What I'm looking at - tech vs. finance, volatility of volatility, high yield, corporate earnings

Here's what I'm looking at:

Tech vs finance

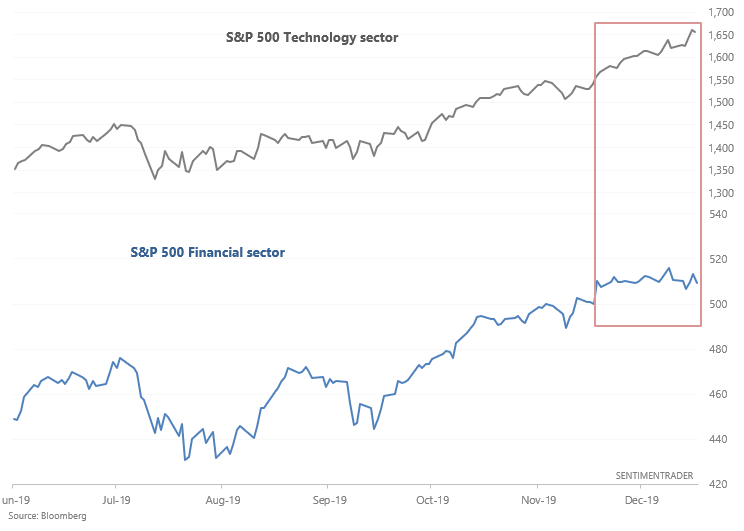

As the stock market's rally rages on, the tech sector has surged relative to other sectors such as finance. (As interesting reads, see the WSJ's take on how big tech is moving into finance and Bloomberg's take on how Wall Street is being changed by machines/tech).

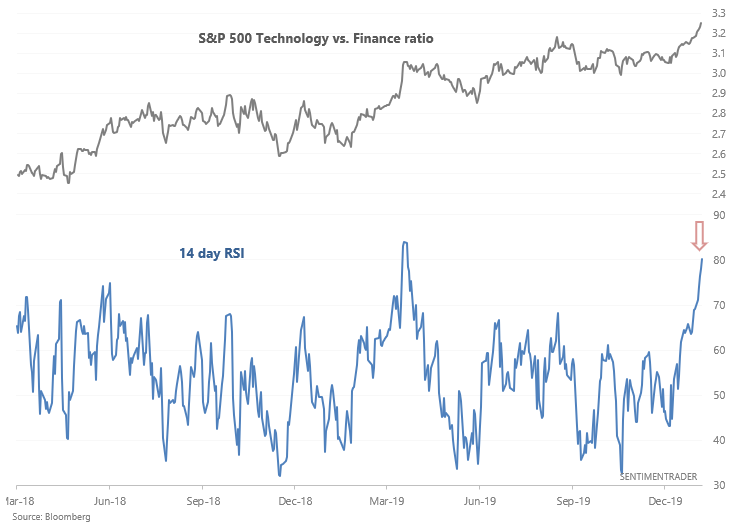

Regardless of why tech stocks are massively outperforming finance stocks, the S&P 500 Technology vs. Finance ratio has surged, pushing its RSI above 80.

