What I'm looking at - stocks in a correction, KBW Bank Index, sentiment indicators, DAX breadth, high yield

With the U.S. stock market at new all-time highs, here's what I'm looking at:

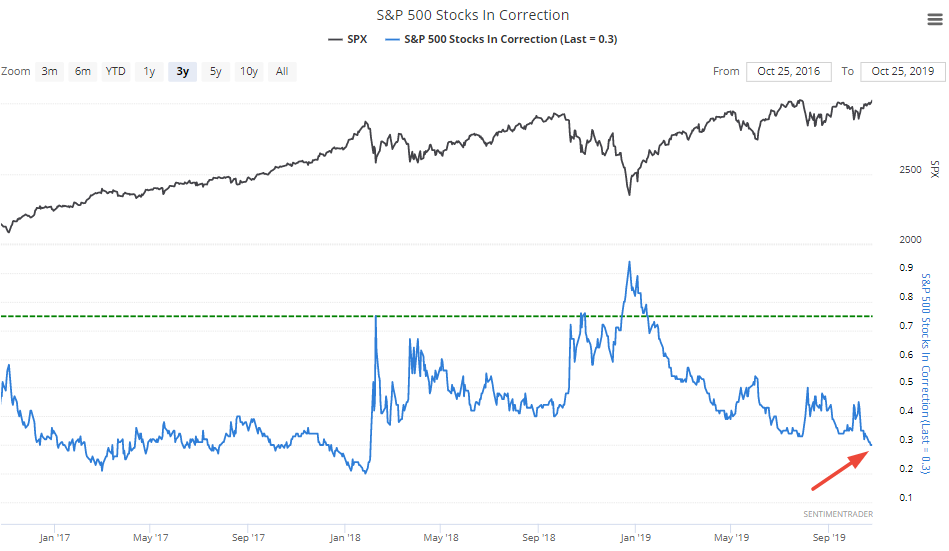

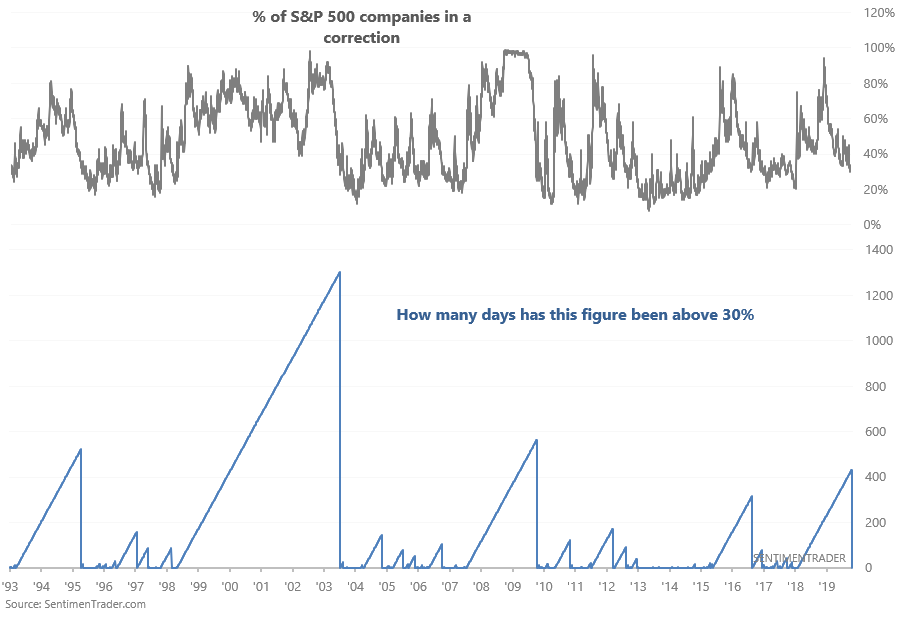

% of stocks in a correction

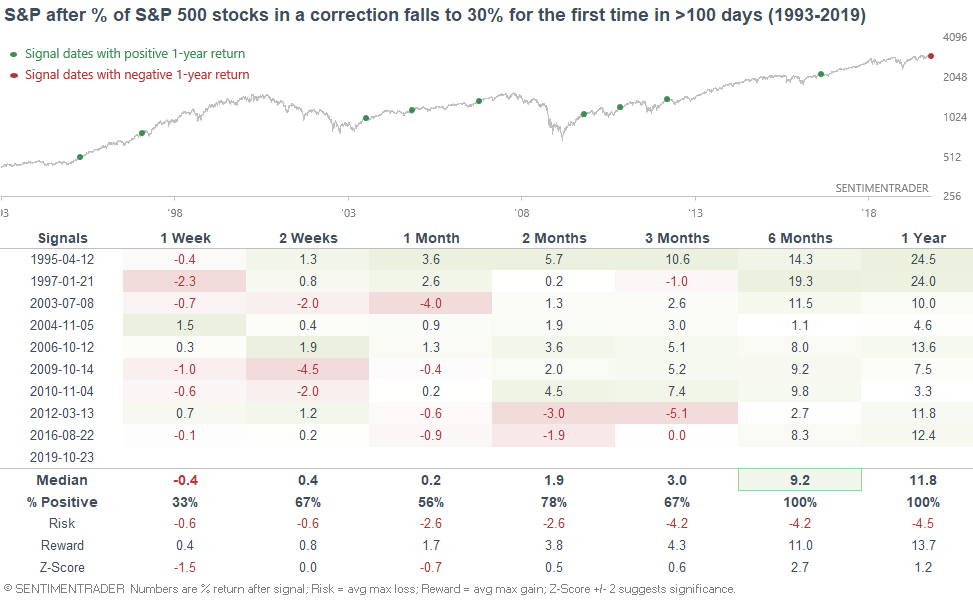

Last week I looked at the decrease in S&P 500 stocks that were in a bear market. Similarly, the % of S&P 500 