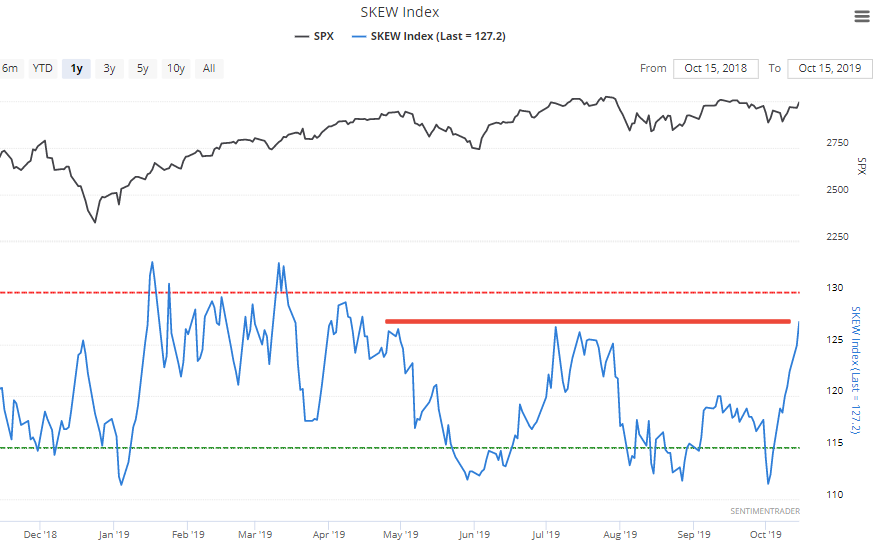

SKEW

And lastly, the SKEW Index has jumped to a 6 month high:

*SKEW demonstrates the risk of a black swan event over the next 30 days.

While high SKEW readings aren't usually good for stocks (e.g. SKEW was very high before the Q4 2018 stock market crash), the first decently high reading in a long time isn't bad (like a breakout).