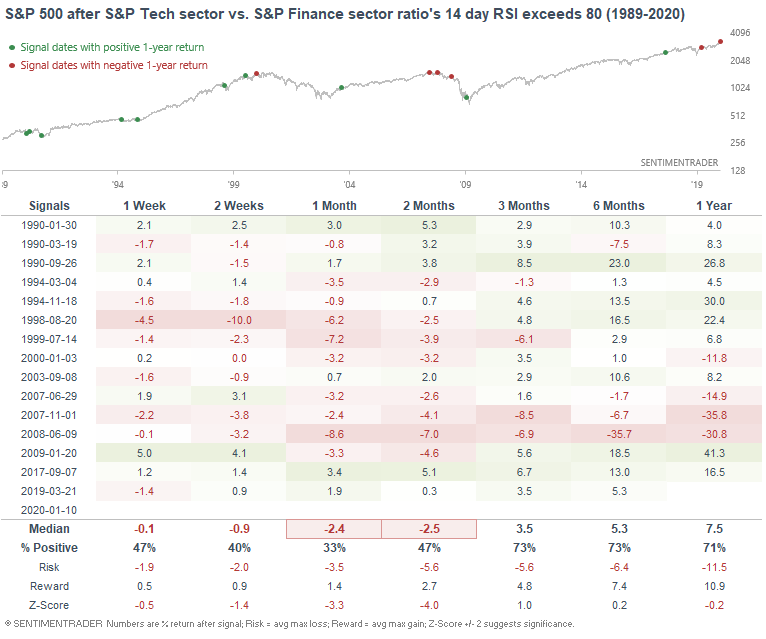

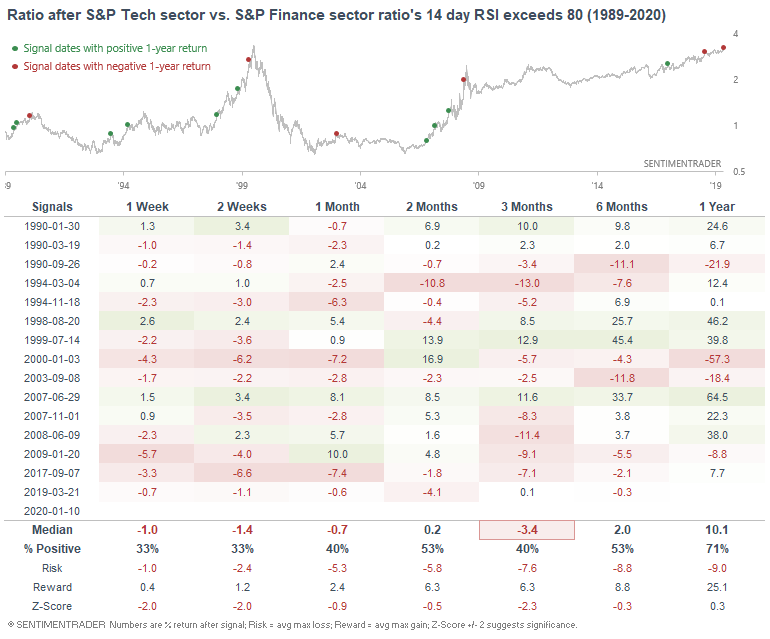

When tech outperformed finance significantly in the past, the S&P's returns over the next 1-2 months were often weak:

And tech often underperformed finance over the next few weeks and months.