stocks in a correction (at least 10% below a 52 week high) is also declining:

When this figure fell to 30% for the first time in more than 100 days...

...the S&P rallied over the next 6-12 months:

KBW Bank Index

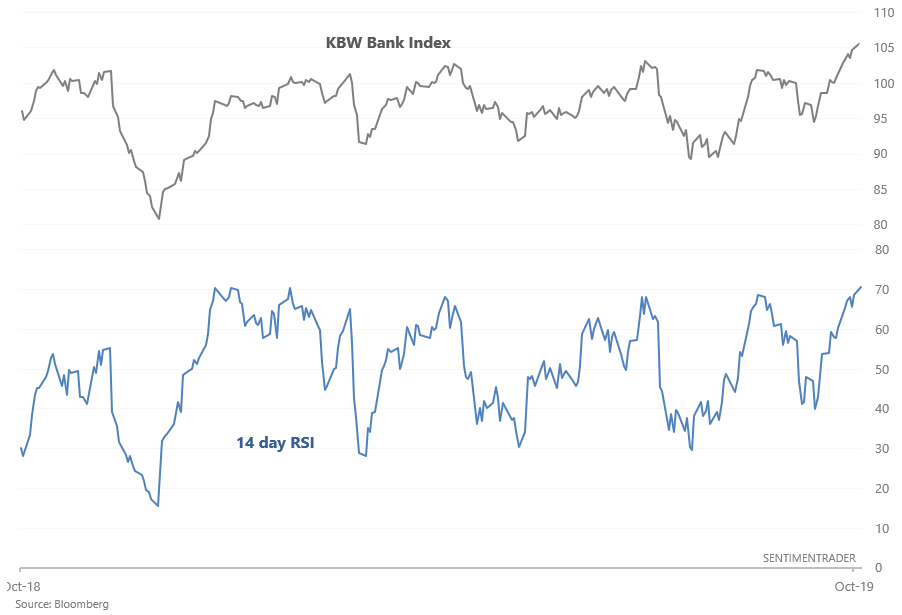

As the S&P 500 breaks out, financial stocks led the way. The KBW Bank Index has surged since early-October, causing its 14 day RSI to exceed 70 (overbought) for the first time since February 2019:

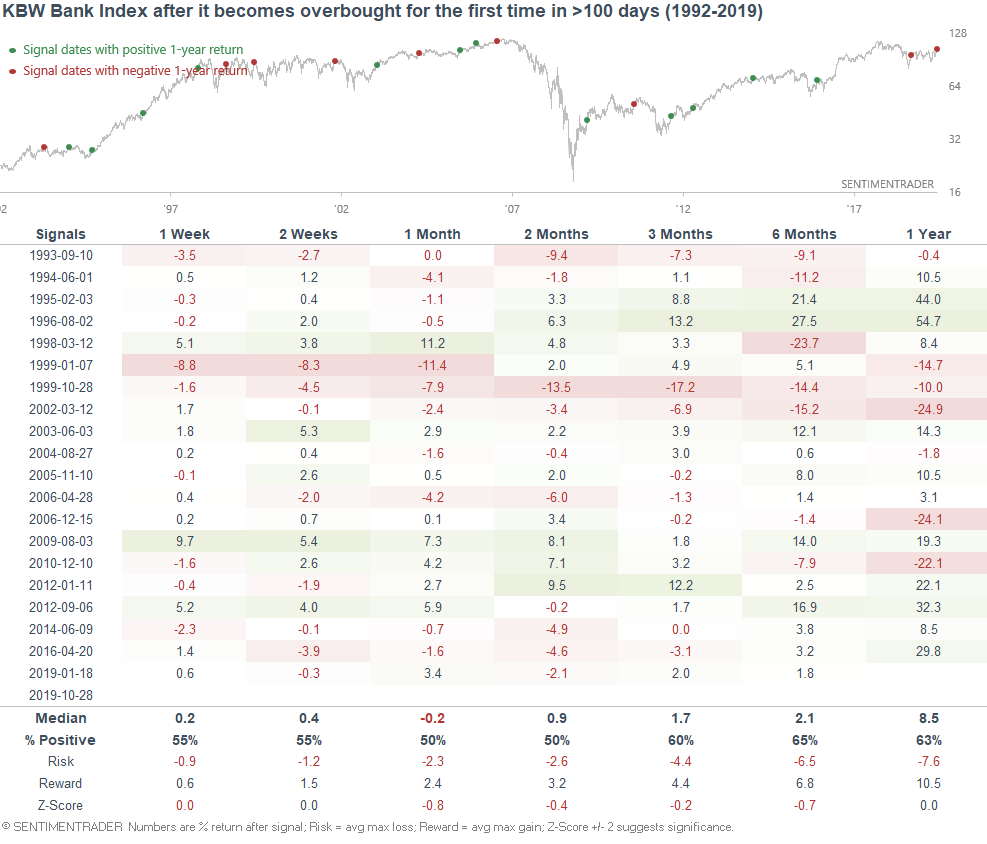

When the KBW Bank Index's 14 day RSI exceeded 70 for the first time in more than 100 days, its returns over the next 1-2 months were mixed, with an emphasis on downside bias:

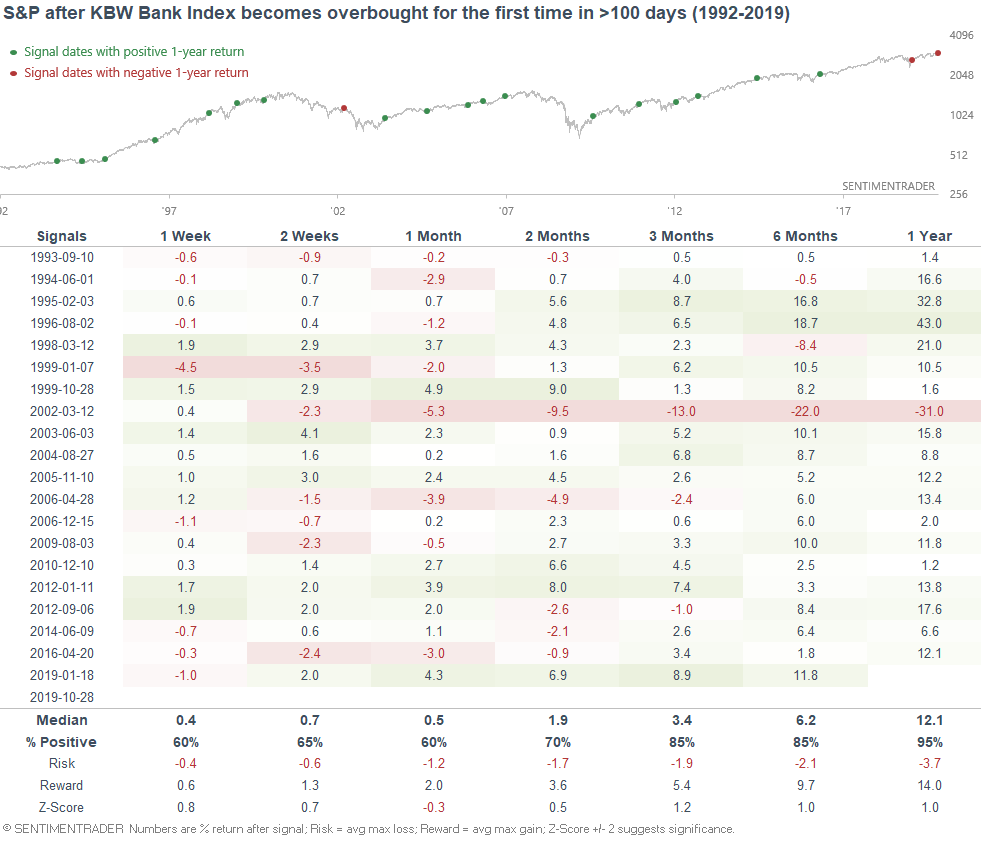

For what it's worth, here's what the S&P 500 did next. Mostly gains over the next 3-12 months, with the big exception being March 2002:

Various sentiment indicators

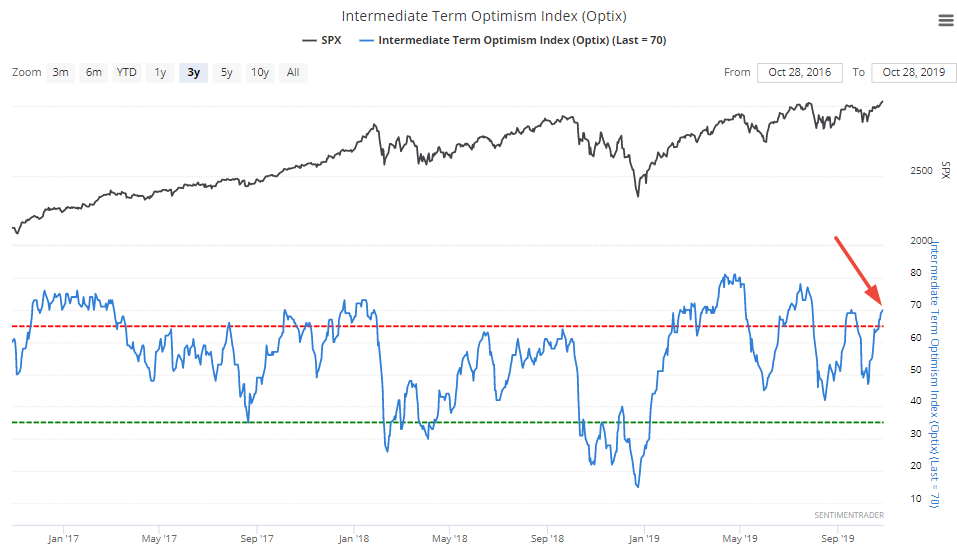

As the stock market rallies, various sentiment indicators are reaching levels of excessive optimism. For example, our Intermediate Term Optimism Index has risen to 70:

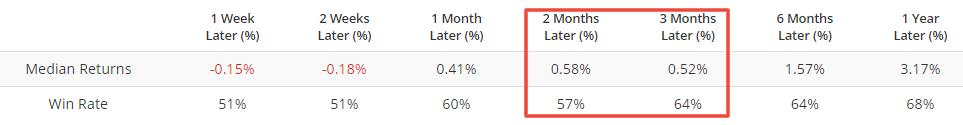

When it did so in the past (excluding overlapping signals over the past month), the S&P 500's forward returns weren't consistently bearish, but were worse than random:

For a more accurate sell signal, it's better to wait for the Intermediate Term Optimism Index to rise to 80.