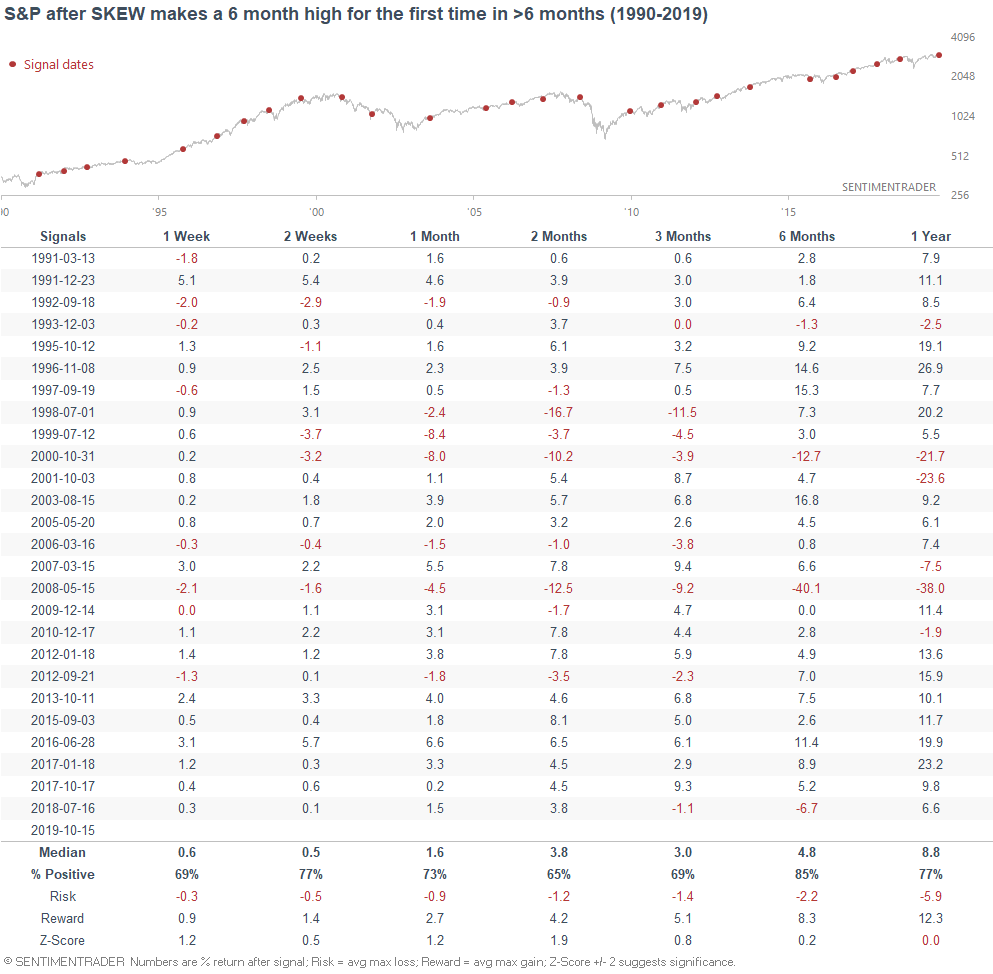

Here's what happened next to the S&P when SKEW made a 6 month high:

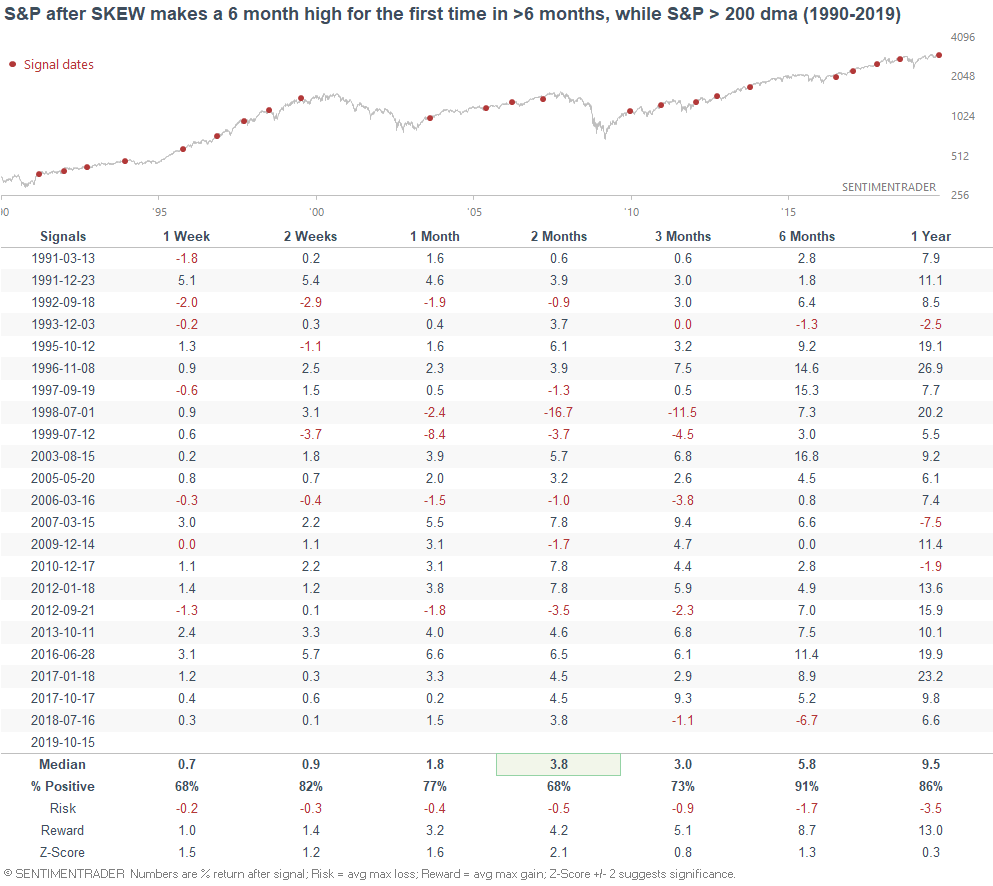

And if we isolate for the cases in which the S&P was above its 200 dma...

The S&P's returns over the next 2-4 weeks are mostly bullish.