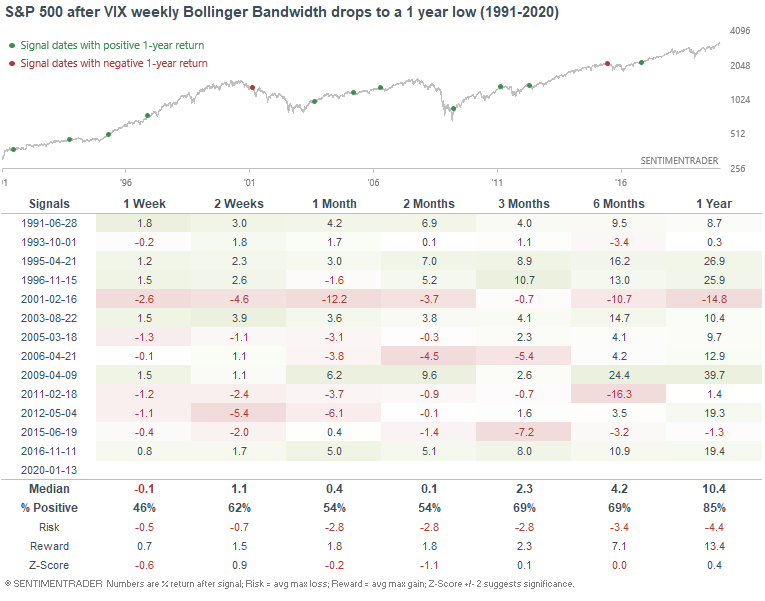

Volatility of volatility

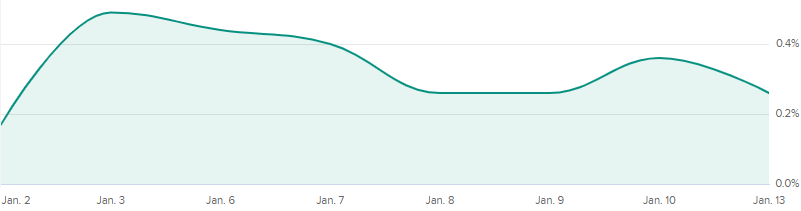

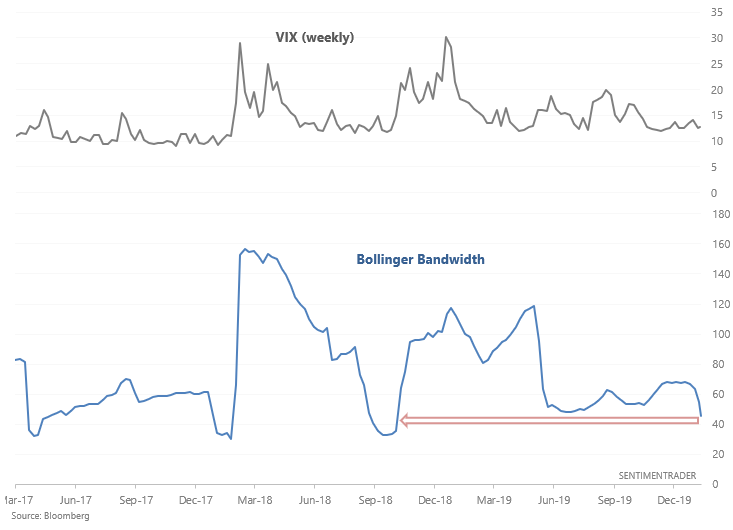

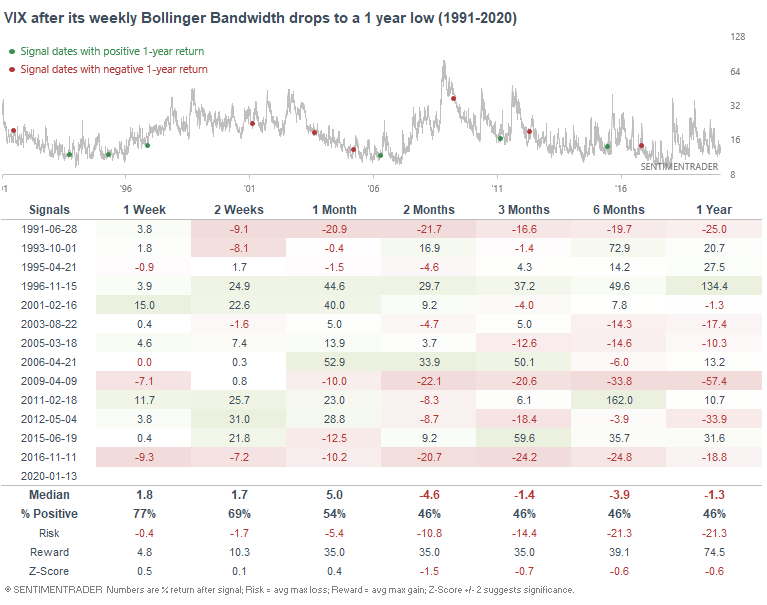

As we begin another week of low volatility, VIX's weekly Bollinger Bandwidth has fallen to the lowest level since Q4 2018, when stocks tanked and volatility exploded. Low volatility remains a short term bearish factor for the U.S. stock market right now.

When this happened in the past, VIX had a tendency to jump over the next 1-2 weeks, particularly over the past 15 years:

As a result, the S&P's returns up to 2 months later were worse-than-random.

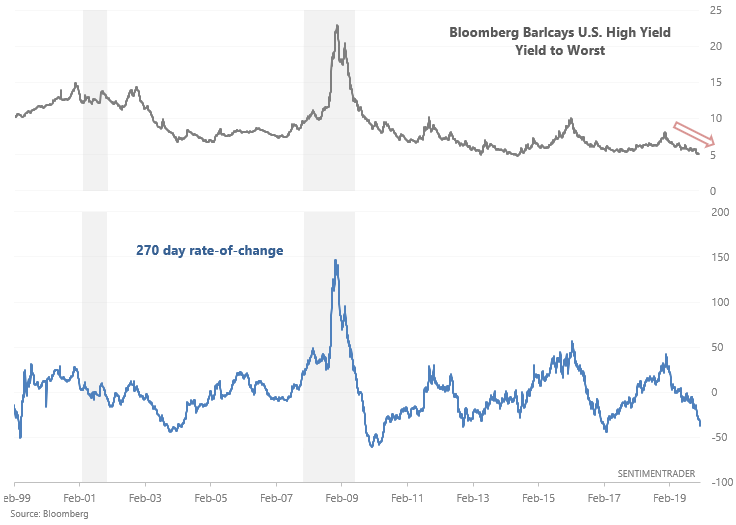

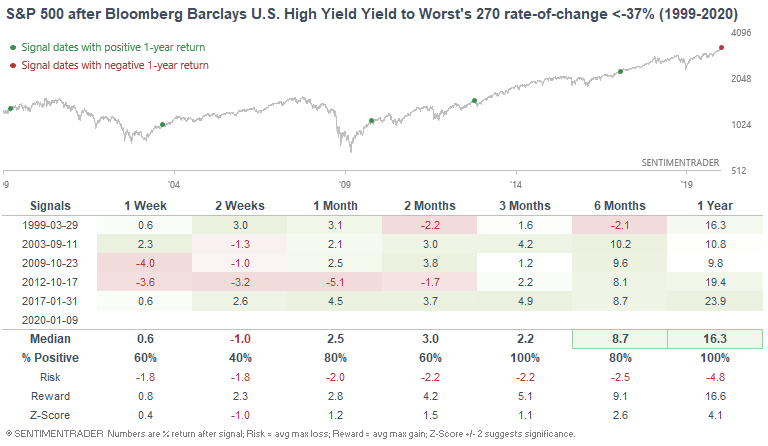

High yield

As Lisa Abramowicz tweeted, yields on junk bonds have fallen significantly over the past 13 months (see the Bloomberg Barclays U.S. High Yield Yield to Worst index):

Junk bonds tend to face trouble before bear markets and recessions begin. So the downtrend in these yields is a long term bullish sign for stocks. When the index's 270 day rate-of-change fell below -37% in the past, the S&P's returns over the next 6-12 months were often strong:

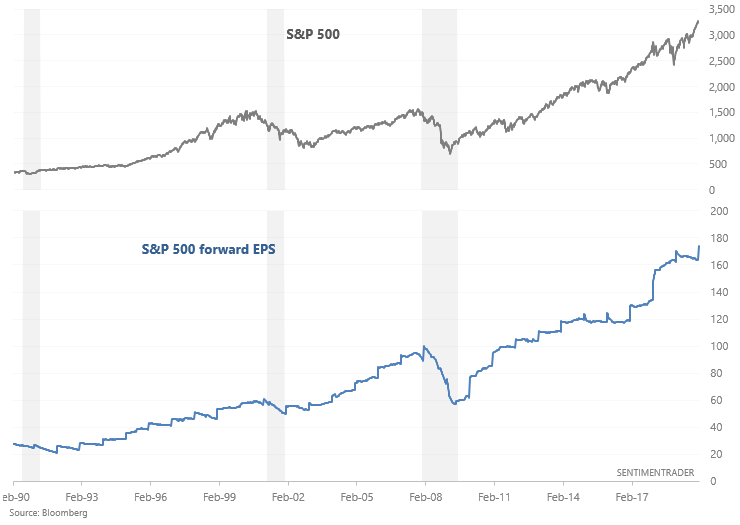

Corporate earnings

And lastly, the stock market and corporate earnings usually move in the same direction in the long term. The WSJ noted that after a lackluster 2019, corporate earnings are expected to grow in 2020. If this is indeed the case, then it's a positive factor for stocks on a 6-12 month forward basis.

Last August I demonstrated that it's better to go long the S&P 500 when earnings are expected to trend higher and sell stocks when earnings are expected to trend lower.

The strategy = buy the S&P 500 when the S&P 500 forward EPS' 52 week average is going up. Otherwise, shift into the Bloomberg Barclays US Aggregate Bond Index

Right now, the S&P 500's forward earnings are expected to increase:

Right now, the S&P 500's forward earnings are expected to increase:

My trading portfolio

My trading portfolio is allocated 50% in the Macro Index Model and 50% in the Simple Trading Model With Fundamentals. At the moment I have instituted a discretionary override and gone 100% long bonds (instead of long stocks) due to the extreme nature of many of our core indicators, even though some of these core indicators aren't in the models.

Performance YTD 2020:

- My trading account is up 0.26%

- Currently 100% in bonds