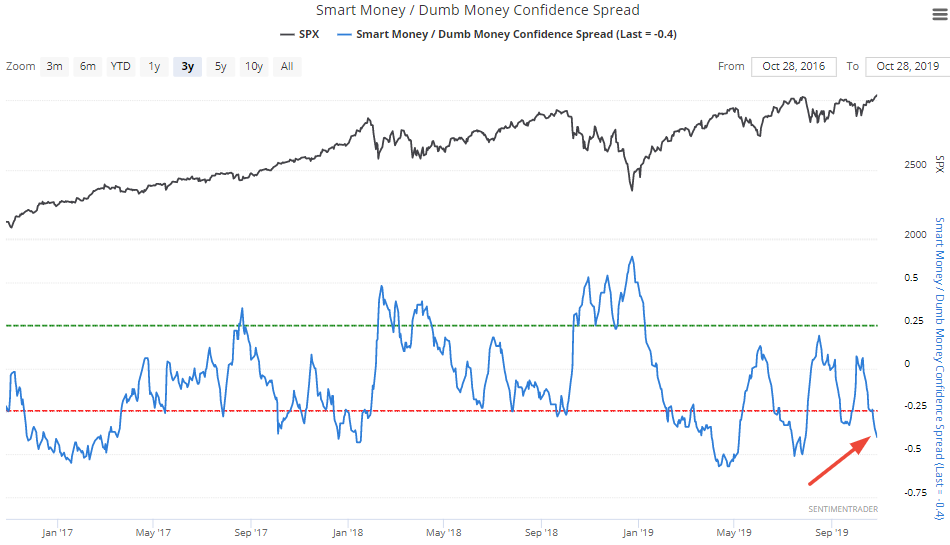

Similarly, our Smart Money/Dumb Money Confidence Spread has fallen to -0.4:

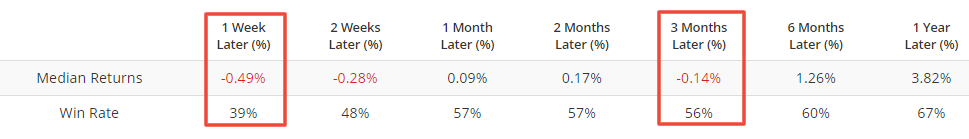

When it did so in the past, the S&P's returns over the next few weeks and months were worse than random:

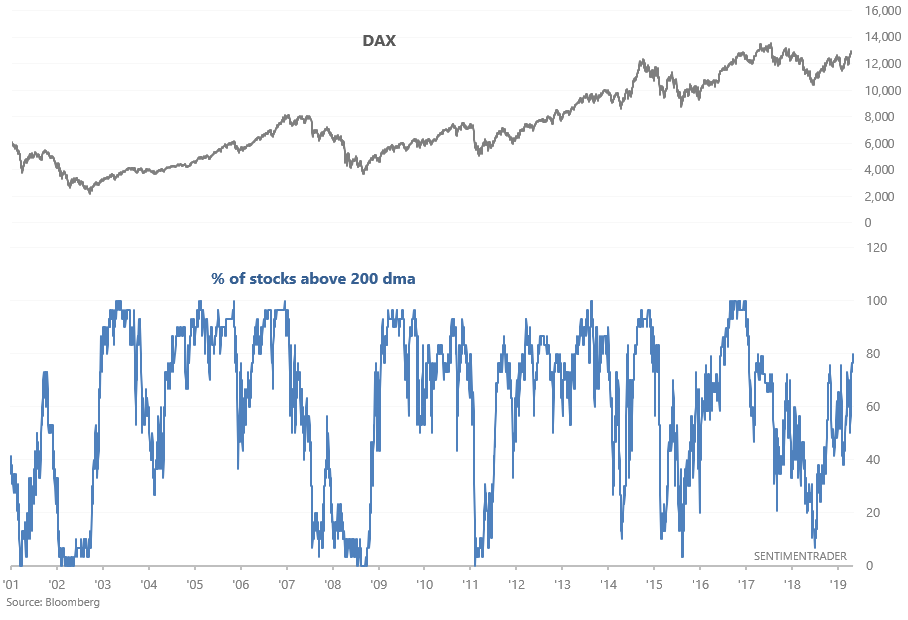

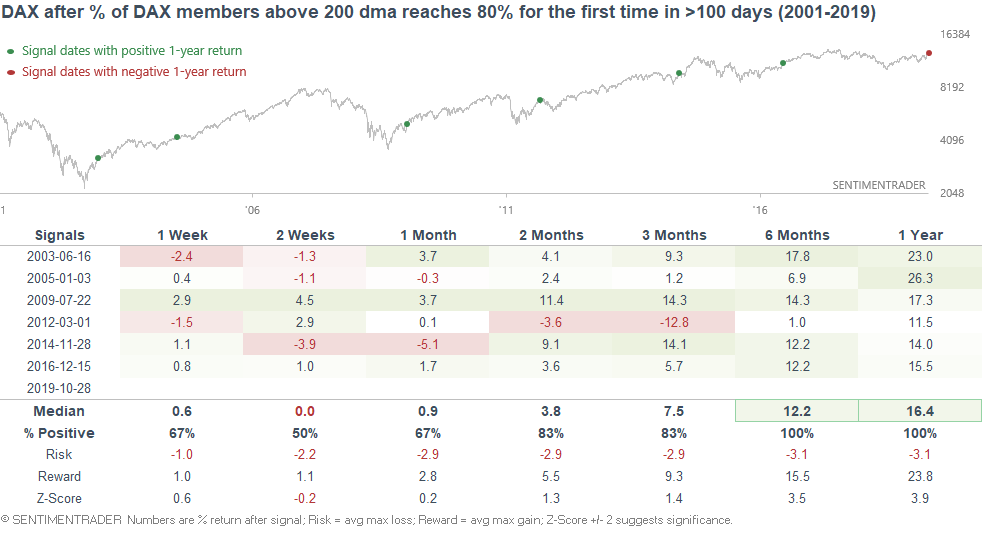

DAX breadth

As overseas markets continue to rally, the % of DAX members above their 200 dma has reached 80% for the first time since October 2017:

When this figure reached 80% for the first time in more than 100 days, the DAX consistently went higher over the next 6-12 months:

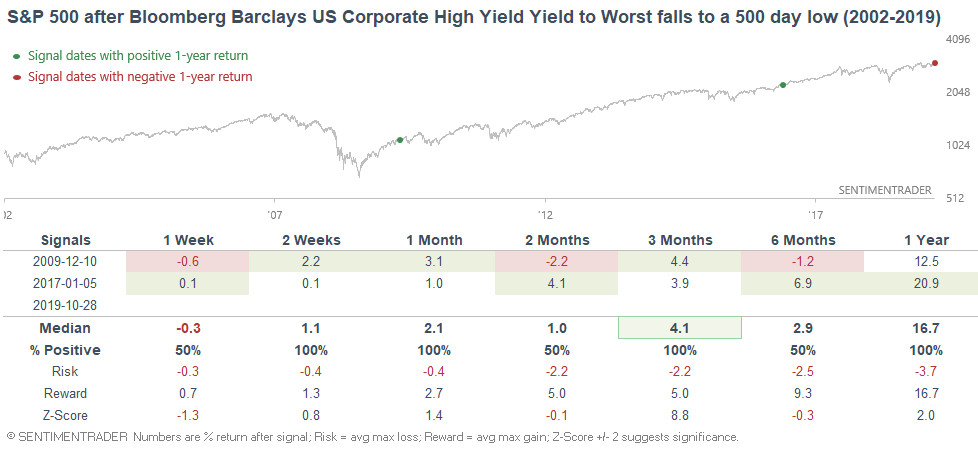

High yield

And finally, as the WSJ noted, yields on U.S. high-yield debt have fallen to the lowest level since 2017:

The 2 other times it did so, the S&P soared over the next year: